Dependent Tax Credit The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents qualifying persons The credit is calculated based on your income and a percentage of expenses that you incur for the care of qualifying persons to enable you to go to work look for work or attend school

What qualifies someone as a dependent The Child Tax Credit is up to 2 000 The Credit for Other Dependents is worth up to 500 The IRS defines a dependent as a qualifying child under age 19 or under 24 if a full time student or any age if permanently and totally disabled or a qualifying relative The Child Tax Credit CTC is a tax benefit to help families who are raising children The child must be your dependent and under the age of 17 at the end of year You must also meet other eligibility rules discussed below

Dependent Tax Credit

Dependent Tax Credit

https://i2.wp.com/static.twentyoverten.com/5afae91ee233a94fd2b8b963/AyQa5SwvUG/1616431432591.png

Tax Year 2021 Dependent Tax Credits And Deductions PriorTax Blog

https://www.blog.priortax.com/wp-content/uploads/2020/01/boy-61171_1280.jpg

What You Need To Know About The Child And Dependent Care Tax Credit

https://image.slidesharecdn.com/whatyouneedtoknowaboutthechildanddependentcaretaxcredit-160531175222/95/what-you-need-to-know-about-the-child-and-dependent-care-tax-credit-1-638.jpg?cb=1464717203

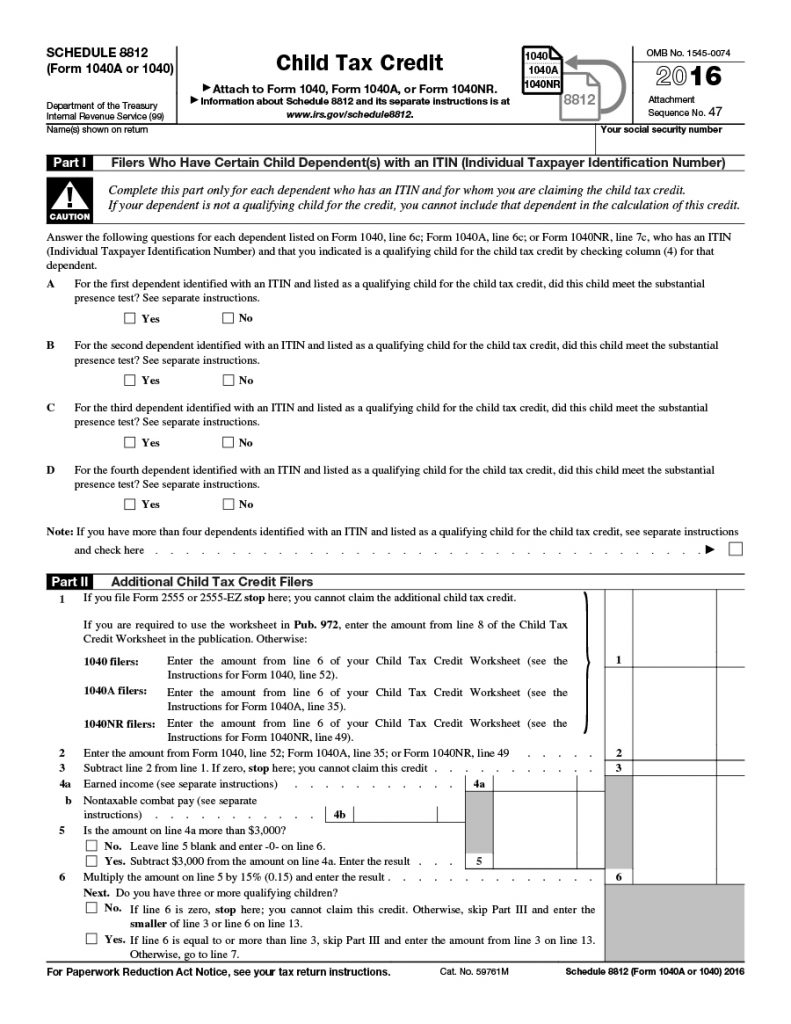

You have 3 years to file a claim after the date your tax return was due Learn more about the EITC and find out If you qualify What is considered earned income How to claim the credit and what forms you will need to file What additional tax credits you may be eligible for Calculate how much EITC you will get What is the child and dependent care credit This credit allows taxpayers to reduce their tax by a portion of their child and dependent care expenses The credit may be claimed by taxpayers who in order to work or look for work pay someone to take

Taxpayers with dependents who don t qualify for the Child Tax Credit may be able to claim the Credit for Other Dependents They can claim this credit in addition to the Child and Dependent Care Credit and the Earned Income Credit Child Tax Credit You may be eligible for the Child Tax Credit which is a tax credit that you get for your dependent kids It s even better than a tax deduction because it reduces your taxes dollar for dollar For tax year 2024 the taxes you file in 2025 the Child Tax Credit is worth up to 2 000 per qualifying child under age 17

Download Dependent Tax Credit

More picture related to Dependent Tax Credit

How To Claim Your Partner As A Dependent On Your Taxes

http://static1.squarespace.com/static/5a1efe26914e6b83e9456629/5a6275db71c10b5a2b431576/5e623b460bfc016010b0da27/1583748041576/Partner+on+Taxes.png?format=1500w

Amanda Explains The Child Tax Credit And Other Dependent Credit E23

https://i.ytimg.com/vi/NtK_2d_kDD8/maxresdefault.jpg

Vermont Tax Rates 2022

https://i2.wp.com/www.taxpolicycenter.org/sites/default/files/model-estimates/images/t16-0179.gif

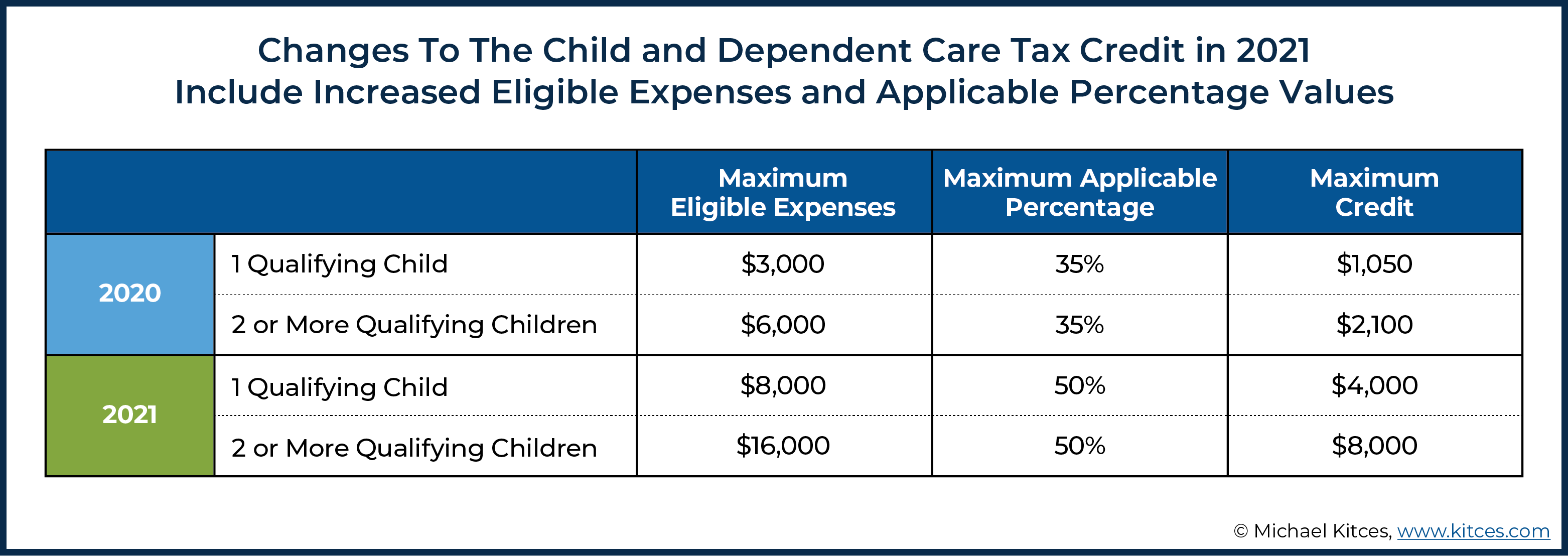

Claiming a dependent can make you eligible for several tax benefits including tax credits and deductions that lower your tax bill or increase your refund An individual can be a There are many credits available for people to help reduce the amount of taxes they owe or increase their refunds Who qualifies for EITC EITC tables shows you the maximum EITC credit amount based on your income The American Rescue Plan Act of 2021 expanding the Child Tax Credit for tax year 2021 only

[desc-10] [desc-11]

Care Credit Printable Application Printable Word Searches

https://handypdf.com/resources/formfile/images/fb/source_images/child-tax-credits-form-irs-d1.png

Dependent Tax Credit Internal Revenue Code Simplified

https://www.irstaxapp.com/wp-content/uploads/2016/02/dependent-tax-credit.jpg

https://www.irs.gov/newsroom/child-and-dependent...

The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents qualifying persons The credit is calculated based on your income and a percentage of expenses that you incur for the care of qualifying persons to enable you to go to work look for work or attend school

https://turbotax.intuit.com/tax-tips/family/rules-for-claiming-a...

What qualifies someone as a dependent The Child Tax Credit is up to 2 000 The Credit for Other Dependents is worth up to 500 The IRS defines a dependent as a qualifying child under age 19 or under 24 if a full time student or any age if permanently and totally disabled or a qualifying relative

:max_bytes(150000):strip_icc()/GettyImages-1150533141-a0599ebe27dd425a93366a8ddefd5887.jpg)

The Tax Credit For Other Dependents For Tax Year 2022

Care Credit Printable Application Printable Word Searches

23 Latest Child Tax Credit Worksheets Calculators Froms

Child care and dependent tax credit Paragon

Ca Dependent Tax Worksheet

2018 Child Dependent Tax Credit Chad Harrison CPA

2018 Child Dependent Tax Credit Chad Harrison CPA

American Rescue Plan 2021 Tax Credit Stimulus Check Rules

2021 Child And Dependent Care Tax Credit

The Child And Dependent Care Tax Credit

Dependent Tax Credit - [desc-14]