Family Tax Benefit Part A Estimator The max FTB part A payment you can get is 6 380 when your salary is no more than 62 634 If your taxable income is between 62 634 and 111 398 the FTB part A will

The amount of Family Tax Benefit FTB Part A you get depends on your family s income Income test for FTB Part B Family Tax Benefit Part B is for single parents or carers and You may get the maximum rate of FTB Part A if your family s adjusted taxable income is 62 634 or less Income between 62 634 and 111 398 We use an income test if your

Family Tax Benefit Part A Estimator

Family Tax Benefit Part A Estimator

https://media.apnarm.net.au/media/images/2015/09/28/IQT_29-09-2015_OPINION_02_ThinkstockPhotos-200405397-001.1_fct1024x768_ct1880x930.jpg

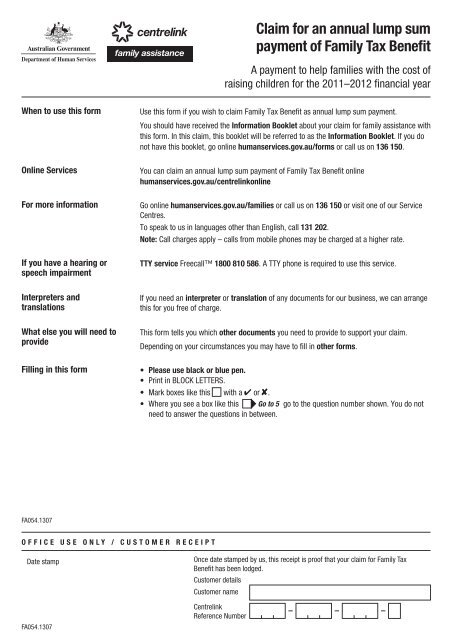

Claim For An Annual Lump Sum Payment Of Family Tax Benefit

https://img.yumpu.com/32296971/1/500x640/claim-for-an-annual-lump-sum-payment-of-family-tax-benefit.jpg

http://img.mp.itc.cn/upload/20160324/51fb282ba8344e709eaab86d5e9db9e1_th.jpg

Family Tax Benefit child care fee assistance To use the Payment and Service Finder answer the questions and choose a payment you want to estimate You can also use it Family Tax Benefit FTB is a payment that helps eligible families with the cost of raising children It is made up of two parts FTB Part A is paid per child and the amount paid

If you receive FTB Part A you may be eligible for Newborn Upfront Payment and Newborn Supplement if you have a baby or adopt a child Rent Assistance if you receive more Family Tax Benefit A 2 part payment that helps with the cost of raising children have a dependent child or full time secondary student aged 16 to 19 who isn t getting a

Download Family Tax Benefit Part A Estimator

More picture related to Family Tax Benefit Part A Estimator

Family Tax Benefit Form Pdf Australian Guid Step by step Instructions

https://fatlosslabs.com/blogimgs/https/cip/data.formsbank.com/pdf_docs_html/347/3479/347914/page_1_thumb_big.png

Serviceability

https://pic1.zhimg.com/v2-97da941f526f8173122b9e43cee46fe8_r.jpg

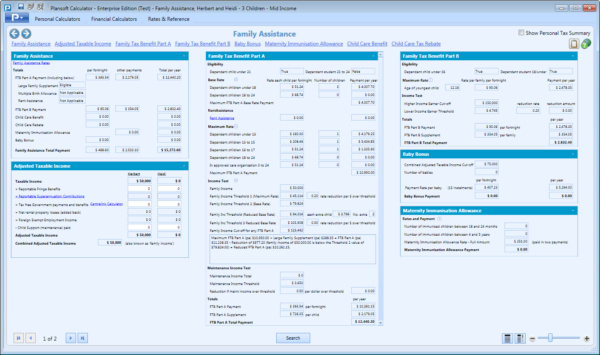

Plansoft Products Calculator Features Family Assistance Estimates

http://www.plansoft.com.au/images/screenshots/FamilyAssistance.png

Family Tax Benefit child criteria To be eligible your child must be aged 0 to 15 years aged 16 to 19 years and meet certain study requirements The child must be in your care A child support assessment is based on annual yearly incomes i e 365 days If there are less than 365 days in the estimate period then the estimated income will convert into an

We use your family income estimate to work out how much Family Tax Benefit and Child Care Subsidy you get during a financial year So your family income estimate needs to Canstar Account What are the rates for the Family Tax Benefit Part A and Family Tax Benefit Part B in 2022 Find out about eligibility and how to claim

1

https://pic2.zhimg.com/v2-d8363f894586fc5834c17eb5ec2b2f05_r.jpg

SBS Language Labor To Cut Family Tax Benefit Bonus

https://sl.sbs.com.au/public/image/file/9ab6b77a-c95d-48f1-a97f-49c99ff9e313/crop/16x9

https://www.bigdream.com.au/family-tax-benefit-calculator

The max FTB part A payment you can get is 6 380 when your salary is no more than 62 634 If your taxable income is between 62 634 and 111 398 the FTB part A will

https://www.servicesaustralia.gov.au/how-much...

The amount of Family Tax Benefit FTB Part A you get depends on your family s income Income test for FTB Part B Family Tax Benefit Part B is for single parents or carers and

Family Tax Benefit Calculator HaleafSylvi

1

Australian Government Begins Fining Parents Who Don t Vaccinate Their

Family Tax Benefit PART A PART B Care For Kids

Australia Fines Parents For Not Vaccinating Kids

C mo Funciona La Inmunizaci n Infantil En Australia SBS Spanish

C mo Funciona La Inmunizaci n Infantil En Australia SBS Spanish

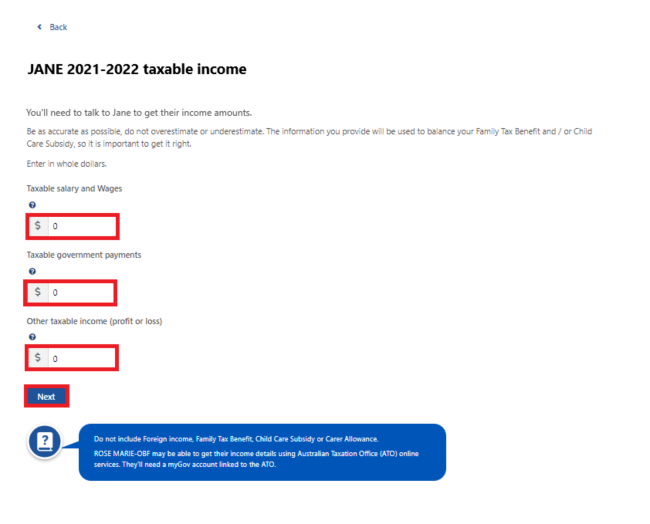

Centrelink Online Account Help Advise Non lodgement Of Tax Return

Child Dental Benefit Schedule Dentistry Plus

Update On The Future Of Family Tax Benefit Part B

Family Tax Benefit Part A Estimator - Family Tax Benefit child care fee assistance To use the Payment and Service Finder answer the questions and choose a payment you want to estimate You can also use it