Can You Claim The Solar Tax Credit Twice For The Same Home Homeowners can claim the solar tax credit once per solar and or battery system installed on an eligible property and the credit must be claimed in the tax year the system was deemed operational There are a few scenarios where the same person could claim the solar tax credit more than once

While you cannot apply for the solar tax credit twice you can claim your tax amount to roll over next year However you first need to apply for a tax credit claim The process is quite technical but pretty simple too Generally you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into the house assuming the builder did not claim the tax credit in other words you may claim the

Can You Claim The Solar Tax Credit Twice For The Same Home

Can You Claim The Solar Tax Credit Twice For The Same Home

https://i.ytimg.com/vi/jZkTfYSsaw8/maxresdefault.jpg

Federal Solar Tax Credit What It Is How To Claim It For 2024

https://www.ecowatch.com/wp-content/uploads/2022/10/Solar-Investment-Tax-Credit-5-1-2.png

How To Fill Out IRS Form 5695 To Claim The Solar Tax Credit Federal

https://094777.com/774f1ba6/https/d98b8f/images.prismic.io/palmettoblog/283c592c-9e38-4b57-a6d0-f70cf6ce54f4_form-5695.jpg?auto=compress,format&rect=0,0,1200,800&w=1200&h=800

Yes you can claim the solar tax credit more than once as long as you re claiming it in different years If you install solar panels in 2023 and then you decide to install more solar panels in 2024 you can claim the 30 ITC For example beginning in 2023 a taxpayer can claim the maximum Energy Efficient Home Improvement Credit allowed every year that eligible improvements are made Q4 May a taxpayer carry forward unused credits to another tax year

Generally you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into the house assuming the builder did not claim the tax credit in other words you may claim the Can you claim the solar tax credit twice Technically you cannot claim the solar tax credit twice if you own your home However if you own more than one home you may be able to claim separate tax credits for solar installations on each of those homes

Download Can You Claim The Solar Tax Credit Twice For The Same Home

More picture related to Can You Claim The Solar Tax Credit Twice For The Same Home

Solar Tax Credit How It Works And Claim Limits FireFly Solar

https://firefly.solar/wp-content/uploads/solar-tax-credit-solar-panel-systems.jpg

Everything You Need To Know The New 2021 Solar Federal Tax Credit

https://www.sunnova.com/-/media/Marketing-Components/Blog/Blog-Optimized-Images/Sunnova_Solar-Tax-Credits-April-Blog_History-min.ashx

The Solar Lowdown Customers Ask What Is The Solar Tax Credit Skyline

https://skylinesmartenergy.com/wp-content/uploads/2023/05/Hero-Locations.jpg

You can claim the tax credit if you receive other clean energy incentives for the same project but that additional financial assistance might shrink the overall cost of your system for When you purchase solar equipment for your home and have tax liability you generally can claim a solar tax credit to lower your tax bill The Residential Clean Energy Credit is non refundable meaning that it can offset your income tax liability dollar for dollar but any excess credit won t be refunded

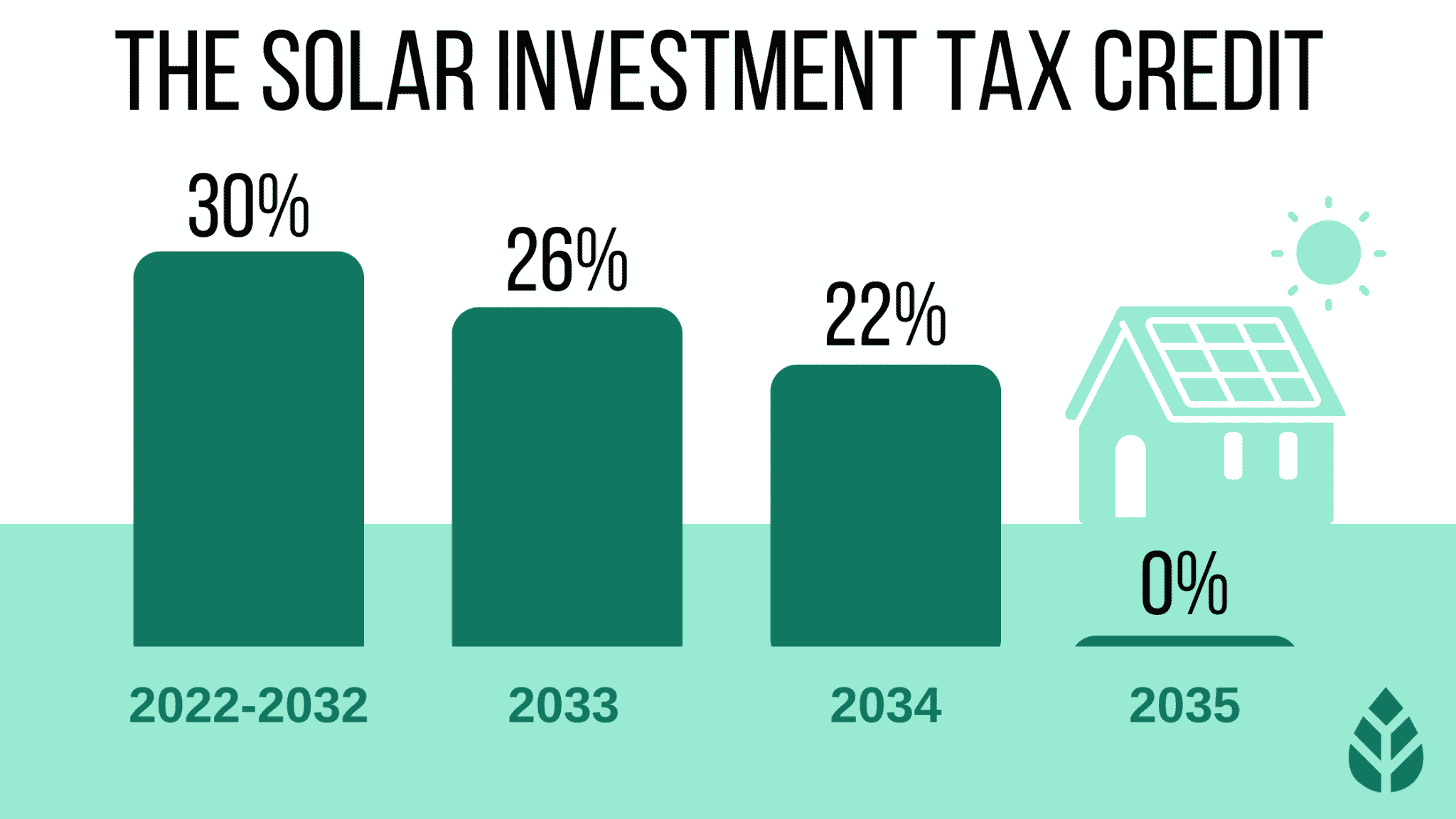

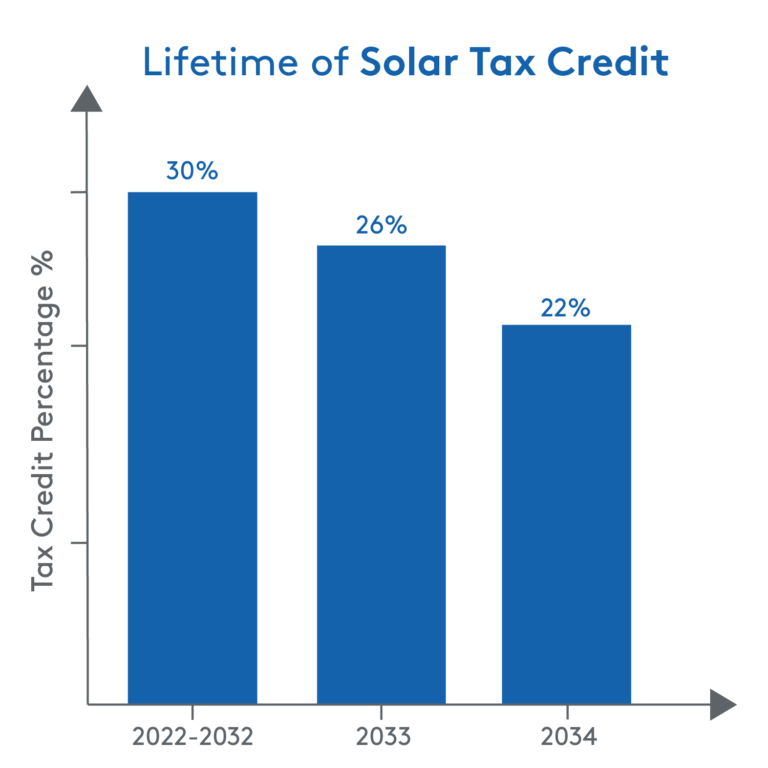

Am I eligible to claim the federal solar tax credit You might be eligible for this tax credit if you meet all of the following criteria Your solar PV system was installed between January 1 2017 and December 31 2034 The solar PV system is located at a primary residence of yours in the United States 5economy by 2050 Residential Clean Energy Credit If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit

What Is Solar Tax Credit How Does It Work Supreme Solar Electric

https://supreme.solar/wp-content/uploads/2022/07/solar-tax-credit.jpg

Everything You Need To Know About The Solar Tax Credit

https://gospringsolarnow.com/wp-content/uploads/2022/08/Everything-You-Need-To-Know-About-The-Solar-Tax-Credit-scaled-2560x1280.jpeg

https://www.solar.com/learn/frequently-asked...

Homeowners can claim the solar tax credit once per solar and or battery system installed on an eligible property and the credit must be claimed in the tax year the system was deemed operational There are a few scenarios where the same person could claim the solar tax credit more than once

https://theimpactinvestor.com/can-you-claim-solar-tax-credit-twice

While you cannot apply for the solar tax credit twice you can claim your tax amount to roll over next year However you first need to apply for a tax credit claim The process is quite technical but pretty simple too

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

What Is Solar Tax Credit How Does It Work Supreme Solar Electric

Solar Tax Credit Guide And Calculator

Can You Claim The Solar Tax Credit More Than Once Solar Power Nation

Can You Claim Solar Tax Credit Twice Energy Theory

How Does The Federal Solar Tax Credit Work Nicki Karen

How Does The Federal Solar Tax Credit Work Nicki Karen

Solar Federal Tax Credit Commercialsolar biz

Federal Investment Solar Tax Credit Guide Learn How To Claim The

The Federal Solar Tax Credit What You Need To Know 2022

Can You Claim The Solar Tax Credit Twice For The Same Home - For example beginning in 2023 a taxpayer can claim the maximum Energy Efficient Home Improvement Credit allowed every year that eligible improvements are made Q4 May a taxpayer carry forward unused credits to another tax year