Will Nps Come Under 80c Synopsis If you have exhausted the Rs 1 5 lakh limit under Section 80C then additional tax can be saved by investing Rs 50 000 in NPS This deduction claimed will be over and above Section 80C deduction of Rs 1 5 lakh Here is a look at the tax benefits one gets by investing in NPS Getty Images Puneet Gupta

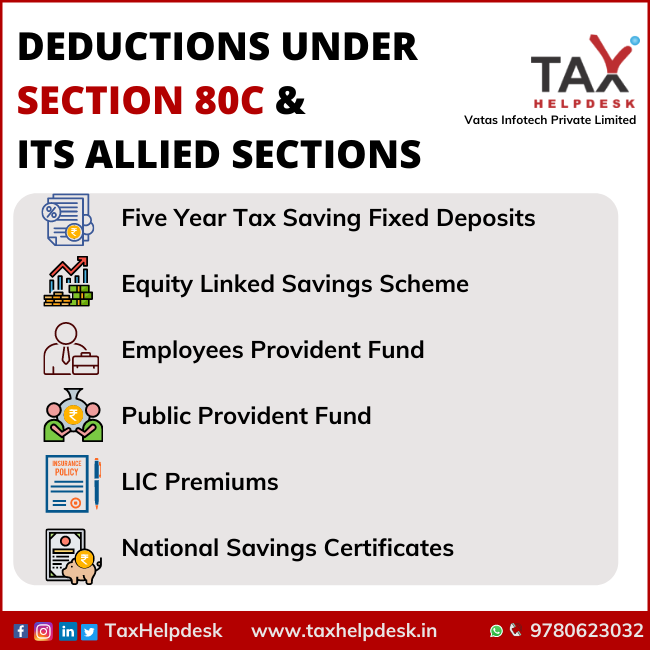

Does this come under Sec 80C The NPS is a pension scheme that has been started by the Indian Government to allow the unorganised sector and working professionals to have a pension after retirement Investments of up to Rs 1 5 lakh can be used to avail tax deductions under Section 80C The maximum deduction under this section is 10 of your salary Basic DA for salaried individuals or 20 of gross total income for self employed The upper limit is Rs 1 5 lakh in a

Will Nps Come Under 80c

Will Nps Come Under 80c

https://www.taxhelpdesk.in/wp-content/uploads/2021/08/Deductions-under-Section-80C-its-allied-sections.png

Deductions Under Chapter VIA

https://life.futuregenerali.in/media/5utfvrlk/chapter-via-section.jpg

NPS Take off pressed ETS NORD

https://www.etsnord.fi/content/uploads/NPS-4.png

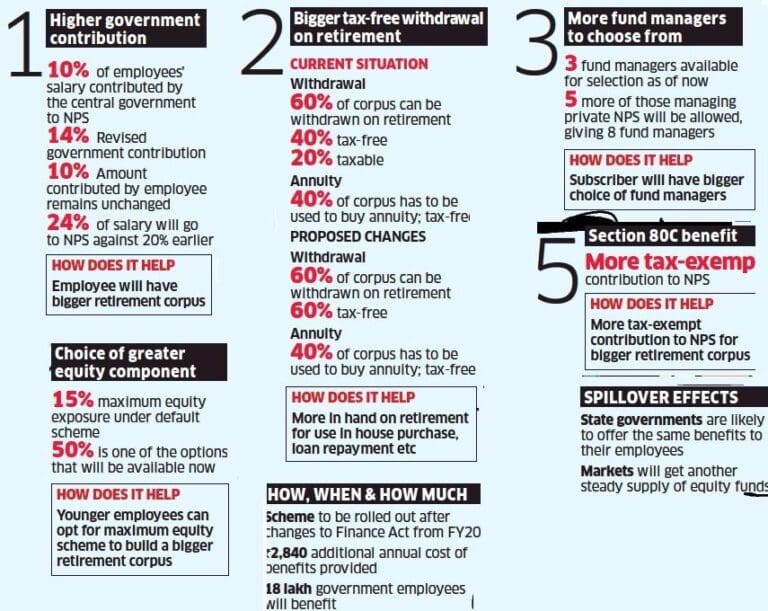

The NPS scheme holds immense value for anyone who works in the private sector and requires a regular pension after retirement The scheme is portable across jobs and locations with tax benefits under Section 80C and Section 80CCD Who should invest in An investment in National Pension System NPS allows three separate deductions under the Income tax Act 1961 These are under Section 80CCD 1 80CCD 1b and 80CCD 2 However deduction under Section 80CCD 2 is available in old as well as new tax regime Tax experts ask government to allow Rs 50 000 tax break in new tax

Investing in NPS Tier I offers three tax deductions Deduction of up to Rs 1 5 lakh from taxable income under Section 80C Additional deduction of up to Rs 50 000 under Section 80CCD 1B of the Income Tax Act exclusively available through NPS investment The third deduction is in the form of employer s contribution of up to 10 per cent of Investments of up to Rs 50 000 in NPS are considered for exemption under this section Section 80CCD 2 Employer s contribution towards NPS up to 10 comprising basic salary and dearness allowance if any is exempted under this category

Download Will Nps Come Under 80c

More picture related to Will Nps Come Under 80c

Deductions Under Section 80C Does PF Come Under 80C

https://d3l793awsc655b.cloudfront.net/blog/wp-content/uploads/2022/08/PF-under-80C-768x319.jpg

AMLnZu914KiYJnoWmEmSMw6ueYX2xtnanwghFDdbQp70 s900 c k c0x00ffffff no rj

https://yt3.ggpht.com/ytc/AMLnZu914KiYJnoWmEmSMw6ueYX2xtnanwghFDdbQp70=s900-c-k-c0x00ffffff-no-rj

NPS Benchmarks SurveySparrow

http://static.surveysparrow.com/site/assets/nps-benchmark/know-all-about-nps.png

80C Investment in LIC Deposit in NPS PPF FDs etc Rs 1 50 000 As per 80CCE aggregate deduction under 80C 80CCC 80CCD 1 is restricted to Rs 1 5 lakh 80CCC Contribution to certain pension funds 80CCD 1 Contribution to NPS Scheme 10 of salary 80CCD 1B Self contribution to NPS Rs 50 000 In addition to the above Rs 1 5 Exclusive Tax Benefit to all NPS Subscribers u s 80CCD 1B An additional deduction for investment up to Rs 50 000 in NPS Tier I account is available exclusively to NPS subscribers under subsection 80CCD 1B This is over and above the deduction of Rs 1 5 lakh available under section 80C of Income Tax Act 1961

NPS helps get extra income tax deduction beyond 1 5 lakh limit under Section 80C Contributions towards Tier 1 accounts of the NPS are eligible for 50 000 income tax deduction under Section 80CCD provides for Income Tax deductions for contributions made to the notified Pension Scheme of the Central Govt i e for contribution to the National Pension Scheme NPS Deduction under this Section is only available to Individuals and not to HUF s The Individual claiming deduction under this Section may be Resident or Non Resident

Section 80C Of Income Tax Act Tax Deduction AY 2023 24

https://cdn-scripbox-wordpress.scripbox.com/wp-content/uploads/2020/01/section-80c.jpg

Section 80C Deductions List To Save Income Tax FinCalC Blog

https://fincalc-blog.in/wp-content/uploads/2022/09/section-80C-deductions-list-to-save-income-tax-video.webp

https://economictimes.indiatimes.com/wealth/tax/...

Synopsis If you have exhausted the Rs 1 5 lakh limit under Section 80C then additional tax can be saved by investing Rs 50 000 in NPS This deduction claimed will be over and above Section 80C deduction of Rs 1 5 lakh Here is a look at the tax benefits one gets by investing in NPS Getty Images Puneet Gupta

https://cleartax.in/s/80C-Deductions

Does this come under Sec 80C The NPS is a pension scheme that has been started by the Indian Government to allow the unorganised sector and working professionals to have a pension after retirement Investments of up to Rs 1 5 lakh can be used to avail tax deductions under Section 80C

Section 80C Deductions Save Up To 1 5 Lakhs On Taxes

Section 80C Of Income Tax Act Tax Deduction AY 2023 24

Tax Savings Deductions Under Chapter VI A Learn By Quicko

Section 80C Deduction Under Section 80C In India Paisabazaar

Income Tax Deduction Under Section 80C To 80U FY 2022 23

Naval Postgraduate School s Video Portal A Rising Sun At NPS

Naval Postgraduate School s Video Portal A Rising Sun At NPS

Is Your Brand Under Attack Growing Forward

Section 80C Deduction FAQs Finwisdom

Best NPS Funds 2019 Top Performing NPS Scheme

Will Nps Come Under 80c - Investments of up to Rs 50 000 in NPS are considered for exemption under this section Section 80CCD 2 Employer s contribution towards NPS up to 10 comprising basic salary and dearness allowance if any is exempted under this category