Covid Tax Breaks 2020 WASHINGTON To help struggling taxpayers affected by the COVID 19 pandemic the Internal Revenue Service today issued Notice 2022 36 which provides

The COVID related Tax Relief Act of 2020 enacted December 27 2020 amended and extended the tax credits and the availability of advance payments of the tax credits for You may be able to claim tax relief for additional household costs if you have to work at home for all or part of the week Who can claim tax relief

Covid Tax Breaks 2020

Covid Tax Breaks 2020

https://andrewhwanpark.github.io/assets/images/blog/taxday1.JPG

Company Tax Breaks For Tuition Assistance Programs In 2020

https://www.cleardegree.com/wp-content/uploads/2020/09/Taxes-1536x1017.jpg

Tax Breaks Financial Tribune

https://financialtribune.com/sites/default/files/styles/telegram/public/field/image/11_Tax---goosh.JPG?itok=zg6Hndib

Risk associated with COVID 19 in the 2020 tax year Some countries provided tax relief to the elderly e g Sweden Canada Italy Ireland and Thailand introduced tax credits We understand that due to COVID 19 your working arrangements may have changed If you have been working from home you may have expenses you can claim a deduction

WASHINGTON Donald Trump has chosen Sen JD Vance an Ohio Republican to be his vice presidential running mate catapulting the first term senator The IRS is encouraging taxpayers who may be eligible for the recovery rebate credit and other potential tax benefits to get help with filing a 2020 and or 2021 tax return

Download Covid Tax Breaks 2020

More picture related to Covid Tax Breaks 2020

Covid Tax Breaks Don t Miss Out

https://www.griffinaccountancy.co.uk/wp-content/uploads/2022/08/shutterstock_1719955270.jpg

COVID 19 UCT News

http://www.news.uct.ac.za/images/userfiles/images/pageimages/2020/covid19/2020-08-28_FAQ_COVID-19.jpg

COVID 19 And Your Business Tax Returns Tax Year 2020 WR Company

https://wrcompany.biz/wr-company/wp-content/uploads/2021/02/COVID-19-And-Your-Business-Tax-Returns-Tax-Year-2020.png

The CARES Act temporarily allows individuals to make penalty free withdrawals from certain retirement plans for coronavirus related expenses permits taxpayers to pay the OVERVIEW Many Americans may be eligible for the Recovery Rebate Credit commonly referred to as the COVID stimulus payment The credit is for the 2020 tax

We are offering help for individuals families businesses tax exempt organizations and others including health plans affected by coronavirus COVID 19 We re offering Some tax credit rules have become more advantageous as a result of the pandemic And you may find yourself eligible for some tax breaks for the first time due

Mortgage Modification And Mortgage Tax Breaks For 2020 Galler Law Firm

https://gallerlaw.com/wp-content/uploads/2020/08/Mortgage-Modification-And-Mortgage-Tax-Breaks-For-2020.jpg

Money s 2020 Tax Survival Guide What s New And How To Get The Biggest

https://i.pinimg.com/originals/f2/1d/cd/f21dcddbf83b0ff22c33a6fefc4aadd1.gif

https://www.irs.gov/newsroom/covid-tax-relief-irs...

WASHINGTON To help struggling taxpayers affected by the COVID 19 pandemic the Internal Revenue Service today issued Notice 2022 36 which provides

https://www.irs.gov/coronavirus/coronavirus-tax...

The COVID related Tax Relief Act of 2020 enacted December 27 2020 amended and extended the tax credits and the availability of advance payments of the tax credits for

COVID 19 Update

Mortgage Modification And Mortgage Tax Breaks For 2020 Galler Law Firm

Tax Breaks LGH Consulting Inc

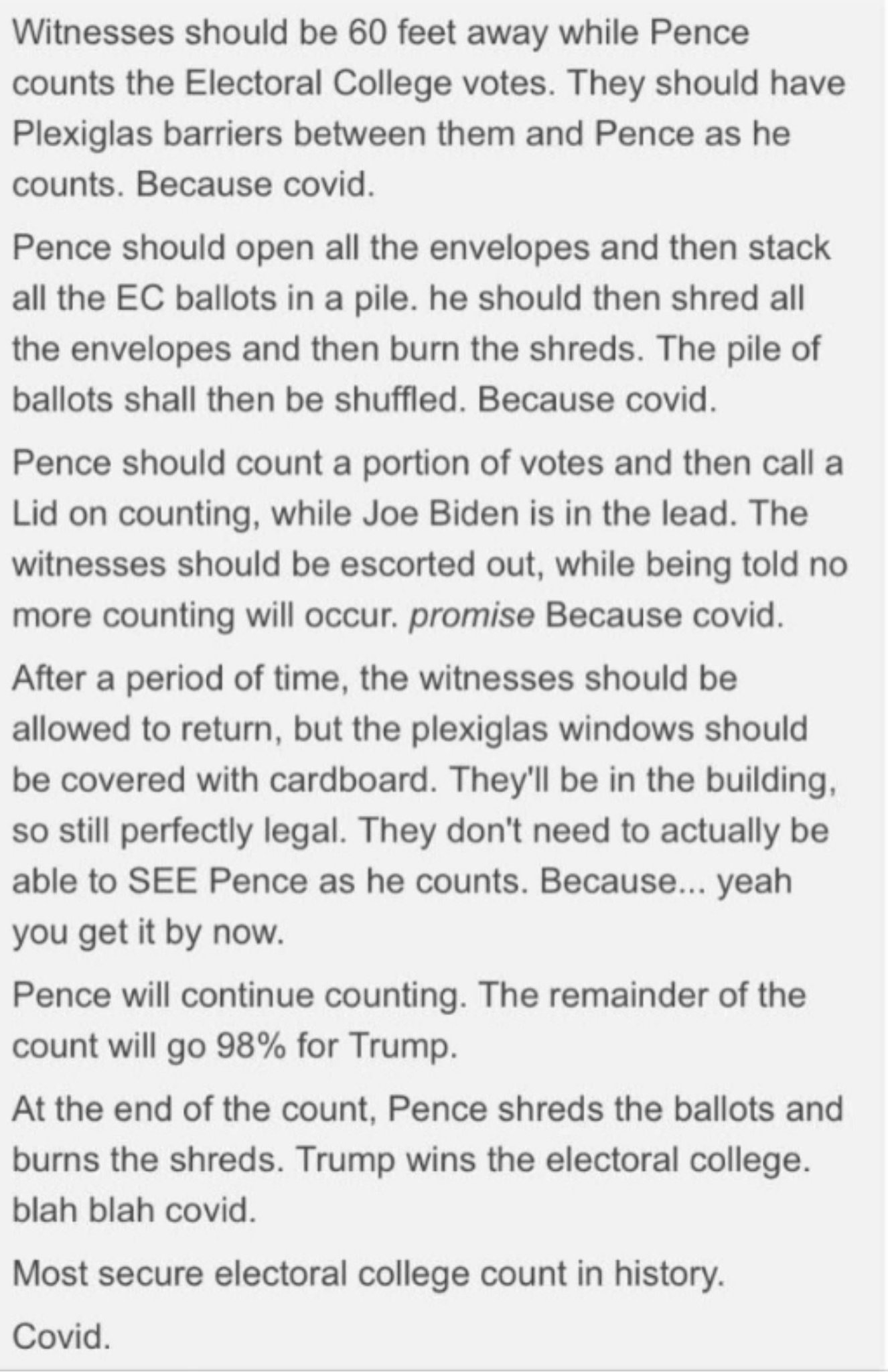

Voter fraud pence covid CITIZEN FREE PRESS

Are There Any Tax Breaks For 2020 Due To Covid TAXW

Protocole COVID 19 Pour Les Livraisons

Protocole COVID 19 Pour Les Livraisons

New Law Extends Key Tax Breaks Into 2020 CPA Practice Advisor

Coronavirus Update 7 14 2020 Should Employers Be Testing Employees For

The 6 Best Tax Deductions For 2020 The Motley Fool

Covid Tax Breaks 2020 - WASHINGTON Donald Trump has chosen Sen JD Vance an Ohio Republican to be his vice presidential running mate catapulting the first term senator