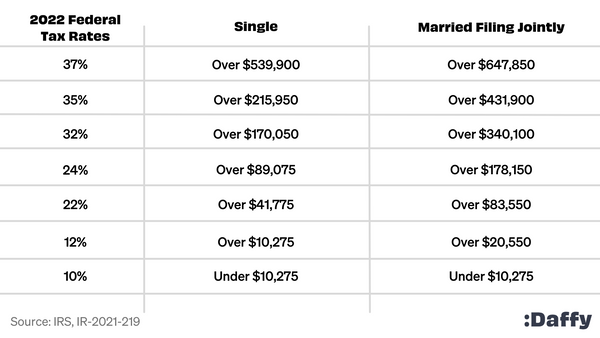

Federal Income Tax Deduction For Charitable Contributions Web 10 Nov 2023 nbsp 0183 32 For the 2023 and 2024 tax years taxpayers can deduct charitable contributions if they itemize their tax deductions using Schedule A of Form 1040 Charitable contribution deductions

Web Charitable contributions to qualified organizations may be deductible if you itemize deductions on Schedule A Form 1040 Itemized Deductions PDF To see if the organization you have contributed to qualifies as a charitable organization for income tax deductions use Tax Exempt Organization Search Web Your deduction for charitable contributions generally can t be more than 60 of your AGI but in some cases 20 30 or 50 limits may apply Table 1 gives examples of contributions you can and can t deduct Table 1 Examples of Charitable Contributions A Quick Check

Federal Income Tax Deduction For Charitable Contributions

Federal Income Tax Deduction For Charitable Contributions

https://www.irs.gov/pub/image/acl-charitable-contributions-870.jpg

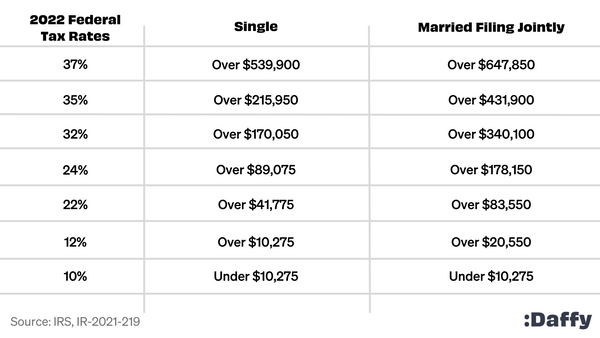

The Complete 2022 Charitable Tax Deductions Guide

https://daffy.ghost.io/content/images/size/w600/2022/05/Daffy-donor-advised-funds-2022-federal-tax-rates.png

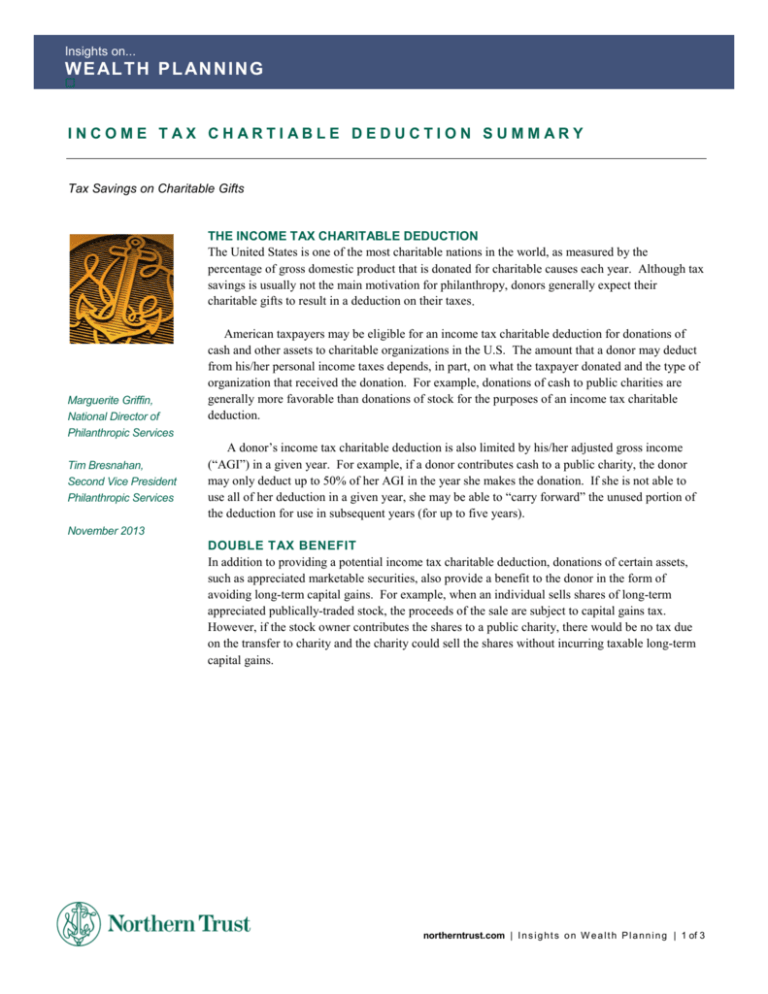

Income Tax Charitable Deduction Summary

https://s3.studylib.net/store/data/008276146_1-2f85c5a3e38b9ec1862b6c6b10994d47-768x994.png

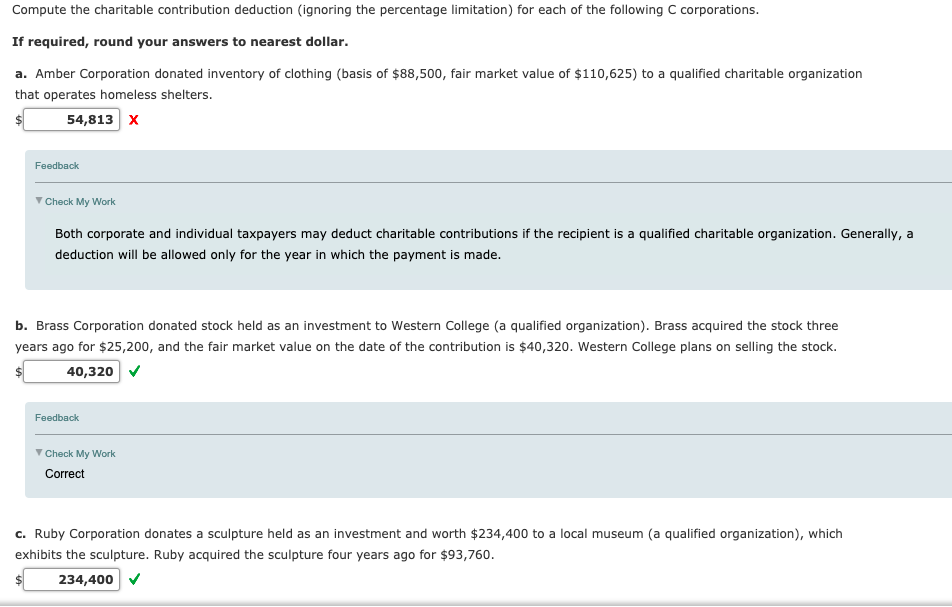

Web Charitable contribution deductions for United States Federal Income Tax purposes are defined in section 170 c of the Internal Revenue Code as contributions to or for the use of certain nonprofit enterprises Exclusions of certain amounts from deduction Web 27 Nov 2023 nbsp 0183 32 Charitable giving tax deduction limits are set by the IRS as a percentage of your income Cash contributions in 2023 and 2024 can make up 60 of your AGI The limit for appreciated assets in 2023 and 2024 including stock is 30 of your AGI Contributions must be made to a qualified organization

Web 15 Dez 2022 nbsp 0183 32 Getty Images Despite the uncertain economy most Americans 93 plan to make at least a small donation to charity this year according to a recent survey by Edward Jones The survey also found Web When you donate cash an IRS qualified 501 c 3 public charity you can generally deduct up to 60 of your adjusted gross income Provided you ve held them for more than a year appreciated assets including long term appreciated stocks and property are generally deductible at fair market value up to 30 of your adjusted gross income

Download Federal Income Tax Deduction For Charitable Contributions

More picture related to Federal Income Tax Deduction For Charitable Contributions

12 Tax Smart Charitable Giving Tips For 2023 Charles Schwab

https://www.schwab.com/learn/sites/g/files/eyrktu1246/files/IE_0523_Tax-Smart Charitable Giving Tips_chart_deductions_bunching.jpg

Solved Compute The Charitable Contribution Deduction Chegg

https://media.cheggcdn.com/media/796/79607122-c1a7-4c4e-8553-c0994871b63d/phpDO7dEO.png

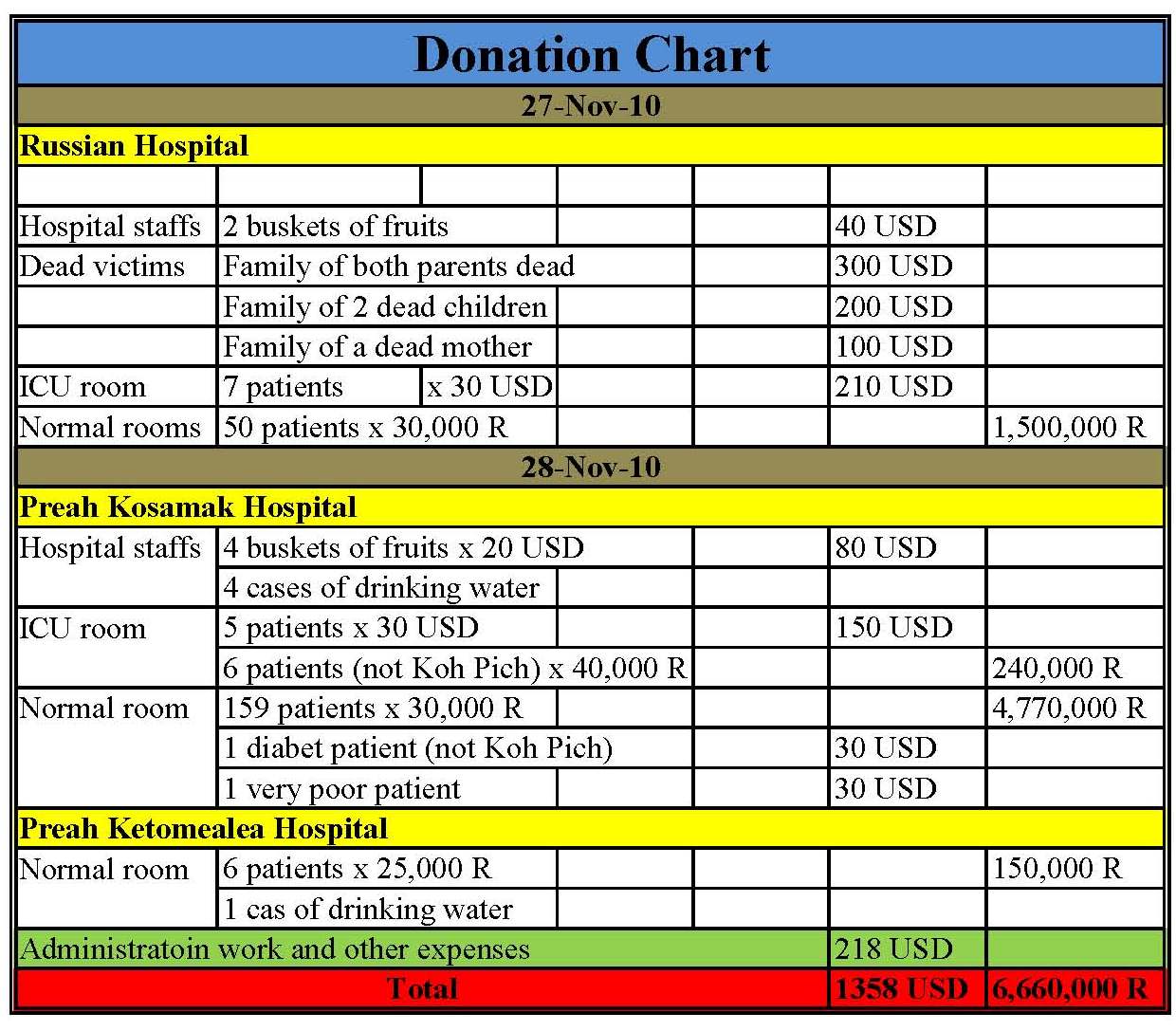

Donation Chart Template

http://4.bp.blogspot.com/_n-8w21PwsUY/TPXZW9cIGCI/AAAAAAAAB08/45h_e3L8QEQ/s1600/Donation+chart1.jpg

Web There shall be allowed as a deduction any charitable contribution as defined in subsection c payment of which is made within the taxable year A charitable contribution shall be allowable as a deduction only if verified Web 14 M 228 rz 2022 nbsp 0183 32 Charitable Deduction Tax Expenditures by Income Class 2022 Source Joint Committee on Taxation Generally taxpayers must itemize deductions to claim a deduction for charitable donations there was a temporary nonitemizer deduction in 2020 and 2021 In 2017 32 of tax filers itemized deductions An estimated 10 of

Web 15 Nov 2023 nbsp 0183 32 Tax deductions When you make a donation to a qualified charitable organization you may be eligible to deduct the donation amount from your taxable income effectively reducing the amount of income subject to taxation This can lead to a lower overall tax bill Itemized deductions Web 16 Okt 2023 nbsp 0183 32 Generally you can only deduct charitable contributions if you itemize deductions on Schedule A Form 1040 Itemized Deductions Gifts to individuals are not deductible Only qualified organizations are eligible

Donation Letter For Taxes Template In PDF Word Set Of 10 Donation

https://i.pinimg.com/originals/6c/16/af/6c16af3ad58c7b51e20fad31e7bb90ad.jpg

Record Of Charitable Contribution Is A Must For Claiming Deduction

https://i.pinimg.com/originals/4c/b0/9d/4cb09dd46b20bf8190f7392998345ab2.png

https://www.investopedia.com/articles/personal-finance/041315/tips...

Web 10 Nov 2023 nbsp 0183 32 For the 2023 and 2024 tax years taxpayers can deduct charitable contributions if they itemize their tax deductions using Schedule A of Form 1040 Charitable contribution deductions

https://www.irs.gov/credits-deductions/individuals/deducting-charitable...

Web Charitable contributions to qualified organizations may be deductible if you itemize deductions on Schedule A Form 1040 Itemized Deductions PDF To see if the organization you have contributed to qualifies as a charitable organization for income tax deductions use Tax Exempt Organization Search

Solved Linda Who Files As A Single Taxpayer Had AGI Of Chegg

Donation Letter For Taxes Template In PDF Word Set Of 10 Donation

Charitable Contributions And How To Handle The Tax Deductions

Sample Church Donation Receipt Letter For Tax Purposes Fill Out Sign

Tax Information For Donors Peninsula Food Runners

2023 IRS Inflation Adjustments Tax Brackets Standard Deduction EITC

2023 IRS Inflation Adjustments Tax Brackets Standard Deduction EITC

Make Sure You Claim Your Charitable Tax Deductions On Form 1040 Or

Section 80G Deduction For Donation To Charitable Organizations

Who Benefits From The Deduction For Charitable Contributions Tax

Federal Income Tax Deduction For Charitable Contributions - Web When you donate cash an IRS qualified 501 c 3 public charity you can generally deduct up to 60 of your adjusted gross income Provided you ve held them for more than a year appreciated assets including long term appreciated stocks and property are generally deductible at fair market value up to 30 of your adjusted gross income