Income Tax Deductions For Ay 2022 23 Pdf The Indian Income Tax Act provides for various deductions under sections 80C to 80U which can be claimed by an individual or a business entity while calculating

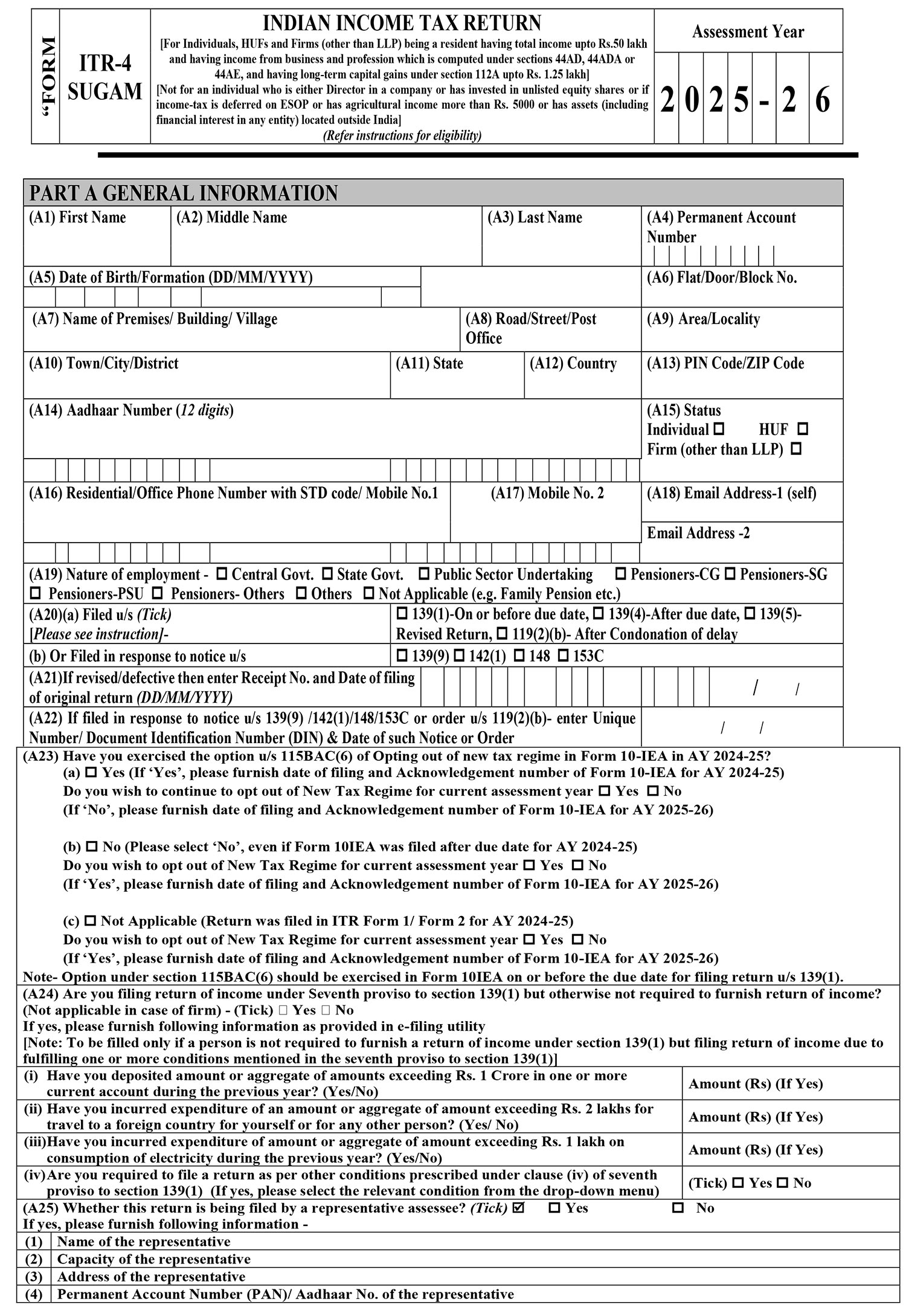

Common Offline Utility for filing Income tax Returns ITR 1 ITR 2 ITR 3 and ITR 4 for the AY 2024 25 Deductions on Section 80C 80CCC 80CCD 80D FY 2022 23 AY 2023 24 Section 80 Deduction List ection 80C is one of the most popular and favorite

Income Tax Deductions For Ay 2022 23 Pdf

Income Tax Deductions For Ay 2022 23 Pdf

https://1.bp.blogspot.com/-yM7MY4B2SMI/YBfAzHLhY8I/AAAAAAAADSw/D-Xb_4wwy9Ip7PuNNaBnb23mAT5xoVitQCLcBGAsYHQ/w640-h526/images%2B%252816%2529.jpeg

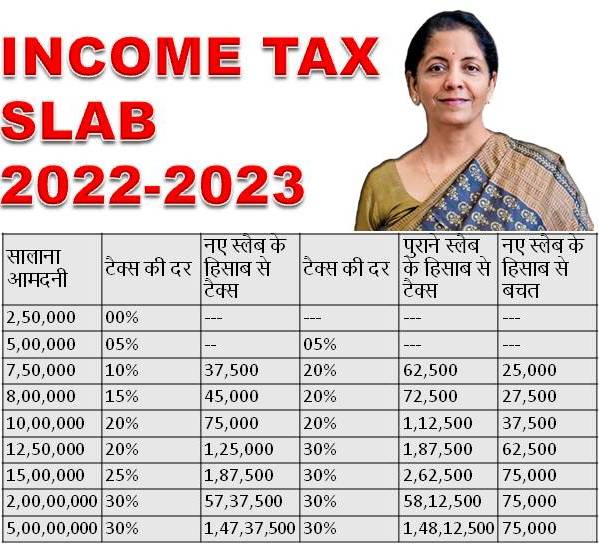

Latest Income Tax Slab Rates For FY 2022 23 AY 2023 24 Budget 2022

https://www.basunivesh.com/wp-content/uploads/2022/02/Latest-Income-Tax-Slab-Rates-for-FY-2022-23-AY-2023-24.jpg

2022 Deductions List Name List 2022

https://wealthtechspeaks.in/wp-content/uploads/2021/03/Tax-Deduction-Calculation.png

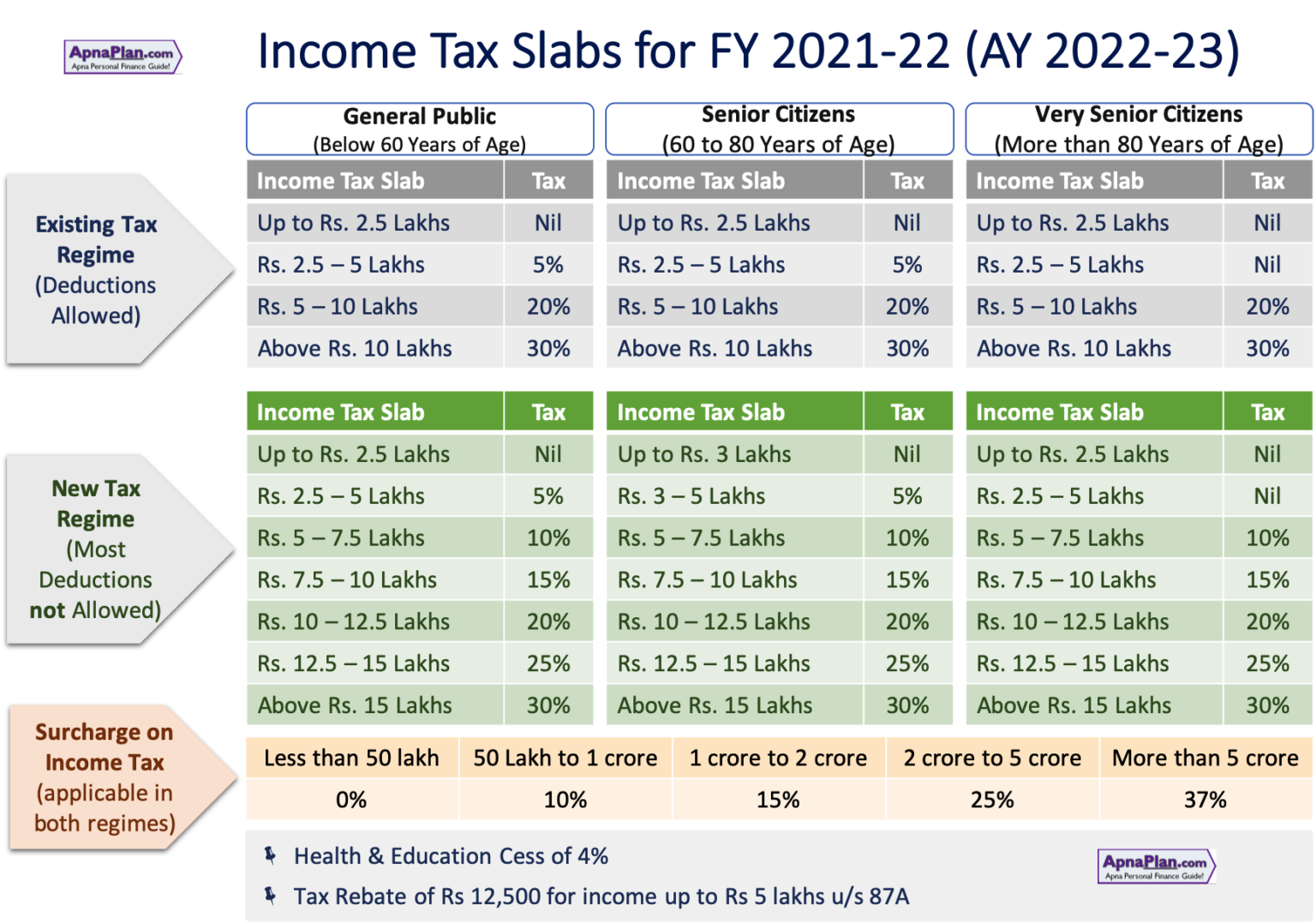

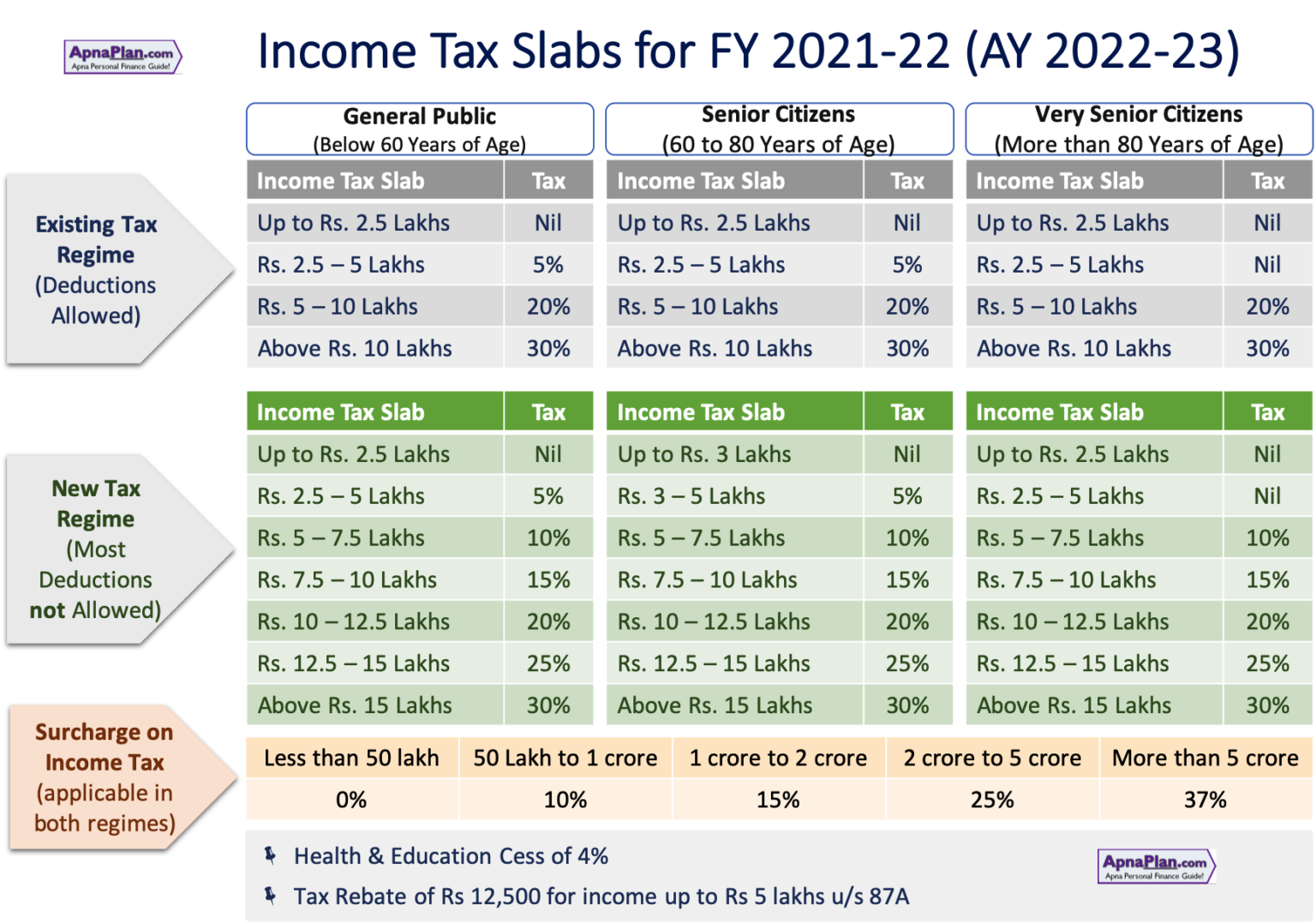

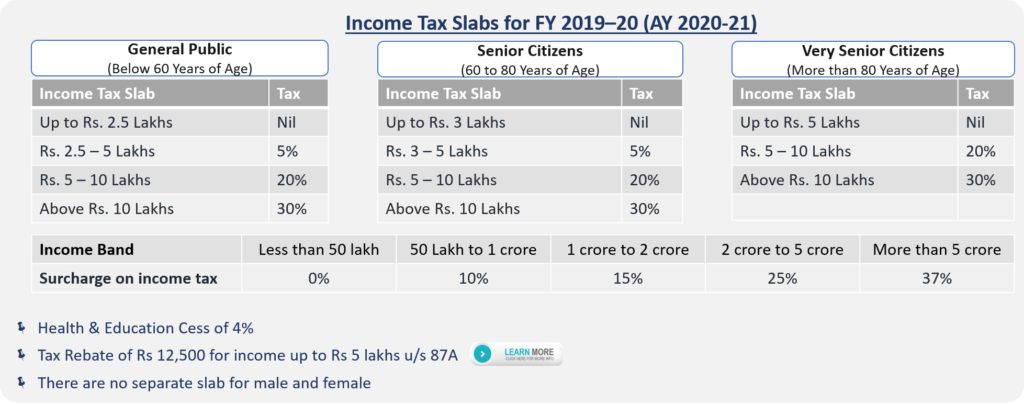

Rates of Income Tax for FY 2021 22 AY 2022 23 and FY 2022 23 AY 2023 24 applicable to various categories of persons viz Individuals Firms companies etc Tax Slabs for AY 2024 25 The Finance Act 2023 has amended the provisions of Section 115BAC w e f AY 2024 25 to make new tax regime the default tax regime for the

Latest Income Tax Slab Tax Rates in India for FY 2023 24 AY 2024 25 Check out the latest income tax slabs and rates as per the New tax regime and Old tax regime Stay informed about the Income Tax Rates for the Financial Year 2022 23 and Assessment Year 2023 24 Explore different tax slabs for individuals HUFs

Download Income Tax Deductions For Ay 2022 23 Pdf

More picture related to Income Tax Deductions For Ay 2022 23 Pdf

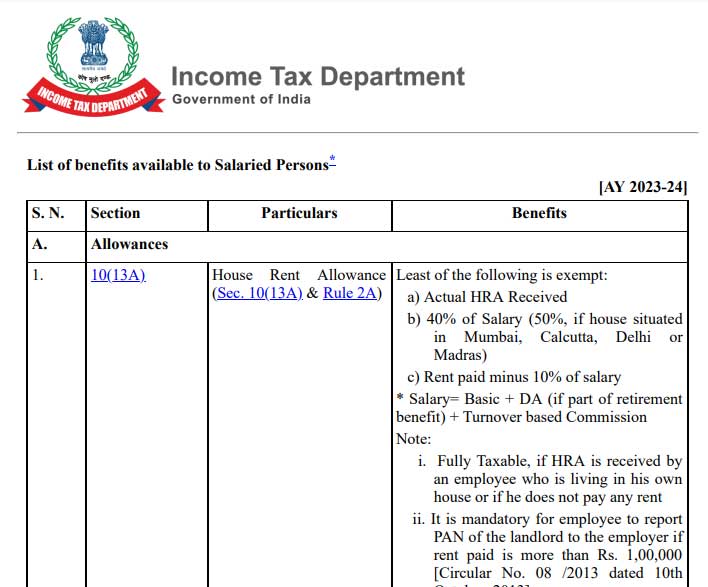

List Of Benefits Available To Salaried Persons For AY 2023 24

https://www.centralgovernmentnews.com/wp-content/uploads/2022/06/List-of-benefits-available-to-Salaried-Persons-for-AY-2023-24-FY-2022-2023-under-Income-Tax-as-amended-by-Finance-Act-2022.jpg

Income Tax Slab For Ay 2023 24 Deduction Printable Forms Free Online

https://www.wecanspirit.com/wp-content/uploads/2022/02/Income-Tax-Slab-for-AY-2022-23.jpg

Income Tax Deductions List Deductions On Section 80C 80CCC 80CCD

https://emailer.tax2win.in/share-banner/guide-deductions-tax2win.jpg

The Income tax Act 1961 43 of 1961 the Central Board of Direct Taxes hereby makes the following rules further to amend Income tax Rules 1962 namely 1 Short title and Advisory Information relates to the law prevailing in the year of publication as indicated Viewers are advised to ascertain the correct position prevailing law before relying upon

A new tax regime has been established by the insertion of section 115 BAC in the Income Tax Act 1961 vide the Finance Act 2020 Individuals and HUFs can choose between ITRs for AY 2022 23 Key Changes through incomes covered under Sections 115A 1 a i and 115AD 1 i taxable 20 and Sections 115AC and 115ACA taxable 10

Download Income Tax Calculator Excel 2021 22 AY 2022 23 Outsource

https://www.apnaplan.com/wp-content/uploads/2021/03/Income-Tax-Slabs-for-FY-2021-22-AY-2022-23-1536x1078.png

Income Tax Slabs For FY 2022 23 AY 2023 24 Kanakkupillai

https://www.kanakkupillai.com/learn/wp-content/uploads/2022/05/Income-tax-slabs-for-FY-2022-23-AY-2023-24.png

https://tax2win.in/guide/deductions

The Indian Income Tax Act provides for various deductions under sections 80C to 80U which can be claimed by an individual or a business entity while calculating

https://www.incometax.gov.in/iec/foportal/...

Common Offline Utility for filing Income tax Returns ITR 1 ITR 2 ITR 3 and ITR 4 for the AY 2024 25

Method Of Calculating Income Tax For Senior Citizen Pensioners

Download Income Tax Calculator Excel 2021 22 AY 2022 23 Outsource

Standard Deduction U s 16 ia For Ay 2021 22 Standard Deduction 2021

Income Tax Deductions List Deductions On Section 80C 80CCC 80CCD

Income Tax Ay 2022 23 Latest News Update

2022 Tax Brackets Chart Latest News Update

2022 Tax Brackets Chart Latest News Update

Step By Step Guide To File ITR 4 Form Online For AY 2023 24 SAG Infotech

Income Tax Slab Fy 2022 23 Ay 2023 24 Old New Regime Home Interior Design

Income Tax Calculator Ay 2021 22 Excel Incometax Calculation 2021

Income Tax Deductions For Ay 2022 23 Pdf - There are different Income Tax Slabs for 2022 2023 year in Pakistan on Salary Income Table of Contents DIVISION OF SALARY INCOME IN PAKISTAN