Does A Tankless Water Heater Qualify For Tax Credit ENERGY STAR certified models are eligible as follows 0 81 UEF for tanks less than 55 gallons and 0 86 UEF for tanks greater than or equal to 55 gallons Tankless gas water heaters ENERGY STAR models with 0 95 UEF are eligible Annual Limits on Energy Efficient Home Improvement Tax Credits

Taxpayers that make qualified energy efficient improvements to their home after Jan 1 2023 may qualify for a tax credit up to 3 200 As part of the Inflation Reduction Act beginning Jan 1 2023 the credit equals 30 of certain qualified expenses Energy Efficient Home Improvement Credit These expenses may qualify if they meet requirements detailed on energy gov Exterior doors windows skylights and insulation materials Central air conditioners water heaters furnaces boilers and heat pumps Biomass stoves and boilers Home energy audits The amount of the credit you can take is a

Does A Tankless Water Heater Qualify For Tax Credit

Does A Tankless Water Heater Qualify For Tax Credit

https://www.achrnews.com/ext/resources/2021/06-June/Tankless-Heaters.jpg?1624921301

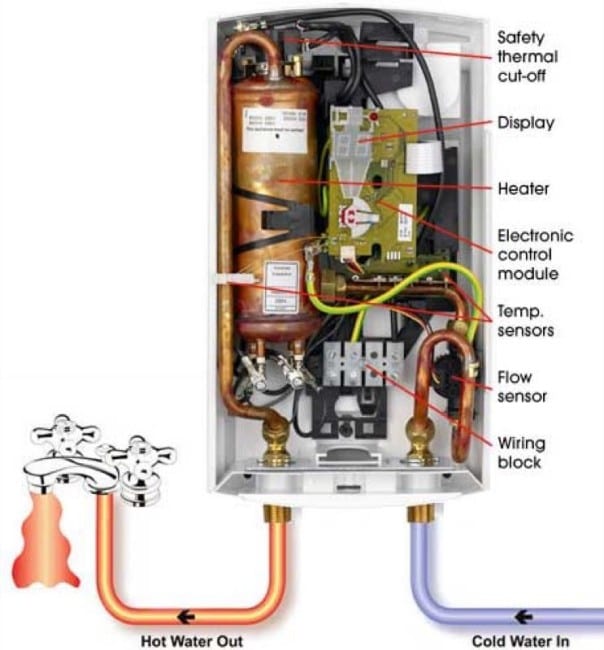

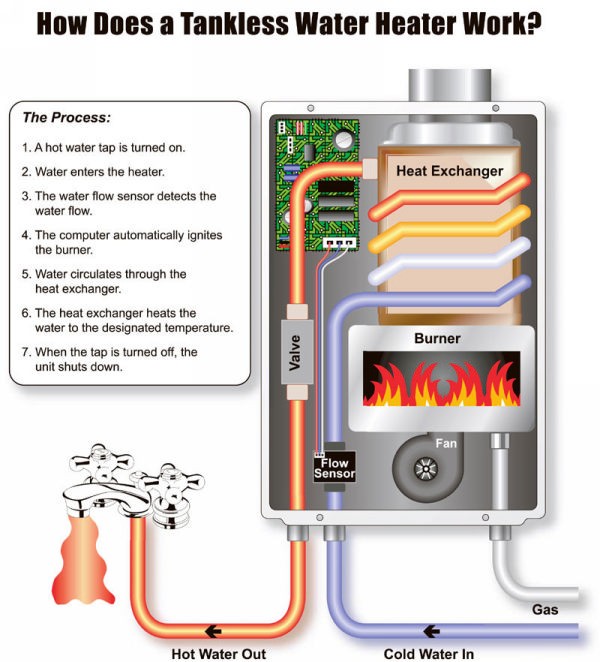

HOW DO TANKLESS WATER HEATERS WORK Hot Water Works

https://www.protoolreviews.com/wp-content/uploads/2009/04/electric-tankless-water-heater-604x650.jpg

Tankless Water Heaters Washington Water Heater

https://heaters.seoseattle.net/wp-content/uploads/2015/05/photo_1.jpg

Homeowners can claim a tax credit of up to 30 of the cost with a maximum credit limit of 1 200 per year and up to 2 000 per year for qualified heat pumps Qualifying heat pumps must meet or Homeowners can receive a tax credit of 30 of the installation cost for qualified geothermal systems through 2032 with descending credit rates still available in the years following

Check with your utility to verify eligibility requirements for residential rebate programs Find available federal tax credits and local rebate programs for Energy Star rated tankless water heaters combi boilers and heating boilers from Navien Qualifying tankless water heaters are those powered by solar power geothermal heat pumps small wind turbines and fuel cells The applicable terms of tax credits for tankless water heaters are as follows Tax credits for residential energy efficiency are no longer in effect as of December 31 2021

Download Does A Tankless Water Heater Qualify For Tax Credit

More picture related to Does A Tankless Water Heater Qualify For Tax Credit

Tankless VS Tank Water Heater Complete Explanation YouTube

https://i.ytimg.com/vi/Q4wQlfEZiv4/maxresdefault.jpg

How To Clean A Tankless Water Heater

https://sweethomeadvisor.com/wp-content/uploads/2021/12/How-to-Clean-a-Tankless-Water-Heater.jpg

Rheem Performance 13 KW Self Modulating 1 97 GPM Electric Tankless

https://images.homedepot-static.com/productImages/feb84227-7ae9-4010-89a7-962a8bfc27d0/svn/rheem-tankless-electric-retex-13-64_1000.jpg

Tax Credits for Energy Efficiency Improvements Total Annual Limit The 2 000 heat pump credit can be combined with credits up to 1 200 for other qualified upgrades made in one tax year Effective Date Products purchased and installed Yes The credit amount for Gas Oil Propane Water Heaters including tankless units is 300 That means if you installed a qualifying tankless water heater last year you could get the credit on the return

Yes the residential energy efficient property credit allows for a credit equal to the applicable percent of the cost of qualified property Qualifying properties are solar electric property solar water heaters geothermal heat pumps small wind turbines fuel cell property and starting December 31 2020 qualified biomass fuel property Homeowners who have made energy efficient improvements including an upgrade to a Rinnai Tankless Water Heater may qualify for a 300 US federal tax credit known as the Nonbusiness Energy Property Credit

How Do Tankless Water Heaters Work ToolKit

http://tool-kit.co/wp-content/uploads/2021/07/EcoSmart-Tankless-Water-Heaters-ECO-11-2048x1537.jpg

Tankless Water Heater Advantages For Your Consideration HomesFeed

http://homesfeed.com/wp-content/uploads/2015/06/Easy-Rinnai-tankless-water-heater-installation-in-wall-with-pipe.jpg

https://www.energystar.gov/about/federal-tax...

ENERGY STAR certified models are eligible as follows 0 81 UEF for tanks less than 55 gallons and 0 86 UEF for tanks greater than or equal to 55 gallons Tankless gas water heaters ENERGY STAR models with 0 95 UEF are eligible Annual Limits on Energy Efficient Home Improvement Tax Credits

https://www.irs.gov/newsroom/irs-home-improvements...

Taxpayers that make qualified energy efficient improvements to their home after Jan 1 2023 may qualify for a tax credit up to 3 200 As part of the Inflation Reduction Act beginning Jan 1 2023 the credit equals 30 of certain qualified expenses

5 Things To Know About Tankless Water Heaters The Green Machine Blog

How Do Tankless Water Heaters Work ToolKit

Pros And Cons Of Tankless Water Heaters Plumbers 911 California

30 Federal Tax Credits For Heat Pump Water Heaters 2023

Beneficial Tankless Water Heater Installation That Save For Environment

Tankless Gas Water Heater

Tankless Gas Water Heater

How Do Tankless Water Heaters Work Plumbing And HVAC Services In

Why A Tankless Water Heater You Ask Plumbing Professors

How Does A Tankless Water Heater Work Informinc

Does A Tankless Water Heater Qualify For Tax Credit - Qualifying tankless water heaters are those powered by solar power geothermal heat pumps small wind turbines and fuel cells The applicable terms of tax credits for tankless water heaters are as follows Tax credits for residential energy efficiency are no longer in effect as of December 31 2021