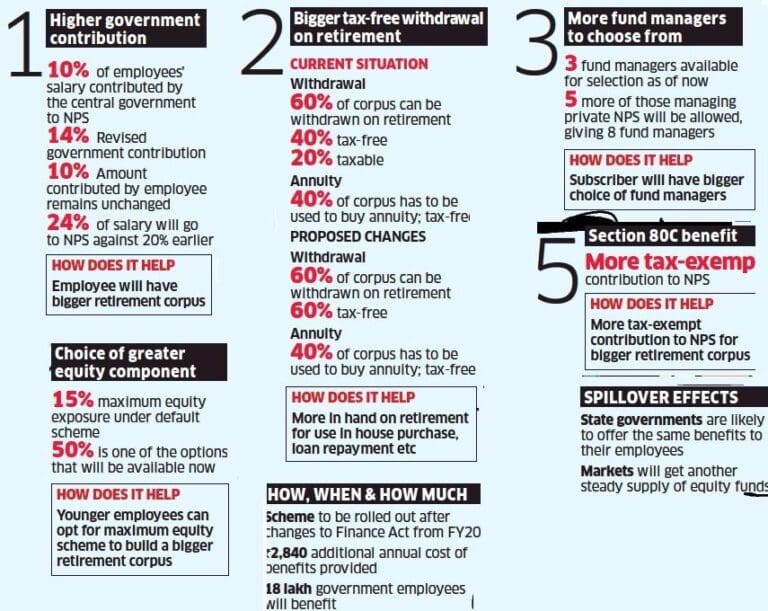

Does Nps Contribution Come Under 80c Employer s contribution towards NPS of an employee is eligible for a tax deduction of up to 10 of salary i e basic plus DA or 14 of salary if such contribution is made by the

Does this come under Sec 80C NSCs are eligible for tax breaks for the financial year in which they are purchased Investments of up to Rs 1 5 lakh in NSCs can be made to save taxes under Section 80C Section 80CCD 1B gives an additional deduction of Rs 50 000 on their NPS contributions Section 80CCD 2 provides that employees can claim a deduction on the NPS contribution of up to 10 of salary 14 of salary for

Does Nps Contribution Come Under 80c

Does Nps Contribution Come Under 80c

https://life.futuregenerali.in/media/5utfvrlk/chapter-via-section.jpg

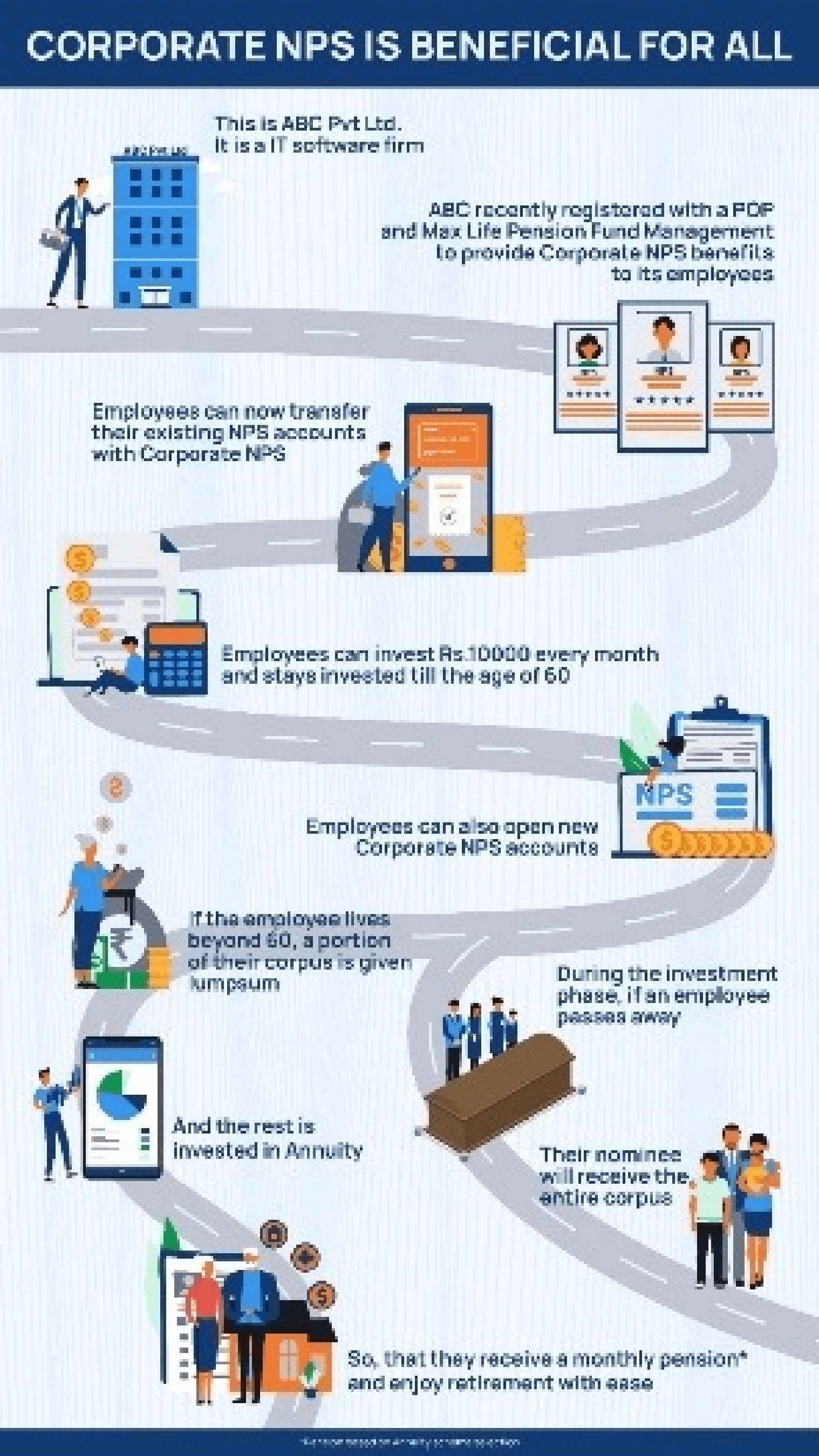

Nps Solutions

https://www.maxlifepensionfund.com/content/dam/pfm/nps-solutions/corporate-nps-working-image.png

Income Tax Deduction Under 80C Lex N Tax Associates

https://lexntax.com/wp-content/uploads/2018/01/Deduction-Under-Income-Tax-1024x640-1.jpg

Your contribution to NPS can be claimed under Section 80CCD1 b as well as Section 80C So If you have can use other investments to claim 1 5 lakh deduction under 80C then you can claim your NPS contribution NPS tax benefits under Section 80CCD 1 Section 80CCD 1 of the Income tax Act 1961 allows for a deduction from your gross total income for contributions made to the NPS Both salaried and self employed taxpayers

Under the Old Tax Regime Section 80CCD 1 of the Income tax Act 1961 a deduction from taxpayers gross total income for contributions made to the NPS is allowed 6 What are the tax benefits of NPS The various Tax benefit as under A Employee Contribution Deduction upto 10 of salary basic DA within overall ceiling Rs 1 50 Lakh

Download Does Nps Contribution Come Under 80c

More picture related to Does Nps Contribution Come Under 80c

Deductions Under Section 80C Does PF Come Under 80C

https://vakilsearch.com/blog/wp-content/uploads/2022/08/PF-under-80C.jpg

-50000.jpg)

NPS Tax Benefit Under Sec 80CCD 1b Of Rs 50 000 Business HimSky

http://www.himsky.com/sites/default/files/field/image/NPS-tax-benefit-under-Sec-80CCD-(1b)-50000.jpg

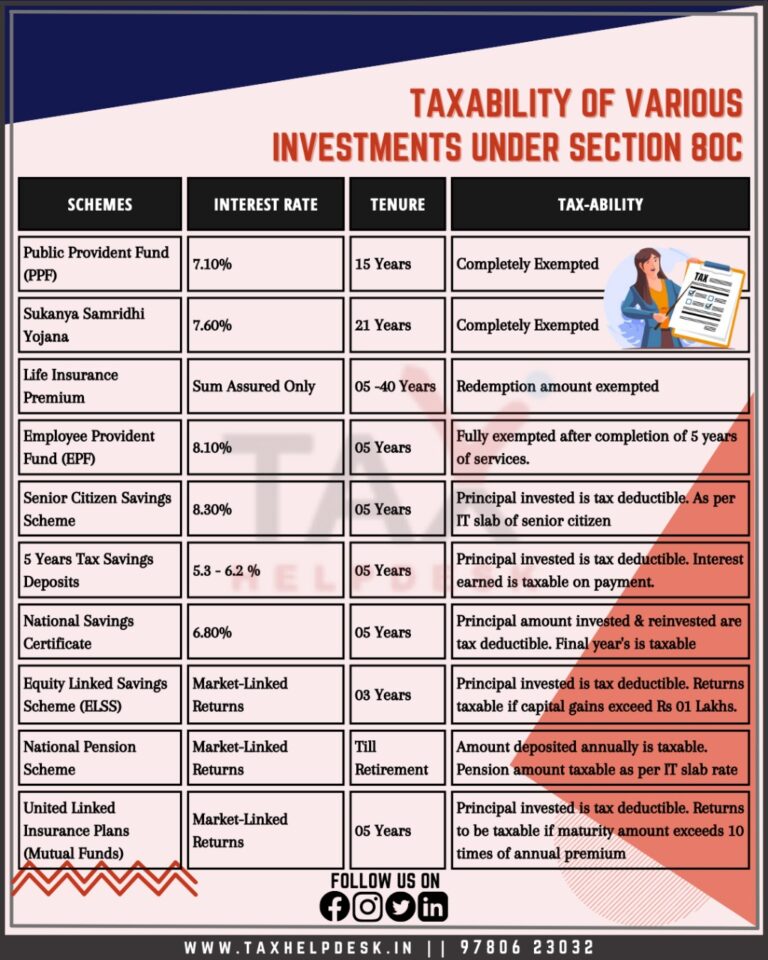

Deduction Under Section 80C Its Allied Sections

https://www.taxhelpdesk.in/wp-content/uploads/2022/07/DEDUCTIONS-UNDER-SECTION-80C-80CCC-80CCD1-80CCD1b-80CCD2--819x1024.png

You can claim tax deductions under Section 80C and Section 80 CCD of the Income Tax Act 1961 You can claim 1 5 lakh tax deduction under Section 80 CCE Note The maximum deduction under Section 80C 80CCC and 80CCD 1 put together is Rs 1 5 lakhs However you may claim an additional deduction of Rs 50 000 allowed u s 80CCD 1B for contributions made to

How is employer s contribution to NPS treated in income tax calculation of salaried employee Is it deductible within the overall limit of Rs 1 50 lakhs under Section 80C Section 80CCD provides for Income Tax deductions for contributions made to the notified Pension Scheme of the Central Govt i e for contribution to the National Pension Scheme NPS

Section 80C Deductions List To Save Income Tax FinCalC Blog

https://fincalc-blog.in/wp-content/uploads/2022/09/section-80C-deductions-list-to-save-income-tax-video.webp

Section 80C Deductions Save Up To 1 5 Lakhs On Taxes

https://life.futuregenerali.in/media/2zjhyg5j/section-80c-deductions.jpg

https://cleartax.in › nps-national-pension-scheme

Employer s contribution towards NPS of an employee is eligible for a tax deduction of up to 10 of salary i e basic plus DA or 14 of salary if such contribution is made by the

https://cleartax.in

Does this come under Sec 80C NSCs are eligible for tax breaks for the financial year in which they are purchased Investments of up to Rs 1 5 lakh in NSCs can be made to save taxes under Section 80C

Employer Contribution May Be Tax Free Under National Pension Scheme

Section 80C Deductions List To Save Income Tax FinCalC Blog

Section 80C Deduction Under Section 80C In India Paisabazaar

Pin On SHAMEEM

Understand About Taxability Of Various Investments Under Section 80C

What Will Be The Inhand Salary 1 5 L In 80c And 5 Fishbowl

What Will Be The Inhand Salary 1 5 L In 80c And 5 Fishbowl

How To Claim Section 80CCD 1B TaxHelpdesk

Best NPS Funds 2019 Top Performing NPS Scheme

Section 80C Of Income Tax Act Tax Deduction AY 2023 24

Does Nps Contribution Come Under 80c - 6 What are the tax benefits of NPS The various Tax benefit as under A Employee Contribution Deduction upto 10 of salary basic DA within overall ceiling Rs 1 50 Lakh