Do You Have To Pay Taxes On Saving Account Interest You may also get up to 1 000 of interest and not have to pay tax on it depending on which Income Tax band you re in This is your Personal Savings Allowance

So if you received 125 in interest on a high yield savings account in 2023 you re required to pay taxes on that interest when you file your federal tax return for the 2023 The short answer is yes Here are a few things you need to know about tax for savings accounts how to file and ways to save Is Savings Account Interest Taxable Interest and

Do You Have To Pay Taxes On Saving Account Interest

Do You Have To Pay Taxes On Saving Account Interest

https://i.ytimg.com/vi/bZjTIHPyY94/maxresdefault.jpg

Common Financial Myths Don t Give Away Too Much Money Or You ll Owe

https://static.twentyoverten.com/5d695e18001fda1ab1b4e561/QaD68MrqIUUQ/cropped/ekaterina-shevchenko-ZLTlHeKbh04-unsplash.jpg

Top 10 Saving Account With A High Interest Rate In UAE

https://busydubai.com/articles/wp-content/uploads/2019/12/Top-10-Saving-Account-with-a-High-Interest-rate-in-UAE.png

Do I have to pay taxes on my savings account interest Any interest you earn is include ded in your gross income along with any salaries wages and tips and is taxed as In fact any interest earned on your savings whether through a savings account money market account certificate of deposit CD bond or Treasury bill is generally taxable The

Similar to how you re required to pay taxes on the income you earn from your job whether it s a full time job or a side hustle so too must you pay taxes on your interest income While you won t owe taxes on the principal account balance in your savings account any savings account interest earned is considered taxable income The IRS taxes interest

Download Do You Have To Pay Taxes On Saving Account Interest

More picture related to Do You Have To Pay Taxes On Saving Account Interest

Do I Have To Pay Taxes On My Checking Account Millennial Money

https://millennialmoney.com/wp-content/uploads/2021/04/Do-I-Have-to-Pay-Taxes-on-My-Checking-Account.jpg

How To Save Money On Taxes The Top Tips To Know Areas Of My Expertise

https://areasofmyexpertise.com/wp-content/uploads/2020/08/113254-1100x778.jpg

You Can Pay Your Taxes With Credit Card But Should You

https://www.gannett-cdn.com/-mm-/e6fc938b703a3aefb17e10ece8094955d629fbcd/c=0-167-3862-2349/local/-/media/2016/03/21/USATODAY/USATODAY/635941795874671933-ThinkstockPhotos-464263169.jpg?width=3200&height=1808&fit=crop&format=pjpg&auto=webp

In the U S the principal balance in your savings account is not taxable Your interest earnings are added to your total income and both are taxed at the same marginal income tax rate You can reduce the taxes owed on interest from your savings account by using various tax advantaged savings accounts Written by Mark Henricks You are required to report and pay federal taxes on any interest income you receive from a savings account The income is taxed as unearned which means you ll escape payroll taxes but you will owe federal income tax on it at your regular rate

That s why it can be such a shock when you find out that yes paying taxes on interest is something you need to do The amount you actually owe in taxes will depend on two factors how much interest you earned and your tax bracket Interest on your savings is paid to you gross The tax you owe is therefore not withheld by the banks before passing the interest you earned on to you Your personal savings allowance is the amount you can earn in interest before you have to start paying tax on it This allowance is based on your tax band

Do You Pay Taxes On A High yield Savings Account

https://assets2.cbsnewsstatic.com/hub/i/r/2023/03/28/25871c73-c641-4660-9c1f-a401185ac113/thumbnail/620x413/2d265a8d68fb9f268991fcae36a9e825/do-i-have-to-pay-taxes-on-my-high-yield-savings-account.jpg

4 Highest Paying Banks Of 2020 Best High Yield Savings Accounts YouTube

https://i.ytimg.com/vi/-F7Xh9kCjxQ/maxresdefault.jpg

https://www.gov.uk/apply-tax-free-interest-on-savings

You may also get up to 1 000 of interest and not have to pay tax on it depending on which Income Tax band you re in This is your Personal Savings Allowance

https://www.usnews.com/banking/articles/do-you-pay...

So if you received 125 in interest on a high yield savings account in 2023 you re required to pay taxes on that interest when you file your federal tax return for the 2023

Kotak Mahindra Bank Savings Account Interest Rate Hunterhour

Do You Pay Taxes On A High yield Savings Account

Do I Have To Pay Taxes On Virtual Currency If My Profit Is Less Than

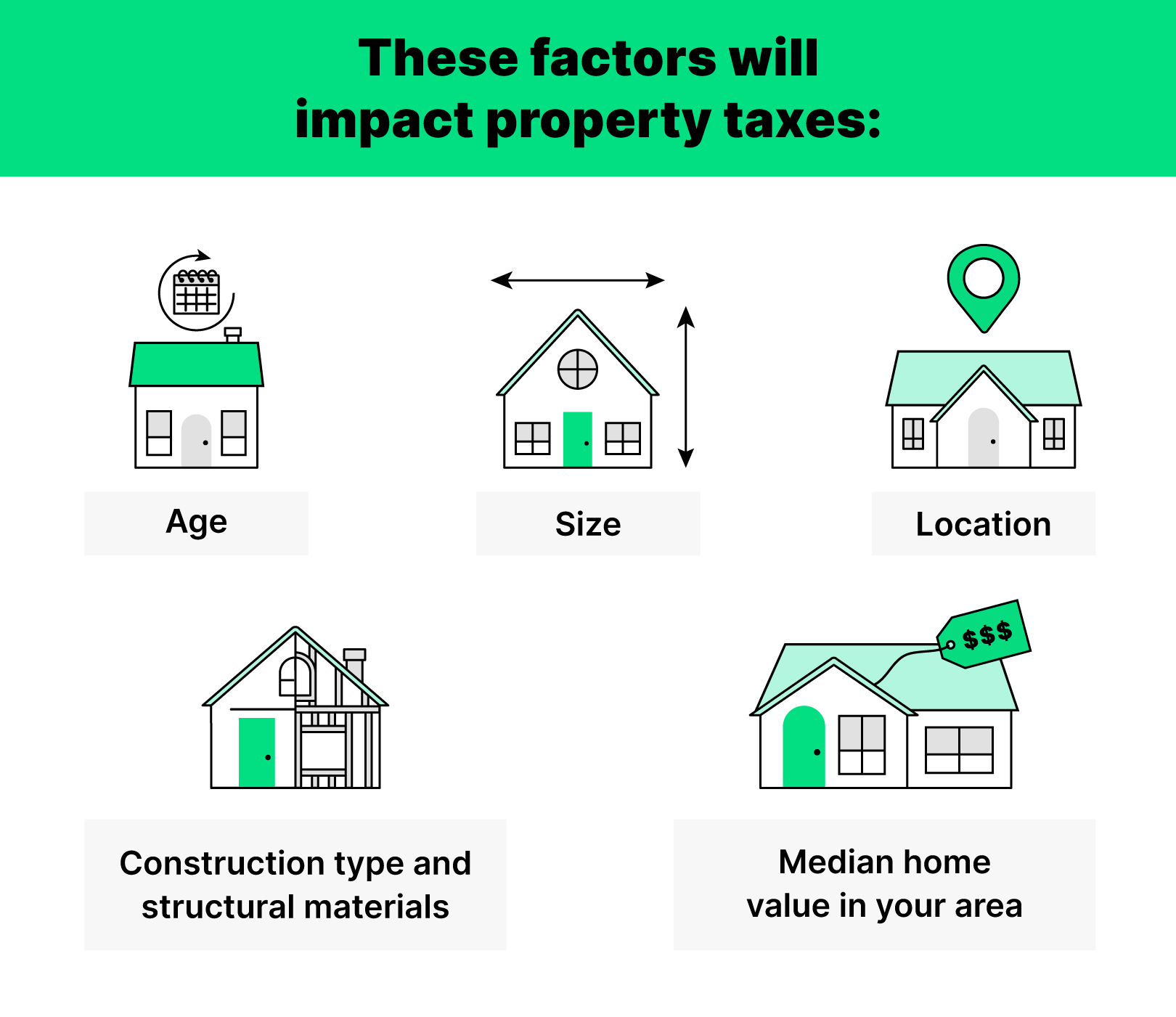

Your Guide To Property Taxes Hippo

Do I Need To Pay Taxes The Minimum Income To File Taxes

How Much Interest Sbi Gives On Savings Account Lacmymages

How Much Interest Sbi Gives On Savings Account Lacmymages

Why We Pay Taxes In South Africa Greater Good SA

Do I Have To Pay Taxes On A 10 000 Inheritance Keystone Law Firm

Do I Have To Pay Taxes On Bank Account Interest Paying Taxes Money

Do You Have To Pay Taxes On Saving Account Interest - Yes you need to include interest in your tax return When you file your income tax return at the end of each financial year you need to declare all your sources of income This includes your salary and income earned from investments as well as interest you ve earned on your savings