Deductions For Disabled Person Section 80U offers tax benefits if an individual suffers a disability while Section 80DD offers tax benefits if an individual taxpayer s dependent family member s suffers from a disability This article is centered around discussing the tax benefits available under Section 80U

15 disability tax credits and deductions Taxpayers with disabilities are eligible to claim all the same deductions and credits as other people but there are some specifically available to those with disabilities Here are some tax credits and deductions to know Additional standard deduction If you are disabled you can take a business deduction for expenses that are necessary for you to be able to work If you take a business deduction for these impairment related work expenses they are not subject to the 7 5 limit that applies to medical expenses

Deductions For Disabled Person

Deductions For Disabled Person

https://cdn.pixabay.com/photo/2012/12/24/08/39/disabled-72211_1280.jpg

Disabled Parking Sign Free Stock Photo Public Domain Pictures

https://www.publicdomainpictures.net/pictures/100000/velka/disabled-parking-sign.jpg

Tax Saving Sections 80DD 80U Tax Saving Deductions For Disabled Persons

https://img.etimg.com/thumb/msid-68282576,width-1200,height-630,imgsize-109843,overlay-etwealth/photo.jpg

A number of tax deductions and exclusions benefit people who are on SSDI or SSI and they can also gain from a few special rules for tax advantaged savings and retirement accounts These deductions and rules are in addition to several tax credits that help recipients of disability benefits AS A PERSON WITH A DISABILITY you may qualify for some of the following tax deductions income exclusions and credits More detailed information may be found in the IRS publications referenced Standard Deduction If you are legally blind you may be entitled to a higher standard deduction on your tax return See IRS Publication 501

If you have a physical or mental disability that limits your being employed or substantially limits one or more of your major life activities such as performing manual tasks walking speaking breathing learning and working you can With tax season upon us here are 5 things you should know about the different tax credits for a child with a disability plus the deductions and liabilities affecting families with children and adult dependents with disabilities

Download Deductions For Disabled Person

More picture related to Deductions For Disabled Person

The Meaning And Symbolism Of The Word Disabled Person

https://weknowyourdreams.com/images/disabled-person/disabled-person-07.jpg

Tax Deductions For Hospitality Workers In 2022 The Kalculators

https://thekalculators.com.au/wp-content/uploads/2022/06/tax-deductions-for-hospitality-workers.jpg

Birth Stories Giving Birth To Twins As A Disabled Person Birthful

https://birthful.com/wp-content/uploads/2022/01/Dani-headshot-scaled.jpeg

The federal tax code includes a number of provisions that can ease the tax burden on people living with a disability Some disability payments and benefits are free of income tax while deductions and credits can reduce the taxes you do owe These tax breaks aren t always obvious though Q 2 Schedule VIA for claiming deductions is not enabled while filing the ITR for AY 2024 25 Ans From AY 2024 25 new tax regime has become the default tax regime and VIA deductions cannot disabilities in support of deduction claimed under section 80DD 80U and to file Form 10IA as applicable as per Rule 11A and details of form 10 IA

Section 80U provides tax deductions and rebates for persons with disabilities or physically handicapped individuals In this article you ll learn everything about section 80U its meaning eligibility deduction limit amount Section 80U offers tax deductions for residents that have at least 40 disability as specified by the law Learn about its meaning eligibility documents requirements etc

Medical Expense Deductions For Disabled Persons Scott M Aber CPA PC

https://www.abercpa.com/wp-content/uploads/2021/10/medical-expense-deductions-for-disabled-persons-1024x683.jpg

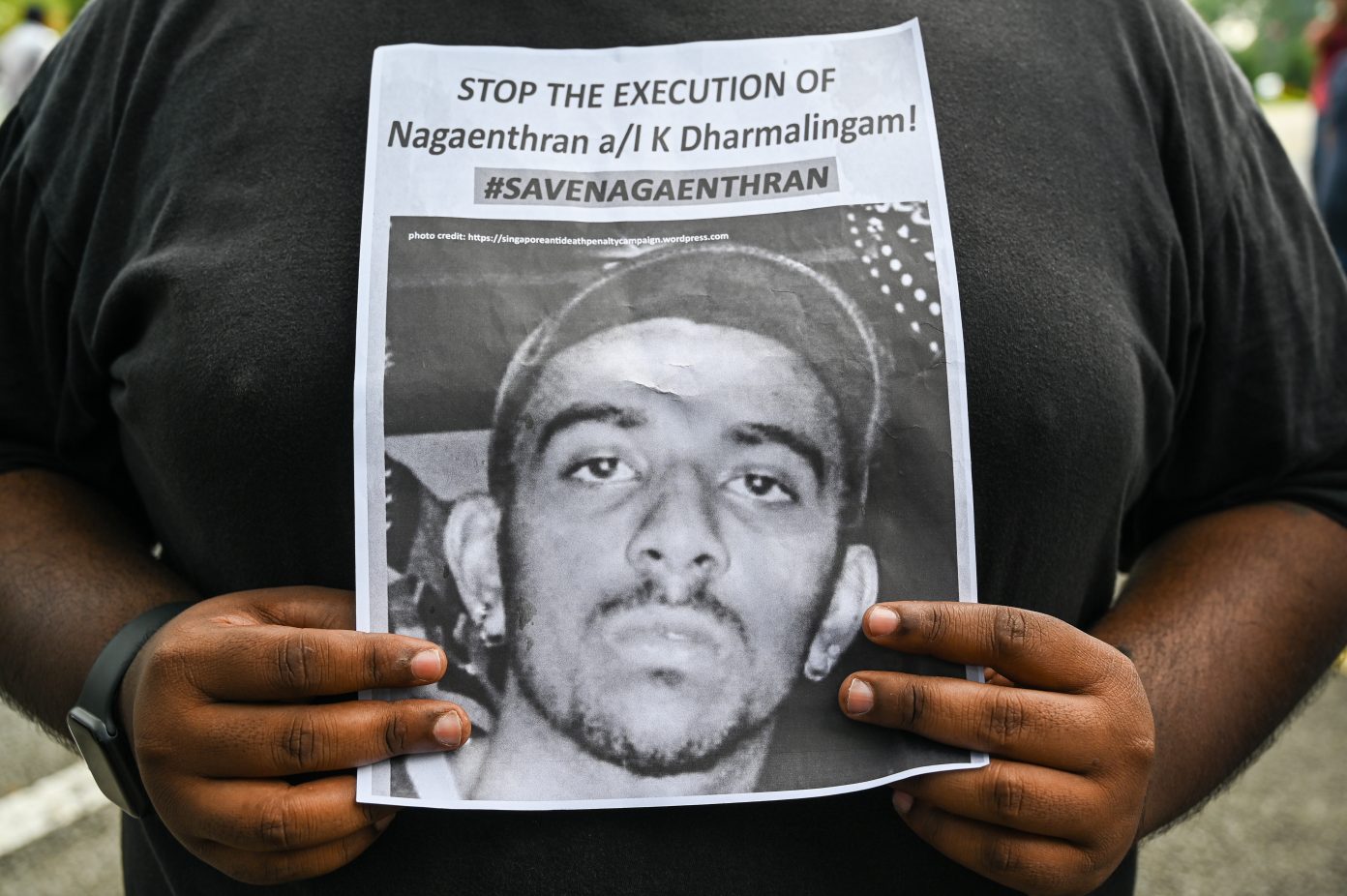

Singapore Court Delays Execution Of Malaysian Disabled Person Due To

https://philippines.licas.news/wp-content/uploads/2021/11/9R98AD-highres-1392x926.jpg

https:// cleartax.in /s/section-80u-deduction

Section 80U offers tax benefits if an individual suffers a disability while Section 80DD offers tax benefits if an individual taxpayer s dependent family member s suffers from a disability This article is centered around discussing the tax benefits available under Section 80U

https://www. atticus.com /advice/general/disability...

15 disability tax credits and deductions Taxpayers with disabilities are eligible to claim all the same deductions and credits as other people but there are some specifically available to those with disabilities Here are some tax credits and deductions to know Additional standard deduction

Payroll Deductions In 2022 What Can And Cannot Be Deducted From An

Medical Expense Deductions For Disabled Persons Scott M Aber CPA PC

Disabled Person Arm Amputee World Disability Day Silhouette Icon

10 Major Tax Credits And Deductions For Disabled Tax Filers

Nail Your Deductions This Tax Time Electrical Trades Union

Disabilities Silhouette Transparent Background Disabled Vector Icon

Disabilities Silhouette Transparent Background Disabled Vector Icon

Tax Credits Benefits And Deductions For Disabled Taxpayers

As A Disabled Person Britney Spears Fight To End Her Conservatorship

Live Is Blind Stock Vector Images Alamy

Deductions For Disabled Person - If you are disabled here are the tax deductions credits and exemptions to which you may be entitled Tax Deductions If you are legally blind you may qualify for a larger standard deduction The amount of the deduction may depend on your age and whether you or someone else is claiming your deduction