Do You Have To Claim Casino Winnings On Taxes Slots Video Poker And Keno All slot and video poker jackpots of 1 200 or more will trigger a W 2G This seems to also apply to electronic keno though the IRS

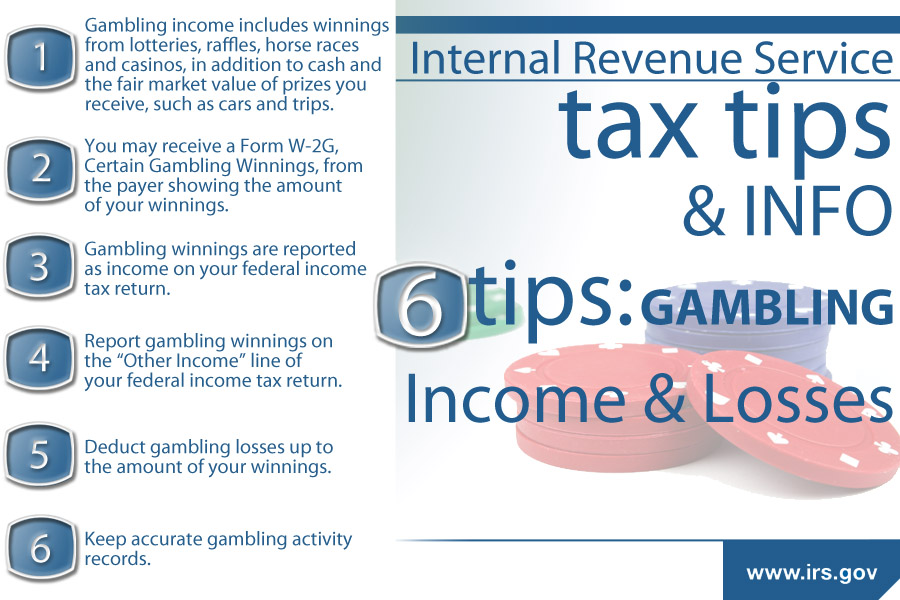

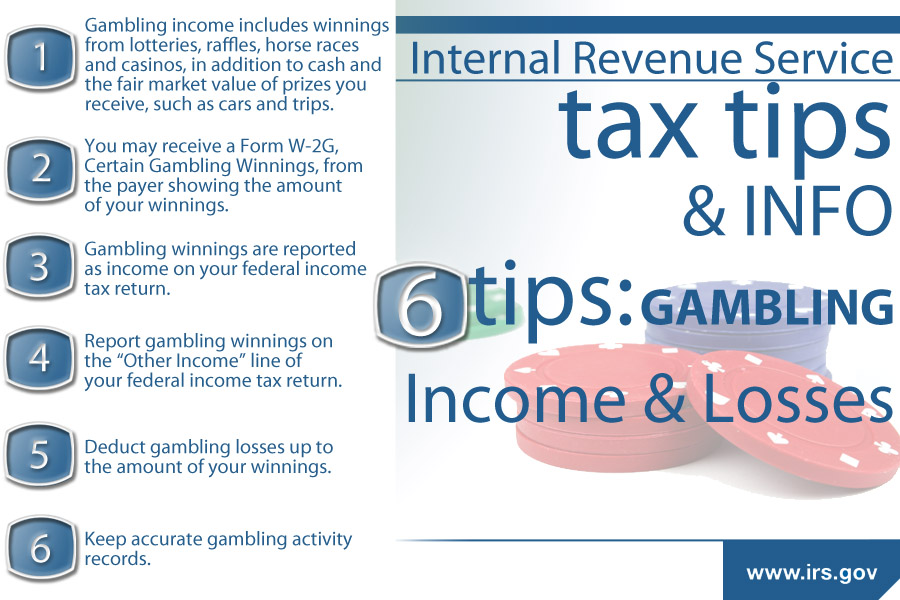

Gambling winnings are fully taxable and you must report the income on your tax return Gambling income includes but isn t limited to winnings from lotteries You are required to report all gambling winnings including the fair market value of noncash prizes you win as other income on your tax

Do You Have To Claim Casino Winnings On Taxes

Do You Have To Claim Casino Winnings On Taxes

https://zomgcandy.com/wp-content/uploads/2021/12/kaysha-V3qzwMY2ak0-unsplash-5-scaled.jpg

How To Report Gambling Winnings Losses To The IRS

https://ayarlaw.com/new-site/wp-content/uploads/2021/09/shutterstock_605058941-1024x682.jpg

A Guide To Properly Managing Your New Casino Winnings

https://sacgames.org/wp-content/uploads/2020/07/Casino-Winnings.jpg

Yes you can use your gambling losses to deduct the tax amounts you must pay on your winnings However these deductions may not exceed the amount you The IRS requires you to claim your gambling winnings on your federal income taxes When you receive a Form W 2G it will list your winnings as well as any federal tax withholdings

If you win 600 or above the gambling facility will ask for your social security number so they can report your winnings to the IRS but remember even if you don t receive a form reporting your income You re required to report all of your gambling winnings as income on your tax return even if you end up losing money overall

Download Do You Have To Claim Casino Winnings On Taxes

More picture related to Do You Have To Claim Casino Winnings On Taxes

Do You Have To Pay Tax On Gambling Winnings Nz

https://mobislot9.weebly.com/uploads/1/3/5/7/135744610/799854862.jpg

Tax On Casino Winnings How Much Do You Have To Win To Pay Tax

https://www.casino.org/blog/wp-content/uploads/form-w2g-casino-winnings-taxes.png

Highest Casino Gambling Taxes In The US Casino Winnings State Tax

https://www.bestuscasinos.org/app/uploads/2020/11/tax2.jpg

Tax Tips 1 8 Image credit Getty Images Gambling Taxes You Have to Report All Your Winnings Whether it s 5 or 5 000 from the track an office pool a casino or a gambling website The payer must provide you with a Form W 2G if you win 600 or more if the amount is at least 300 times the wager the payer has the option to reduce the winnings by the

Yes all gambling income is taxable Do online casinos report winnings to the IRS It depends on if you re playing at licensed US online casinos or offshore This interview will help you determine how to claim your gambling winnings and or losses Information you ll need Your and your spouse s filing status Amount of

6 Tips On Gambling And Income Taxes Don t Play The IRS For A Sucker

https://www.cpapracticeadvisor.com/wp-content/uploads/sites/2/2022/07/17834/tumblr_mquwjxyxX21roj7sjo1_1280_1_.54c2a4e28d5a1.png

Mega Millions Lottery How Lottery Winners Spent Their Money

https://www.gannett-cdn.com/-mm-/b2b05a4ab25f4fca0316459e1c7404c537a89702/c=0-0-1365-768/local/-/media/2018/07/19/USATODAY/usatsports/lottery-winner-money.jpg?width=3200&height=1680&fit=crop

https://www.casino.org/blog/taxes-on-casino-winnings

Slots Video Poker And Keno All slot and video poker jackpots of 1 200 or more will trigger a W 2G This seems to also apply to electronic keno though the IRS

https://www.irs.gov/taxtopics/tc419

Gambling winnings are fully taxable and you must report the income on your tax return Gambling income includes but isn t limited to winnings from lotteries

Do You Have To Pay Taxes When You Sell Your House Prudential Cal

6 Tips On Gambling And Income Taxes Don t Play The IRS For A Sucker

Do You Pay Taxes On Casino Winnings 22 Countries Explained

Should You Avoid Big Sweepstakes To Avoid Paying Taxes On Prize

Taxes Do I Pay Tax On My Casino Winnings US Gambling Taxation

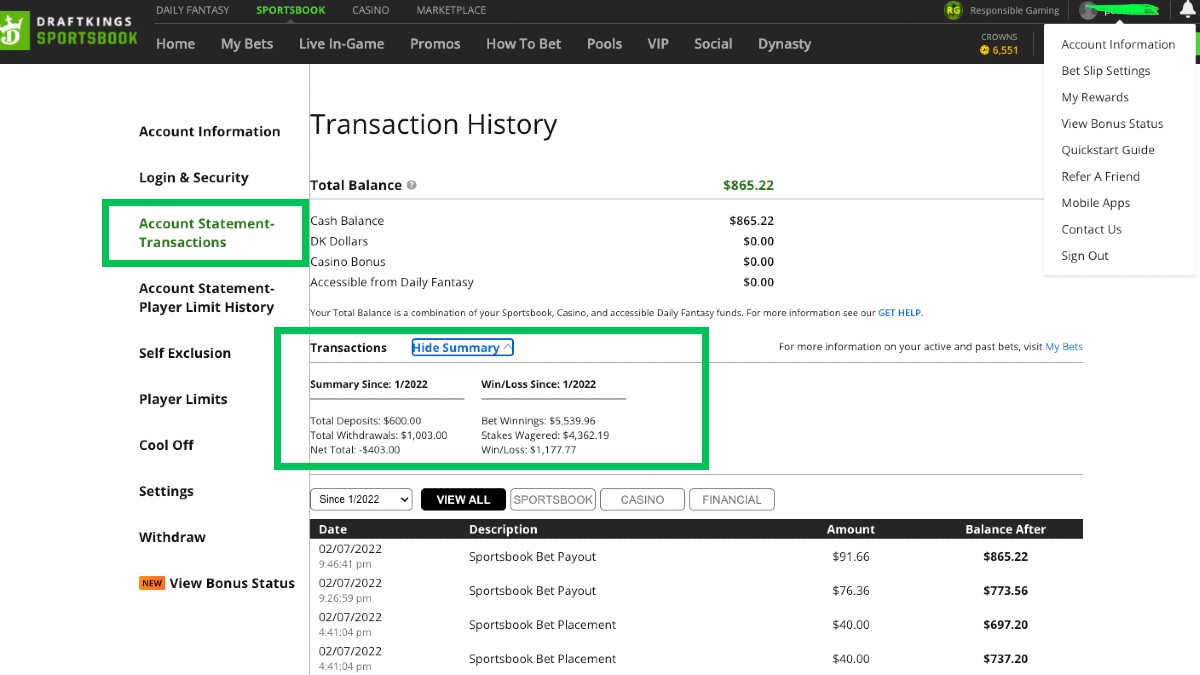

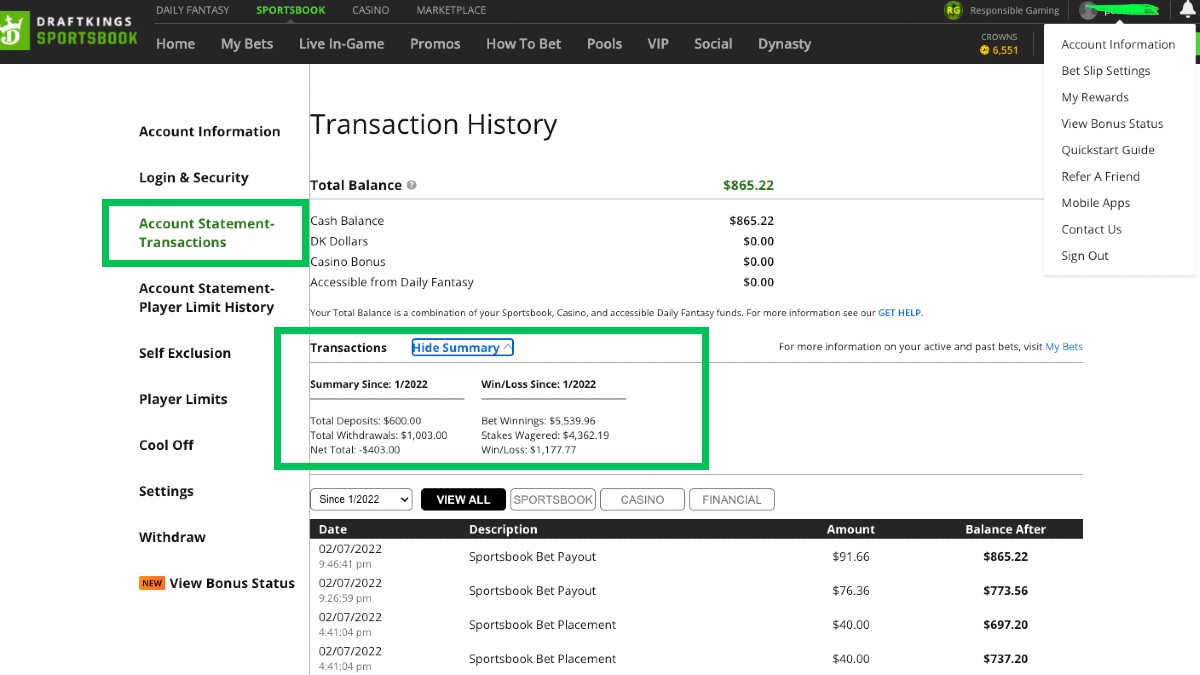

The Hidden Ways To Find Your All Time Profits Losses At A Sportsbook

The Hidden Ways To Find Your All Time Profits Losses At A Sportsbook

Tax On Casino Winnings How Much Do You Have To Win To Pay Tax

Do I Have To Pay Taxes On Game Show Winnings NerdWallet

Do I Have To Claim Casino Winnings On My Taxes BoVegas Blog

Do You Have To Claim Casino Winnings On Taxes - You re required to report all of your gambling winnings as income on your tax return even if you end up losing money overall