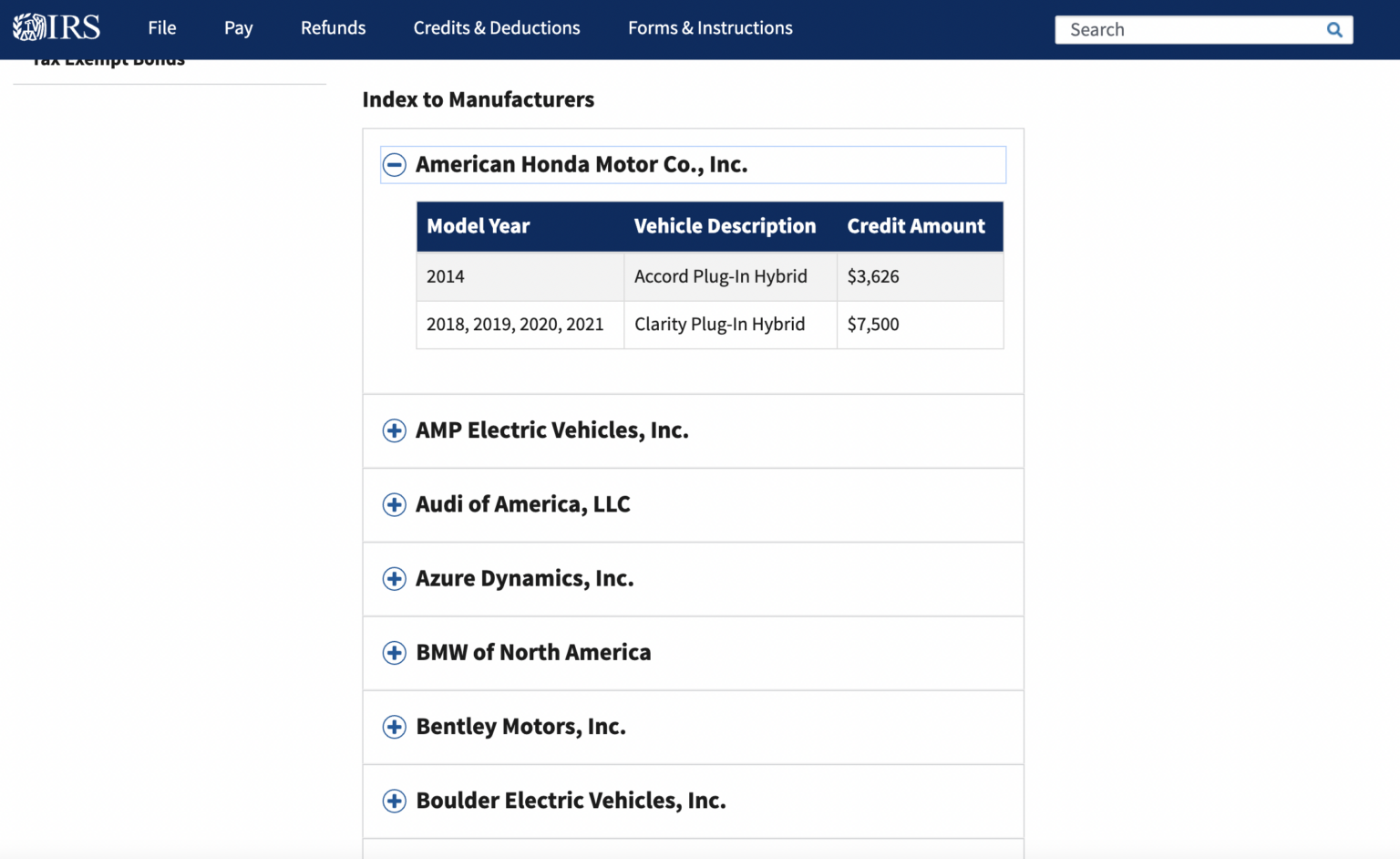

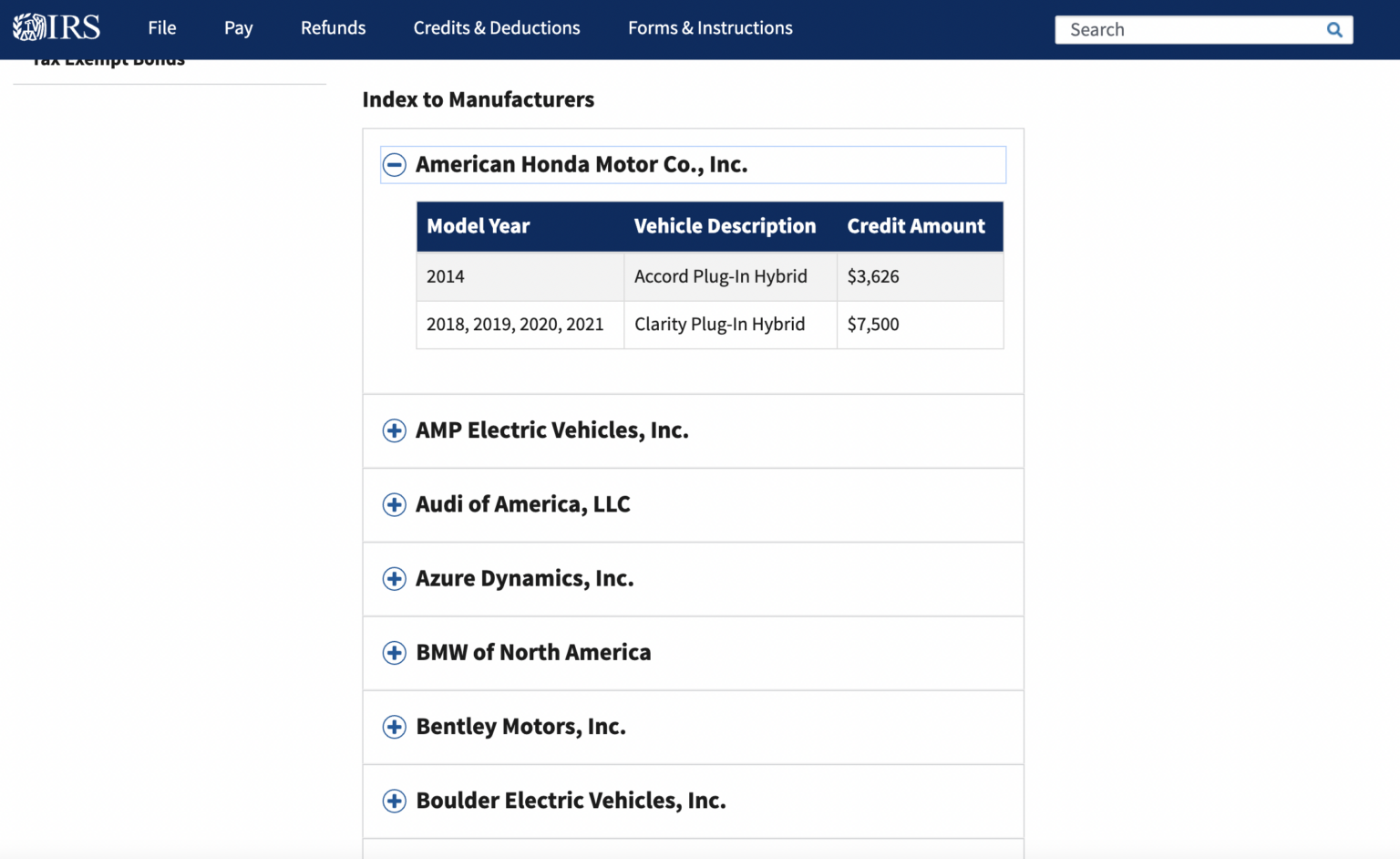

Federal Tax Credit Electric Vehicle Income Limit You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032

The EV tax credit is a federal tax incentive for taxpayers looking to go green on the road Here are the rules income limit qualifications and how to claim the credit in 2024 A federal EV tax credit is here thanks to the Inflation Reduction Act IRA massive tax and climate legislation promoting clean energy The credit of up to 7 500 for certain electric

Federal Tax Credit Electric Vehicle Income Limit

Federal Tax Credit Electric Vehicle Income Limit

https://i.pcmag.com/imagery/articles/04InvhVC1HTje7XJcv9Tb7Q-4.fit_lim.v1681756100.jpg

Income Tax Credit Electric Vehicle Update Income Tax Payments Deferred

https://www.taxproadvice.com/wp-content/uploads/tax-credits-drive-electric-northern-colorado-932x1024.png

Has Federal EV Tax Credit Been Saved The Green Car Guy

https://thegreencarguy.com/wp-content/uploads/2016/05/GCG-CashandCar-1024x1024.jpg

The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in section 30D of the Internal Revenue Code Code for qualified plug in electric drive motor vehicles including adding fuel cell vehicles to All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to 7 500

Taxpayers who meet the income requirements and buy a vehicle that satisfies the price battery and assembly restrictions are eligible to receive up to 7 500 from the government as a tax Treasury and the Internal Revenue Service released guidance and FAQs with information on how the North America final assembly requirement will work so consumers can determine what vehicles are eligible and claim a

Download Federal Tax Credit Electric Vehicle Income Limit

More picture related to Federal Tax Credit Electric Vehicle Income Limit

How To Calculate Electric Car Tax Credit OsVehicle

https://cdn.osvehicle.com/how_is_tax_credit_for_ev_calculated.png

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

https://www.autopromag.com/usa/wp-content/uploads/2022/08/EV-Federal-Tax-Credits-5MgJUp.jpeg?is-pending-load=1

Federal Tax Credit For Redevelopment Introduced REHAB Act Greater

http://static1.squarespace.com/static/59396fee59cc6877bacf5ab5/5947ec9a2985262ece0ebb1e/5e7a6fe1b8ae72565ee2e35a/1631114839305/?format=1500w

Effective immediately after enactment of the Inflation Reduction Act after August 16 2022 the tax credit is only available for qualifying electric vehicles for which final assembly occurred in North America Further changes to the eligibility rules will begin in 2023 Federal EV tax credits in 2024 top out at 7 500 if you re buying a new car and 4 000 if you re buying a used car while the bank or the automaker s finance company can take a 7 500 tax

If you buy a used electric vehicle model year 2021 or earlier you can get up to 4 000 back as a tax credit This tax credit has an income cap too 150 000 for a household 75 000 for What are the income limits to qualify for any federal EV tax credits Modified adjusted gross income limits are 150 000 for individuals 225 000 for heads of households and 300 000 for

The Federal Tax Credit For Electric Cars How To Save 7 500

https://evroom.com/wp-content/uploads/2022/11/Screen-Shot-2022-10-22-at-8.37.36-PM-1536x942.png

What Is Federal Tax Credit For Electric Cars ElectricCarTalk

https://www.electriccartalk.net/wp-content/uploads/electric-vehicle-tax-credit-you-can-still-save-greenbacks-for-going.png

https://www.irs.gov/credits-deductions/credits-for...

You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032

https://www.nerdwallet.com/article/taxes/ev-tax...

The EV tax credit is a federal tax incentive for taxpayers looking to go green on the road Here are the rules income limit qualifications and how to claim the credit in 2024

Income Tax Exemption On Electric Vehicle Deduction On Electric Vehicle

The Federal Tax Credit For Electric Cars How To Save 7 500

U S Lawmakers Propose To Extend EV Tax Credit At A Cost Of 11 4

Invictus Solar Power

Federal Tax Credit Calculation

Act Fast The Solar Tax Credit Will Soon Expire

Act Fast The Solar Tax Credit Will Soon Expire

Tesla Passed 200 000 US Electric Car Deliveries In July GM Will Pass

How Does The Federal Solar Tax Credit Work CRJ Contractors

Electric Vehicles And Government issued Checks

Federal Tax Credit Electric Vehicle Income Limit - All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to 7 500