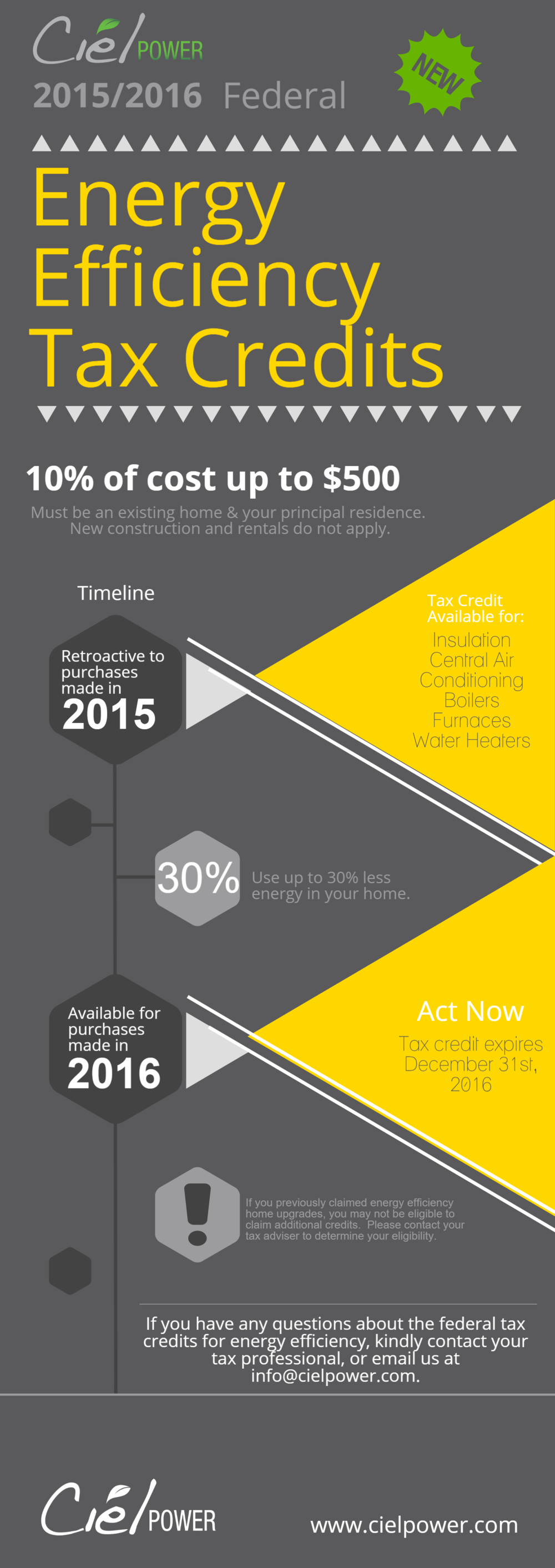

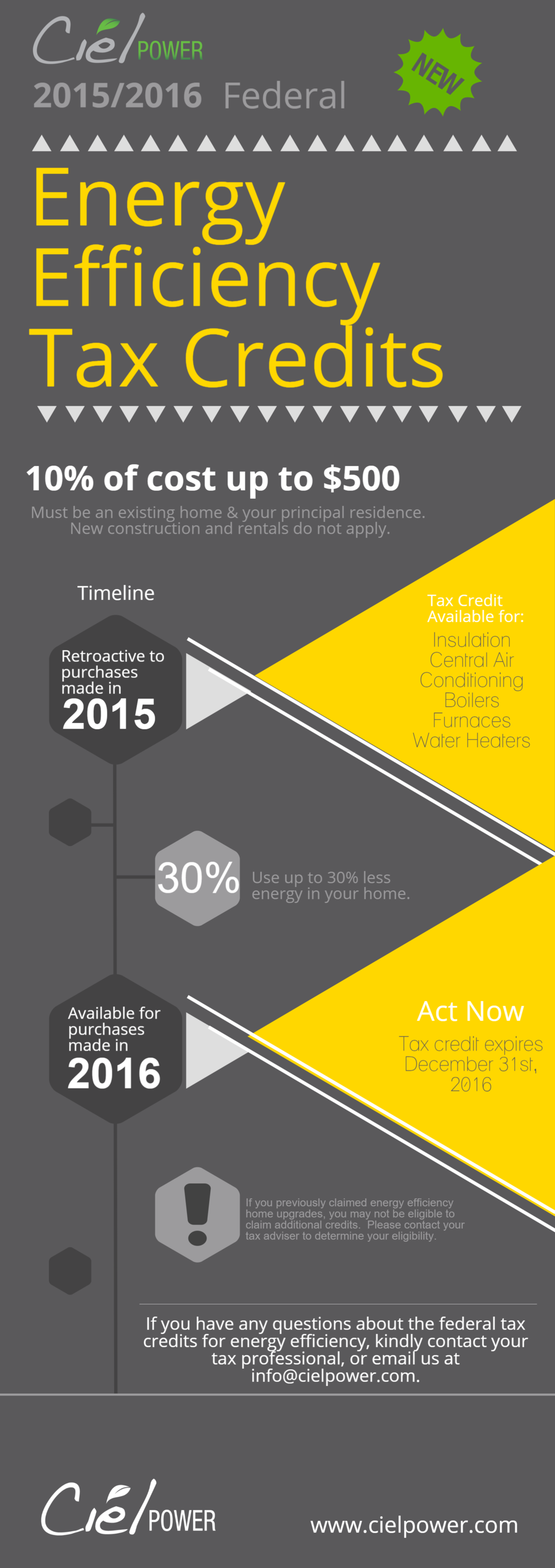

Energy Tax Credit Air Conditioner Verkko 1 tammik 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit

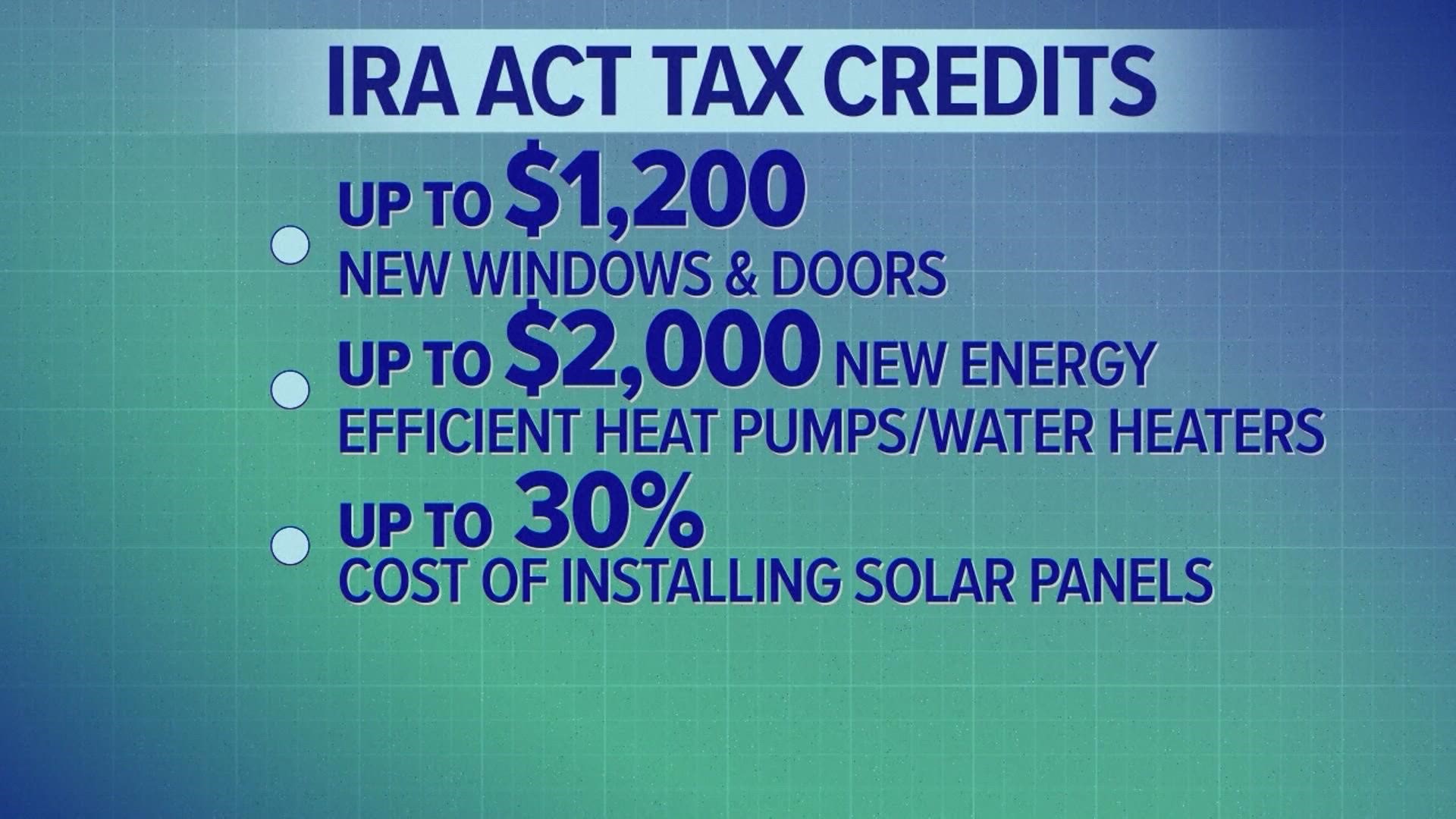

Verkko 30 jouluk 2022 nbsp 0183 32 The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope Verkko 25 jouluk 2023 nbsp 0183 32 In 2024 you can claim 30 of the costs for all qualifying HVAC systems installed during the year as tax credits The maximum tax credit amount you can get

Energy Tax Credit Air Conditioner

Energy Tax Credit Air Conditioner

https://static1.squarespace.com/static/55b78a58e4b0e36966db31f9/t/56c73587cf80a157221137e4/1455896001786/

Do You Qualify For A Home Energy Tax Credit Benefyd

https://www.benefyd.com/wp-content/uploads/2016/02/home-energy-tax-credits0.png

Energy Tax Credits Armanino

https://www.armanino.com/-/media/images/hero/energy-tax-credits.jpg

Verkko 10 jouluk 2023 nbsp 0183 32 Two tax credits for renewable energy and energy efficiency home improvements have been extended through 2034 and expanded starting in 2023 Verkko Central air conditioning 300 for air conditioners recognized as ENERGY STAR Most Efficient Air source heat pumps 300 for ENERGY STAR certified heat pumps Natural gas propane or oil

Verkko Solar electricity Fuel Cells 30 of cost Wind Turbine Battery Storage N A 30 of cost Heating Cooling and Water Heating Heat pumps 300 30 of cost up to 2 000 per Verkko If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were

Download Energy Tax Credit Air Conditioner

More picture related to Energy Tax Credit Air Conditioner

Inflation Reduction Act Increases Home Energy Tax Credits Wfaa

https://media.wfaa.com/assets/WFAA/images/e2c1cb63-8375-4e50-be65-6c75edcd8446/e2c1cb63-8375-4e50-be65-6c75edcd8446_1920x1080.jpg

/cdn.vox-cdn.com/uploads/chorus_image/image/47733023/tax-credits.0.jpg)

Clean Energy Tax Credits Mostly Go To The Affluent Is There A Better

https://cdn.vox-cdn.com/thumbor/WuOuOQRdPx1e96FGTdEFcOHebJ8=/0x0:1000x669/1200x800/filters:focal(525x411:685x571)/cdn.vox-cdn.com/uploads/chorus_image/image/47733023/tax-credits.0.jpg

Energy Efficient Features To Look For In Air Conditioners Total

http://www.totalelectricsandac.com.au/wp-content/uploads/2020/08/totalelectricsandac_Energy-efficient-air-conditioner.jpg

Verkko 27 huhtik 2021 nbsp 0183 32 Energy efficient exterior windows doors and skylights Roofs metal and asphalt and roof products Insulation Residential energy property expenditures Verkko 22 jouluk 2022 nbsp 0183 32 Finally 30 of the taxpayer s 5 000 cost paid for the central air conditioner is 1 500 but the 600 per item limit for energy property applies to limit

Verkko 22 jouluk 2022 nbsp 0183 32 The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs Verkko 13 huhtik 2023 nbsp 0183 32 The federal Inflation Reduction Act passed in 2022 expanded and extended federal income tax credits available for energy efficiency home

The Basics Of ITC Vs PTC For Solar Projects Stracker Solar

https://images.squarespace-cdn.com/content/v1/603c23d0dde1340721bdb043/69879859-3833-4057-a583-48b13af235db/Tax+credits+and+incentives+for+solar.jpg

Home Energy Tax Credits Will Ease The Pain Of An Ailing A C

https://www.fredsheatingandair.com/wp-content/uploads/2017/03/TaxCredits-770x494.jpg

https://www.irs.gov/credits-deductions/energy-efficient-home...

Verkko 1 tammik 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit

https://www.energystar.gov/about/federal_tax_credits/central_air...

Verkko 30 jouluk 2022 nbsp 0183 32 The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

The Basics Of ITC Vs PTC For Solar Projects Stracker Solar

Does My Carrier Air Conditioner Qualify For Tax Credit HVACseer

Federal Tax Credits For Air Conditioners Heat Pumps 2023

The Residential Renewable Energy Tax Credit Is A Little known

Federal Solar Tax Credit What It Is How To Claim It For 2024

Federal Solar Tax Credit What It Is How To Claim It For 2024

2023 Residential Clean Energy Credit Guide ReVision Energy

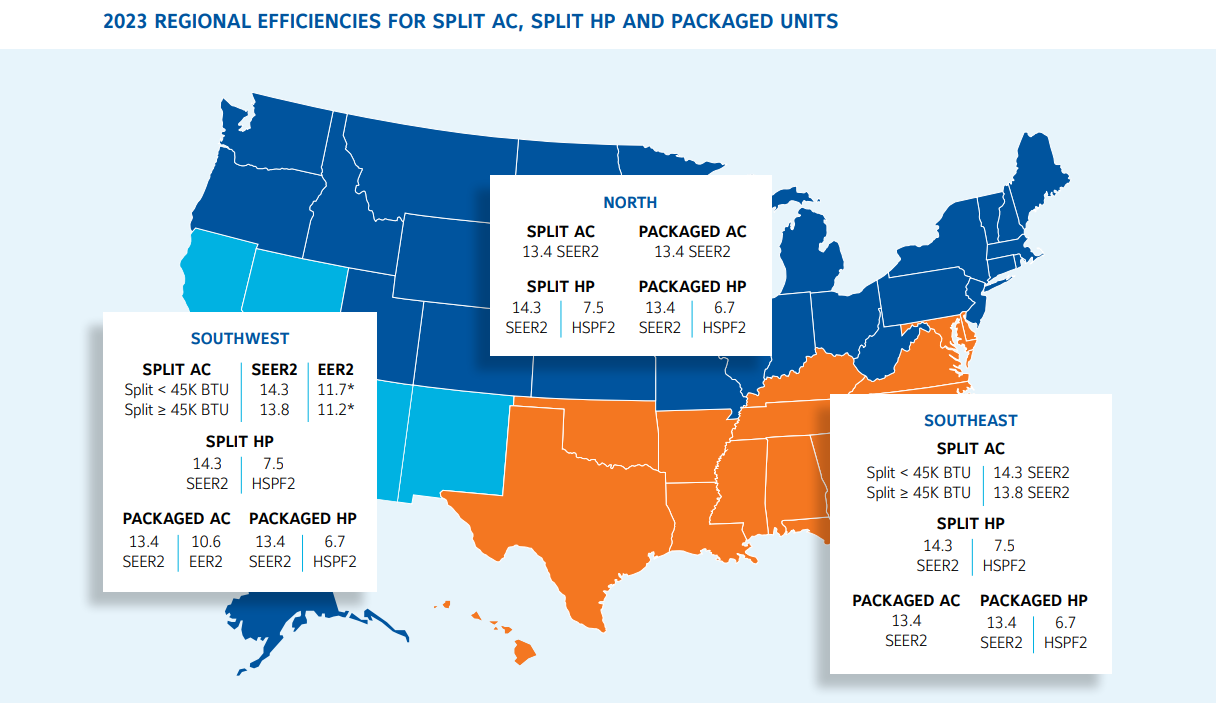

Manasota Air Conditioning Contractors Association Prepare Now For

IRS Updates On Residential Energy Credits Key Insights

Energy Tax Credit Air Conditioner - Verkko 10 jouluk 2023 nbsp 0183 32 Two tax credits for renewable energy and energy efficiency home improvements have been extended through 2034 and expanded starting in 2023