Can You Deduct 529 Contributions In Georgia Georgia taxpayers may be eligible for a Georgia income tax deduction on contributions made to a Path2College 529 Plan up to 8 000 per year per beneficiary for joint filers

For contributions made to a Path2College 529 Plan account by April 18 2023 Georgia taxpayers may be eligible for a state income tax deduction up to 8 000 Georgia taxpayers filing jointly can deduct up to 8 000 per year per beneficiary in the Path2College 529 Plan contributions from their Georgia adjusted gross income Individual filers can deduct up to 4 000

Can You Deduct 529 Contributions In Georgia

Can You Deduct 529 Contributions In Georgia

https://i2.wp.com/thedailycpa.com/wp-content/uploads/2017/06/36858563_xl.jpg?fit=3831%2C2554&ssl=1

Hecht Group Can You Deduct Employee Wages For Working On Rental Property

https://img.hechtgroup.com/1663815977999.a80ddf7e236158c3db9a35affdb4d746

Investing Retirement Funds Can You Deduct Losses On A 529 Plan

https://i.ytimg.com/vi/MMYfzOA9FTk/maxresdefault.jpg

The state also offers a sizable tax deduction for residents who contribute to its Path2College 529 plan Contributors can deduct 4 000 per beneficiary and 8 000 Georgia taxpayers may be eligible for a state income tax deduction up to 8 000 per beneficiary for those filing a joint return and up to 4 000 per beneficiary for

State residents can deduct annual contributions to the Georgia 529 plan on their taxes Single residents can deduct up to 4 000 a year And married residents who file jointly can deduct up to 8 000 a year Starting with tax year 2020 married Georgia taxpayers who file jointly and invest in the Path2College 529 Plan can deduct up to 8 000 from their state taxable income per account each year Single filers can deduct up

Download Can You Deduct 529 Contributions In Georgia

More picture related to Can You Deduct 529 Contributions In Georgia

Can Grandparents Deduct 529 Contributions In Pennsylvania Linesville

https://linesville.net/wp-content/uploads/2023/07/tamlier_unsplash_Can-Grandparents-Deduct-529-Contributions-in-Pennsylvania-3F_1688833860.webp

529 Acres In Webster County Georgia

https://assets.landsofamerica.com/resizedimages/10000/10000/h/80/1-4044237719

Introduction To Financial Econometrics Mock Exam Can You Deduct The

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/3d88d280661ee184a9827052f4bec253/thumb_1200_1553.png

Georgia offers a state tax deduction for contributions to a 529 plan of up to 4 000 for single filers and 8 000 for married filing jointly tax filers Minimum 25 Maximum Accepts contributions until all account For tax years beginning on or before January 1 2016 you may deduct up to 2 000 of your contribution on behalf of any beneficiary of a Georgia Higher Education Savings

You can obtain enrollment ACP and payroll deduction information by contacting the state office of the Path2College 529 Plan at 404 463 0000 or outside metro Atlanta at 866 If a taxpayer contributes to a Georgia 529 College Savings plan a portion of the contribution can be subtracted from income on the Georgia return Contributions up

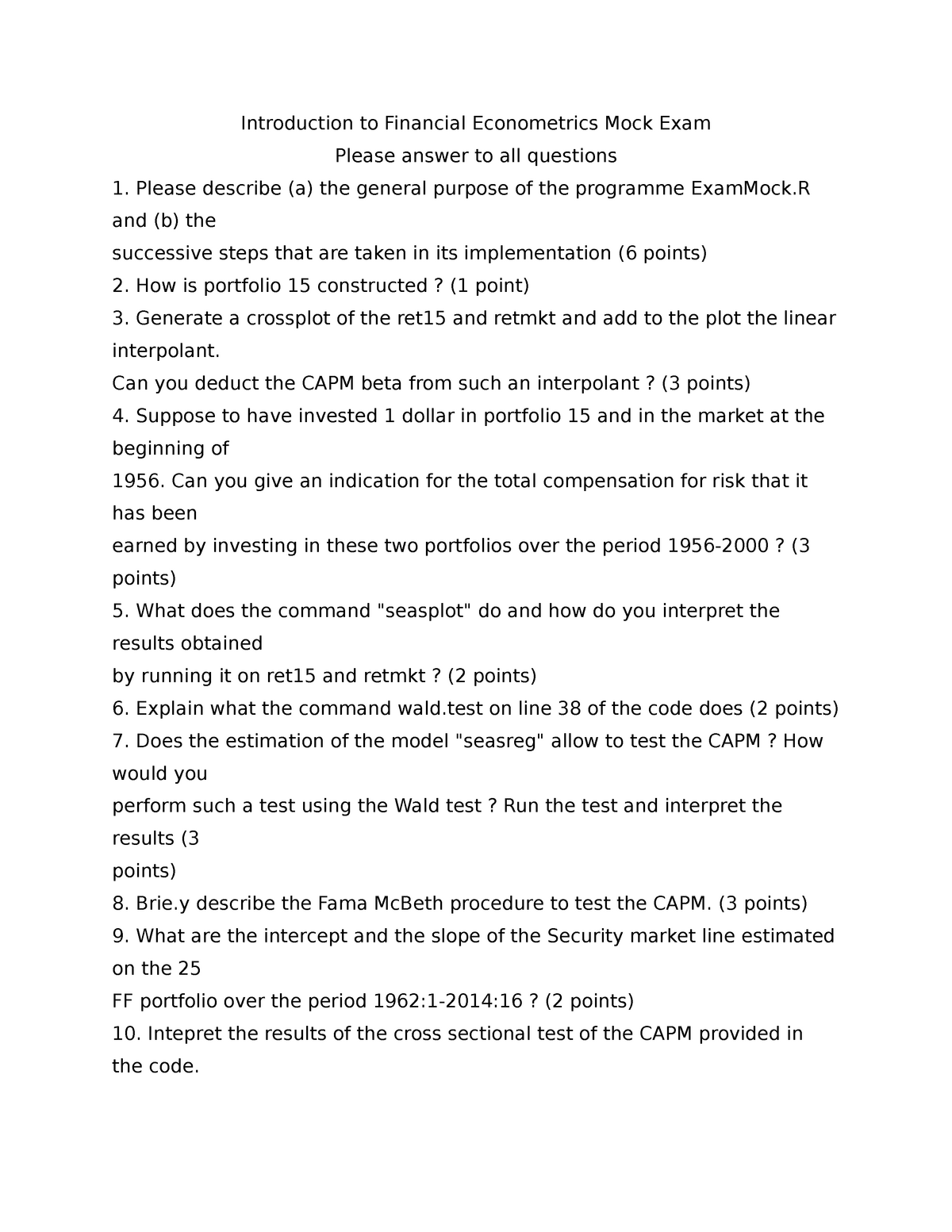

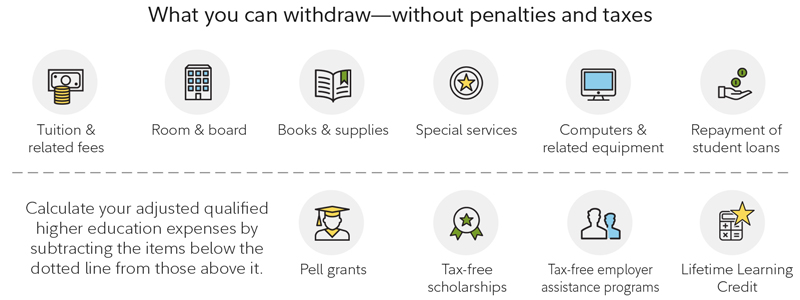

How To Spend From A 529 College Plan Fidelity Institutional

https://institutional.fidelity.com/app/proxy/image?literatureURL=/RD_9895516/spend_from_529plan_2020_info_1.jpg

Are Professional Conferences Tax Deductible

https://i0.wp.com/utrconf.com/wp-content/uploads/2022/03/ARE-PROFESSIONAL-CONFERENCES-TAX-DEDUCTIBLE.png?resize=1536%2C864&ssl=1

https://www.path2college529.com/resources/faq

Georgia taxpayers may be eligible for a Georgia income tax deduction on contributions made to a Path2College 529 Plan up to 8 000 per year per beneficiary for joint filers

https://gsfc.georgia.gov/press-releases/2023-03-20/...

For contributions made to a Path2College 529 Plan account by April 18 2023 Georgia taxpayers may be eligible for a state income tax deduction up to 8 000

Are Cryptocurrency Losses From Scams Deductible Babbage Co

How To Spend From A 529 College Plan Fidelity Institutional

Are Student Loan Payments Tax Deductible

How To Deduct Charitable Contributions QuickBooks

Tax Deductible Donations FAQs

Income 529 Plan Account Deduction

Income 529 Plan Account Deduction

Deductible Business Expenses For Independent Contractors Financial

Interest Rate For 529 Plans Dollar Keg

Deber a Transferir Los Saldos A Una Tarjeta De Cr dito Sin Intereses

Can You Deduct 529 Contributions In Georgia - If you made a contribution to the 529 plan you will be able to claim a subtraction from income If you withdrew money from your 529 plan you may have to add the withdrawal