Can Social Security Tax Be Refunded Verkko Social Security tax is based on a flat percentage of salary and does not allow for deductions from your income like the income tax system so a Social Security tax

Verkko 14 lokak 2022 nbsp 0183 32 You might overpay Social Security and Medicare taxes for a number of reasons Some workers are exempt from paying these taxes The government will Verkko Can I get a refund of Social Security taxes paid if I live in another country and I am not eligible for U S benefits Views Although we can t refund correctly paid U S Social

Can Social Security Tax Be Refunded

Can Social Security Tax Be Refunded

https://img.money.com/2023/07/News-Missouri-Nixes-Social-Security-Tax.jpg?quality=85

Proposed Law Would Increase The Social Security Taxable Wage Base

https://www.clevelandgroup.net/wp-content/uploads/2022/07/SS-Blog.jpg

2022 Social Security Wage Base SKP Accountants Advisors LLC

https://skpadvisors.com/wp-content/uploads/2021/10/Payroll-tax_rsz.jpg

Verkko 31 lokak 2018 nbsp 0183 32 If you have multiple employers and end up paying too much Social Security tax you can get a refund from the IRS Claim the excess tax as a credit Verkko 22 marrask 2023 nbsp 0183 32 Yes you can get excess Social Security tax refunded The procedure depends on whether the excess withholdings were caused by multiple

Verkko The IRS assigns a debt code to your tax file and automatically sends your tax refund to the SSA Your refund is applied first to any amount you owe the Administration If your Verkko 12 lokak 2023 nbsp 0183 32 Under 25 000 single or 32 000 joint filing No tax on your Social Security benefits Between 25 000 and 34 000 single or 32 000 and 44 000

Download Can Social Security Tax Be Refunded

More picture related to Can Social Security Tax Be Refunded

WHAT TO KNOW Social Security Tax Refunds In 2023 WHY TO FILE YouTube

https://i.ytimg.com/vi/p4vDWdgVhEM/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4Ac4FgAKACooCDAgAEAEYUyBNKGUwDw==&rs=AOn4CLCOFPjDjqGvlpYHPzRlH6OEwkExAg

States That May Cut Taxes On Social Security Income SSI Texas

https://texasbreaking.com/wp-content/uploads/2023/02/GettyImages-1136346827-3eba69ab996a4abeb0836afe62abfd3c.jpg

Social Security Tax Unfair And Impractical

https://s.hdnux.com/photos/17/75/51/4184660/8/rawImage.jpg

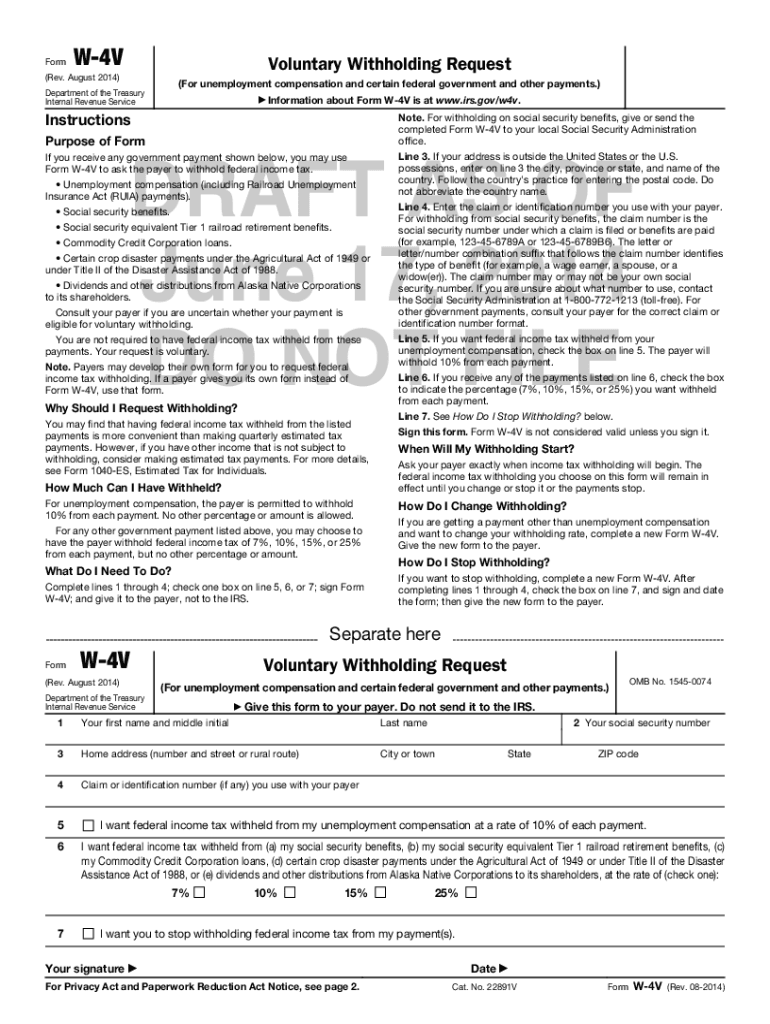

Verkko If you get Social Security you can ask us to withhold funds from your benefit and we will credit them toward your federal taxes See Withholding Income Tax From Your Social Verkko You will pay tax on your Social Security benefits based on Internal Revenue Service IRS rules if you Between 25 000 and 34 000 you may have to pay income tax on

Verkko Although we can t refund correctly paid U S Social Security taxes and contributions you still may be able to get benefits based on those tax contributions We have Verkko 18 tammik 2023 nbsp 0183 32 Here are seven things Social Security recipients present and future should know about taxation of benefits 1 Income matters age doesn t Contrary to

What Is Social Security Tax YouTube

https://i.ytimg.com/vi/LknWkRgtHNc/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4AbYIgAKAD4oCDAgAEAEYciBWKDowDw==&rs=AOn4CLDEbGS4PwTK5-pssbblCwXhyIcaHA

Deferred Social Security Tax Payments Due By Jan 3 2022 CPA

https://www.cpapracticeadvisor.com/wp-content/uploads/sites/2/2021/12/social_secruity_admin_1_.61ca6c0f9a855.png

https://finance.zacks.com/refund-social-security-taxes-withheld-4223.html

Verkko Social Security tax is based on a flat percentage of salary and does not allow for deductions from your income like the income tax system so a Social Security tax

https://www.thebalancemoney.com/social-security-and-medicare-taxes...

Verkko 14 lokak 2022 nbsp 0183 32 You might overpay Social Security and Medicare taxes for a number of reasons Some workers are exempt from paying these taxes The government will

States That Reduce Taxes On Social Security Social Security Tax

What Is Social Security Tax YouTube

Social Security GuangGurpage

Social Security Basics MCF

What Is Social Security Tax And How Much Is It TheStreet

Social Security Tax Withholding Form 2022 WithholdingForm

Social Security Tax Withholding Form 2022 WithholdingForm

Social Security Income Penalties Are Refunded To You When You Reach

Tax 3361 Individual Income Taxes Tax Return Project Chegg

Social Security Tax What Employers Need To Know

Can Social Security Tax Be Refunded - Verkko 12 lokak 2023 nbsp 0183 32 Under 25 000 single or 32 000 joint filing No tax on your Social Security benefits Between 25 000 and 34 000 single or 32 000 and 44 000