Can You Claim 80c Deduction On Under Construction Property Since the under construction stage of the house is well defined and no principal amount is owed during this period the eligibility for claiming tax benefits under

This benefit allows for a deduction of up to 1 50 000 per financial year on the interest paid on home loans provided that the limit of 1 5 lakh under Section 80C has already been exhausted To claim this Articles deals with Faqs on Benefit U s 24 and 80C on Jointly Owned Property Under Construction Property multiple properties and Simultaneous benefit of

Can You Claim 80c Deduction On Under Construction Property

Can You Claim 80c Deduction On Under Construction Property

https://life.futuregenerali.in/media/5utfvrlk/chapter-via-section.jpg

All Deductions In Section 80C Chapter VI A FinCalC Blog

https://fincalc-blog.in/wp-content/uploads/2022/03/All-Deductions-in-Section-80C-80CCC-80CCD-80D-in-Hindi-Chapter-VI-A-1.webp

Section 80C Deduction Income Tax Act IndiaFilings

https://img.indiafilings.com/learn/wp-content/uploads/2017/05/12010349/Section-80C-Deduction.jpg

Deduction on home loan interest cannot be claimed when the house is under construction This pre construction interest can be claimed only after the construction is A home loan borrower can claim Income Tax exemption on interest payments of up to Rs 2 lakh and another Rs 1 5 lakh under Section 80 C towards the principal repayment

The taxpayer can claim a deduction under section 80C for repaying the principal amount on a home loan taken for the construction or purchase of residential property Additionally deductions are also The Income Tax Act allows individuals to claim a deduction on the interest paid during the pre construction period which is the period between the starting date of

Download Can You Claim 80c Deduction On Under Construction Property

More picture related to Can You Claim 80c Deduction On Under Construction Property

Section 80C Deductions Save Up To 1 5 Lakhs On Taxes

https://life.futuregenerali.in/media/2zjhyg5j/section-80c-deductions.jpg

Section 80C Deductions List To Save Income Tax FinCalC Blog

https://fincalc-blog.in/wp-content/uploads/2022/09/section-80C-deductions-list-to-save-income-tax-video.webp

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/11/Tax-Saving-Benefits-of-having-property-through-Home-Loan-1.png

Section 80EEA states that borrowers can claim tax exemption up to a maximum of Rs 1 5 Lakh on payments made towards the interest component repayment 1 Can I get income tax benefit on under construction property Yes you get income tax benefits for an under construction property under Sections 24 and 80C

Deduction Under Section 80C You can claim deductions on the principal component of your home construction loan under this Section After the construction of your property is A home loan for under construction property can get tax deductions up to Rs 2 lakhs on interest paid in a year and up to 1 5 lakhs for principal paid under Section 80C of the

Deductions Under Section 80C Benefits Works Myfinopedia

https://www.myfinopedia.com/wp-content/uploads/2023/01/Deductions-Under-Section-80C.jpg

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2022/07/Tax-benefits-on-Home-Loan-819x1024.jpeg

https://tax2win.in/guide/under-construction-property-tax-benefit

Since the under construction stage of the house is well defined and no principal amount is owed during this period the eligibility for claiming tax benefits under

https://vakilsearch.com/blog/tax-deduction-o…

This benefit allows for a deduction of up to 1 50 000 per financial year on the interest paid on home loans provided that the limit of 1 5 lakh under Section 80C has already been exhausted To claim this

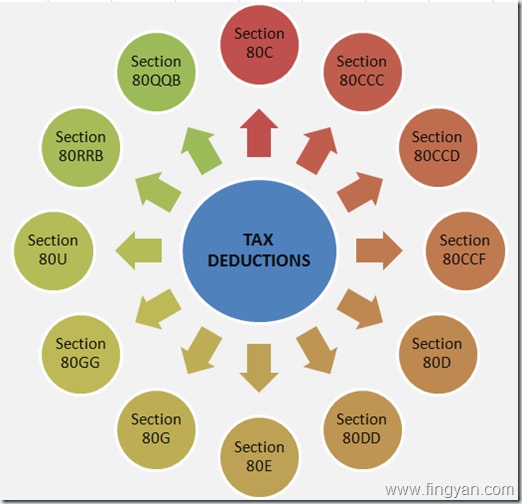

Tax Savings Deductions Under Chapter VI A Learn By Quicko

Deductions Under Section 80C Benefits Works Myfinopedia

Have You Claimed These ITR Deductions On Section 80C 80CCD 80D

How To Claim Business Loan Tax Deductions Under Section 80C IIFL Finance

Tax Savings Under Section 80 Provisions You Need To Know

All About Deduction Under Section 80C Of The Income Tax Act Ebizfiling

All About Deduction Under Section 80C Of The Income Tax Act Ebizfiling

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

Section 80C Deduction Under Section 80C In India Paisabazaar

Tax Deductions For Financial Year 2018 19 WealthTech Speaks

Can You Claim 80c Deduction On Under Construction Property - Deduction on home loan interest cannot be claimed when the house is under construction This pre construction interest can be claimed only after the construction is