Family Tax Benefit Part A Supplement Income Limit The standard rate of FTB Part A is the maximum annual amount payable for all FTB children based on their age without including the supplements and without applying the

The Part A supplement increases the maximum annual FTB Part A rate for each child if eligible FTB Part A supplement is subject to an income limit The Part B supplement increases the Use our Payment Finder to see how much FTB Part A you may be eligible for The base rate for FTB Part A is 71 26 for each child per fortnight The base rate isn t the minimum rate of FTB

Family Tax Benefit Part A Supplement Income Limit

Family Tax Benefit Part A Supplement Income Limit

https://i.ytimg.com/vi/2AgLUdh9nOw/maxresdefault.jpg

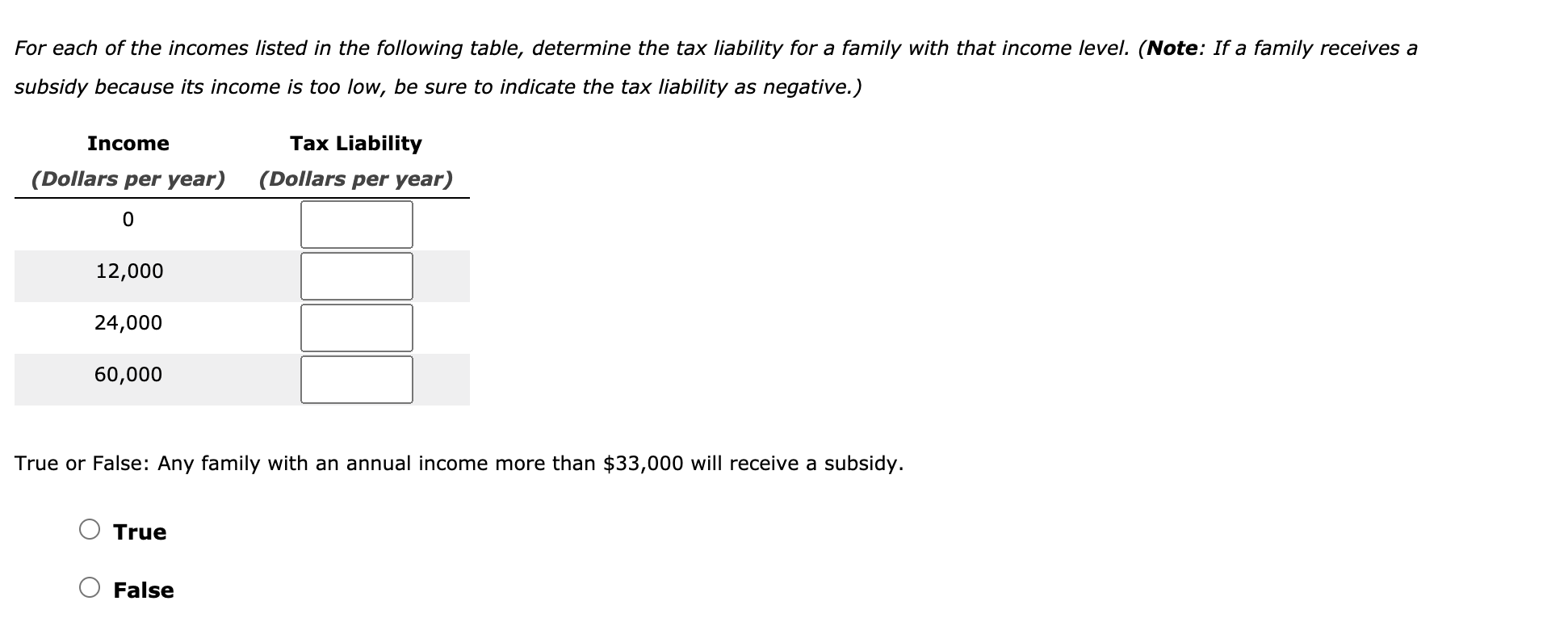

Claim For An Annual Lump Sum Payment Of Family Tax Benefit

https://img.yumpu.com/32296971/1/500x640/claim-for-an-annual-lump-sum-payment-of-family-tax-benefit.jpg

Shared Care And Family Tax Benefit

https://flast.com.au/s/bx_posts_photos_resized/qzcn8hzfsz5nrttexf4rngmdepayyzfb.png

The FTB Part A supplement is a per child payment introduced for the 2003 04 income year and is payable at the end of an income year after reconciliation has occurred It is a component of the Family Tax Benefit Part A FTB Part A is the primary payment for families with dependent children The payment is based on family income and the amount varies depending on the age and number of children in the

The FTB Part A supplement is subject to an income limit is only paid after the end of the financial year and is not included in this calculation Table 1 this table describes an example of To be eligible for FTB Part B the primary earner 1 1 P 122 must have an ATI at or below the income limit 1 1 I 45 FTB Part B is paid at different rates depending on the age of

Download Family Tax Benefit Part A Supplement Income Limit

More picture related to Family Tax Benefit Part A Supplement Income Limit

Family Tax Benefit Form Pdf Australian Guid Step by step Instructions

https://fatlosslabs.com/blogimgs/https/cip/data.formsbank.com/pdf_docs_html/347/3479/347914/page_1_thumb_big.png

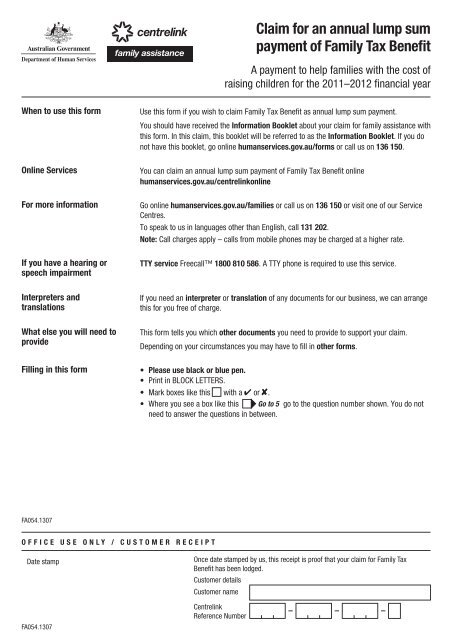

Solved 6 The Negative Income Tax Many Economists Believe Chegg

https://media.cheggcdn.com/media/f5c/f5c6eedc-75f3-4f24-a4d9-cf7f7812e2a5/php8aYms1.png

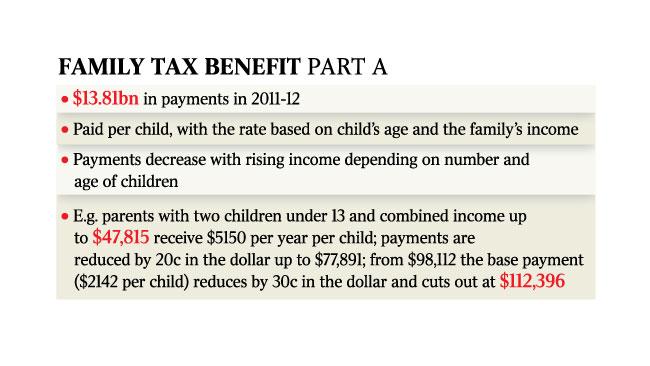

Family Tax Benefit PART A PART B Care For Kids

https://www.careforkids.com.au/image/blog/socialimage/cd7ae634-c645-4db7-b26e-f7c1993bdc9d

To receive the FTB Part A supplement your family s adjusted tax able income must be 80 000 or less How much is the FTB Part A The maximum rate for the FTB Part A depends on the age The first tax benefit Part A is per eligible child you care for the second Part B is paid out per family for single parent families non parental carers and for some families that only have the one main source of income

If your taxable income is over 115 997 the FTB part A will reduce by 0 30 for each dollar of income over 115 997 This applies until your payment is nil To be eligible for the part A Who is eligible for Family Tax Benefit Part A To be eligible for Family Tax Benefit Part A you must care for a dependent child meet the residence rules meet an income test Family Tax

Family Tax Benefit Cuts Could Save 1bn A Year The Australian

https://content.api.news/v3/images/bin/5e7d357683d858fd878fce5a66ee1348?width=1280

Income Tax Benefits On Housing Loan In India

https://blog.saginfotech.com/wp-content/uploads/2016/09/income-tax-benefit.jpg

https://guides.dss.gov.au › family-assistance-guide

The standard rate of FTB Part A is the maximum annual amount payable for all FTB children based on their age without including the supplements and without applying the

https://operational.servicesaustralia.gov.au › public › Pages › families

The Part A supplement increases the maximum annual FTB Part A rate for each child if eligible FTB Part A supplement is subject to an income limit The Part B supplement increases the

Earned Income Tax Credit For Households With One Child 2023 Center

Family Tax Benefit Cuts Could Save 1bn A Year The Australian

Who Gets Tax Credits Leia Aqui Who Gets Federal Tax Credits

Who Is Eligible For EIC Credit Leia Aqui What Is The Income Level For

How Much Social Security Taxable TaxableSocialSecurity

Family Tax Benefit Part A Base Rate Tax Walls

Family Tax Benefit Part A Base Rate Tax Walls

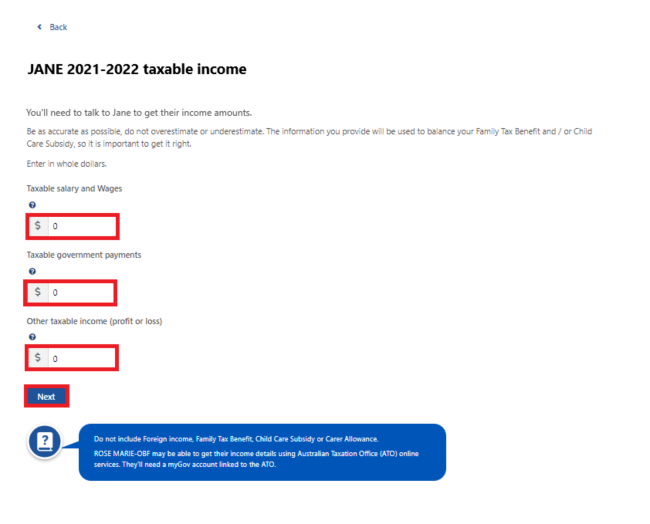

Centrelink Online Account Help Advise Non lodgement Of Tax Return

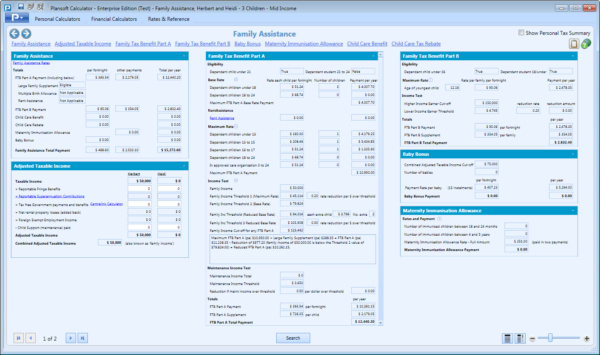

Plansoft Products Calculator Features Family Assistance Estimates

Family Tax Benefit Part A And An Earnings Credit Download Scientific

Family Tax Benefit Part A Supplement Income Limit - To be eligible for FTB Part B the primary earner 1 1 P 122 must have an ATI at or below the income limit 1 1 I 45 FTB Part B is paid at different rates depending on the age of