Can We Claim Two Home Loans Web 29 Juni 2022 nbsp 0183 32 The answer is Yes You can take a second home loan and you can get tax benefits on two home loans as well In fact under the current income tax laws there

Web 28 Juni 2021 nbsp 0183 32 In case you intend to claim both properties as self occupied then benefit of interest deduction is restricted to Rs 2 lakh each for co owners in a financial year Web 9 Jan 2021 nbsp 0183 32 You will be able to claim the interest paid on second home loan in fy 23 24 only once you get the possession and any unclaimed interest of prior years can be

Can We Claim Two Home Loans

Can We Claim Two Home Loans

https://www.paisabazaar.com/wp-content/uploads/2019/05/HRA-Home-Loan.jpg

Can You Have Two Home Equity Loans

https://images.ratecity.com.au/large/20210712/can-you-have-two-home-equity-loans-gaZT1CkGM.jpg?width=3840

Understanding The Rules Can We Claim HRA And Home Loan Deductions

https://www.wpc-2025.com/wp-content/uploads/2023/04/NRI-Home-Loans-790x444.png

Web 4 Jan 2024 nbsp 0183 32 Yes you can apply for two home loans simultaneously provided you meet the eligibility criteria set by the lenders This includes having a strong credit score Web 12 Okt 2023 nbsp 0183 32 A second loan is available to cover the closing costs of buying the property such as property transfer tax and notary fees If you live and work in Germany but aren t a full resident you can theoretically

Web 31 Jan 2022 nbsp 0183 32 If you have three or more properties you can only claim two of them as respectively your primary and second homes for a given year If you happen to sell one of the homes you were claiming in Web The Government made a significant amendment to the financial budget for FY 2019 20 in which taxpayers have been allowed to declare two houses as self occupied As a result taxpayers can now claim tax benefits on a

Download Can We Claim Two Home Loans

More picture related to Can We Claim Two Home Loans

Can We Claim HRA And Home Loan Deduction Both At The Same Time YouTube

https://i.ytimg.com/vi/4NbDusOghXE/maxresdefault.jpg

How To Get A Second Home Loan For Rental Income

https://www.comparepolicy.com/blogs/wp-content/uploads/2018/01/Home-Loan-Benefits.png

Credit Union Spots Savings Opportunity For Homeowners Dupaco

https://www.dupaco.com/wp-content/uploads/2021/02/DupacoChrisandJessWalters-11241-web-1200x600-1.jpg

Web 13 Jan 2021 nbsp 0183 32 Under Section 24B of the Income Tax I T Act you can claim deduction for interest payable on a loan repair renovation or construction But if you own only one house which is self occupied the Web 30 M 228 rz 2023 nbsp 0183 32 Yes Mr Prakash can avail a second home loan and claim tax benefits as per Section 80C and 24 of the Income Tax Act Final Word Thus you can invest in a

Web Vor 2 Tagen nbsp 0183 32 The mortgage interest deduction MID allows borrowers to write off a portion of the interest on their home loan That lowers your taxable income and can move you Web The tax deduction fraction is determined by the loan s ownership proportion Each joint owner of the home loan can claim the maximum tax refund i e Rs 2 00 000 for

Can I Avail Two Home Loans At The Same Time 30th November 2023

https://www.mymoneymantra.com/_next/image?url=https:%2F%2Fd1lt2ralzv8247.cloudfront.net%2FCan_I_Avail_Two_Home_Loans_at_the_Same_Time_b1c627b358.jpg&w=3840&q=75

How To Claim Interest On Home Loan Deduction While Efiling ITR

https://mytaxcafe.com/how-to-e-file/images/HLI/3.jpg

https://stableinvestor.com/2022/06/tax-benefits-second-home-loan.html

Web 29 Juni 2022 nbsp 0183 32 The answer is Yes You can take a second home loan and you can get tax benefits on two home loans as well In fact under the current income tax laws there

https://economictimes.indiatimes.com/wealth/tax/what-will-be-the...

Web 28 Juni 2021 nbsp 0183 32 In case you intend to claim both properties as self occupied then benefit of interest deduction is restricted to Rs 2 lakh each for co owners in a financial year

Common Types Of Home Loans Infographic Disaster Blaster

Can I Avail Two Home Loans At The Same Time 30th November 2023

Home Loan EMI And Tax Deduction On It EMI Calculator

Top 3 Tips To Find The Best Homeowner Loans UK Homeowner Loan Types

All You Need To Know About Home Loan For Women

Which Home Loan Is Right For Your Home Infographic Which Loan Is

Which Home Loan Is Right For Your Home Infographic Which Loan Is

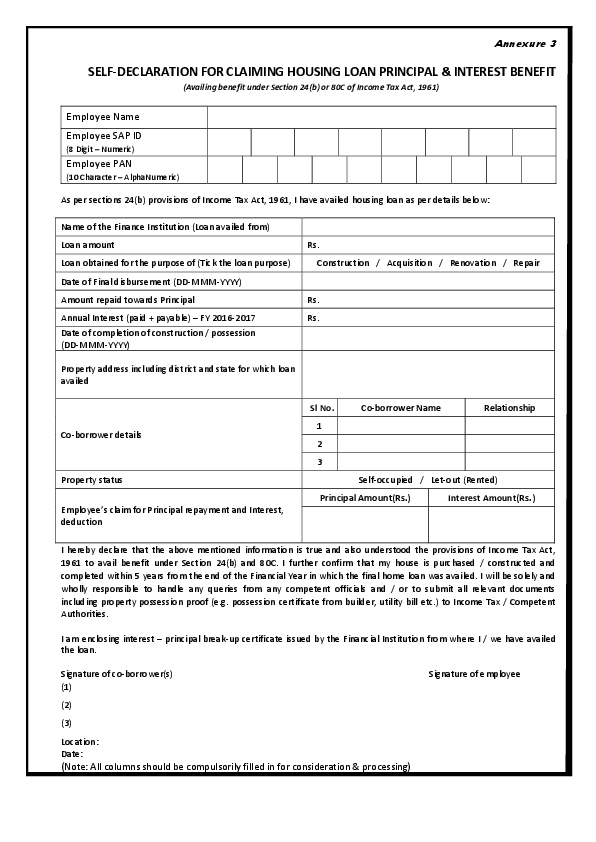

PDF SELF DECLARATION FOR CLAIMING HOUSING LOAN PRINCIPAL INTEREST

Home Equity Loans Security State Bank

I Have Two Home Loans Can I Claim Income Tax Benefit On Both Mint

Can We Claim Two Home Loans - Web 12 Okt 2023 nbsp 0183 32 A second loan is available to cover the closing costs of buying the property such as property transfer tax and notary fees If you live and work in Germany but aren t a full resident you can theoretically