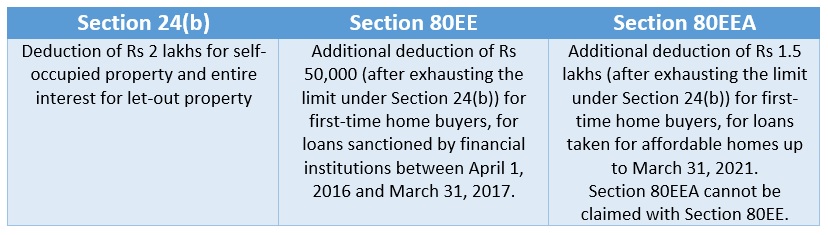

Deduction On Home Loan The new tax regime has limited these benefits Here are 3 questions What are the maximum deductions for home loan interest payments How can joint home loan

Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution The deduction is up The home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750 000 of their loan

Deduction On Home Loan

Deduction On Home Loan

http://4.bp.blogspot.com/-1n-pssIhuMA/UBhfE1xILOI/AAAAAAAAC9Q/SQjPSp6h2fc/s1600/HIExample.png

Tax deduction On Home Loan Interest Under Section 80EE Wishfin

https://www.wishfin.com/blog/wp-content/uploads/2023/03/Tax-deduction-on-home-loan-interest-under-Section-80EE.jpg

Sample Denial Letter

https://i.pinimg.com/originals/b1/04/d6/b104d625ba0b13cf491a9b4450a04a9c.jpg

For homes acquired after December 15 2017 the debt limitation is 750 000 or 375 000 if you re married filing separately If one or more of your The mortgage interest tax deduction is a tax benefit available to homeowners who itemize their federal income tax deductions States that assess an income tax also may allow

In general yes The mortgage interest deduction allows you to reduce your taxable income by the amount of money you ve paid in mortgage interest during the Most homeowners can deduct all of their mortgage interest The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on

Download Deduction On Home Loan

More picture related to Deduction On Home Loan

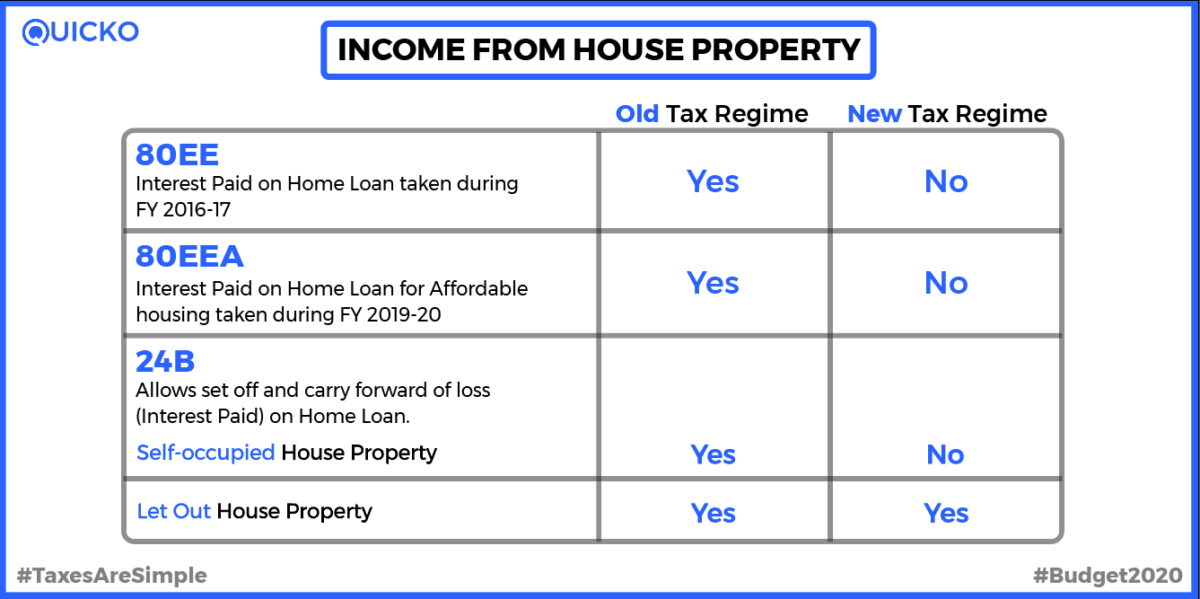

Important Highlights Of The Budget 2020 Learn By Quicko

https://learn.quicko.com/wp-content/uploads/2020/02/image-1-1200x599.png

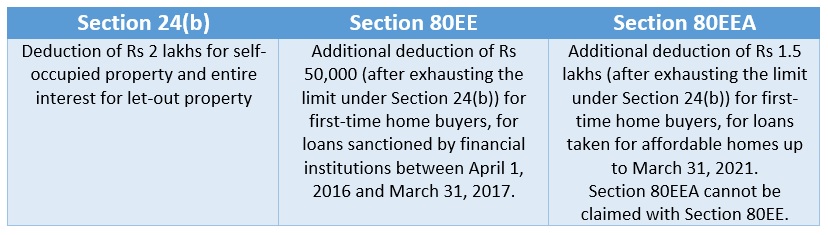

All About Section 80EEA For Deduction On Home Loan Interest

https://blog.saginfotech.com/wp-content/uploads/2023/01/tax-deduction-under-section-80eea.jpg

Download Automated Income Tax Revised Form 16 For The F Y 2020 21 With

https://1.bp.blogspot.com/-LHGCMQoTVpY/YDxWK6QONjI/AAAAAAAAPnc/A54uF-Alzto_vq4c8pUlpou7HKjmoHQZwCNcBGAsYHQ/w640-h390/Form%2B16%2BPart%2BA%2526B.jpg

Paying mortgage interest may reduce your taxable income By William Perez Updated on January 4 2023 Reviewed by Michelle P Scott In This Article View All Homeowners can also claim the deduction on loans for second homes providing that they stay within IRS limits See What You Qualify For 0 Type of Loan

You can usually deduct the interest you pay on a mortgage for your main home or a second home but there are some restrictions The maximum amount of debt You can deduct the points to obtain a mortgage or to refinance your mortgage to pay for home improvements on your principal residence in the year you

Section 80EEA Deduction For Interest Paid On Home Loan For Affordable

https://finvestfox.com/wp-content/uploads/2021/07/Section-80EEA-2.jpg

Request Letter For EMI Deduction Sample Request Letter Format YouTube

https://i.ytimg.com/vi/0R-wpHeDp9w/maxresdefault.jpg

https://cleartax.in/s/home-loan-tax-benefits

The new tax regime has limited these benefits Here are 3 questions What are the maximum deductions for home loan interest payments How can joint home loan

https://cleartax.in/s/section-80ee-income-tax...

Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution The deduction is up

Home Loan Tax Exemption Check Tax Benefits On Home Loan

Section 80EEA Deduction For Interest Paid On Home Loan For Affordable

Budget Expectations 2020 Women Should Get Tax Breaks On Home Loan In

Claiming The Student Loan Interest Deduction

Income Tax Update New Sec 80EEA Applicable From A Y 20 21 Deduction

Employee Payroll Deduction Form Template Best Template Ideas

Employee Payroll Deduction Form Template Best Template Ideas

Request Letter To Stop Deduction From Salary Sample Letter Of Request

Awesome Loan Calculator Education References Educations And Learning

VA Loan Requirements Will I Be Penalized For Paying Off My Loan Early

Deduction On Home Loan - Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C