Child Care Tax Benefit Canada This booklet explains who is eligible for the Canada Child Tax Benefit how to apply for it how we calculate it and when we make payments

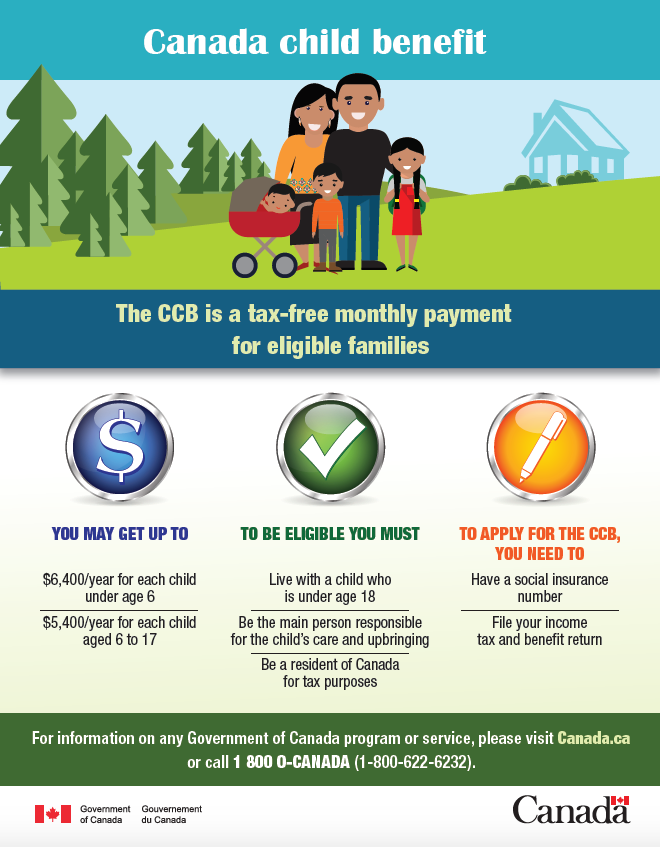

If you live in Canada and have a child below the age of 18 you may be eligible for the Canada Child Benefit CCB a monthly tax exempt payment administered by the The Canada child benefit CCB provides a tax free monthly payment to families to help them with the cost of raising children under the age of 18 You must meet specific criteria to qualify for the CCB such

Child Care Tax Benefit Canada

Child Care Tax Benefit Canada

https://wowa.ca/static/img/opengraph/canada-child-benefit.png

Canada Child Benefit 7 000

https://files.picobino.com/wp-content/uploads/2022/07/asda.jpg

CHILD CARE TAX Statement Form Daycare Or Childcare Printable Tuition

https://i.etsystatic.com/23403566/r/il/7a55e3/3981264249/il_1080xN.3981264249_lgte.jpg

The Canada Child Benefit CCB is a federal measure designed to help meet the needs of parents with one or more children under the age of 18 The payments are monthly and tax free Canada child benefit The Canada child benefit CCB is a non taxable amount paid monthly to help eligible families with the cost of raising children under 18 years of age

What is the Canada child benefit The Canada child benefit CCB is a non taxable amount paid monthly to help eligible families with the cost of raising children under 18 years of An Overview of the CCB Effective July 2016 the new Canada Child Benefit CCB replaced the Canada Child Tax Benefit CCTB the National Child

Download Child Care Tax Benefit Canada

More picture related to Child Care Tax Benefit Canada

Tax Statement Customize Child Care Business Daycare Parents Tuition

https://i.etsystatic.com/37448110/r/il/295c47/4564871668/il_1080xN.4564871668_jx7m.jpg

CHILD CARE TAX Statement Form Daycare Or Childcare Printable Etsy

https://i.etsystatic.com/23403566/r/il/f7133a/3736849859/il_1140xN.3736849859_31z4.jpg

Is The Canada Child Benefit An Effective Policy Impacts On Earnings

https://financesofthenation.ca/wp-content/uploads/2021/10/fig_1.jpg

The Canada Child Benefit CCB is a tax free monthly payment made to eligible families to help with the cost of raising children under 18 years of age The CCB The Canada Child Benefit CCB previously the Canada Child Tax Benefit CCTB is an income tested income support program for Canadian families It is delivered as a tax

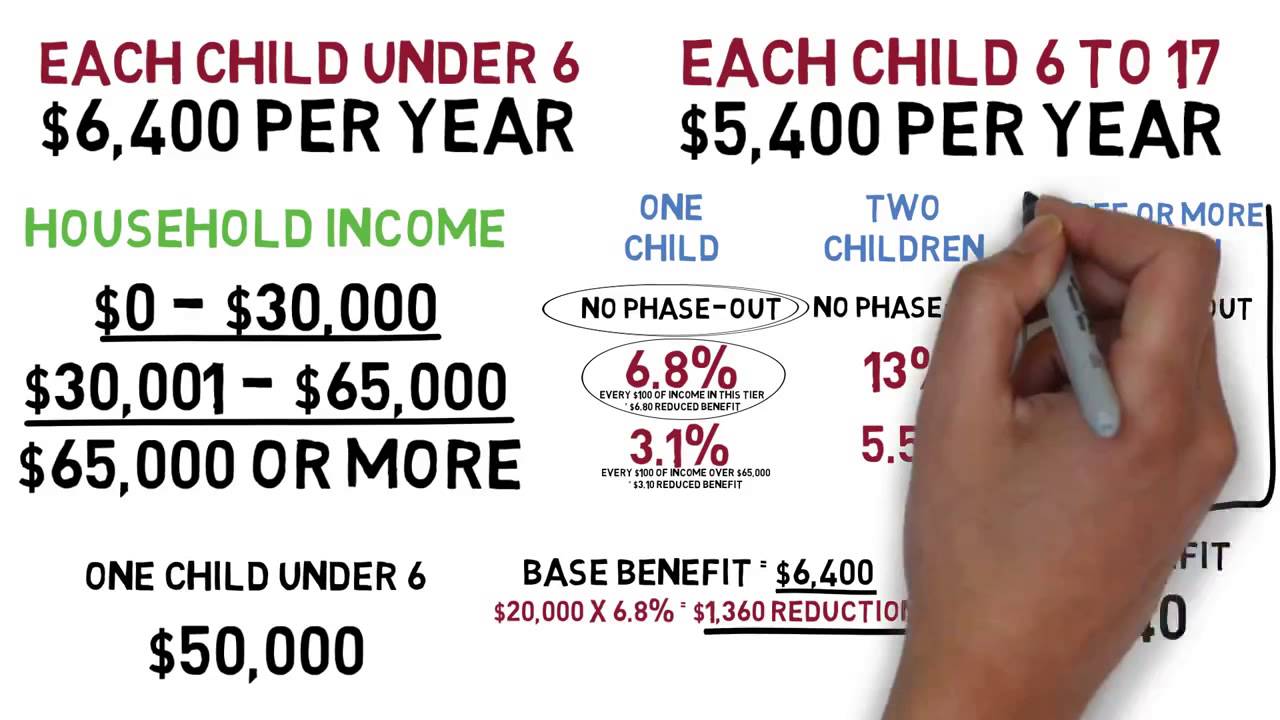

The amount you receive depends on your family net income in 2019 and 2020 You and your spouse or common law partner must file your 2019 and 2020 tax returns to get all The Canada Child Benefit formerly the Canada Child Tax Credit is a monthly payment available to parents and caretakers of children

Child And Dependent Care Credit LO 7 3 Calculate Chegg

https://media.cheggcdn.com/media/c7a/c7a7e54f-d046-435c-826a-3945e90aad03/php4ulBhq

Canada Child Benefit Info Apps On Google Play

https://play-lh.googleusercontent.com/KfoEGFezDOrJv2WSDNfnmc7m92TqZPvGvtwqqsd6da2hFZSMdNCVPn_lO9nkHPCncAY

https://www.canada.ca/.../canada-child-benefit.html

This booklet explains who is eligible for the Canada Child Tax Benefit how to apply for it how we calculate it and when we make payments

https://www.wealthsimple.com/en-ca/learn/canada-child-benefit

If you live in Canada and have a child below the age of 18 you may be eligible for the Canada Child Benefit CCB a monthly tax exempt payment administered by the

-1.png)

A Brief Guide To The Child Tax Benefit In Canada

Child And Dependent Care Credit LO 7 3 Calculate Chegg

Child Tax Benefit Policies For New Immigrants In Canada Super

How Much Is Child Benefit 2023 Leia Aqui How Much Is Child Benefit In

NewJourneys What Is The Canada Child Benefit

Pin On Best Of MapleMoney

Pin On Best Of MapleMoney

Child Tax Benefit Application Form 2 Free Templates In PDF Word

Use Of The Child Care Tax Credit 1976 1988 Download Table

Canada Child Benefit Amount 2019 YouTube

Child Care Tax Benefit Canada - An Overview of the CCB Effective July 2016 the new Canada Child Benefit CCB replaced the Canada Child Tax Benefit CCTB the National Child