Child Tax Credit 2022 Monthly Payment WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families have started receiving monthly Child Tax Credit payments as direct deposits begin posting in bank accounts and checks arrive in mailboxes

If you didn t receive one or more monthly advance Child Tax Credit payments in 2021 for a qualifying child you can still receive those payments and the remaining amount of your credit by claiming the Child Tax Credit for that child when you file a 2021 tax return during the 2022 tax filing season File your taxes to get your full Child Tax Credit now through April 18 2022 Get help filing your taxes and find more information about the 2021 Child Tax Credit ChildTaxCredit gov

Child Tax Credit 2022 Monthly Payment

Child Tax Credit 2022 Monthly Payment

http://www.pncpa.com/userfiles/bios/787.jpg

Child Tax Credit 2022 How Much Can You Get Shared Economy Tax

https://sharedeconomycpa.com/wp-content/uploads/2022/04/child-tax-credit-2022.png

Child Tax Credits 2021 And 2022 What To Do If You Didn t Get Your

https://www.the-sun.com/wp-content/uploads/sites/6/2021/11/KB_COMP_child-tax-credit-ctc-2.jpg?strip=all&quality=100&w=1500&h=1000&crop=1

As it stands right now child tax credit payments won t be renewed this year The law authorizing last year s monthly payments clearly states that no payments can be made after The Internal Revenue Service IRS announced in May it will automatically send monthly child tax credit payments to families who qualify starting July 15 About 39 million households which

Eligible families will receive monthly payments of the Child Tax Credit automatically if they filed taxes in the last two years Monthly payments Families could receive advanced CTC payments of either up to 300 per eligible child per month depending on the kids ages and the family s income Expanded eligibility

Download Child Tax Credit 2022 Monthly Payment

More picture related to Child Tax Credit 2022 Monthly Payment

Child Tax Credit 2022 How Much Is It And When Will I Get It CR News

https://i0.wp.com/www.the-sun.com/wp-content/uploads/sites/6/2022/09/SC-Child-Tax-Credit-Comp-copy.jpg?resize=816%2C9999&ssl=1

Monthly Child Tax Credit Payments Start Thursday Here s What To Know

https://www.courier-journal.com/gcdn/-mm-/a75b61cdf29c924e642301138dcb5b5b73c5e5d5/c=0-30-1998-1159/local/-/media/2018/01/31/Louisville/Louisville/636530052069237063-IMG-3796.jpg?width=1998&height=1129&fit=crop&format=pjpg&auto=webp

Child Tax Credit 2022 Income Phase Out Latest News Update

https://i2.wp.com/www.taxpolicycenter.org/sites/default/files/model-estimates/images/t21-0190.gif

Monthly child tax credit payments of up to 300 per child ended last year While past efforts to renew the policy fell apart there s new optimism something could come together soon Advocates The monthly payments from the expanded child tax credit that have been given to roughly 35 million families in the U S during the pandemic will expire at the end of the month after

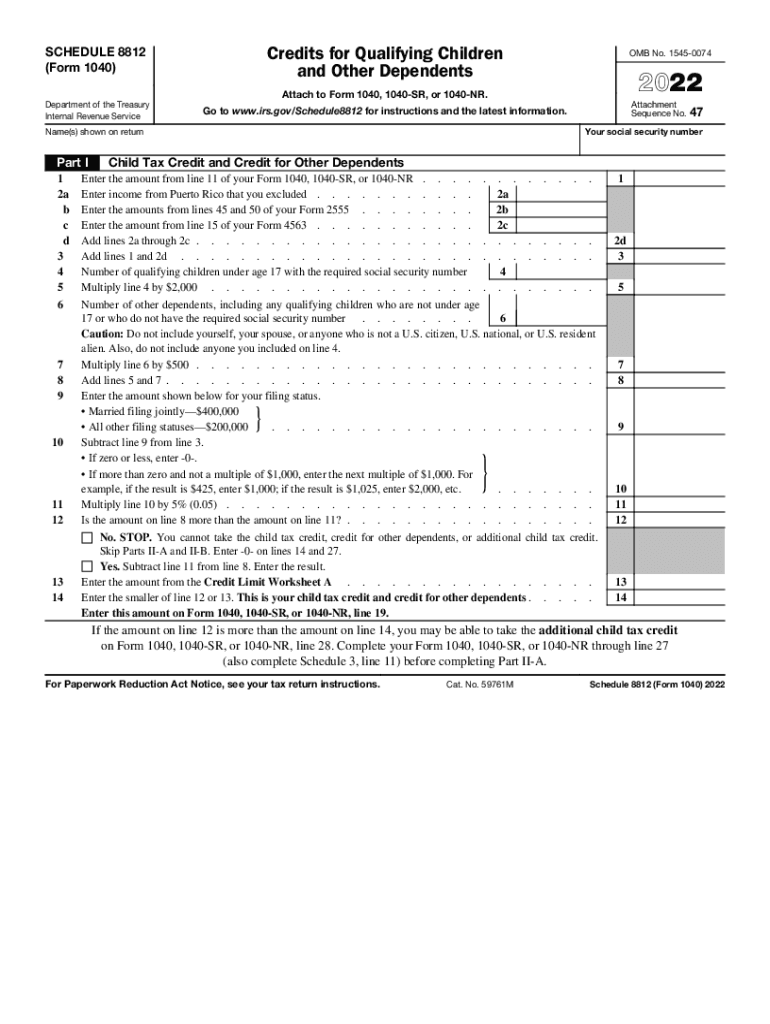

Starting in July families will get monthly payments of up to 300 for each child under 6 years old and up to 250 for each child 6 to 17 years old The credit goes away once a child reaches 18 You can claim the Child Tax Credit by entering your children and other dependents on Form 1040 U S Individual Income Tax Return and attaching a completed Schedule 8812 Credits for Qualifying Children and Other Dependents

Child Tax Credit 2022 Virginia Latest News Update

https://i2.wp.com/cdn.statically.io/img/www.the-sun.com/wp-content/uploads/sites/6/2021/12/MF-Final-child-tax-credit-payment-coming-COMP.jpg

Advance Child Tax Credit Changes For 2021 Cerebral Tax Advisors

https://www.cerebraltaxadvisors.com/wp-content/uploads/2021/06/shutterstock_1860325558-scaled-e1624977145855-1024x576.jpg

https://www.irs.gov › newsroom › irs-monthly-child-tax...

WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families have started receiving monthly Child Tax Credit payments as direct deposits begin posting in bank accounts and checks arrive in mailboxes

https://www.irs.gov › credits-deductions

If you didn t receive one or more monthly advance Child Tax Credit payments in 2021 for a qualifying child you can still receive those payments and the remaining amount of your credit by claiming the Child Tax Credit for that child when you file a 2021 tax return during the 2022 tax filing season

Thousands Of Americans Eligible For 5 000 Stimulus Check And Child Tax

Child Tax Credit 2022 Virginia Latest News Update

New Child Tax Credit For 2021 Explained By CPA New Child Tax Credit

2022 Form IRS 1040 Schedule 8812 Fill Online Printable Fillable

Taking A Stand For Children Through The Child Tax Credit Tax Credits

The Proposed 2022 Child Tax Credit How Will The Changes Affect You

The Proposed 2022 Child Tax Credit How Will The Changes Affect You

Child Tax Credit 2022 Are CTC Payments Really Over Marca

Child Tax Credit 2022 Age Limit Latest News Update

Child Tax Credit 2022 How To Get Your Money Faster Marca

Child Tax Credit 2022 Monthly Payment - New monthly payments worth up to 300 from the enhanced child tax credit are set to begin on July 15 and will go to about 39 million households