Ev Tax Credit Rules 2022 Tucked inside the massive Inflation Reduction Act of 2022 that was signed into law in August is a complex set of requirements around which EVs and other clean vehicles do and do not qualify for

Treasury Releases Initial Information on Electric Vehicle Tax Credit Under Newly Enacted Inflation Reduction Act August 16 2022 Today s guidance marks a first step in the Biden Administration s implementation of Inflation Reduction Act tax credits to lower costs for families and make electric vehicles more affordable The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in 30D of the Internal Revenue Code Code for qualified plug in electric drive motor vehicles including adding fuel cell vehicles to the 30D tax credit The IRA also added a new credit for previously owned clean vehicles under 25E of the Code

Ev Tax Credit Rules 2022

Ev Tax Credit Rules 2022

https://i.kinja-img.com/gawker-media/image/upload/c_fill,f_auto,fl_progressive,g_center,h_675,pg_1,q_80,w_1200/41cce697d02567f472ac5922c1f0db93.jpg

Congress Saves 7 500 EV Tax Credit Following Full Court Pressure

https://imageio.forbes.com/blogs-images/sebastianblanco/files/2017/12/11323330056_0da376df53_k-1200x800.jpg?format=jpg&width=1200

The New Federal Tax Credit For EVs

https://blog.greenenergyconsumers.org/hubfs/Federal Tax Credit Blog header.png

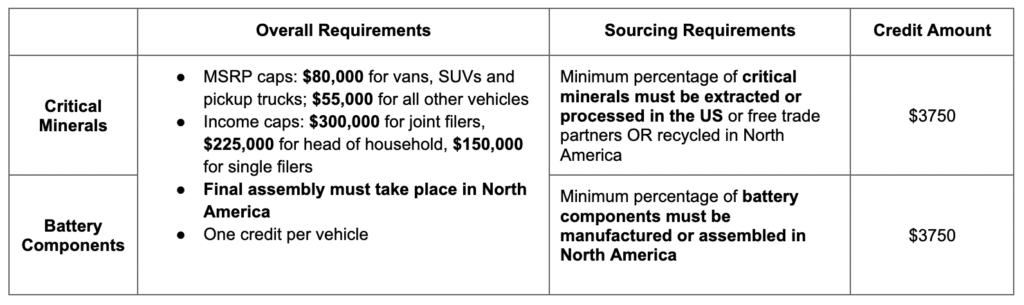

You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032 The rules for cars purchased in 2022 or before The rules for cars purchased after January 1st 2023 The list of eligible vehicles The rules for used cars The rules for commercial

Effective immediately after enactment of the Inflation Reduction Act after August 16 2022 the tax credit is only available for qualifying electric vehicles for which final assembly occurred in North America Further changes to the eligibility rules will begin in 2023 Aug 22 2022 at 8 38am ET By Ben O Hare The Inflation Reduction Act signed into law by President Joe Biden last Tuesday saw one obligation for the 7 500 Federal Tax Credit come into

Download Ev Tax Credit Rules 2022

More picture related to Ev Tax Credit Rules 2022

Has Federal EV Tax Credit Been Saved The Green Car Guy

https://thegreencarguy.com/wp-content/uploads/2016/05/GCG-CashandCar-1024x1024.jpg

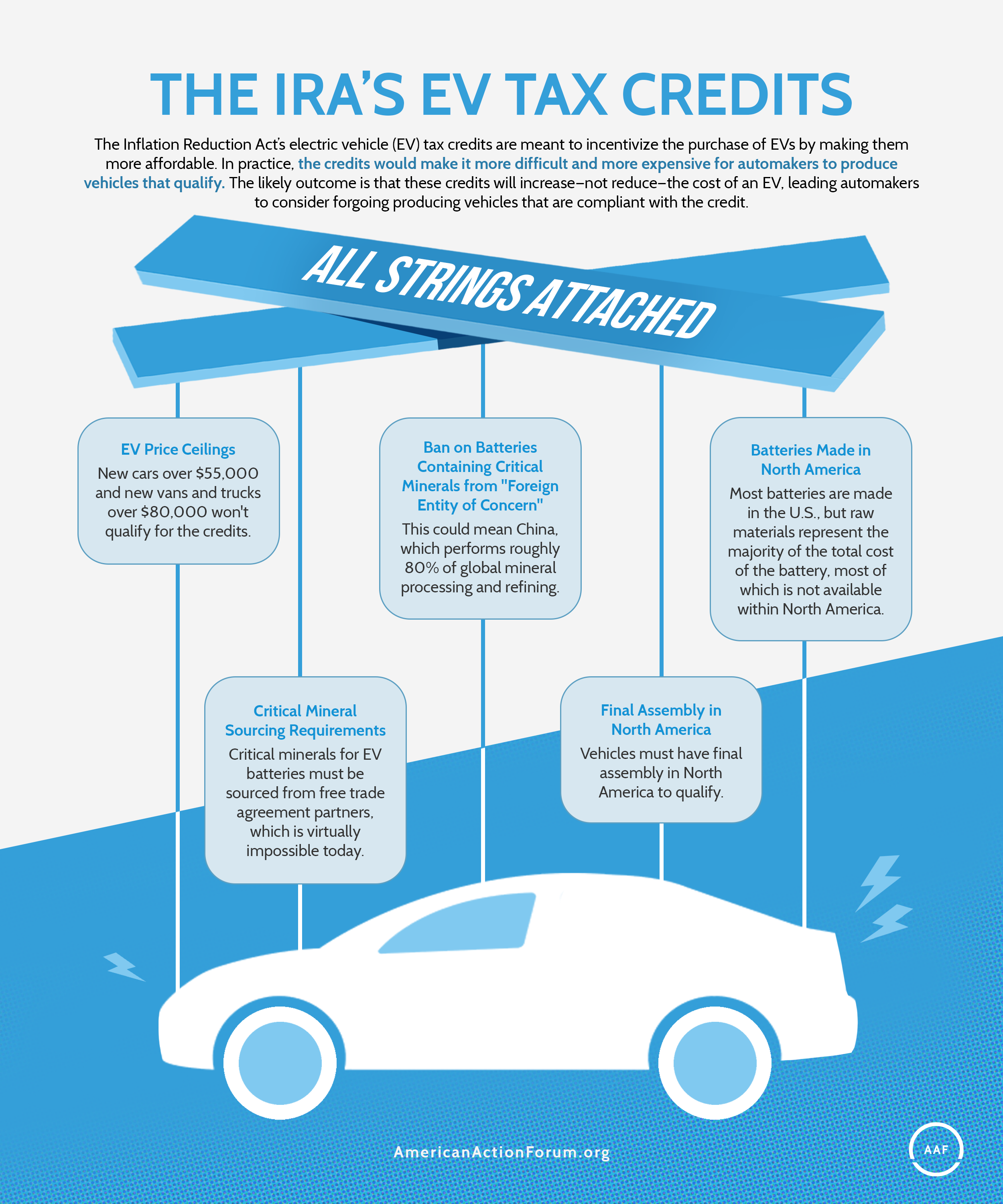

The IRA s EV Tax Credits AAF

https://www.americanactionforum.org/wp-content/uploads/2022/08/The-IRAs-EV-Tax-Credits-Infographic.png

How To Calculate Electric Car Tax Credit OsVehicle

https://cdn.osvehicle.com/how_is_tax_credit_for_ev_calculated.png

Executive summary The IRS released guidance to assist taxpayers with navigating the transition from electric vehicle EV credits under prior law to the rules under the Inflation Reduction Act of 2022 the Act EV Tax Credit Rules and Qualifications for Electric Vehicle Purchases The 2024 electric vehicle tax credit has been expanded and modified Here are the rules restrictions and how

Simply put the Inflation Reduction Act includes a 7 500 tax credit at the point of sale for new EVs and 4 000 for used EVs The new tax credits replace the old All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to 7 500

Payne How EV Tax Credit Bills Disadvantage Foreign Domestic Models

https://www.gannett-cdn.com/presto/2021/11/02/PDTN/af46539a-106d-4d75-bc9e-c93935bf56ca-EVcredits_FordMustangMachEGT.jpg?crop=3181

Tax Credits ElectricVehicleSolar

https://static.wixstatic.com/media/d01121_9abd5528e3d5421198995c9f6da16436~mv2.png/v1/fit/w_2500,h_1330,al_c/d01121_9abd5528e3d5421198995c9f6da16436~mv2.png

https://techcrunch.com/2022/09/02/a-complete-guide...

Tucked inside the massive Inflation Reduction Act of 2022 that was signed into law in August is a complex set of requirements around which EVs and other clean vehicles do and do not qualify for

https://home.treasury.gov/news/press-releases/jy0923

Treasury Releases Initial Information on Electric Vehicle Tax Credit Under Newly Enacted Inflation Reduction Act August 16 2022 Today s guidance marks a first step in the Biden Administration s implementation of Inflation Reduction Act tax credits to lower costs for families and make electric vehicles more affordable

New EV Tax Credit 2023 What You Need To Know

Payne How EV Tax Credit Bills Disadvantage Foreign Domestic Models

Why Getting A 7 500 EV Tax Credit Will Be Easier In 2024 WSJ

EV Tax Credit 2022 NEW Dates Pass Or Fail YouTube

The Verge On Twitter Fewer EVs Will Qualify For The Federal 7 500

The 12 500 EV Tax Credit 2022 Everything You Need To Know GOOD Chip

The 12 500 EV Tax Credit 2022 Everything You Need To Know GOOD Chip

Moving Goalposts EV Tax Credit Changes Coming In 2024

8 Incredible Tips What Is Dependent Care Credit Outbackvoices

2022 EV Tax Credits From Inflation Reduction Act Plug In America

Ev Tax Credit Rules 2022 - For anyone who doesn t follow the thrilling world of Treasury Department guidance and truly you re missing out if you don t what this means is several EVs will now remain eligible for the full