Family Tax Benefit Part A Eligibility FTB Part A eligibility We pay Family Tax Benefit FTB Part A per child The amount we pay you depends on your family s circumstances FTB Part B eligibility We may pay

You may get the maximum rate of FTB Part A if your family s adjusted taxable income is 62 634 or less Income between 62 634 and 111 398 We use an income test if your Family Tax Benefit FTB is a 2 part payment for eligible families to help with the cost of raising children The Family Tax Benefit is made up of 2 parts Part A a payment

Family Tax Benefit Part A Eligibility

Family Tax Benefit Part A Eligibility

https://media.apnarm.net.au/media/images/2015/09/28/IQT_29-09-2015_OPINION_02_ThinkstockPhotos-200405397-001.1_fct1024x768_ct1880x930.jpg

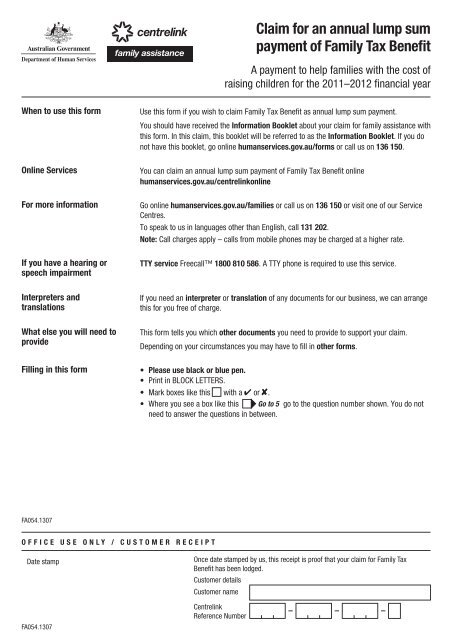

Claim For An Annual Lump Sum Payment Of Family Tax Benefit

https://img.yumpu.com/32296971/1/500x640/claim-for-an-annual-lump-sum-payment-of-family-tax-benefit.jpg

Family Tax Benefit Form Pdf Australian Guid Step by step Instructions

https://fatlosslabs.com/blogimgs/https/cip/data.formsbank.com/pdf_docs_html/347/3479/347914/page_1_thumb_big.png

Multiple Birth Allowance Energy Supplement FTB Part A recipients also have to meet immunisation and or health check requirements link is external Find out more What are the rates for the Family Tax Benefit Part A and Family Tax Benefit Part B in 2022 Find out about eligibility and how to claim

FTB Part A helps with the cost of raising children It is paid to a parent guardian carer including foster carer eligible grandparent or approved care Family Tax Benefit FTB is a payment from Services Australia To get this you must There are 2 parts to FTB Find out more about eligibility on the Services

Download Family Tax Benefit Part A Eligibility

More picture related to Family Tax Benefit Part A Eligibility

When Am I Eligible For Medicare Insurance

https://hp-prod-wp-data.s3.us-west-1.amazonaws.com/content/uploads/medicare-eligibility.png

Update On The Future Of Family Tax Benefit Part B

https://singlemum.com.au/wp-content/uploads/2015/05/family-tax-benefit-1.jpg

Family Tax Benefit PART A PART B Care For Kids

https://www.careforkids.com.au/image/blog/socialimage/cd7ae634-c645-4db7-b26e-f7c1993bdc9d

FTB eligibility FTB Part A components FTB Part B components determining FTB rates FTB payment options FTB end of year supplements supplementary benefits What are the income thresholds for family tax benefit Part A and B Part A The income thresholds for Part A adjusted family taxable income are 62 634 or less

FTB Part A standard rates FTB Part A supplement FTB Part B standard rates FTB Part B supplement FTB Part B primary income earner limit 1 1 I 45 income free You may be eligible for FTB Part A if you care for a dependent child who s either 0 to 15 years of age 16 to 19 years of age and meets the study requirements

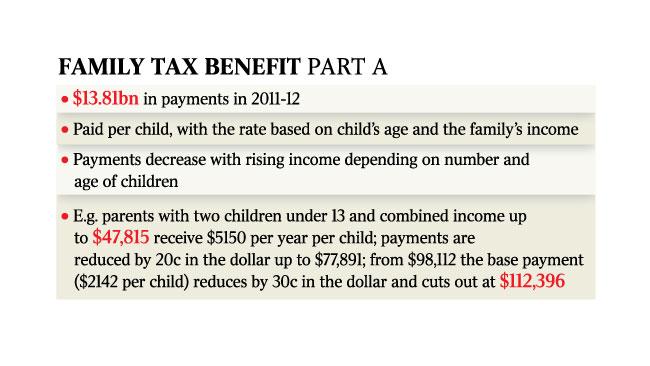

Family Tax Benefit Cuts Could Save 1bn A Year The Australian

https://content.api.news/v3/images/bin/5e7d357683d858fd878fce5a66ee1348?width=1280

Who Gets Tax Credits Leia Aqui Who Gets Federal Tax Credits

https://cdn.newswire.com/files/x/32/c9/0bc29c33e2af4d42f581fad9e660.png

https://www.servicesaustralia.gov.au/who-can-get-family-tax-benefit

FTB Part A eligibility We pay Family Tax Benefit FTB Part A per child The amount we pay you depends on your family s circumstances FTB Part B eligibility We may pay

https://www.servicesaustralia.gov.au/income-test...

You may get the maximum rate of FTB Part A if your family s adjusted taxable income is 62 634 or less Income between 62 634 and 111 398 We use an income test if your

Family Tax Benefit Residential Property Or Estate Tax Concept Stock

Family Tax Benefit Cuts Could Save 1bn A Year The Australian

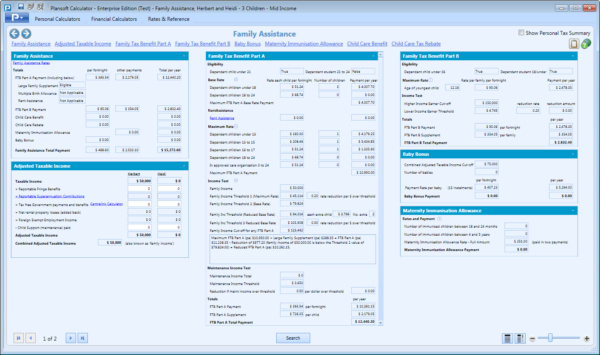

Plansoft Products Calculator Features Family Assistance Estimates

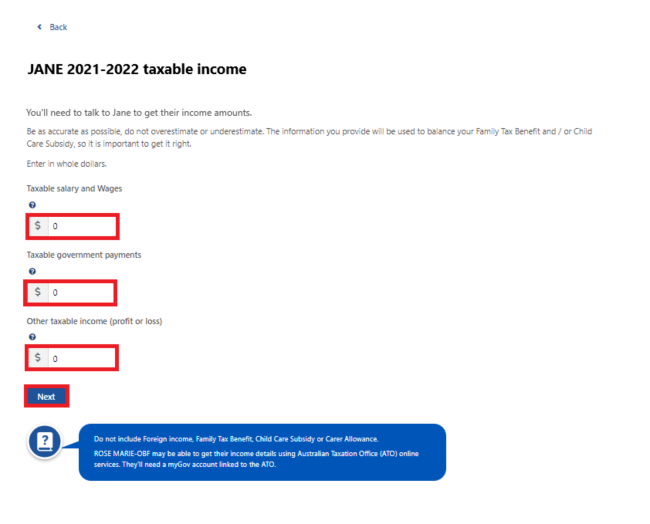

Centrelink Online Account Help Advise Non lodgement Of Tax Return

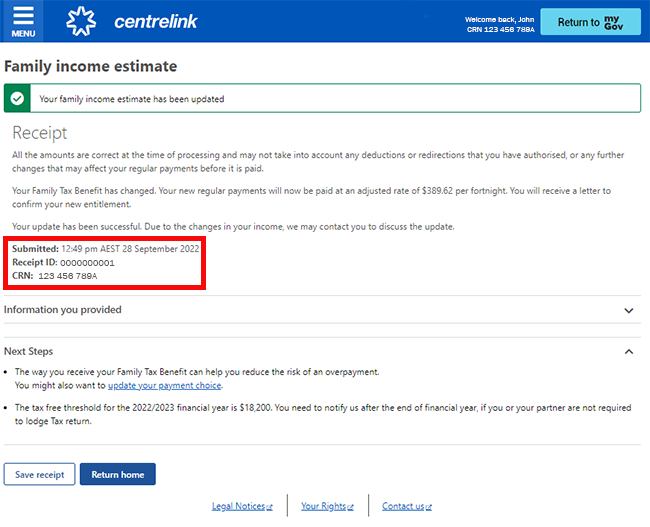

Centrelink Online Account Help Update Your Family Income Estimate And

Family Tax Benefit Part A Base Rate Tax Walls

Family Tax Benefit Part A Base Rate Tax Walls

Family Tax Benefit In 2019 Calculator Threshold Eligibility Online

Medicare Eligibility Infographic

How Does Family Tax Benefit Really Work Grandma s Jars

Family Tax Benefit Part A Eligibility - FTB Part A helps with the cost of raising children It is paid to a parent guardian carer including foster carer eligible grandparent or approved care