Exemption Limit Of Transport Allowance In Income Tax Verkko 16 marrask 2022 nbsp 0183 32 Table of maximum allowance for an employee s business travel Vehicle means of transport Maximum allowance amounts per Km Passenger car

Verkko 10 hein 228 k 2023 nbsp 0183 32 Transport allowance is taxable in the hands of the employee since it is added to their gross salaries However employees can claim tax exemption Verkko 75 rivi 228 nbsp 0183 32 Allowances allowable to tax payer AY 2024 25 Capital Gain Account

Exemption Limit Of Transport Allowance In Income Tax

Exemption Limit Of Transport Allowance In Income Tax

https://i.pinimg.com/originals/cd/bf/52/cdbf5266dd5ee6d50226e5e607a73e23.png

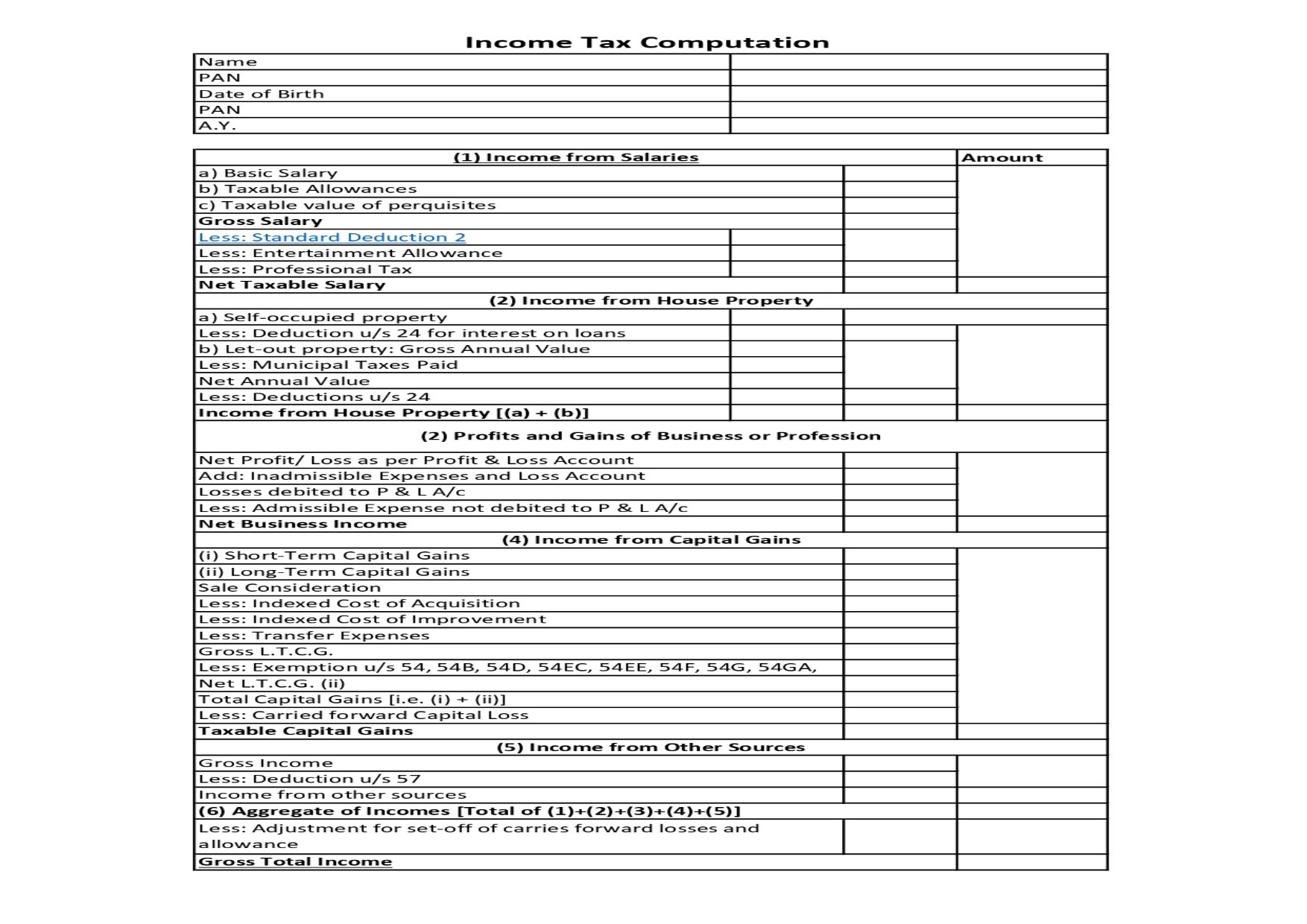

How To Calculate Standard Deduction In Income Tax Act Scripbox

https://cdn-scripbox-wordpress.scripbox.com/wp-content/uploads/2021/05/standard-deduction-income-tax.jpg

Income Tax Return

https://media.licdn.com/dms/image/D4D12AQH16mipCAWcKQ/article-cover_image-shrink_720_1280/0/1657633859840?e=2147483647&v=beta&t=6aoXUC-aT_rWIZcAVk2wa-5nIQBCt_E6Gw3dadRLWj4

Verkko 24 lokak 2023 nbsp 0183 32 Tax on Transport Allowance Transport allowance is taxable under the head salaries in the hands of the employee It is added to your gross salary You Verkko 26 jouluk 2020 nbsp 0183 32 You can claim for an exemption of your transport allowance as per Section 10 14b of the Income Tax Act The exemption provided consist of the following Transport allowance

Verkko 97 rivi 228 nbsp 0183 32 Following allowances and perquisites given to serving Chairman Member of UPSC is exempt from tax a Value of rent free official residence b Value of Verkko The tax exemption limit for transport allowance was Rs 1 600 per month Rs 19 200 annually based on previous regulations If the received amount is above this

Download Exemption Limit Of Transport Allowance In Income Tax

More picture related to Exemption Limit Of Transport Allowance In Income Tax

Travelling Allowance To The Officials Deployed For Election Duty

https://www.staffnews.in/wp-content/uploads/2022/09/travelling-allowance-to-the-officials-deployed-for-election-duty-claim-form.jpg

HRA Exemption Calculator In Excel House Rent Allowance Calculation

https://fincalc-blog.in/wp-content/uploads/2021/09/hra-exemption-calculator-house-rent-allowance-to-save-income-tax-salaried-employees-video.webp

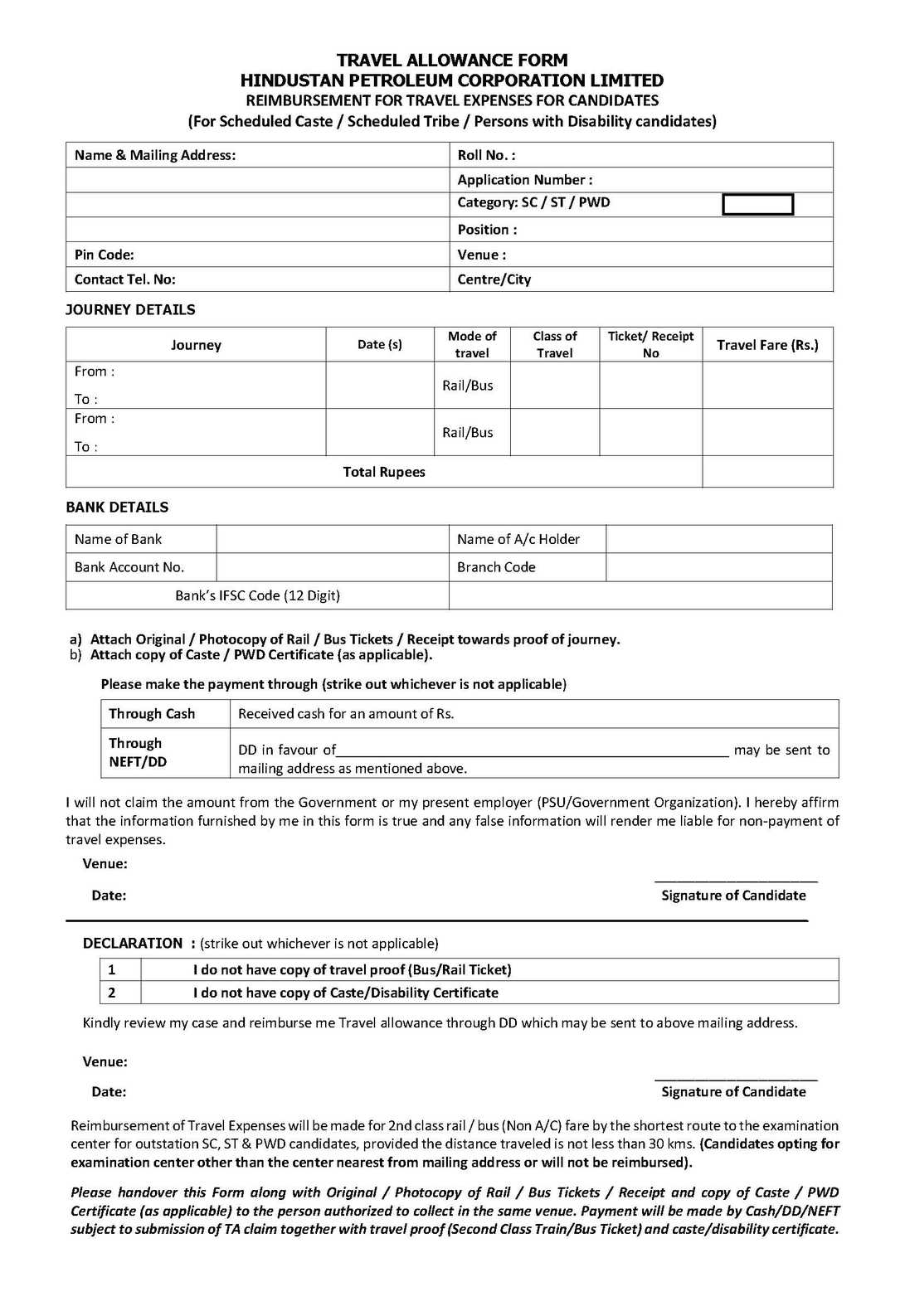

Travel Allowance Form For HPCL 2024 2025 EduVark

https://eduvark.com/img/f/Travel-Allowance-Form-For-HPCL-.jpg

Verkko Every person being an Individual HUF AOP BOI or AJP shall be required to file return of income if his total income before claiming exemption or deduction under 10 38 Verkko 29 hein 228 k 2023 nbsp 0183 32 According to Section 10 14 ii of the Income Tax Act and Rule 2BB of the Income Tax Rules salaried individuals can claim conveyance allowance

Verkko 28 jouluk 2023 nbsp 0183 32 These are Limits of tax exemption on Transport Allowance Transport Allowance for Salaried Person Non Handicapped Transport Allowance Verkko quot Conveyance And Transport Allowances Are Completely Exempted From Tax quot Rule 2BB provides that any allowance granted to meet the expenditure incurred on

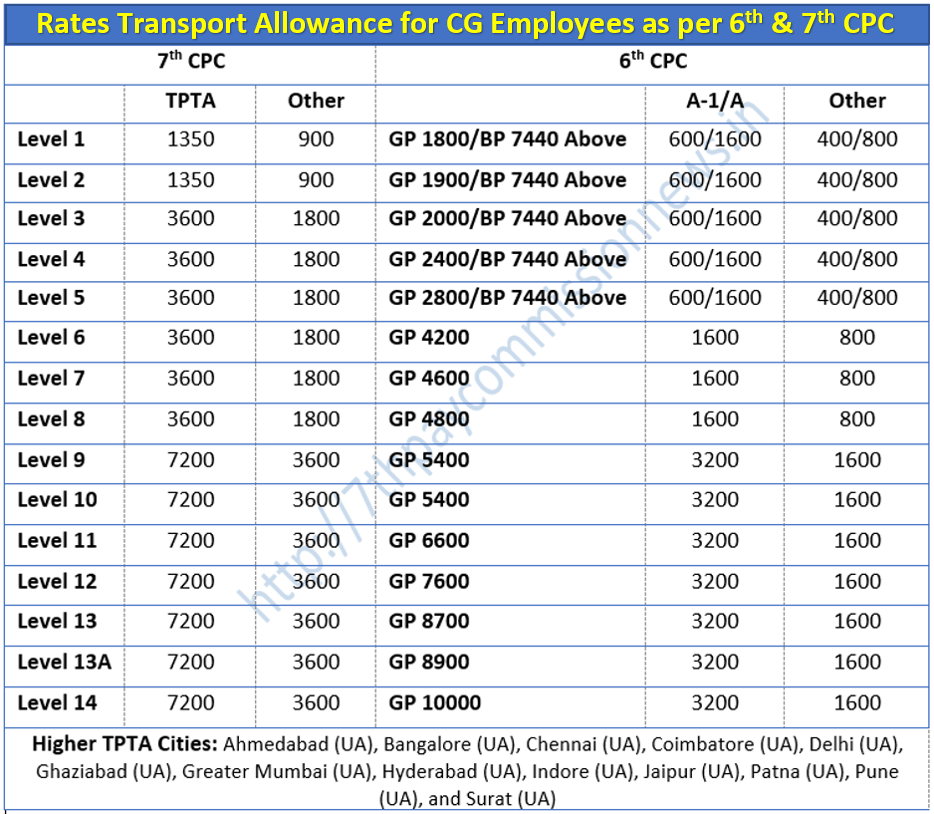

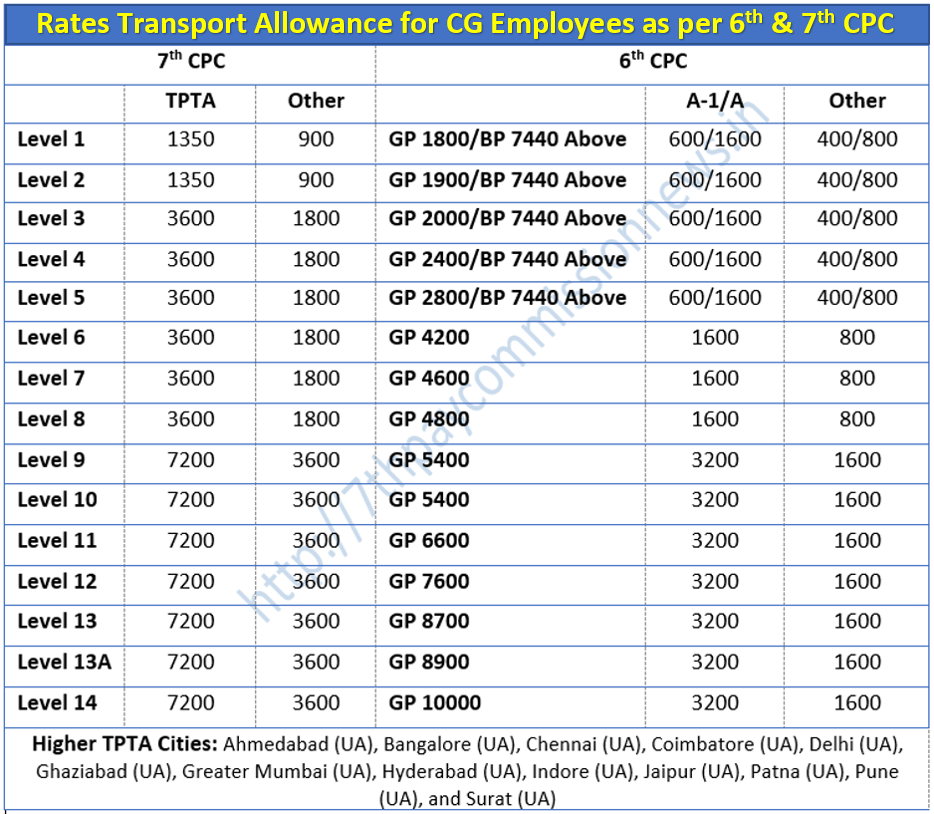

Th Pay Commission Rates Of Transport Allowance Central Government

https://7thpaycommissionnews.in/wp-content/uploads/2017/07/7th-cpc-transport-Allowance-1.png

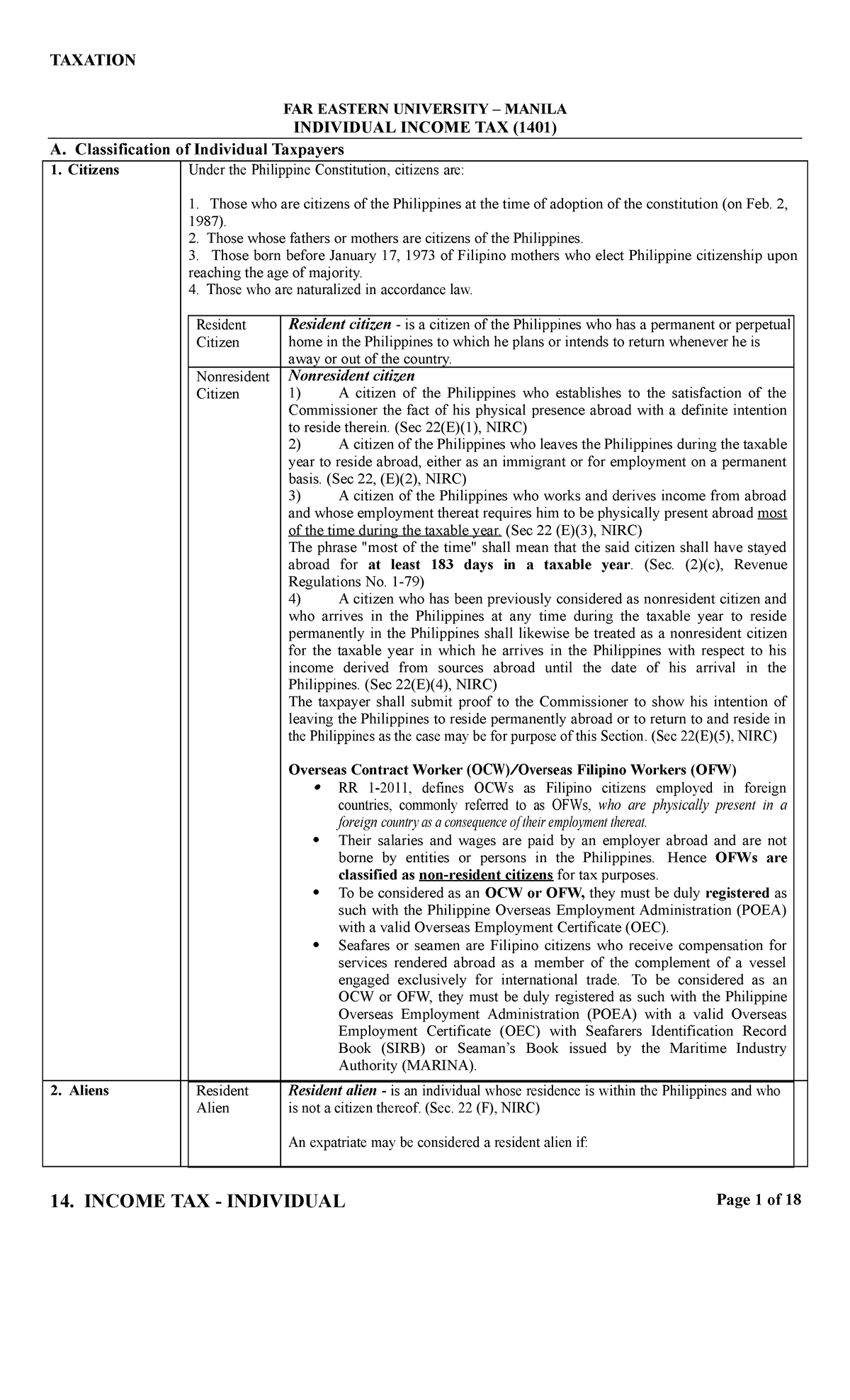

14 Individual Income Tax 14 INCOME TAX INDIVIDUAL Page 1 Of 18

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/4d966e49d5a44496b768338cc972ac91/thumb_1200_1976.png

https://www.vero.fi/en/detailed-guidance/decisions/47405

Verkko 16 marrask 2022 nbsp 0183 32 Table of maximum allowance for an employee s business travel Vehicle means of transport Maximum allowance amounts per Km Passenger car

https://cleartax.in/s/transport-allowance

Verkko 10 hein 228 k 2023 nbsp 0183 32 Transport allowance is taxable in the hands of the employee since it is added to their gross salaries However employees can claim tax exemption

Procedure Of Pre Validating Bank Account In Income Tax

Th Pay Commission Rates Of Transport Allowance Central Government

Exempt Transport Running Allowance From Income Tax 48th NC JCM Meeting

2022 Tax Brackets JeanXyzander

Income Tax Computation Format PDF A Comprehensive Guide

Income Tax Appellate Tribunal Recruitment Https www itat gov in

Income Tax Appellate Tribunal Recruitment Https www itat gov in

What Is The Exemption Limit For Transport Allowance Conveyance

What Is Income Tax MGC Legal

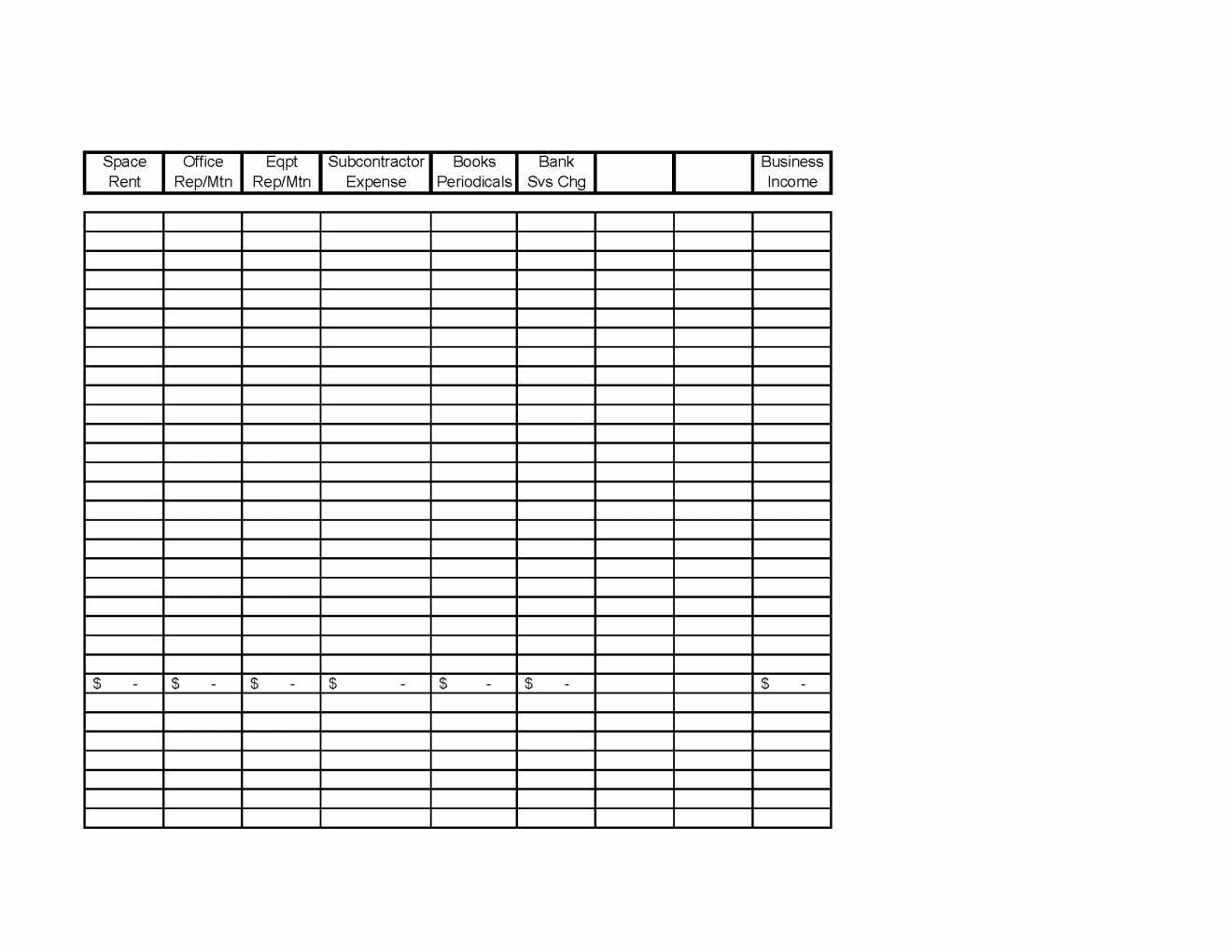

Income Tax Spreadsheet Tax Organizer Worksheet Download New In Income

Exemption Limit Of Transport Allowance In Income Tax - Verkko 13 huhtik 2015 nbsp 0183 32 Notification No 39 2015 Income Tax CBDT has vide Notification No 39 2015 increased Transport allowance exemption limit for employees from Rs