Can I Get Tax Benefit On Home Renovation Loan Yes tax benefits on a home loan taken for the renovation of a property can be claimed under Section 24 of the Income Tax Act 1961 up to a maximum limit of Rs

Yes you can claim a tax benefit if you have taken a top up on your home loan Some of us who want to renovate or repair our homes take a top up over the home loan due to the long tenure of the mortgage Tax Benefits Home home renovation loan rates are sometimes tax deductible potentially saving homeowners money in certain nations Homeowners may lower their tax bill by deducting loan

Can I Get Tax Benefit On Home Renovation Loan

Can I Get Tax Benefit On Home Renovation Loan

https://www.ashar.in/wp-content/uploads/2021/03/Tax-benefits-of-home-loans-image.jpg

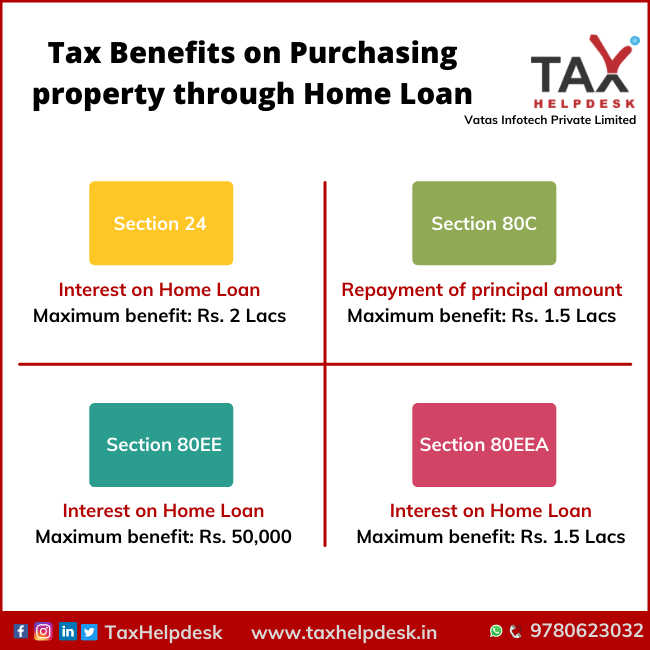

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/11/Tax-Saving-Benefits-of-having-property-through-Home-Loan-1.png

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2022/07/Tax-benefits-on-Home-Loan-819x1024.jpeg

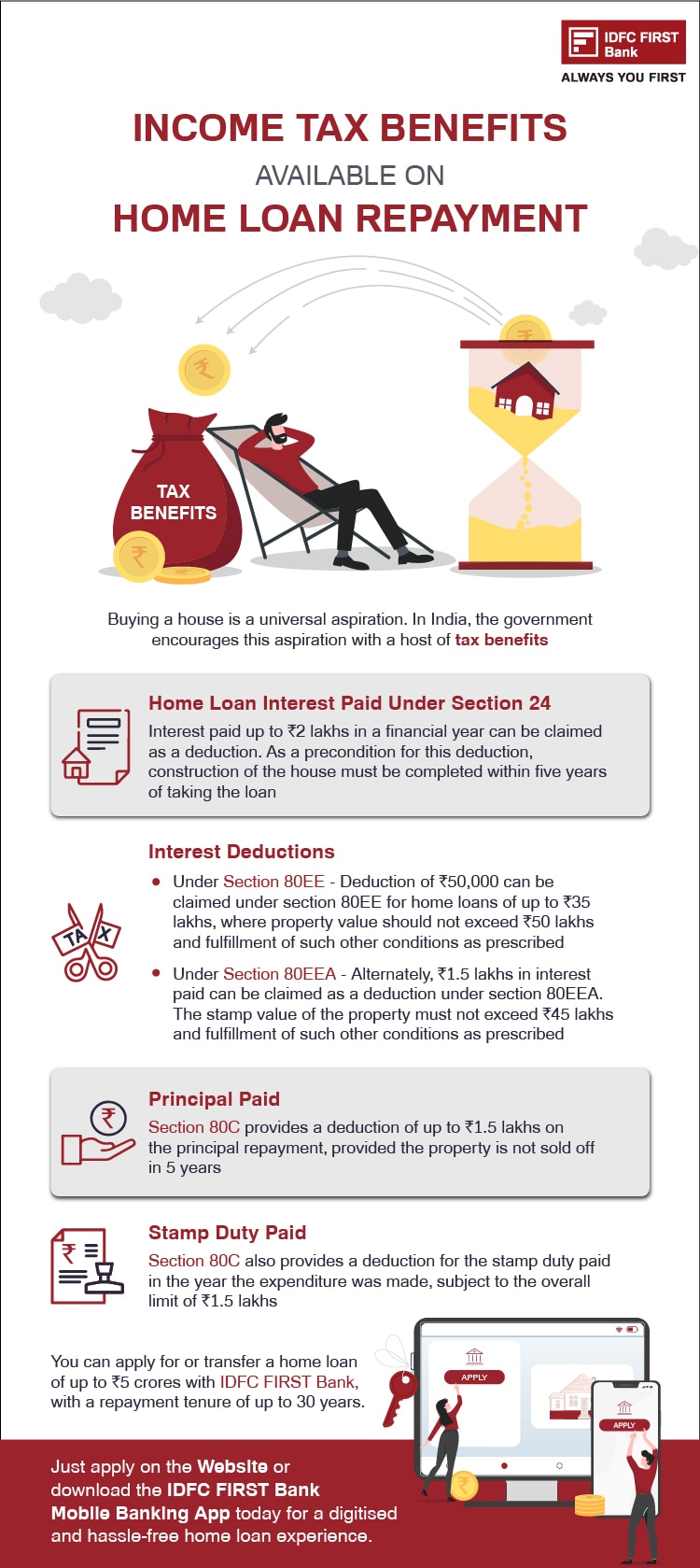

Under Section 24 of the Income Tax Act you can avail up to Rs 30 000 tax benefits per annum on your home improvement loan However note that this deduction of Rs 30 000 falls within the limit of Tax benefit A house renovation loan fetches you a tax benefit on the interest component that is you can avail a deduction of up to Rs 30 000 per annum under section 24 for

Home renovation loan tax benefits Under Section 24 b of the Income Tax Act a borrower enjoys deductions of up to Rs 2 lakhs in a year on the home loan interest payment Within that limit this borrower Home renovation If you take a personal loan to renovate or repair your home then you will be eligible for a tax deduction under Section 24 b of the Income Tax

Download Can I Get Tax Benefit On Home Renovation Loan

More picture related to Can I Get Tax Benefit On Home Renovation Loan

Tax Benefit On Home Loan Interest Payment Adeex News

https://adeex-in-news.s3.ap-south-1.amazonaws.com/news/wp-content/uploads/2024/01/12122905/Tax-benefit-on-home-loan-interest-payment.jpeg

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

https://homefirstindia.com/app/uploads/2022/07/Untitled-design-14.png

Can I Get Tax Benefit On Home Loan During Pre construction Period Mint

https://images.livemint.com/img/2022/01/07/1600x900/homeloans-kbaH--621x414@LiveMint_1641549835222.jpg

So without further ado let s explore the loan tax benefits available for home improvements or reconstructions in 2023 Interpreting Home Improvement Loans According to Income Tax Regulations Governed by Section 24 b of the Income Tax Act of 1961 it allows you to claim a tax rebate of up to 30 000 annually on the interest paid on your home improvement loan tax benefit However

Notably if the home improvement loan is taken for a second home you can claim a tax deduction on interest repaid of up to Rs 30 000 over and above the interest repayment You can get a deduction of up to 30 000 every year on the interest component of your repayment instalments for a home renovation loan This is as per the provisions under

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

https://homefirstindia.com/app/uploads/2022/07/Untitled-1.png

Home Loan Interest Tax Benefit 2019 20 Home Sweet Home Insurance

https://img.etimg.com/thumb/height-450,width-800,msid-67320956,imgsize-277725/tax4-getty.jpg

https://cleartax.in/s/home-loan-tax-benefit

Yes tax benefits on a home loan taken for the renovation of a property can be claimed under Section 24 of the Income Tax Act 1961 up to a maximum limit of Rs

https://economictimes.indiatimes.com/we…

Yes you can claim a tax benefit if you have taken a top up on your home loan Some of us who want to renovate or repair our homes take a top up over the home loan due to the long tenure of the mortgage

Here Is The Tax Benefit On Personal Loans That You Can Avail

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

What Is The Maximum Tax Benefit On Housing Loan Leia Aqui Is There A

Home Loan Tax Benefit saving In 2019 20 In Hindi tax Benefit saving On

Income Tax Benefit On Home Loan Your Quick Guide On Tax Exemption

Here s Everything You Need To Know About Tax Benefit On Home Loan

Here s Everything You Need To Know About Tax Benefit On Home Loan

Income Tax Benefits On Home Loan Loanfasttrack

What Are The Tax Benefits On Top Up Loan HomeFirst

Tax Certificate In Real Estate All You Need To Know S Ehrlich

Can I Get Tax Benefit On Home Renovation Loan - Tax benefit A house renovation loan fetches you a tax benefit on the interest component that is you can avail a deduction of up to Rs 30 000 per annum under section 24 for