Deductions In Income Tax 2023 24 You may be entitled to certain deductions that reduce the total amount of taxes you must pay Some deductions have to be claimed You can claim deductions on your tax card or in your tax return You can also submit deduction details on paper forms

The article discusses the new income tax regime for the fiscal year 2023 24 covering tax slabs deductions and changes brought in by Budget 2023 It addresses frequently asked questions relating to tax rates surcharge exemptions deductions and comparisons between old and new tax regimes Standard deduction of Rs 50 000 under New Tax Regime applicable from FY 2023 24 Deduction under Section 57 iia of family pension income Deduction of amount paid or deposited in the Agniveer Corpus Fund under Section 80CCH 2 Exemptions and deductions not claimable under the new tax regime

Deductions In Income Tax 2023 24

Deductions In Income Tax 2023 24

https://www.armstrongeconomics.com/wp-content/uploads/2020/09/Tax-Deductions-scaled.jpg

Section 13 OF THE INCOME TAX ACT

https://www.legalmantra.net/admin/assets/upload_image/blog/INCOME_TAX2.jpg

Printable Itemized Deductions Worksheet

https://i2.wp.com/www.worksheeto.com/postpic/2011/02/federal-income-tax-deduction-worksheet_472256.jpg?crop=12

The Finance Act 2023 has amended the provisions of Section 115BAC w e f AY 2024 25 to make new tax regime the default tax regime for the assessee being an Individual HUF AOP not being co operative societies BOI or Artificial Juridical Person This type of taxation allows for a fair and progressive tax system in the country The income tax slabs are revised periodically typically during each budget These slab rates vary for different groups of taxpayers Let us take a look at all the slab rates applicable for FY 2023 24 AY 2024 25

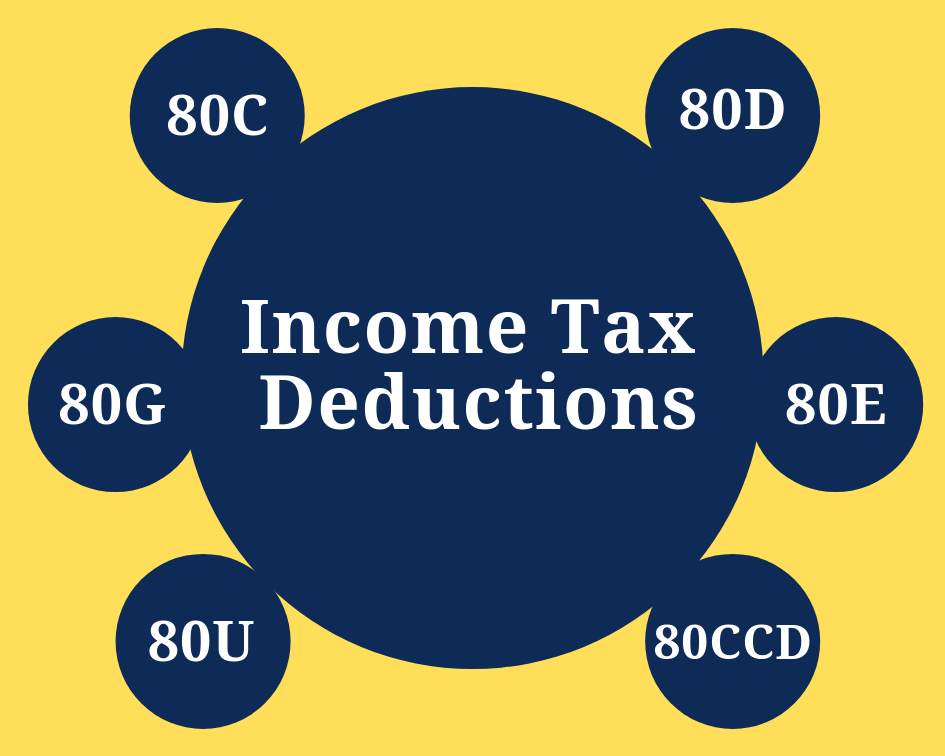

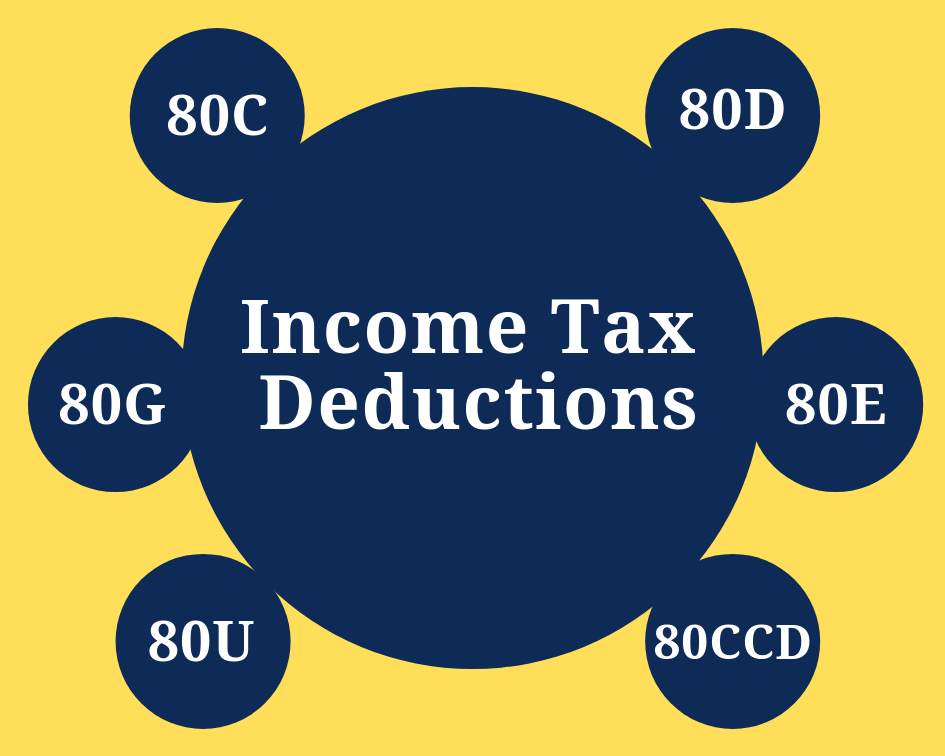

Income Tax Benefits available under Old Tax Regime for FY 2023 24 AY 2024 25 Below are the income tax deductions that are available under the old tax regime only Section 80c The maximum tax exemption limit under Section 80C is INCOME TAX SECTION 115BAC OF INCOME TAX ACT NEW TAX REGIME DEDUCTIONS ALLOWED EXEMPTION LIST BENEFITS Section 115BAC of Income Tax Act New Tax Regime Deductions Allowed Exemption List Benefits Updated on Mar 25th 2024 17 min read Latest update Budget 2023 changes under

Download Deductions In Income Tax 2023 24

More picture related to Deductions In Income Tax 2023 24

Tax Prep Checklist Tracker Printable Tax Prep 2022 Tax Checklist Tax

https://i.etsystatic.com/31990504/r/il/22f689/3639280950/il_fullxfull.3639280950_fitj.jpg

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

https://www.investopedia.com/thmb/JjB8KxvTErLB2ZgozO3H_wkKoNA=/2338x2338/smart/filters:no_upscale()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg

Tax Relief 2023

https://www.zrivo.com/wp-content/uploads/2020/05/Itemizing-vs.-Standard-Deduction.jpg

Updated on 21 May 2024 01 08 PM India s income tax system is progressive meaning tax rates increase with higher income This article summarizes Income Tax Rates Surcharge Health Education Cess Special rates and rebate relief applicable to various categories of Persons viz Individuals Resident Non

Section 80C deduction can be claimed by Individuals and HUFs Maximum deduction allowed under section 80C U p to Rs 150 000 can be claimed as deduction every year from the Gross total income Companies partnership firms and LLPs cannot avail the benefit of this deduction Plan Your Taxes In Advance Save Taxes with Tax Tax Deduction and Documentation for Salary AY 2023 24 Affluence Advisory Private Limited 23 Feb 2023 65 961 Views 0 comment Print Income Tax Articles Maximize Tax Savings AY 2023 24 Essential Documentation for Salary Deductions A concise guide to documents required for claiming deductions

Income Tax Deductions In India Capitalante

https://capitalante.com/wp-content/uploads/2019/02/Income-Tax-Deductions-In-India.png

Small Business Expenses Tax Deductions 2023 QuickBooks

https://quickbooks.intuit.com/oidam/intuit/sbseg/en_us/Blog/Graphic/standard-vs-itemized-deductions.png

https://www.vero.fi/en/individuals/tax-cards-and...

You may be entitled to certain deductions that reduce the total amount of taxes you must pay Some deductions have to be claimed You can claim deductions on your tax card or in your tax return You can also submit deduction details on paper forms

https://cleartax.in/s/new-tax-regime-frequently-asked-questions

The article discusses the new income tax regime for the fiscal year 2023 24 covering tax slabs deductions and changes brought in by Budget 2023 It addresses frequently asked questions relating to tax rates surcharge exemptions deductions and comparisons between old and new tax regimes

Business Tax Deductions Cheat Sheet Excel In PINK Tax Etsy

Income Tax Deductions In India Capitalante

2023 Form 1040 Standard Deduction Printable Forms Free Online

Govt Announced Seven Slabs For Salaried Class In Budget 2022 23

IRS Here Are The New Income Tax Brackets For 2023 Bodybuilding

Income Tax Deductions For The FY 2019 20 ComparePolicy

Income Tax Deductions For The FY 2019 20 ComparePolicy

The 6 Best Tax Deductions For 2020 The Motley Fool

Standard Deduction 2020 Self Employed Standard Deduction 2021

2023 IRS Inflation Adjustments Tax Brackets Standard Deduction EITC

Deductions In Income Tax 2023 24 - The Finance Act 2023 has amended the provisions of Section 115BAC w e f AY 2024 25 to make new tax regime the default tax regime for the assessee being an Individual HUF AOP not being co operative societies BOI or Artificial Juridical Person