Do Seniors Pay Property Tax In Montana February 22 2022 House Bill 191 passed during the 67th Montana Legislative Session made changes to the Elderly Homeowner Renter Tax Credit effective tax year 2022 The bill increased both the allowable exclusion and the tax credit itself effective tax year 2022 The previous exclusion was 6 300 and the previous maximum credit was 1 000

Aberdeen News 0 09 0 56 BOZEMAN Mont As the tax filing season begins Montana State University Extension wants to remind state residents 62 and older of a property tax relief program What is the Elderly Homeowner Renter Credit Changes to the EHRC for tax year 2022 How to you claim the EHRC Step by step example Previous years How to file the EHRC on TAP Audit Procedures Fully refundable tax credit for elderly Montanans Offsets property tax rent paid Not new but has been updated EHRC What s stayed the same

Do Seniors Pay Property Tax In Montana

Do Seniors Pay Property Tax In Montana

https://www.cityofwillowick.com/sites/default/files/imageattachments/finance/page/2305/pie_chart_2022-1.jpg

Do Seniors Pay Property Tax In Washington State YouTube

https://i.ytimg.com/vi/p0U9PZy8eLY/maxresdefault.jpg

Hecht Group Paying Your Property Taxes Online In Russell Kansas

https://img.hechtgroup.com/1665369701273.jpg

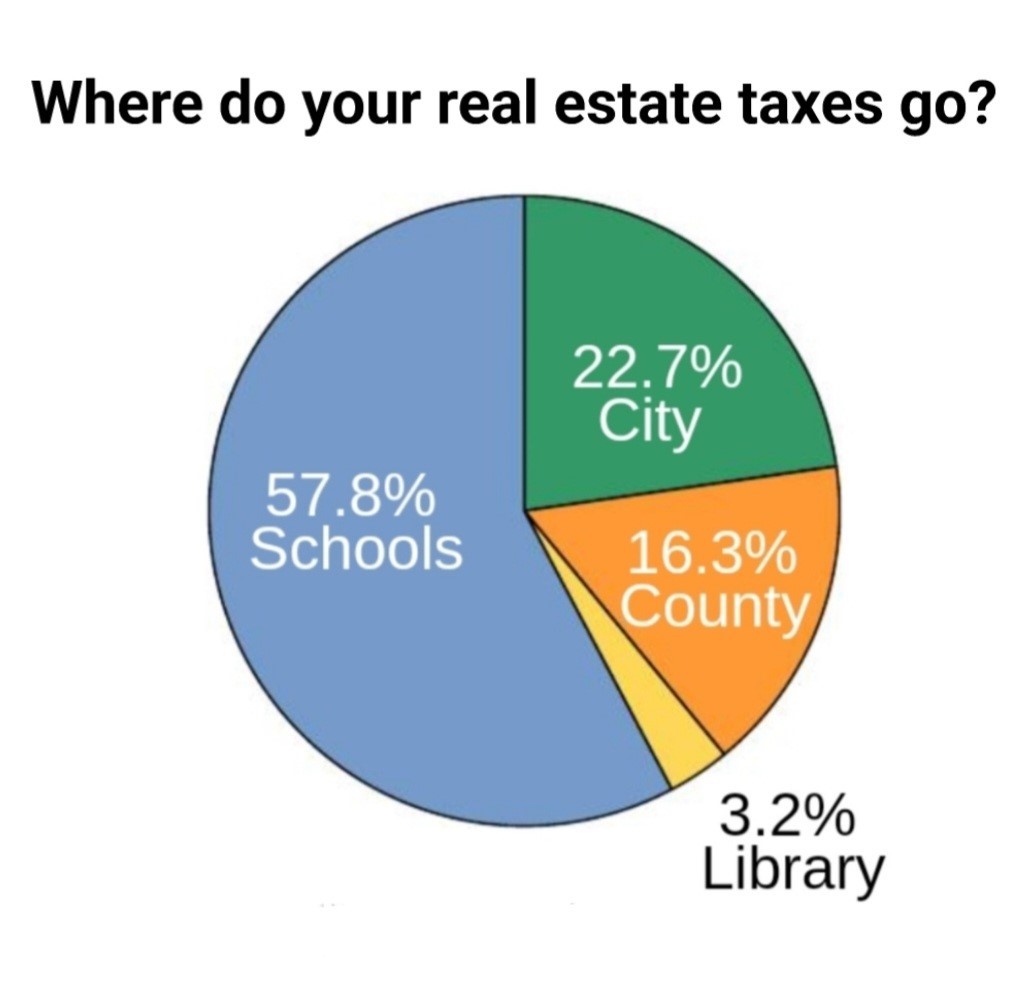

Montana has four property tax assistance programs for residential taxpayers two income based homestead credits a circuit breaker and an exemption for high value land All programs require the claimant to live in the residence for at least 6 months of the claim year Montana s elderly homeowner and renter tax credit is a credit for a portion of property tax paid by seniors living on low incomes who rent or own their homes One basic principle of fair taxation is that taxes should reflect the taxpayer s ability to pay

Senior Tax Help Available There are several programs that can help senior property owners save money on their taxes AARP is championing similar changes in states around the country as older adults are less likely than other homeowners to pay property taxes through monthly escrow payments with their mortgage In Montana property taxes are due twice a year in May and November

Download Do Seniors Pay Property Tax In Montana

More picture related to Do Seniors Pay Property Tax In Montana

This County Has The Highest Property Tax In Montana

https://townsquare.media/site/1104/files/2023/08/attachment-Untitled-design206.jpg?w=980&q=75

The 10 States With The Lowest Property Tax In 2023 Host Tools

https://hosttools.com/wp-content/uploads/Property-tax-1536x865.png

The Rise Of Residential Property Tax In Arizona Klauer Law

http://klauerlaw.com/wp-content/uploads/2015/10/tax-increase.jpg

The Property Tax Rebate is a rebate of up to 675 per year of property taxes paid on a principal residence There is a rebate available for property taxes paid for Tax Year 2023 Check the status of your Property Tax Rebate Impact on Elderly Taxpayers Montana s recent tax changes bring both opportunities and challenges for its elderly residents With the state s adjustments to tax brackets rates and deductions seniors are looking at a different financial landscape

The Property Assessment Division values all taxable property at 100 percent of market value Property taxable values determined by the department are used by the county governments to calculate property taxes 2023 Supplemental Tax Bills On November 22 2023 the Montana Supreme Court ruled that all county governments must collect the Property Tax Relief Programs for Homeowners Apply by April 15 Montana Department of Revenue March 27 2024 Homeowners may qualify for the Property Tax Assistance Program PTAP Eligibility for this program is based on home ownership occupancy requirements and income qualifications

KY State Legislature Makes Changes To Property Tax In House Bill 6

https://deandorton.com/wp-content/uploads/2022/05/Property-Tax-1.jpg

NDMC Records Highest Collection Of Property Tax In Five Years The

https://img.etimg.com/thumb/msid-49229753,width-1070,height-580,imgsize-66247,overlay-etwealth/photo.jpg

https://mtrevenue.gov/house-bill-191-increased...

February 22 2022 House Bill 191 passed during the 67th Montana Legislative Session made changes to the Elderly Homeowner Renter Tax Credit effective tax year 2022 The bill increased both the allowable exclusion and the tax credit itself effective tax year 2022 The previous exclusion was 6 300 and the previous maximum credit was 1 000

https://www.aberdeennews.com/story/news/local/farm...

Aberdeen News 0 09 0 56 BOZEMAN Mont As the tax filing season begins Montana State University Extension wants to remind state residents 62 and older of a property tax relief program

How To Pay Property Tax And Where YouTube

KY State Legislature Makes Changes To Property Tax In House Bill 6

PROPERTY TAX BILL ALERT TIME IS RUNNING OUT Joseph Joseph Hanna

How To Pay House Tax Mahander Vihar Army Flats 4 MDC

Hecht Group In Iowa Seniors May Be Eligible For A Property Tax

Understanding Property Tax In Georgia A Comprehensive Guide

Understanding Property Tax In Georgia A Comprehensive Guide

Homes In Northwest Montana Offer Better Deals Baessosrl Information

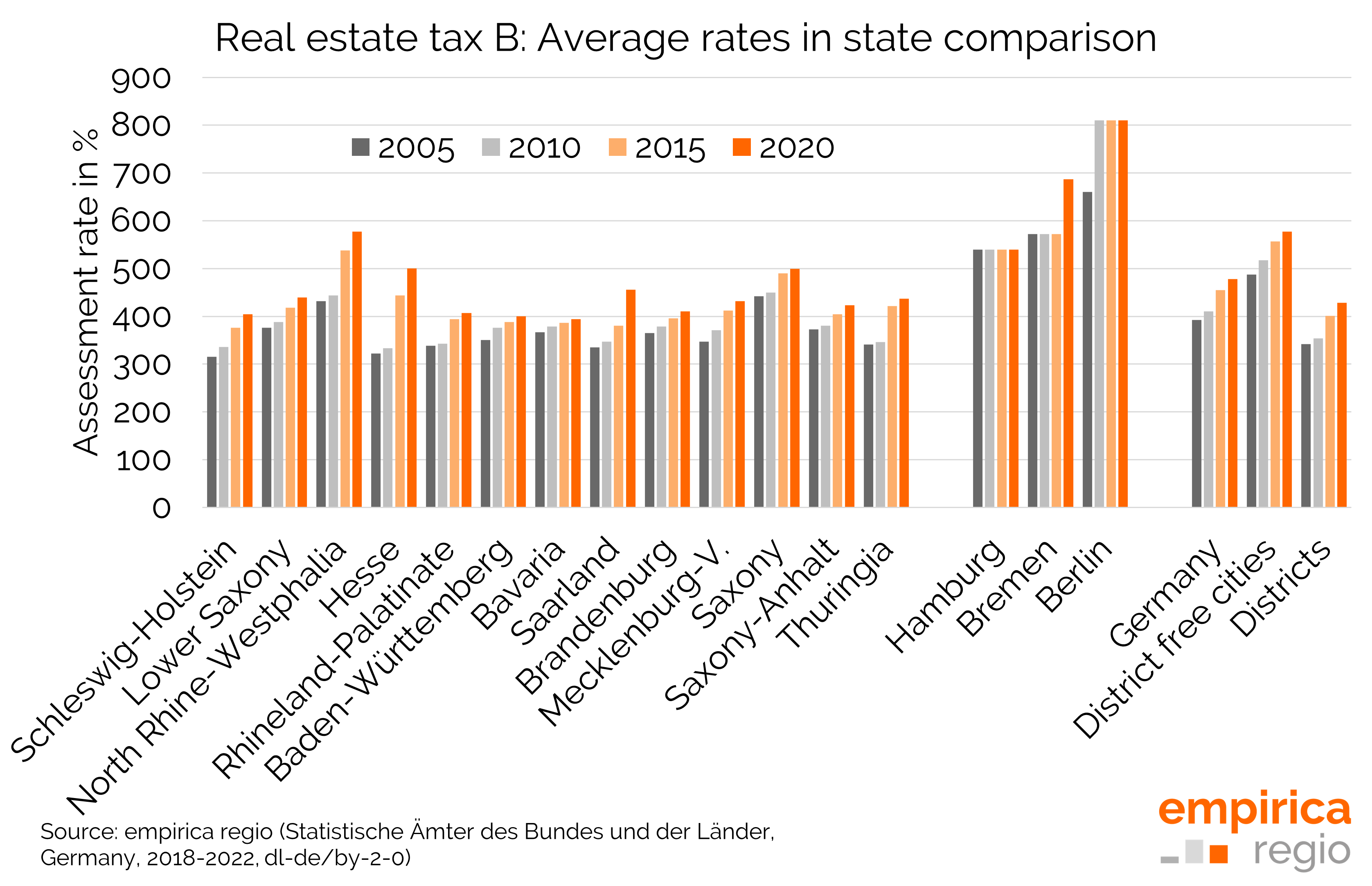

Property Tax B In Top 7 Unchanged Lorch Rheingau Increases Property

Popular Services Fairbanks North Star Borough AK

Do Seniors Pay Property Tax In Montana - Senior Tax Help Available There are several programs that can help senior property owners save money on their taxes