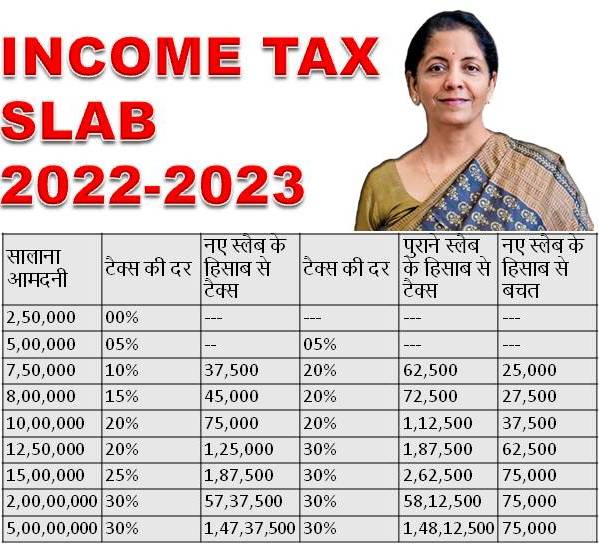

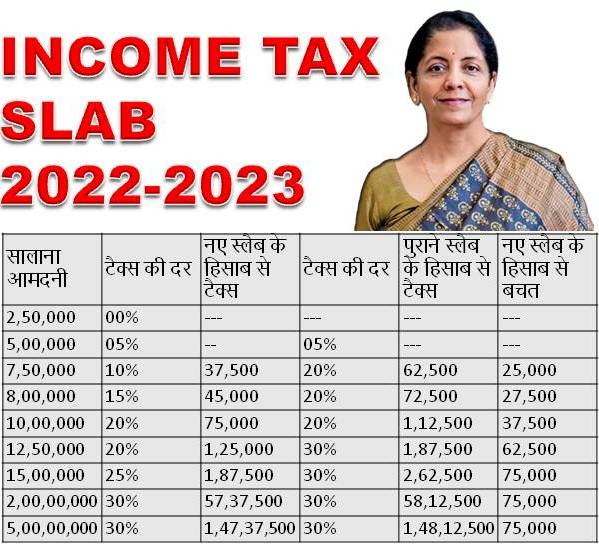

Income Tax Deductions For Ay 2022 23 In the Budget 2020 Finance Minister Nirmala Sitharam pronounced that a taxpayer who chooses not to claim certain deductions and exemptions i e forgo certain

Tax deductions specified under Chapter VIA of the Income Tax Act These deductions will not be available to a taxpayer opting for the New Tax Regime u s 115BAC except for Income Tax Deductions List FY 2022 23 AY 2023 24 Section 80C Deduction Section 80CCD The following investments and expenses are eligible for deduction under

Income Tax Deductions For Ay 2022 23

Income Tax Deductions For Ay 2022 23

https://www.wecanspirit.com/wp-content/uploads/2022/02/Income-Tax-Slab-for-AY-2022-23.jpg

Standard Deduction For Salary Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-11.jpg

Section Wise Income Tax Deductions For AY 2022 23 FY 2021 22

https://taxguru.in/wp-content/uploads/2020/05/Tax-Deductions.jpg

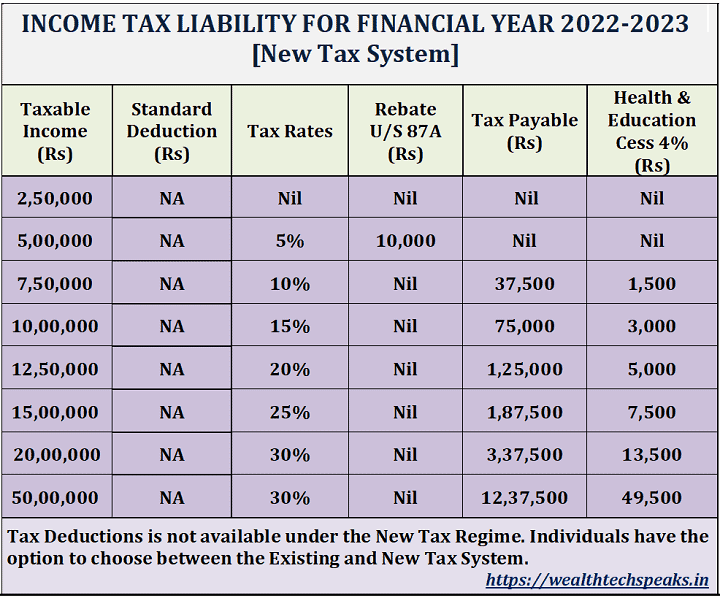

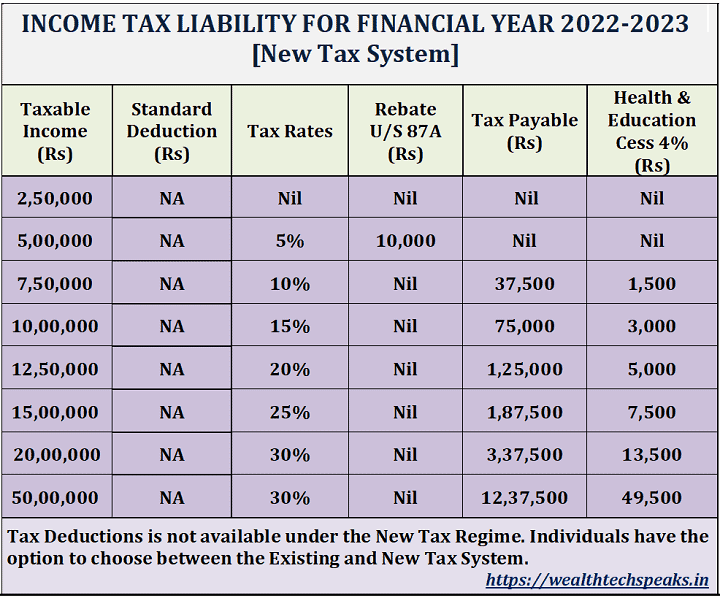

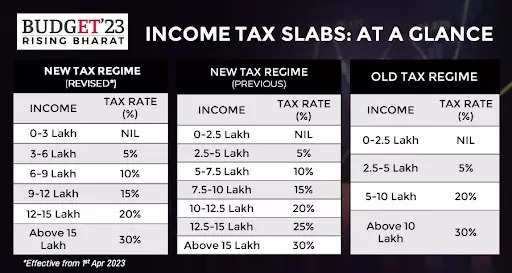

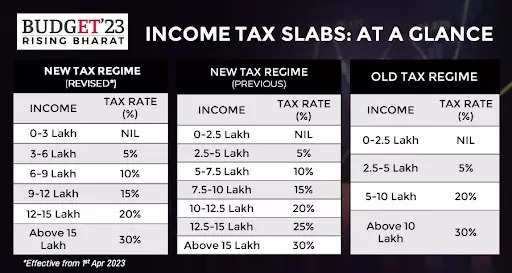

Latest Income Tax Slab Tax Rates in India for FY 2023 24 AY 2024 25 Check out the latest income tax slabs and rates as per the New tax regime and Old tax What are the Income Tax Deductions Exemption not available under the New Tax Regime What are the Income Tax Exemptions and Allowances available under New Tax Regime Which

The New Tax Slabs are made common for taxpayers of all age groups with reduced income tax rates allowed in income brackets up to INR 15 00 000 But it disallows 70 tax E Filing of Income Tax Return or Forms and other value added services Intimation Rectification Refund and other Income Tax Processing Related Queries

Download Income Tax Deductions For Ay 2022 23

More picture related to Income Tax Deductions For Ay 2022 23

Income Tax Slabs For FY 2022 23 AY 2023 24 FinCalC Blog

https://fincalc-blog.in/wp-content/uploads/2022/09/income-tax-slabs-india-2022-23-1024x576.webp

New Income Tax Slab FY 2023 24 AY 2024 25 Old New Regime

https://vakilsearch.com/blog/wp-content/uploads/2022/05/Income-Tax-Slabs.png

Income Tax FY 2022 23 AY 2023 24 Income Tax Act IT FY 2022 23 New And

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiuBLR2sr4zdq6frnOvYmY4TMuEbMynEFSiCiVO9-h9YlyZVcz20Rnk1V34S46-X5dWuSxwpF5eEVHb9f_Y-PWQSvT6D5tOGCeOjc5Ffmu9hxfpK9DcrJcDq3faqy3aR4w7eexxY8DMrm13bqa9-CohjejrV7vWzHLgplcUb6NtDbK0V_2k8wdyiQ9e/s1600/Income Tax FY 2022-23 AY 2023-24 Income Tax Act - IT Slab Rates Income Tax Official Circular.png

Income Tax Slab Rates for AY 2022 23 Blog Income Tax 5 Min Read By Taxmann Last Updated on 6 March 2023 Union Budget 2022 23 Highlights Less Deduction u s 57 iia in case of family pension only Less Income claimed for relief from taxation u s 89A B5 Gross Total Income B1 B2 B3 B4 To avail the benefit of

E Filing of Income Tax Return or Forms and other value added services Intimation Rectification Refund and other Income Tax Processing Related Queries ITR 4 ITR Individuals and HUFs can choose between the new or old tax regime and pay applicable income tax as per slabs and rates for FY 2021 22 AY 2022 23 This option to

Nebun Evaluare ngrijire Personal Income Tax Calculator R sucit Jurnal

https://wealthtechspeaks.in/wp-content/uploads/2022/03/Income-Tax-Liability-New-Tax-System.png

Income Tax Rates Slab For FY 2021 22 Or AY 2022 23 Ebizfiling

https://ebizfiling.com/wp-content/uploads/2021/04/Income-Tax-Rate-Slabs.png

https://tax2win.in/guide/deductions

In the Budget 2020 Finance Minister Nirmala Sitharam pronounced that a taxpayer who chooses not to claim certain deductions and exemptions i e forgo certain

https://www.incometax.gov.in/iec/foportal/help/...

Tax deductions specified under Chapter VIA of the Income Tax Act These deductions will not be available to a taxpayer opting for the New Tax Regime u s 115BAC except for

Latest Income Tax Slab Rates For FY 2021 22 AY 2022 23 If You Are

Nebun Evaluare ngrijire Personal Income Tax Calculator R sucit Jurnal

Tax Rates For Assessment Year 2022 23 Tax Hot Sex Picture

Discover Your Favorite Brand Free Shipping Stainless Steel Flat Collar

Income Tax Slab For AY 2023 24 TAXCONCEPT

New Income Tax Slab Rates For FY 2023 24 AY 2024 25 In India Budget

New Income Tax Slab Rates For FY 2023 24 AY 2024 25 In India Budget

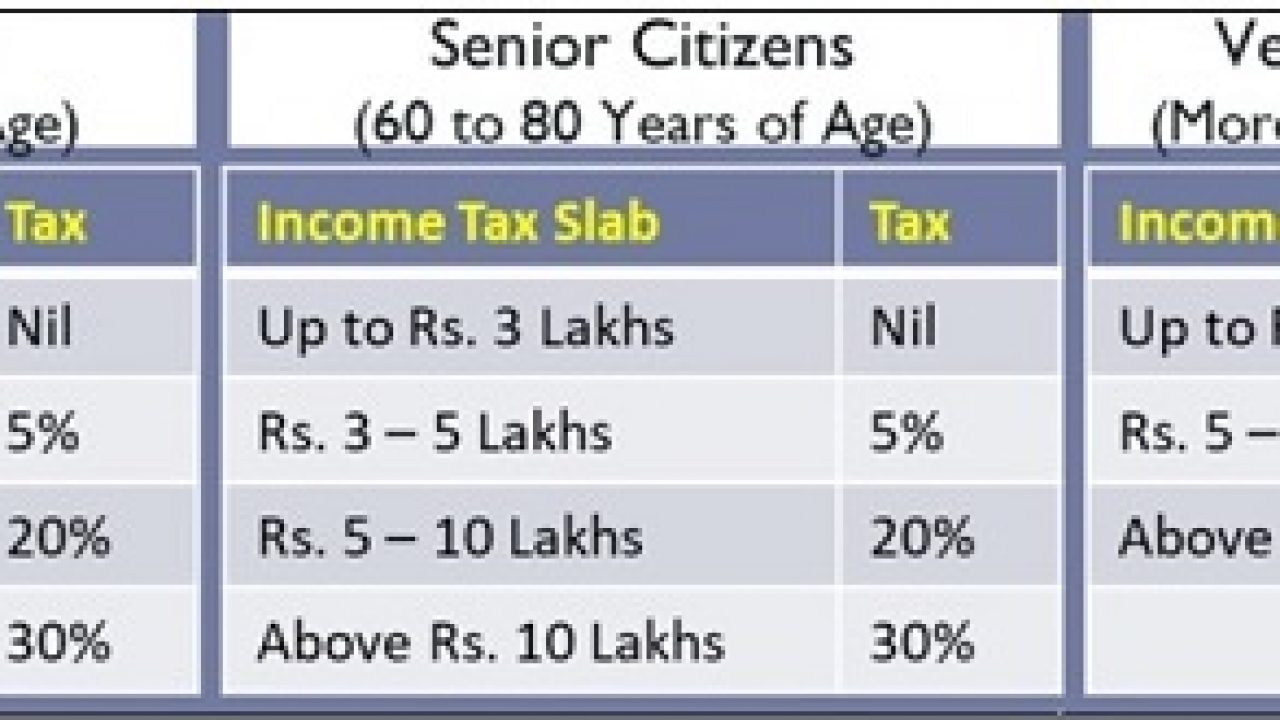

Standard Deduction For Ay 2020 21 For Senior Citizens Standard

Income Tax 2022 23 Slab Bed Frames Ideas

Preventive Check Up 80d Wkcn

Income Tax Deductions For Ay 2022 23 - E Filing of Income Tax Return or Forms and other value added services Intimation Rectification Refund and other Income Tax Processing Related Queries