Elss Tax Rebate Web 15 mars 2022 nbsp 0183 32 If you have made investments in equity shares and equity mutual funds in the previous financial year and withdraw the money now i e in the current financial

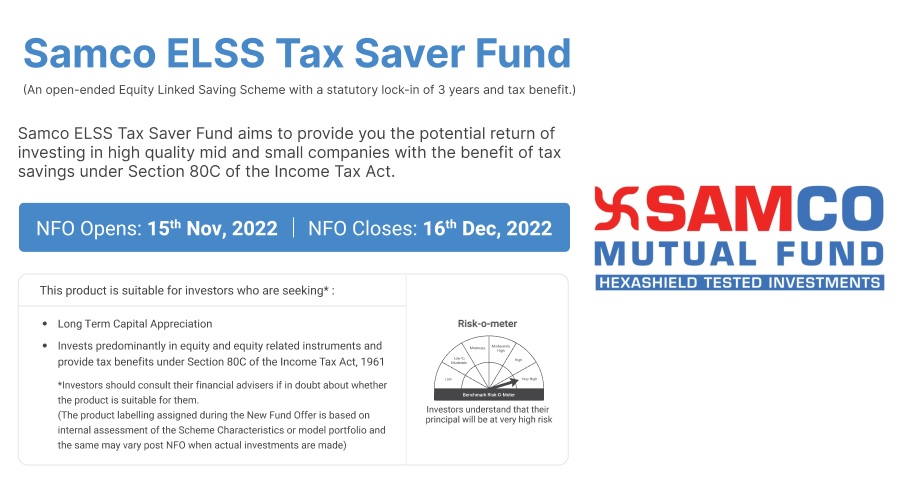

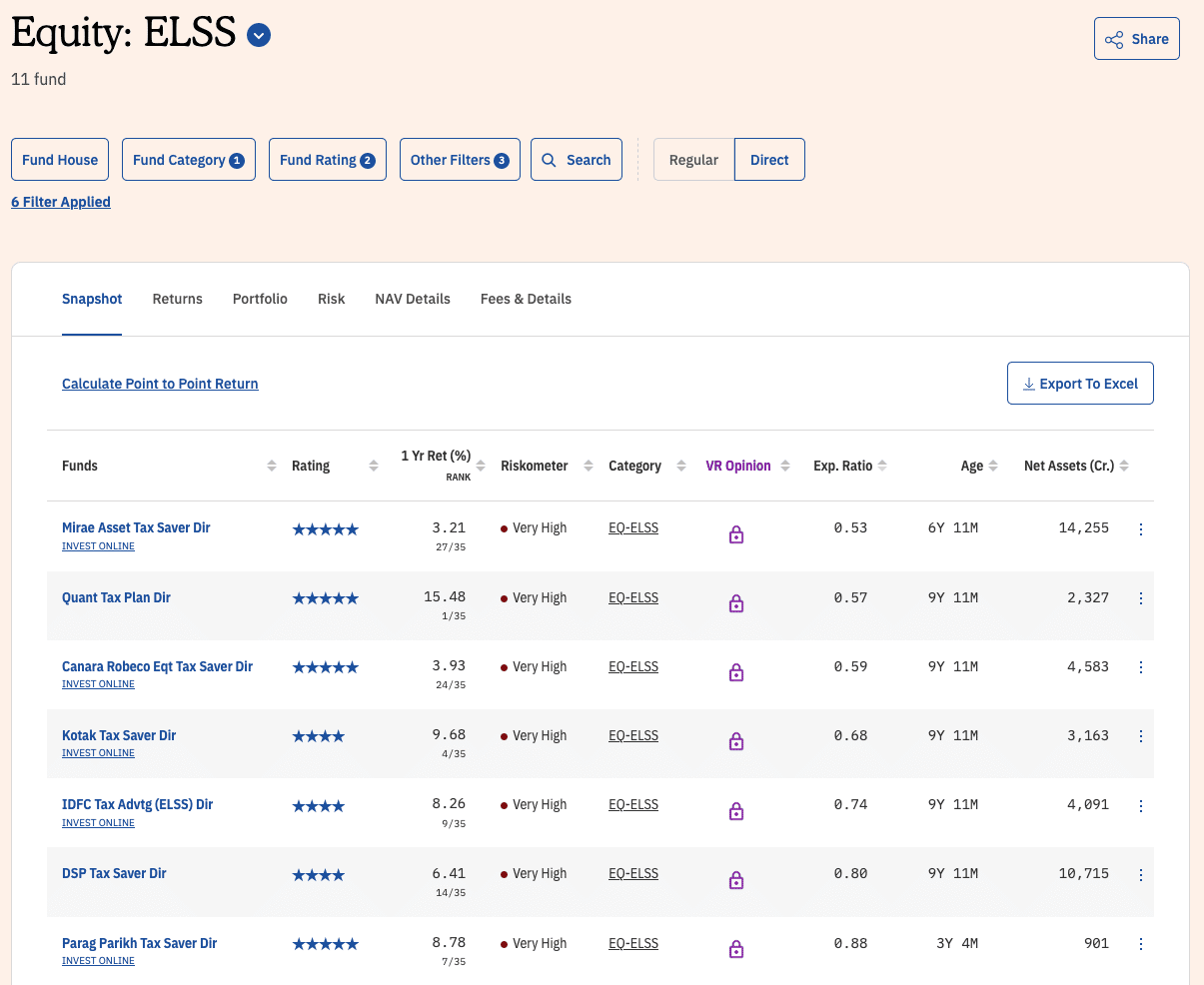

Web 16 sept 2022 nbsp 0183 32 As the name suggests the equity linked savings scheme ELSS is a type of mutual fund scheme that primarily invests in the stock market or equity Investments of Web 2 juil 2020 nbsp 0183 32 A part of the equity oriented mutual fund MF category ELSS schemes have a lock in period of 3 years The amount invested in ELSS is eligible for tax deduction up to

Elss Tax Rebate

Elss Tax Rebate

https://i.ytimg.com/vi/RtMJmT7wNMo/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AHiAYAC4AOKAgwIABABGFsgWyhbMA8=&rs=AOn4CLDu_QgggKXtss6SIZDN3uuxmdgInA

Best ELSS Mutual Funds To Invest In 2023 80 C Rebate With Tax Saving

https://i.ytimg.com/vi/9QLU4J7ykKk/maxresdefault.jpg

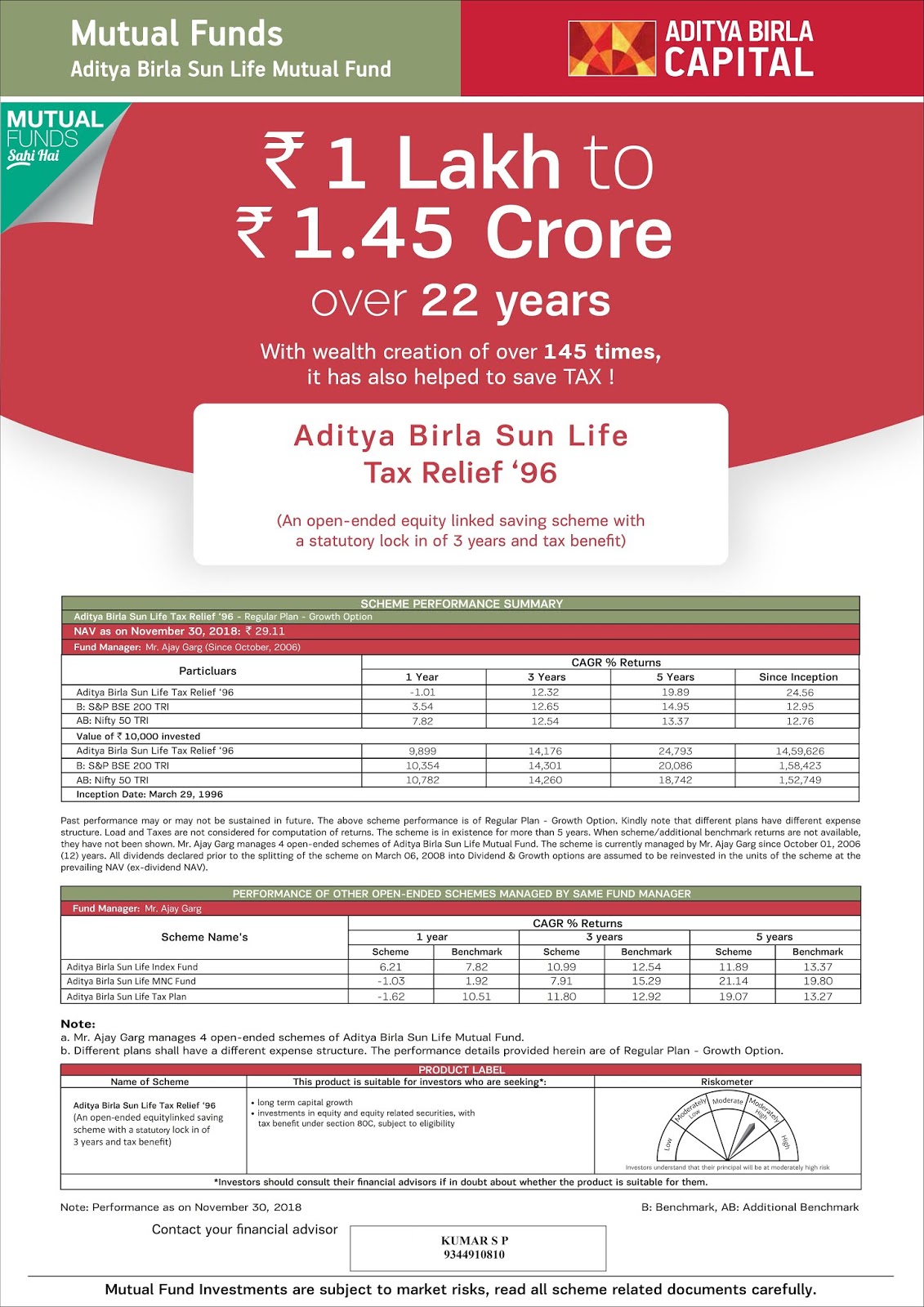

ELSS Tax Saving Solution Aditya Birla Sun Life GainEQ

https://4.bp.blogspot.com/-0xir44uRcTw/XDyp80fOBJI/AAAAAAAAAmw/SfU6K_7NKTsK3glUgmM5Jk8Sx09b9rBaQCEwYBhgL/s1600/Ad%2Bimage_ELSS%2B3.jpg

Web 2 juin 2020 nbsp 0183 32 Under Section 80C of the IT Act ELSS funds are eligible for a tax deduction of up to Rs 1 5 lakhs But just like all the other investments that are eligible for 80C benefit Web 20 janv 2023 nbsp 0183 32 Looking to invest in Equity Linked Saving Scheme ELSS to avail tax benefits of up to Rs 1 5 lakh under Section 80C for the financial year 2022 23 Well you

Web 2 d 233 c 2022 nbsp 0183 32 Under Sec 80C of the Income Tax Act you can avail of tax rebates for up to Rs 1 5 lakh in a year through your ELSS investment Moreover the scheme typically offers inflation beating and risk adjusted Web 10 f 233 vr 2023 nbsp 0183 32 This fund qualifies for tax exemption under Section 80C provision which means that investors have a tax rebate of up to Rs 1 50 000 in a year By investing in ELSS one can save up to Rs

Download Elss Tax Rebate

More picture related to Elss Tax Rebate

ELSS Vs Tax Saving FDs Yadnya Investment Academy

https://i2.wp.com/blog.investyadnya.in/wp-content/uploads/2019/06/ELSS-Vs-Tax-Saving-FDs.png?fit=1025%2C769

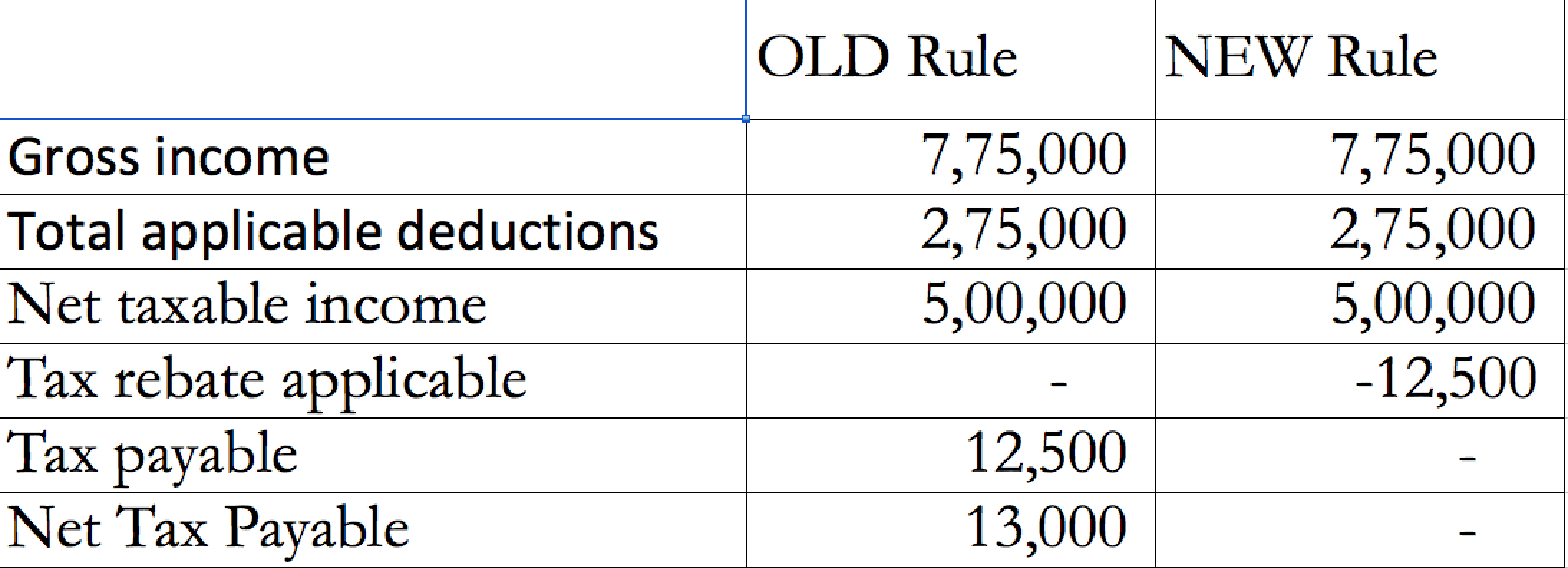

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

https://freefincal.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-02-at-8.46.44-AM.png

Os 5 Melhores Fundos M tuos De ELSS Com Economia De Impostos 2021 22

https://www.relakhs.com/wp-content/uploads/2021/01/Top-5-Best-Tax-Saving-ELSS-Mutual-Funds-2021-2022-Best-ELSS-Funds-for-SIP.jpg

Web Maximum amount that is allowed for deduction in the Section 80C of the IT Act is Rs 1 5 lakh in a year Why should a Taxpayer choose ELSS The following are the reasons why Web 21 d 233 c 2021 nbsp 0183 32 When you invest in an ELSS fund you can claim a tax rebate of up to 1 5 lakhs from your annual taxable income under Section 80C of The Income Tax Act and

Web 14 d 233 c 2022 nbsp 0183 32 If you put money in ELSS plans you can have a tax rebate on the amount you put in for Rs 150 000 Also the money you make from this ELSS investment at the Web 21 mars 2023 nbsp 0183 32 What is equity linked savings scheme ELSS Equity linked savings schemes represent a category of mutual funds that enable investors to claim tax

INCOME TAX REBATES FOR FY 22 23 FINANCIAL PLANNING FOR PROSPERITY

https://www.plannprogress.com/uploads/4/1/7/0/41706423/edited/590533831_3.jpg?1659257911

Which ELSS Tax Saver Mutual Fund Is The Best Quora

https://qph.fs.quoracdn.net/main-qimg-104b4a7337ec4a5794db248f51f37ac4

https://economictimes.indiatimes.com/wealth/tax/how-to-double-your-tax...

Web 15 mars 2022 nbsp 0183 32 If you have made investments in equity shares and equity mutual funds in the previous financial year and withdraw the money now i e in the current financial

https://www.etmoney.com/learn/mutual-funds/elss-mutual-funds

Web 16 sept 2022 nbsp 0183 32 As the name suggests the equity linked savings scheme ELSS is a type of mutual fund scheme that primarily invests in the stock market or equity Investments of

DEDUCTION UNDER SECTION 80C TO 80U PDF

INCOME TAX REBATES FOR FY 22 23 FINANCIAL PLANNING FOR PROSPERITY

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Samco Mutual Fund Introduces A Differentiated ELSS Tax Saver Fund

Illinois Tax Rebate Tracker Rebate2022

Best ELSS Tax Saving Mutual Funds To Invest In 2014 GoodMoneying

Best ELSS Tax Saving Mutual Funds To Invest In 2014 GoodMoneying

Save Tax With ELSS

Best ELSS Tax Saving Mutual Fund To Invest In 2023 Shabbir Bhimani

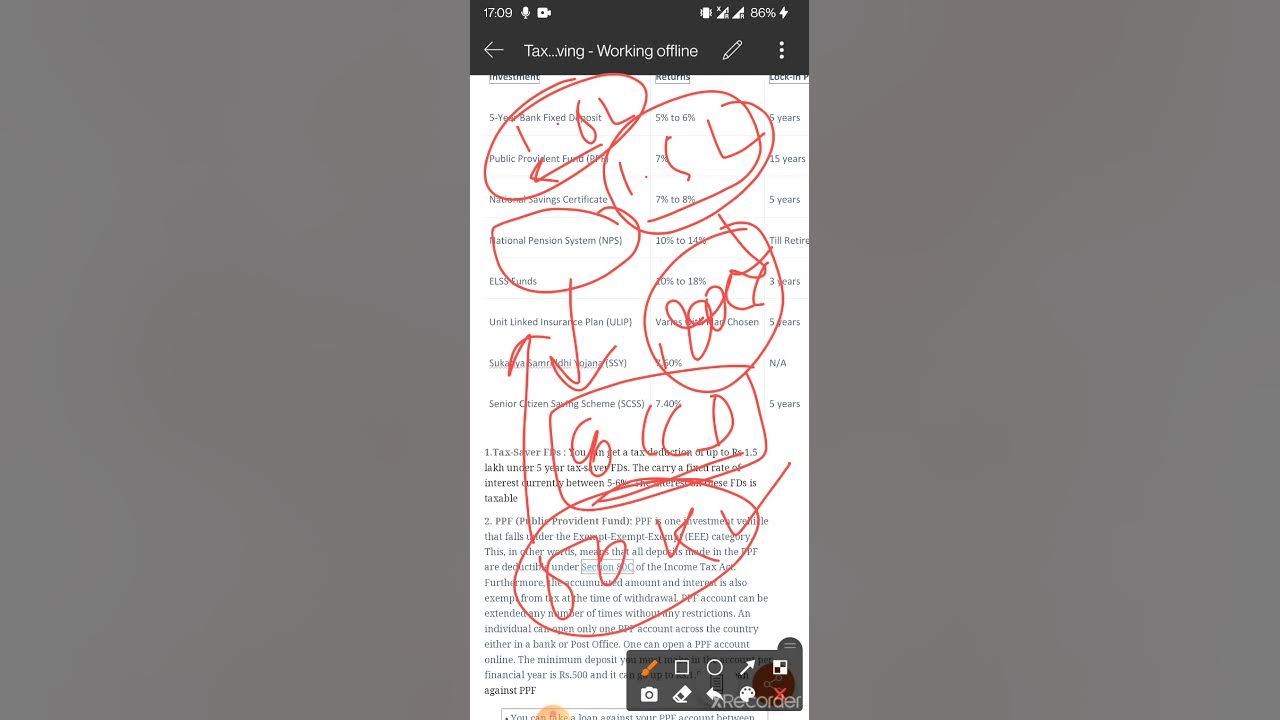

Tax Saving Tips Ppf Fd Ssy Epfo Nps Scss Elss Tax Exemption Rebate

Elss Tax Rebate - Web 13 juil 2023 nbsp 0183 32 ELSS is best suited for young investors as they have time on their side to unleash the power of compounding to the fullest and enjoy high returns while saving on