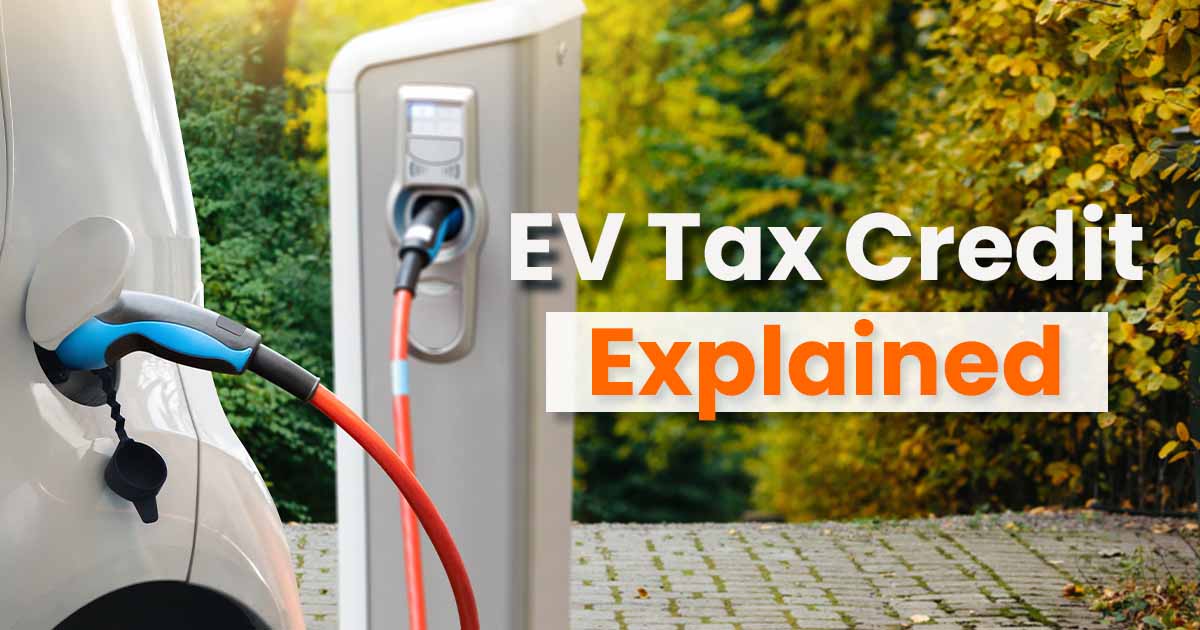

Ev Tax Credit Rebate Rules The EV tax credit is a federal tax incentive for taxpayers looking to go green on the road Here are the rules income limit qualifications and how

The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in section 30D of the Internal Revenue Code Code for qualified plug in electric If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug

Ev Tax Credit Rebate Rules

Ev Tax Credit Rebate Rules

https://i2.wp.com/image.cnbcfm.com/api/v1/image/106916725-1627308432240-gettyimages-1330261567-bth_014_7-21-2021_chargingstationforelectricvehicleinpennsyl.jpeg?resize=780,470

Updated EV Tax Credit FAQ Answered

https://blog.cmp.cpa/hubfs/EV-Tax-Credit-FAQ-Answered.jpg#keepProtocol

How To Calculate Electric Car Tax Credit OsVehicle

https://cdn.osvehicle.com/how_is_tax_credit_for_ev_calculated.png

The U S Treasury Department on Friday issued new guidance on how a 7 500 electric vehicle tax credit can be used as a point of sale rebate starting in January EV buyers no longer have to wait until the following year s tax season to claim and pocket the clean vehicle tax credit Instead there s a new option to take the credit as a

The Treasury Department released new guidance that outlines how car dealers can give EV buyers an instant rebate rather than waiting until they file their taxes To claim the EV tax credit you file IRS Form 8936 with your federal income tax return You ll need the VIN vehicle identification number for your electric vehicle to complete

Download Ev Tax Credit Rebate Rules

More picture related to Ev Tax Credit Rebate Rules

Tax Credits For Electric Vehicles Are About To Get Confusing The New

https://static01.nyt.com/images/2022/12/28/multimedia/28ev-credits-1-5aaf/28ev-credits-1-5aaf-videoSixteenByNine3000.jpg

Sourcing Requirements May Limit EV Tax Credit CFM Advocates

https://cfmadvocates.com/wp-content/uploads/2022/08/EV-Tax.jpg

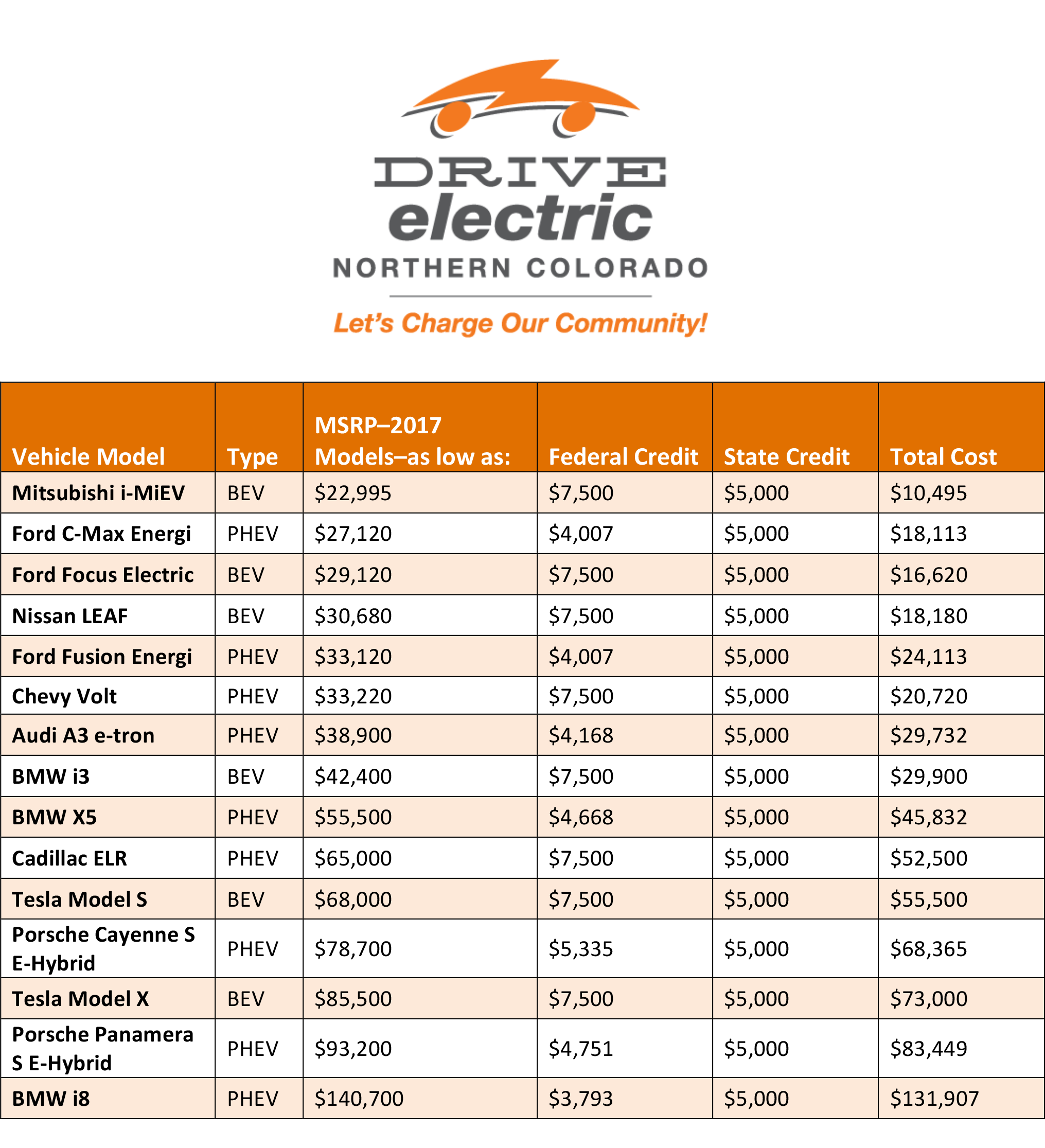

Ev Car Tax Rebate Calculator 2024 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/06/tax-credits-drive-electric-northern-colorado.png

Today s release also includes rules for transferring the 30D clean vehicle credit of up to 7 500 and 25E previously owned clean vehicle credit of up to 4 000 to registered dealers Consumers will need to directly repay the full value of a transferred tax credit to the IRS when filing their taxes if they exceed the applicable modified adjusted gross income

Treasury and the Internal Revenue Service released guidance and FAQs with information on how the North America final assembly requirement will work so consumers can Those who meet the income requirements and buy a qualifying vehicle must claim the electric vehicle EV tax credit on their annual tax filing for 2023 However starting in

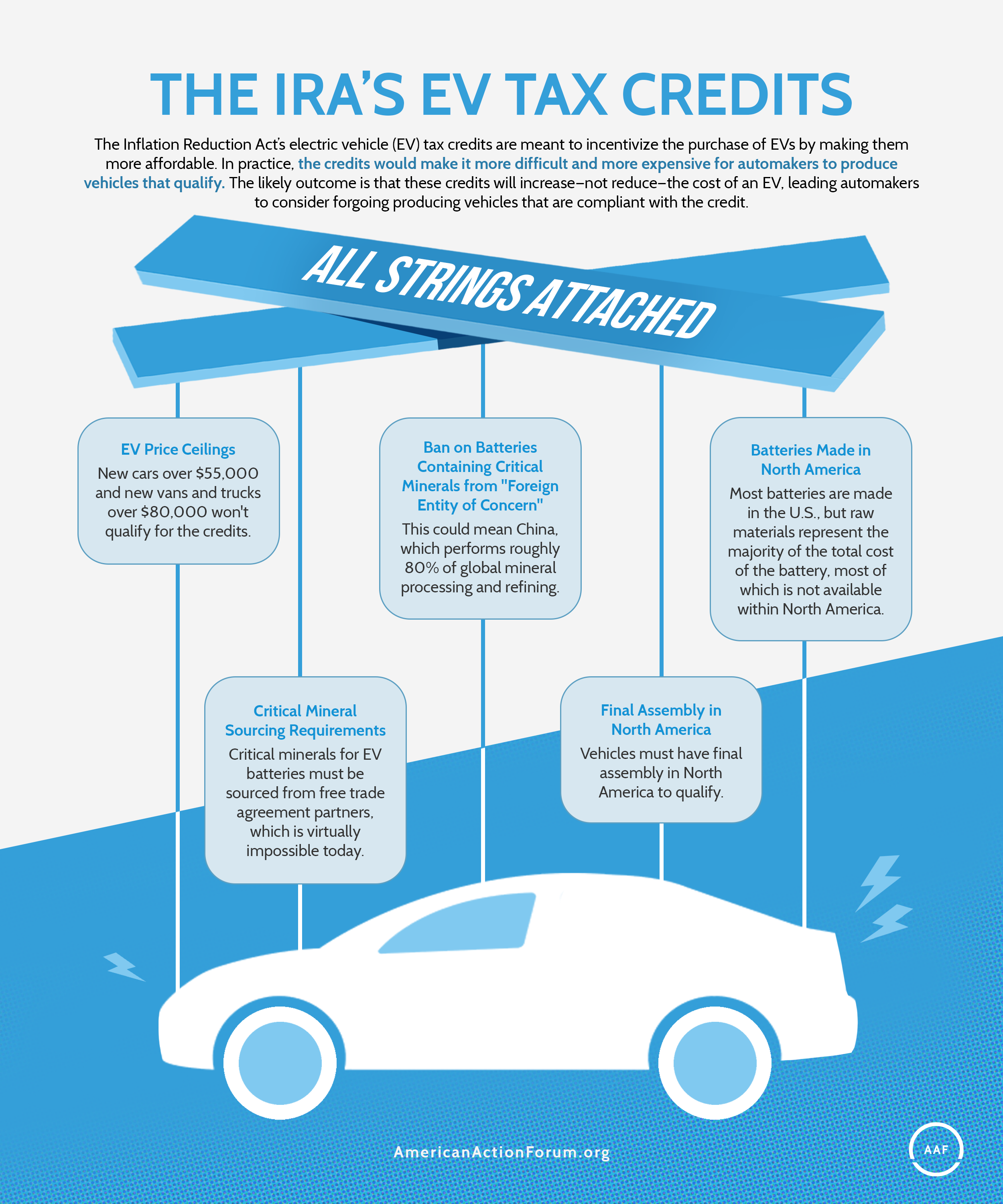

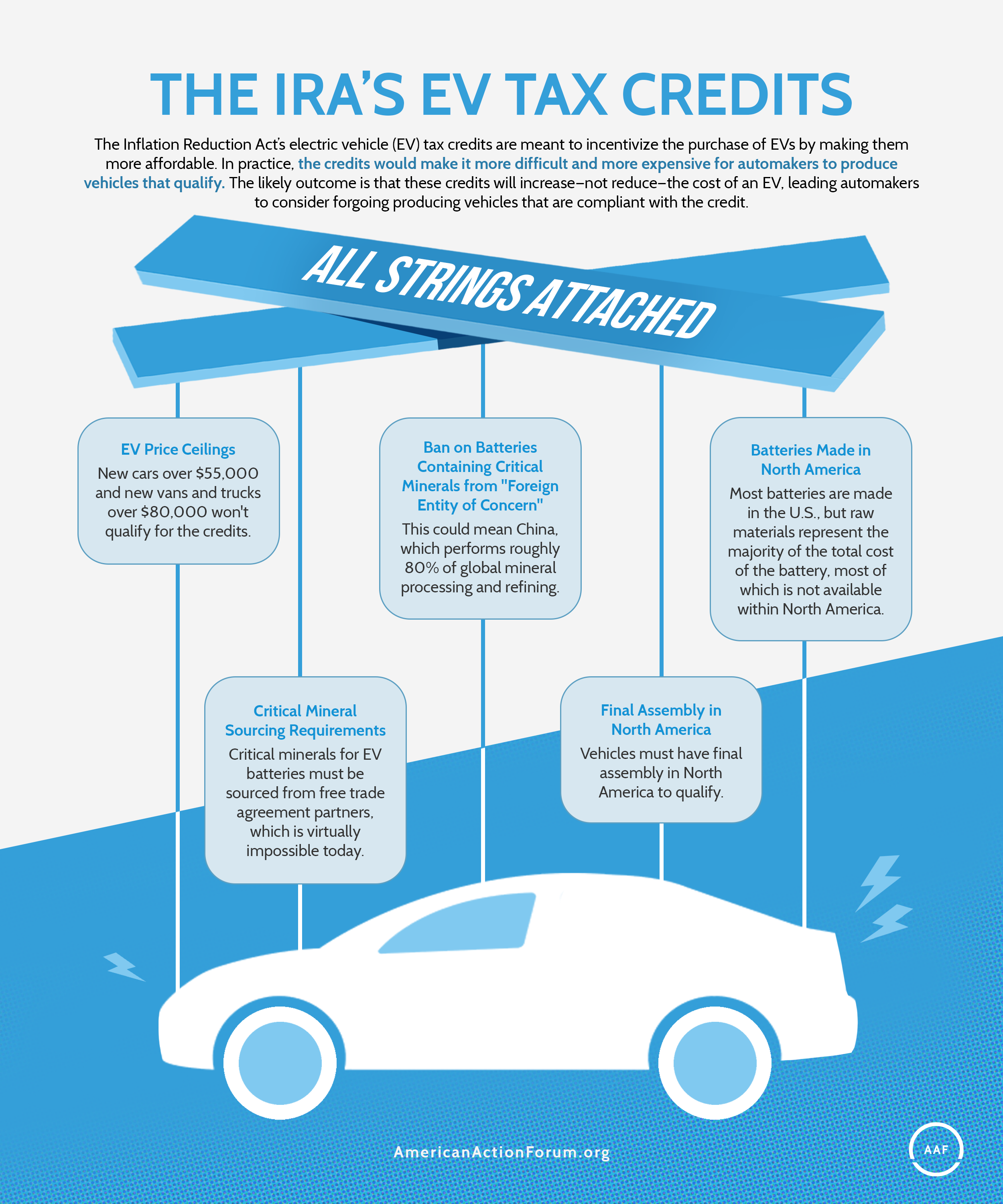

The IRA s EV Tax Credits AAF

https://www.americanactionforum.org/wp-content/uploads/2022/08/The-IRAs-EV-Tax-Credits-Infographic.png

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2022-10/Summary-ITC-and-PTC-Values-Table.png?itok=_72eWNBC

https://www.nerdwallet.com/article/tax…

The EV tax credit is a federal tax incentive for taxpayers looking to go green on the road Here are the rules income limit qualifications and how

https://www.irs.gov/newsroom/topic-a-frequently...

The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in section 30D of the Internal Revenue Code Code for qualified plug in electric

Revamping The Federal EV Tax Credit Could Help Average Car Buyers

The IRA s EV Tax Credits AAF

EV Tax Credit Explained What You Need To Know YouTube

EV Tax Credits For 2023 How To Navigate The New Federal Rules

Tax Credits ElectricVehicleSolar

EV Tax Credit 2023 New Rule Changes And What s Ahead Kiplinger

EV Tax Credit 2023 New Rule Changes And What s Ahead Kiplinger

A Complete Guide To The New EV Tax Credit

Ev Tax Credit 2022 Cap Clement Wesley

Main Post Image

Ev Tax Credit Rebate Rules - The Treasury Department released new guidance that outlines how car dealers can give EV buyers an instant rebate rather than waiting until they file their taxes