Can You Claim Gas Mileage To Work On Taxes If you use your vehicle for work you may be entitled to a tax deduction The IRS vehicle tax deduction is either a standard mileage

You can claim tax relief on the money you ve spent on fuel and electricity for business trips in your company car Keep records to show the actual cost of the fuel How to claim gasoline on your taxes There are two ways to write off car related expenses on your tax return the actual expense method and the standard

Can You Claim Gas Mileage To Work On Taxes

Can You Claim Gas Mileage To Work On Taxes

https://www.theoasisfirm.com/wp-content/uploads/2022/04/Can-You-Claim-Gas-On-Your-Taxes.png

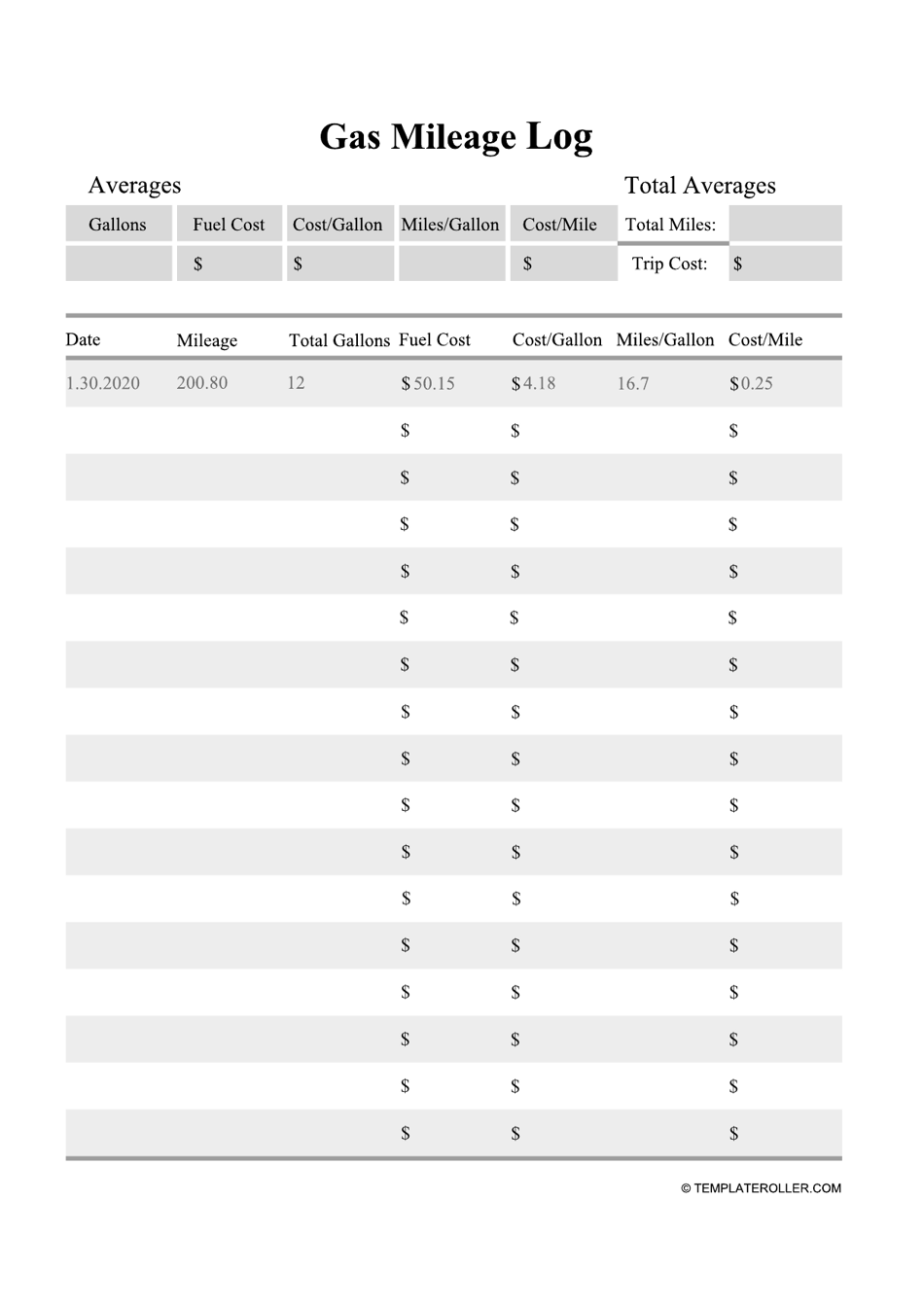

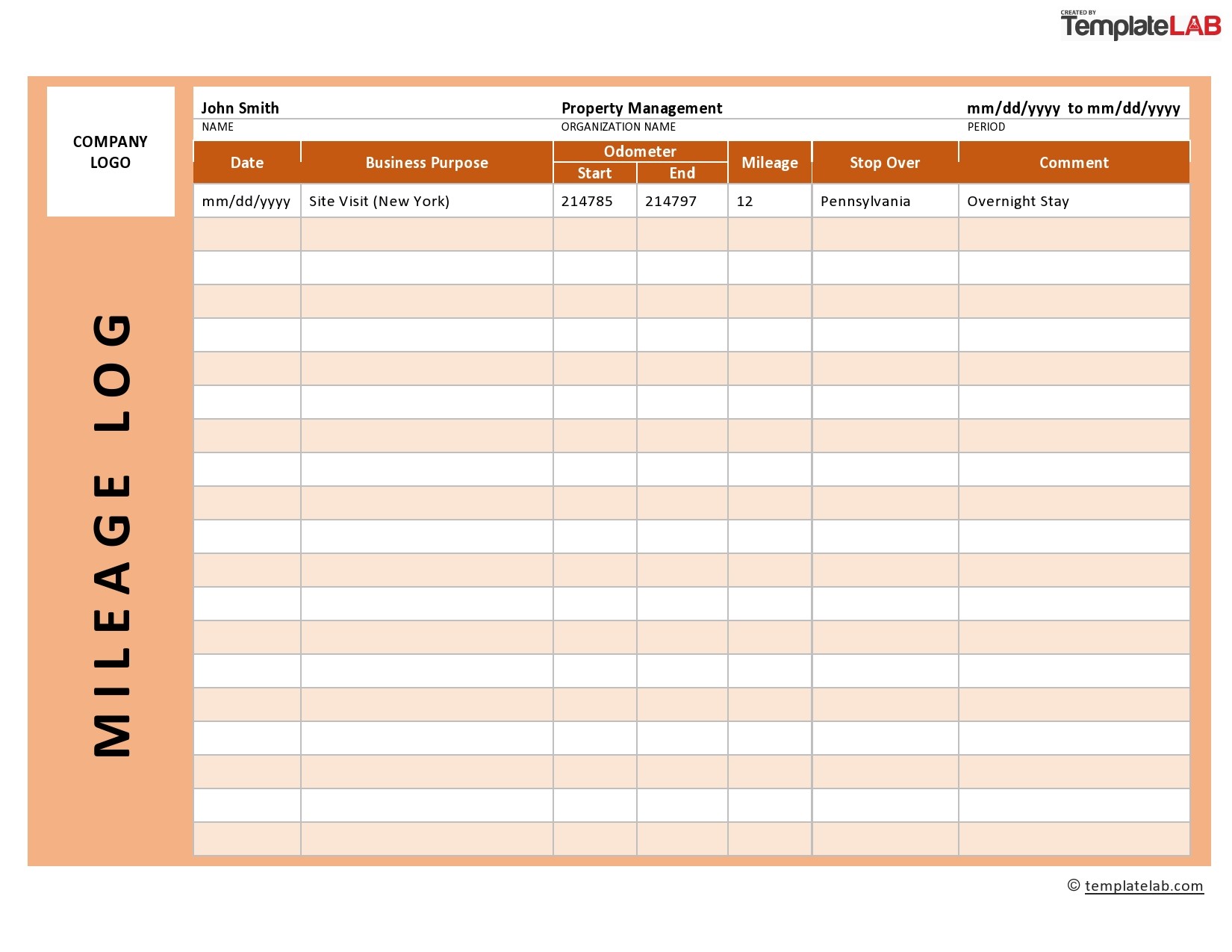

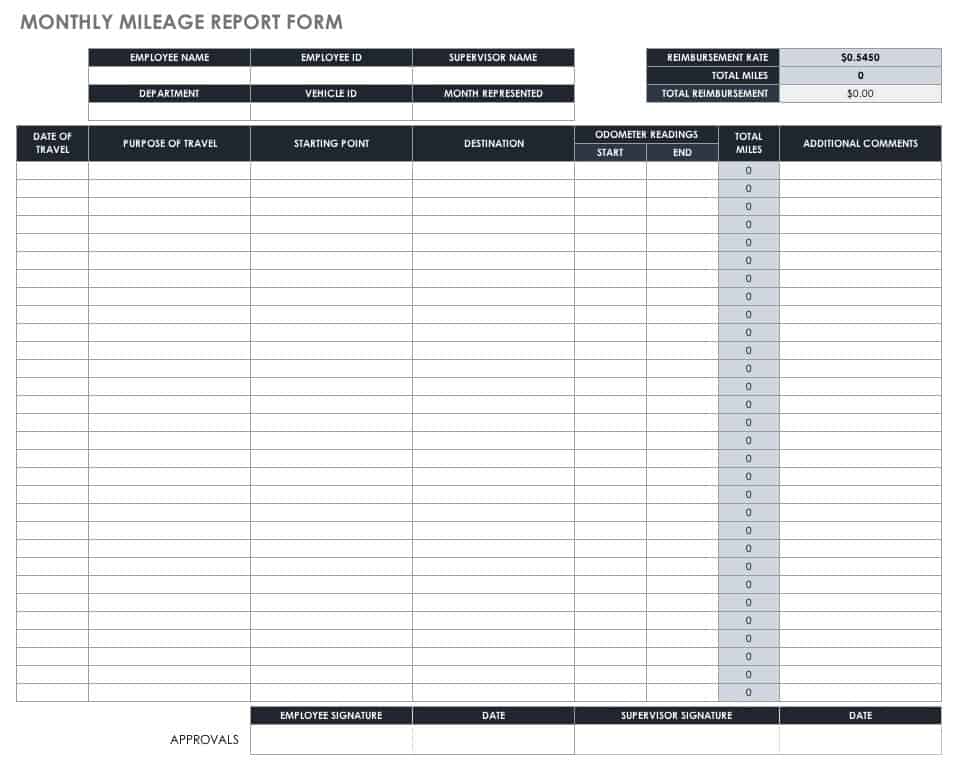

Example Of 25 Printable Irs Mileage Tracking Templates Gofar Mileage

https://i.pinimg.com/originals/5b/93/c0/5b93c0ebe22d3e39de585887378000ba.jpg

18 Mileage Expense Worksheets Worksheeto

https://www.worksheeto.com/postpic/2013/05/gas-mileage-log-sheet-printable_557927.png

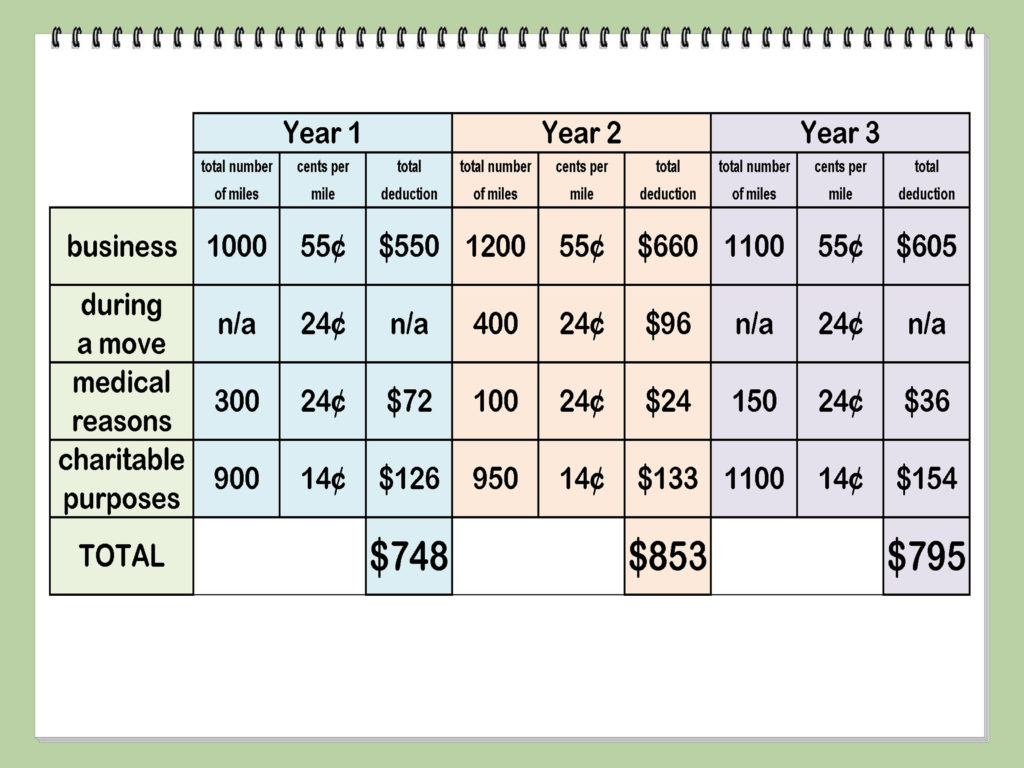

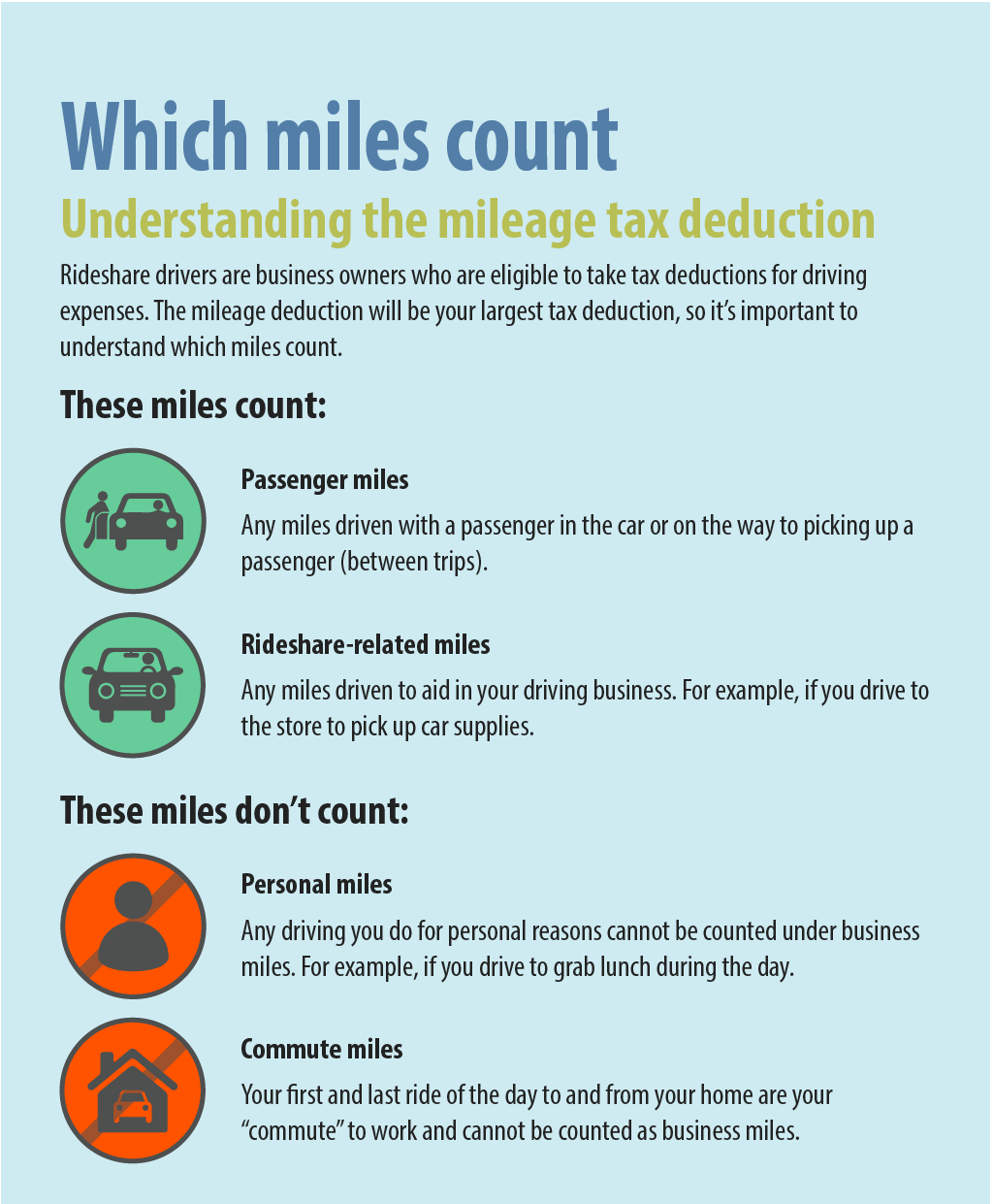

You can deduct your mileage at the standard rate of 18 cents per mile for 2022 and 22 cents per mile for 2023 or you can deduct your actual costs of gas and oil Deducting parking costs and tolls is also You should use Form 2106 and Schedule 1 Form 1040 to claim mileage on taxes An individual itemizing deductions and are claiming a deduction for medical or charity

Certain taxpayers can deduct mileage from vehicle use related to business charity medical or moving purposes To take the deduction taxpayers must meet use requirements and may have to The IRS has not set a limit or cap on the amount of deductible miles you can claim You cannot deduct mileage expenses as a W 2 employee because miscellaneous unreimbursed employee

Download Can You Claim Gas Mileage To Work On Taxes

More picture related to Can You Claim Gas Mileage To Work On Taxes

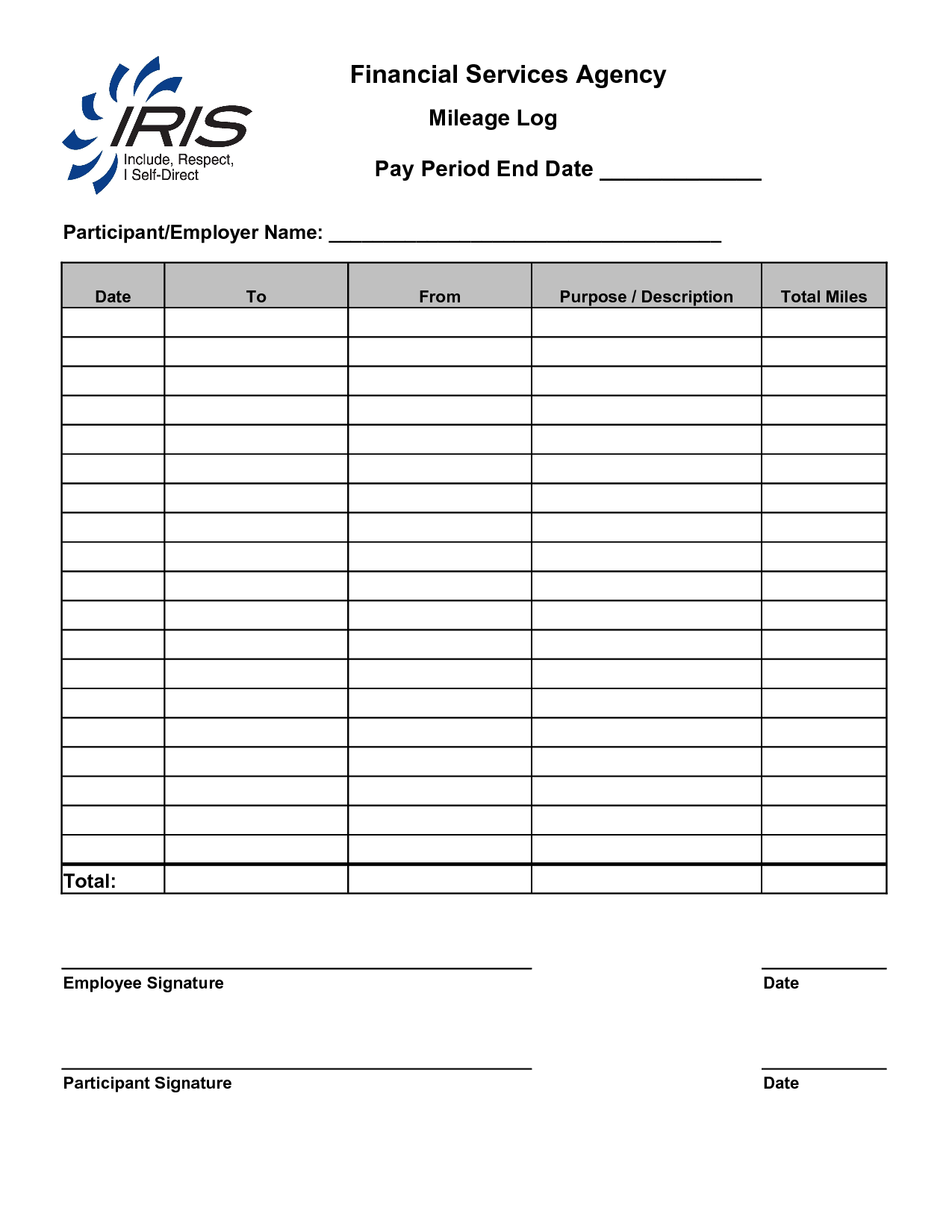

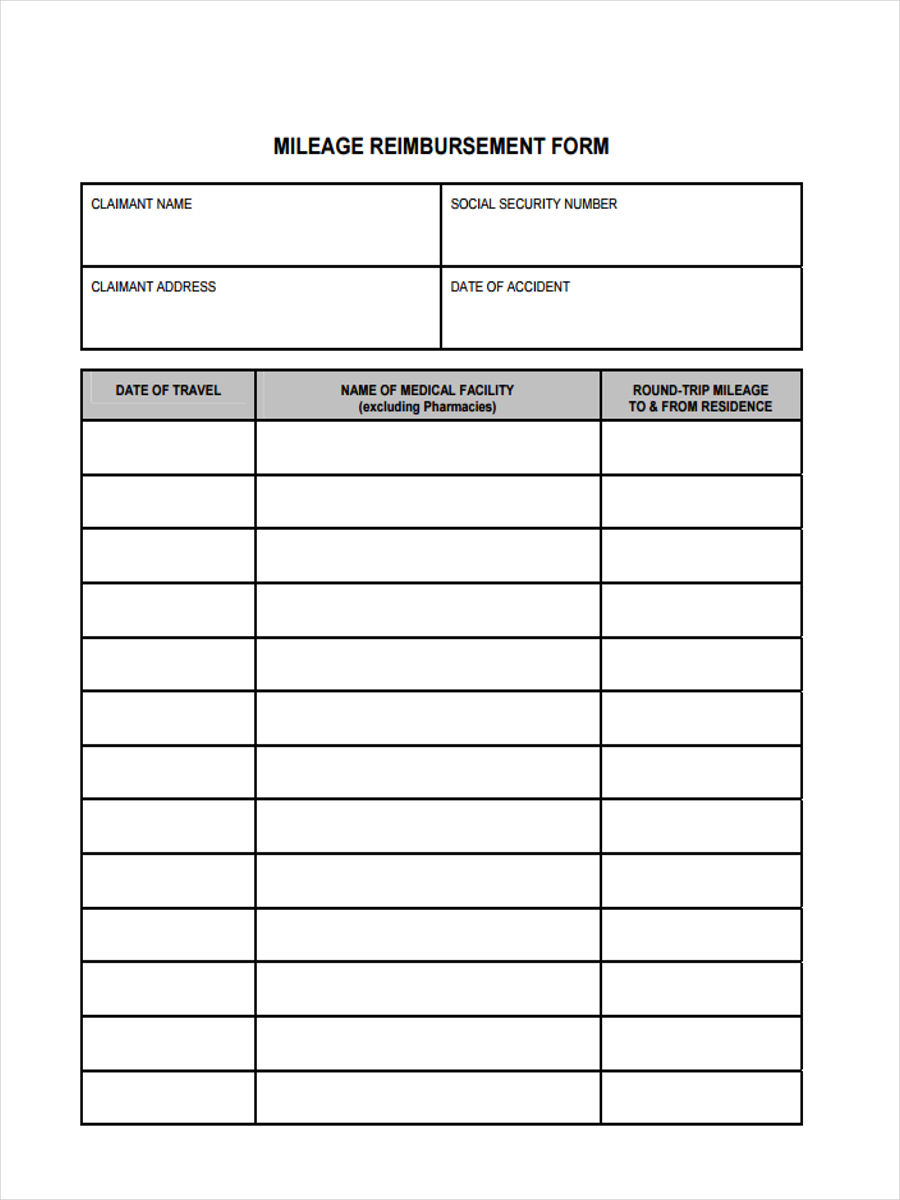

Workers Compensation Mileage Reimbursement Form Colorado Form

https://www.viralcovert.com/wp-content/uploads/2018/12/workers-compensation-mileage-reimbursement-form-colorado-700x547.jpg

Free Printable Gas Mileage Logs Printable Templates

https://data.templateroller.com/pdf_docs_html/2049/20499/2049985/gas-mileage-log-template_print_big.png

Government Mileage Calculator IRS Mileage Rate 2021

https://irs-mileage-rate.com/wp-content/uploads/2021/08/how-to-calculate-mileage-for-taxes-10-steps-with-pictures-1024x768.jpg

If you qualify you can claim mileage or vehicle expenses on your tax return Your choice depends on how often and how far you drive for business medical If you re self employed you typically can deduct expenses for the miles you drive or for the actual automobile costs for business purposes You can calculate your driving deduction

You can claim a section 179 deduction and use a depreciation method other than straight line only if you don t use the standard mileage rate to figure your business related car Mileage is an allowable deduction if you re self employed or own your own business You can choose between the standard mileage rate or the actual cost method where you

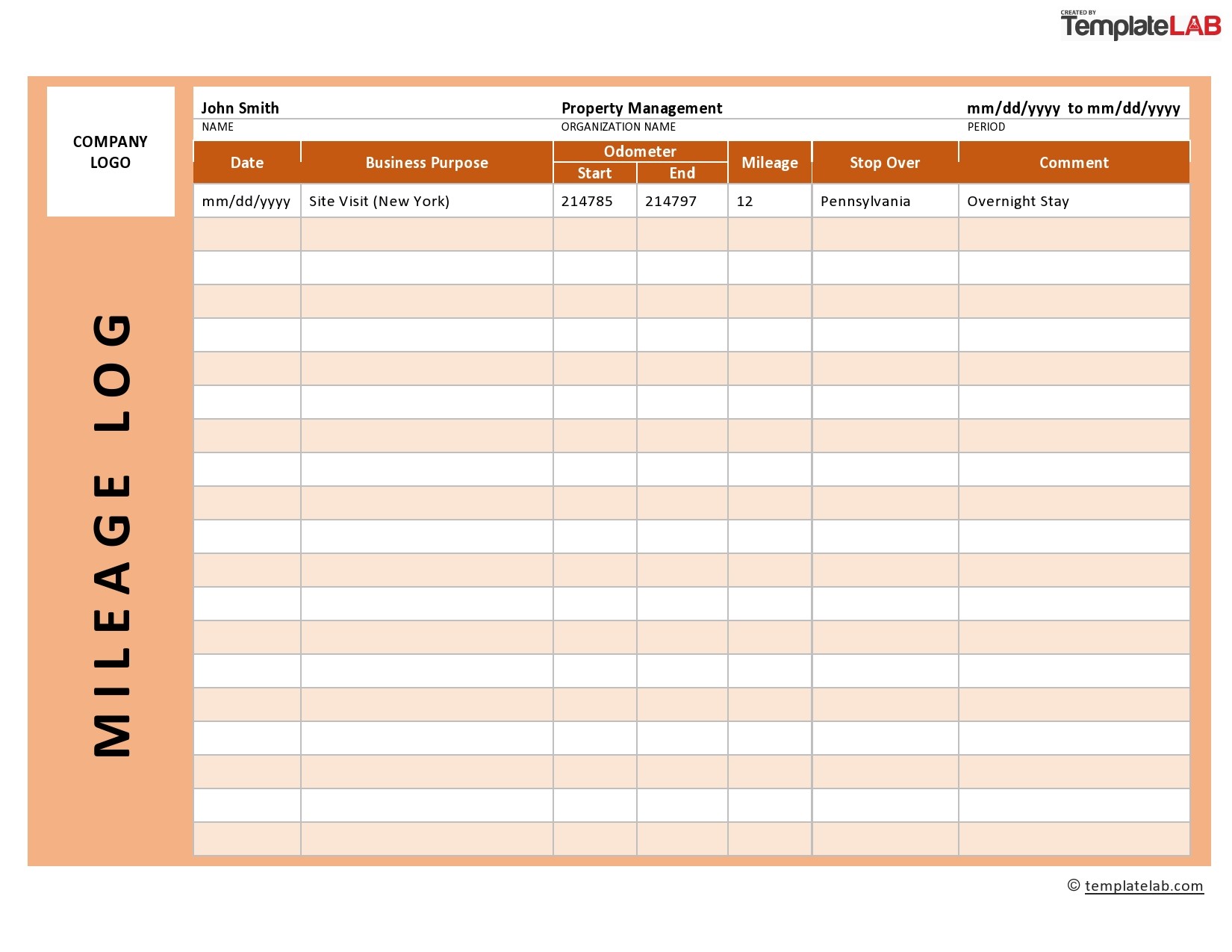

Mileage Tracker Template Excel

https://templatelab.com/wp-content/uploads/2020/02/Mileage-Log-TemplateLab.com_.jpg

Can I Claim Gas On My Taxes For Driving To Work Rules Explained

https://media.marketrealist.com/brand-img/vU5D3n61d/1280x670/can-i-claim-gas-on-my-taxes-for-driving-to-work-1667227818247.jpg?position=top

https://marketrealist.com/taxes/can-i-cla…

If you use your vehicle for work you may be entitled to a tax deduction The IRS vehicle tax deduction is either a standard mileage

https://www.gov.uk/.../vehicles-you-use-for-work

You can claim tax relief on the money you ve spent on fuel and electricity for business trips in your company car Keep records to show the actual cost of the fuel

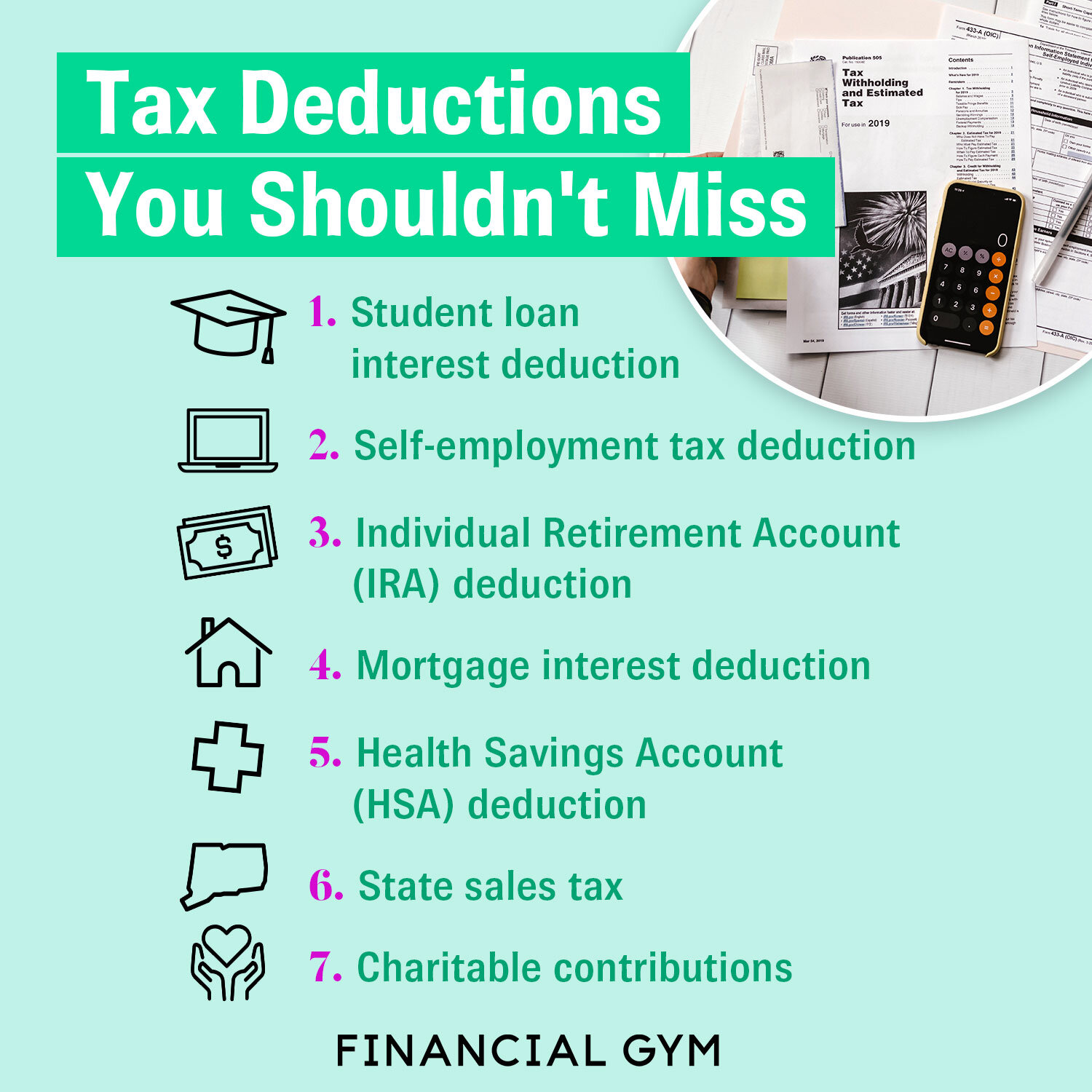

Tax Deductions Write Offs To Save You Money Financial Gym

Mileage Tracker Template Excel

Very Much Premedication Demon Play Free Mileage Tracker Spreadsheet

How To Claim The Work Mileage Tax Rebate Goselfemployed co

Mileage Report Template 5 In 2020 Mileage Logging Mileage Tracker

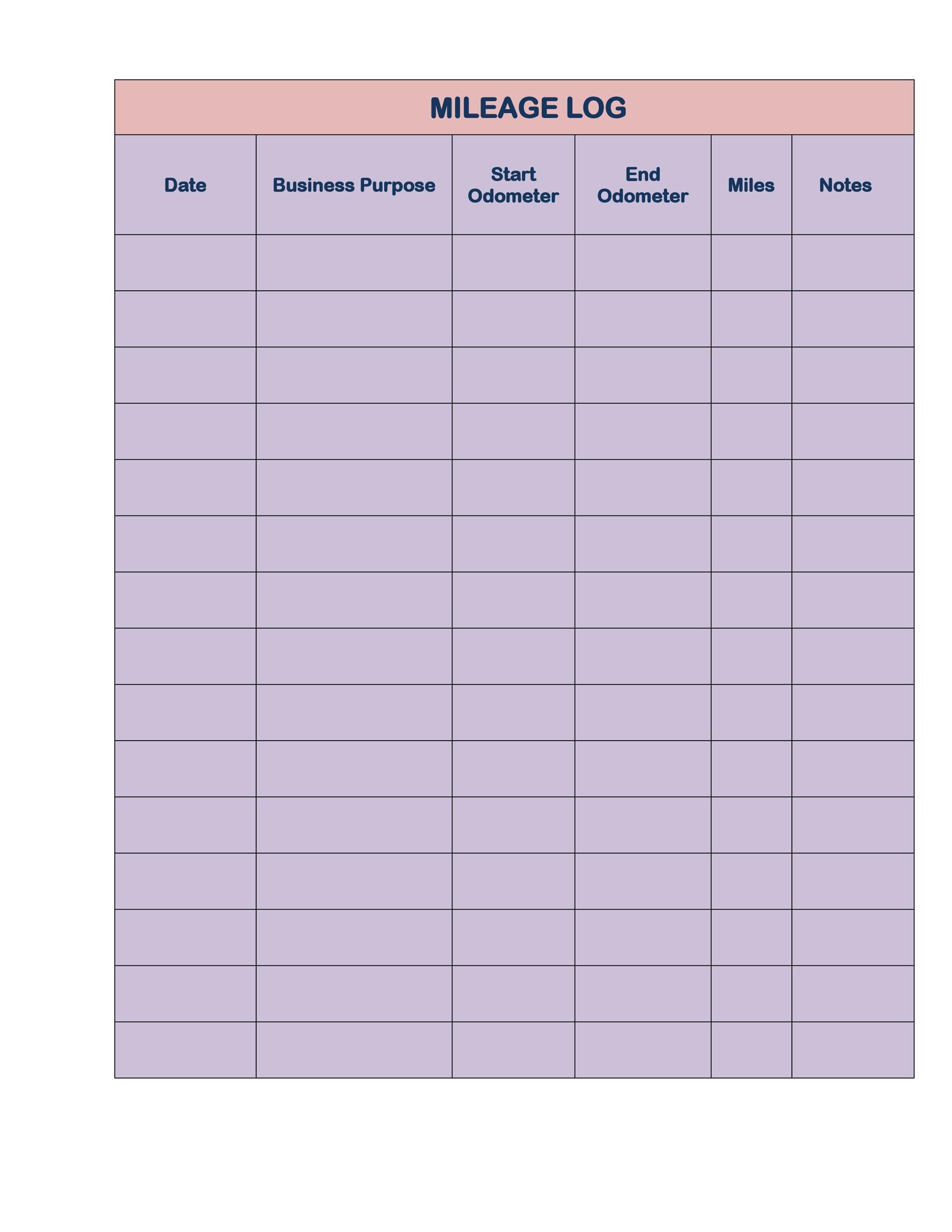

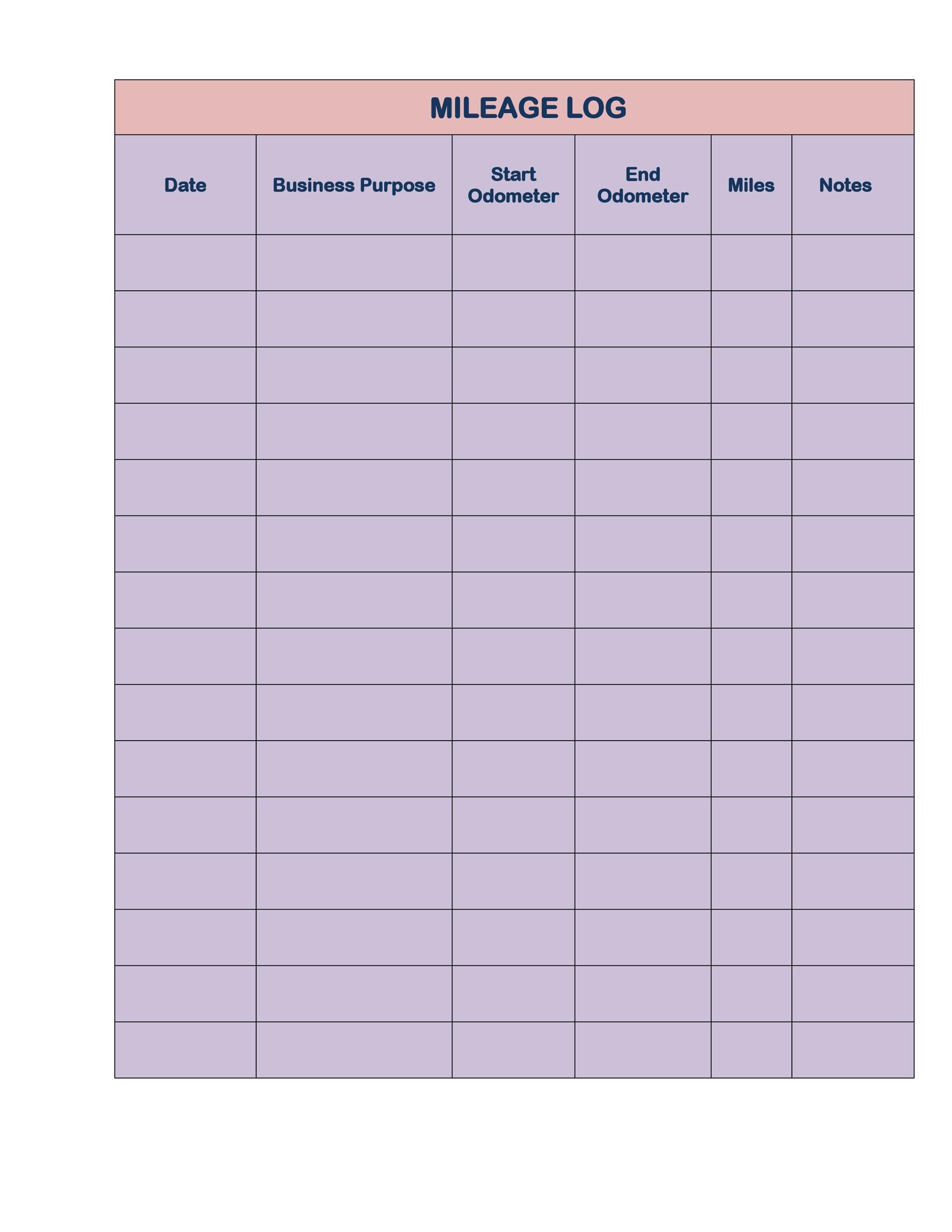

Free Printable Mileage Tracker

Free Printable Mileage Tracker

How To Claim The Standard Mileage Deduction Get It Back

Free Mileage Log Templates Smartsheet 2023

Example Mileage Reimbursement Form Printable Form Templates And Letter

Can You Claim Gas Mileage To Work On Taxes - You can deduct your mileage at the standard rate of 18 cents per mile for 2022 and 22 cents per mile for 2023 or you can deduct your actual costs of gas and oil Deducting parking costs and tolls is also