Federal Ev Tax Credit 2023 Find out if your electric vehicle EV or fuel cell vehicle FCV qualifies for a tax credit based on type purchase date and business or personal use

Oct 6 2023 If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug in How to Claim the New Clean Vehicle Tax Credit Starting on Jan 1 2024 eligible consumers will have the option to transfer the value of the tax credit to dealers that meet certain requirements in exchange for an equivalent reduction in the

Federal Ev Tax Credit 2023

Federal Ev Tax Credit 2023

https://i.pcmag.com/imagery/articles/04InvhVC1HTje7XJcv9Tb7Q-4.fit_lim.v1681756100.jpg

Congress Saves 7 500 EV Tax Credit Following Full Court Pressure

https://imageio.forbes.com/blogs-images/sebastianblanco/files/2017/12/11323330056_0da376df53_k-1200x800.jpg?format=jpg&width=1200

Has Federal EV Tax Credit Been Saved The Green Car Guy

https://thegreencarguy.com/wp-content/uploads/2016/05/GCG-CashandCar-1024x1024.jpg

Here s what you need to know about the revised EV tax credit for 2023 including which cars qualify and how to claim it And if you re considering purchasing an electric vehicle in 2024 How to know if your car qualifies for the EV tax credit aka Clean Vehicle Tax Credit if it was delivered on or after April 18 2023

How to Navigate the Fed s New EV Tax Credit Nightmare What you need to know about the Inflation Reduction Act s EV tax credit before shopping for a new or used electric The changes to the federal EV tax credit under the Inflation Reduction Act came into effect in January 2023 and the IRS released updated guidance on March 31 for the EV battery

Download Federal Ev Tax Credit 2023

More picture related to Federal Ev Tax Credit 2023

The New Federal Tax Credit For EVs

https://blog.greenenergyconsumers.org/hubfs/Federal Tax Credit Blog header.png

Why Getting A 7 500 EV Tax Credit Will Be Easier In 2024 WSJ

https://images.wsj.net/im-865215/social

New EV Tax Credits The Details Virginia Automobile Dealers Association

https://vada.com/wp-content/uploads/2022/08/EV-Tax-Credits-Facebook-Post.png

The federal tax credit for electric vehicles Clean Vehicle tax credit in 2023 is 7 500 for a new EV and 4 000 for a pre owned EV if the EV qualifies Until now the IRS allowed taxpayers to claim a tax credit of up to 7 500 on a new plug in vehicle with the exact amount determined by the battery s capacity in kWh Additionally the credit

Under the new rule consumers can get up to 7 500 back in tax credits on eligible cars More than a dozen new models and some of their variations are eligible for all or half of The Inflation Reduction Act of 2022 made several changes to the tax credits provided for qualified plug in electric drive motor vehicles including adding fuel cell vehicles to

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2022-10/Summary-ITC-and-PTC-Values-Table.png?itok=_72eWNBC

Should These EVs Qualify For The Federal EV Tax Credit EVAdoption

https://evadoption.com/wp-content/uploads/2021/08/Should-these-EVs-qualify-for-the-federal-EV-tax-credit-1024x557.png

https://www.irs.gov › clean-vehicle-tax-credits

Find out if your electric vehicle EV or fuel cell vehicle FCV qualifies for a tax credit based on type purchase date and business or personal use

https://www.irs.gov › newsroom › qualifying-clean...

Oct 6 2023 If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug in

U S Federal EV Tax Credit Update For January 2019

Federal Solar Tax Credits For Businesses Department Of Energy

EV Tax Credit Rules Are Becoming More Complicated Local News Today

EV Tax Credit 2023 What s Changed And What s Ahead Tax Credits

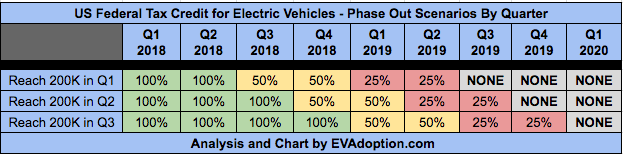

Updated Federal EV Tax Credit Phase Out Scenarios Nov 24 2017

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

IRS EV Tax Credit 2024 Who Can Qualify Qualified Vehicles

List Of Vehicles Eligible For The New 7 500 Federal EV Tax Credit

4 Ways How Does The Federal Ev Tax Credit Work Alproject

Federal Ev Tax Credit 2023 - The changes to the federal EV tax credit under the Inflation Reduction Act came into effect in January 2023 and the IRS released updated guidance on March 31 for the EV battery