Electric Scooter Deduction In Income Tax GST rate for electric vehicles is reduced to 5 from 12 Upon RC renewal after 15 years a tax will be applied but electric cars

Under this scheme EVs must be manufactured and registered by 31 July 2024 to receive subsidies The support under the EMPS 2024 is provided in the Tax Benefit MOST IMPORTANT THING You get a deduction of Rs 1 50 000 under section 80EEB on the interest paid on loan taken to buy Electric

Electric Scooter Deduction In Income Tax

Electric Scooter Deduction In Income Tax

https://i.ytimg.com/vi/8YGA1J0osW4/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4AbYIgAKAD4oCDAgAEAEYZSBlKGUwDw==&rs=AOn4CLCC0RxXFiqSh49yRRQdWOauPuqxMg

Section 80EEB Of Income Tax Act Deduction On Purchase Of Electric Vehicle

https://housing.com/news/wp-content/uploads/2023/02/Section-80EEB-of-Income-Tax-Act-Deduction-on-purchase-of-electric-vehicle-f-686x400.jpg

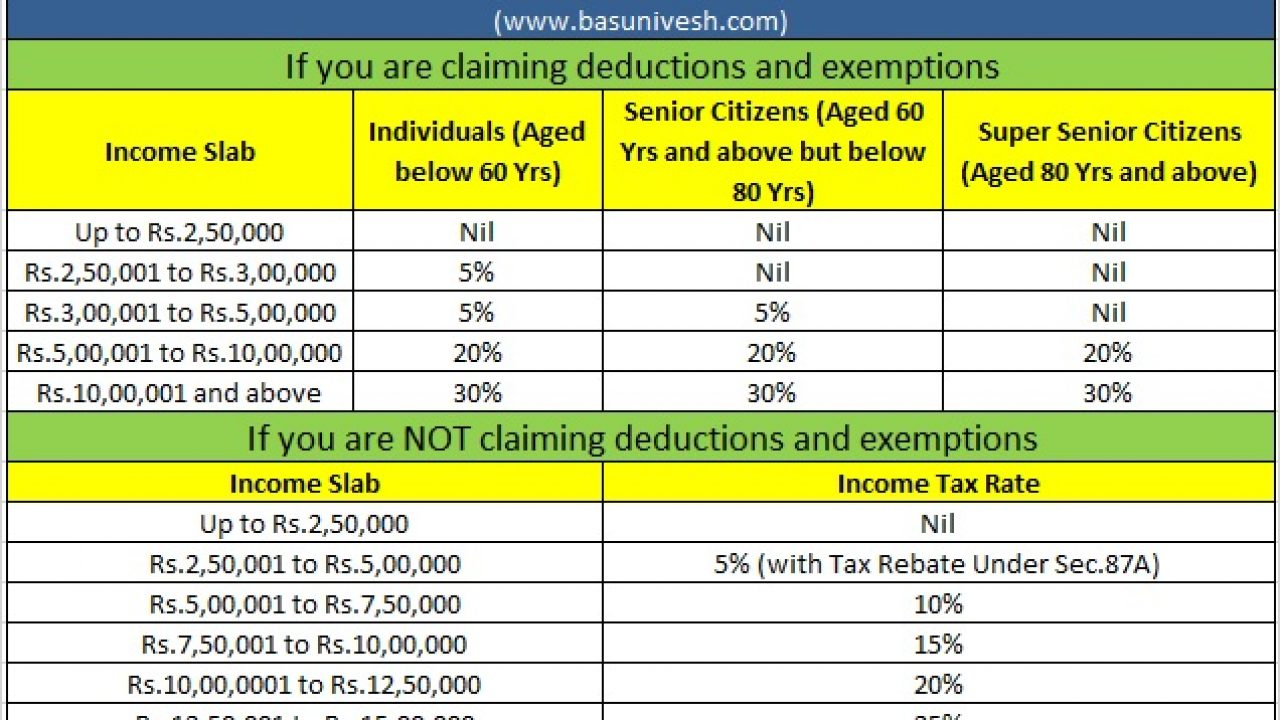

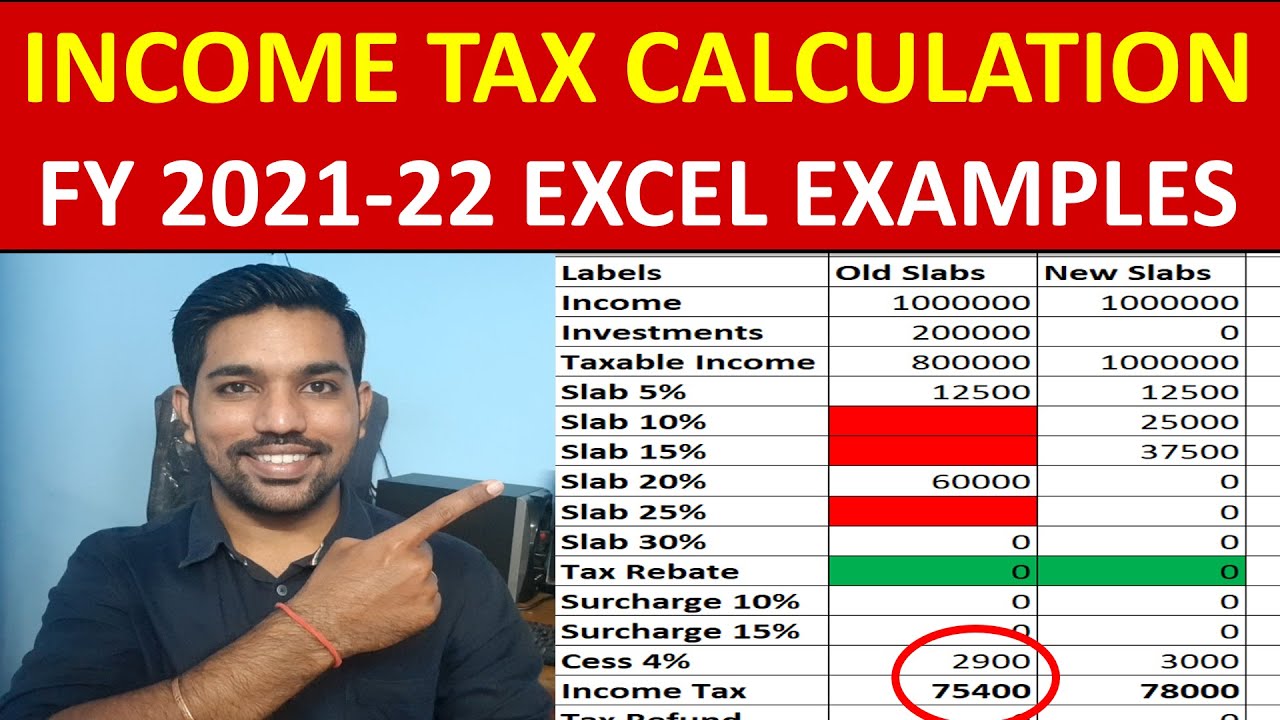

Standard Deduction On Salary Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-7.jpg

Section 80EEB of the Income Tax Act 1961 allows individuals to claim a deduction of up to Rs 1 50 000 on the interest paid on a loan taken for the purchase of an electric vehicle This deduction is available for loans The Income Tax Act of 1961 s Section 80 EEB focuses on the interest payments made on loans taken out to purchase an electric vehicle for personal or

You can claim tax savings of up to Rs 1 5 lakh on interest paid on loan taken out particularly to buy electric automobile under Section 80EEB of Income Tax Explore Section 80EEB Income tax deduction for individuals on electronic vehicle purchases Eligibility conditions and maximum deduction of Rs 1 50 000 Learn how the provision benefits

Download Electric Scooter Deduction In Income Tax

More picture related to Electric Scooter Deduction In Income Tax

INTEREST DEDUCTION ON ELECTRIC VEHICLE TAX BENEFIT ON ELECTRIC CAR

https://i.ytimg.com/vi/rsqOGQe7WLw/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4AZQDgALQBYoCDAgAEAEYciBLKDYwDw==&rs=AOn4CLA_bDzbbAZ8BrjKkJG7cBbYBkxCcQ

How To Calculate Standard Deduction In Income Tax Act Scripbox

https://cdn-scripbox-wordpress.scripbox.com/wp-content/uploads/2021/05/standard-deduction-income-tax.jpg

Deduction In Income Tax U s 80C To 80U Chapter VIA Tax Savings In ITR

https://i.ytimg.com/vi/MrYwexSfeHs/maxresdefault.jpg

Section 80EEB is a provision where you can claim Deduction on interest for the purchase of an electric vehicle It was introduced for the first time in the Finance Act 2019 Electric vehicles for Section 80 EEB is a newly inserted item in the Income Tax Act to boost electric vehicles in India You can claim deductions up to Rs 1 5 lacs under this

FAME 2 Subsidy on Electric Scooter Phase II of this subsidy aims to support 1 million electric two wheelers during the tenure of the subsidy The said number of What is Section 80EEB of Income Tax Act Under Section 80EEB of Income Tax Act you can claim tax deduction benefits of up to 1 5 lakh on the interest paid

Material Requirement Form House Rent Deduction In Income Tax Section

https://www.aegonlife.com/insurance-investment-knowledge/wp-content/uploads/2018/12/house-rent.png

How To Submit VAT Reconsideration Form In UAE

https://www.kanakkupillai.com/learn/wp-content/uploads/2022/06/How-to-Submit-VAT-Reconsideration-Form-in-UAE.png

https://tax2win.in/guide/section-80eeb-d…

GST rate for electric vehicles is reduced to 5 from 12 Upon RC renewal after 15 years a tax will be applied but electric cars

https://cleartax.in/s/electric-mobility-promotion-scheme-emps-2024

Under this scheme EVs must be manufactured and registered by 31 July 2024 to receive subsidies The support under the EMPS 2024 is provided in the

Deduction In Income Tax deduction Under 80c To 80u 80u 80jja 80qqb

Material Requirement Form House Rent Deduction In Income Tax Section

Tax Benefits On Electric Car Bike Scooter Loan How To Get Tax

Deduction In Income Tax The Income Tax Department Has Thou Flickr

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

What Is Standard Deduction In Income Tax Means PHYSCIQ

What Is Standard Deduction In Income Tax Means PHYSCIQ

House Rent Deduction In Income Tax TOP CHARTERED ACCOUNTANT IN

EcoRealty 5 Financial Reasons To Buy

Income Tax Rebate Astonishingceiyrs

Electric Scooter Deduction In Income Tax - Section 80EEB of the Income Tax Act 1961 allows individuals to claim a deduction of up to Rs 1 50 000 on the interest paid on a loan taken for the purchase of an electric vehicle This deduction is available for loans