Federal Tax Credit Income Limits Income Limits and Amount of EITC for additional tax years See the earned income and adjusted gross income AGI limits maximum credit for the current year

If you earned less than 63 398 if Married Filing Jointly or 56 838 if filing as an individual surviving spouse or Head of Household in tax year 2023 you may For the 2024 tax year taxes filed in 2025 the max earned income credit amounts are 632 4 213 6 960 and 7 830 depending on your filing status and the number of children you

Federal Tax Credit Income Limits

Federal Tax Credit Income Limits

https://cdn.osvehicle.com/can_i_claim_the_ev_tax_credit_every_year.png

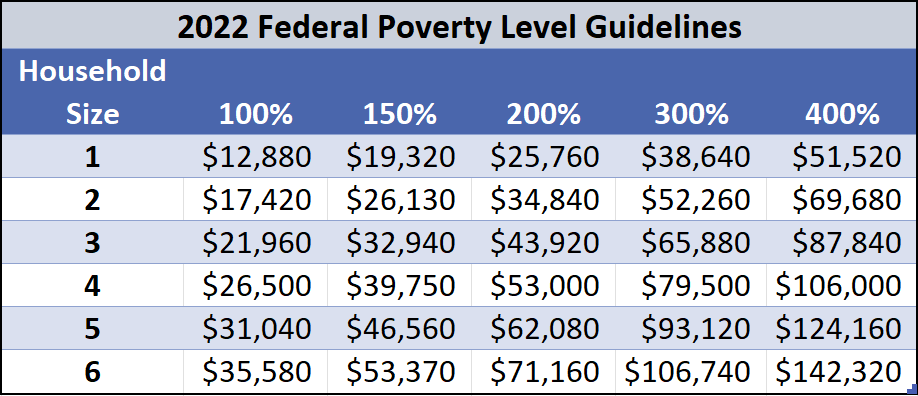

ACA Subsidies And How A New Retiree Can Maximize Them

https://images.squarespace-cdn.com/content/v1/5bd0b97a840b16625270b8e3/b23c3d5e-acc1-4ecd-ba5f-288a1904f8ca/2022+Federal+Poverty+Level+Guidelines.png

Can I Opt Out Of The Child Tax Credit Payments Here s The Answer Dogwood

https://vadogwood.com/wp-content/uploads/sites/12/2021/07/Child-Tax-Credit1.jpg

The maximum Earned Income Tax Credit EITC in 2022 for single and joint filers is 560 if the filer has no children Table 5 The maximum credit is 3 733 for one Federal tax brackets range from 10 to 37 There are a number of different individual tax credits including the earned income credit and the qualified adoption expenses credit

The maximum earned income tax credit EITC in 2024 for single and joint filers is 632 if the filer has no children Table 5 The maximum credit is 4 213 for one The EV tax credit is a federal tax incentive for taxpayers looking to go green on the road Here are the rules income limit qualifications and how to claim the credit in 2024

Download Federal Tax Credit Income Limits

More picture related to Federal Tax Credit Income Limits

Earned Income Tax Credit For Households With One Child 2023 Center

https://www.cbpp.org/sites/default/files/2023-04/policybasics-eitc_rev4-28-23_f1.png

Earned Income Tax Credit EITC Who Qualifies

https://assets-global.website-files.com/600089199ba28edd49ed9587/63ab2cfeb6ed4e84980e9602_5Q05z7zzxkuPsQXDnaB9jShs6SVdcb0uB84DMBeLXFAIZJwwSAmHnQ4a7WbGqdLfxs9kSpNnGo8K3YMonR0wgBTu--Pgkhfuie7pFBG4XhGd3Kj-sMXIsb9rNoZWGXn0fc0IkJZa7T7C3Hhn3f492M_Gdep5jUnJluN29uavkjwe4XzK-GPA4B6nDNjE00CQKNhoDAt7LA.png

2023 IRS Contribution Limits And Tax Rates By Kristin McKenna Harvest

https://darrowwealthmanagement.com/wp-content/uploads/2022/10/2023-IRS-Contribution-Limits.png

A tax credit is a benefit that lowers your taxes owed by the amount of the credit Tax credits can be nonrefundable refundable or partially refundable Tax credits directly reduce the amount of tax you owe while tax deductions reduce your taxable income For example a tax credit of 1 000 lowers your tax bill by

A federal EV tax credit is here thanks to the Inflation Reduction Act IRA massive tax and climate legislation promoting clean energy The credit of up to 7 500 Because credits are so valuable the government usually places income limits or other restrictions on who can claim them These restrictions vary for each credit

Tax Return 2022 With Eic Latest News Update

https://i2.wp.com/www.taxpolicycenter.org/sites/default/files/model-estimates/images/T12-0177.GIF

Earned Income Credit Table 2017 Cabinets Matttroy

https://boxelderconsulting.com/wp-content/uploads/2022/11/Screen-Shot-2022-11-17-at-12.22.52-PM.png

https://www.eitc.irs.gov/eitc-central/income-limits-and-range-of-eitc

Income Limits and Amount of EITC for additional tax years See the earned income and adjusted gross income AGI limits maximum credit for the current year

https://turbotax.intuit.com/tax-tips/tax...

If you earned less than 63 398 if Married Filing Jointly or 56 838 if filing as an individual surviving spouse or Head of Household in tax year 2023 you may

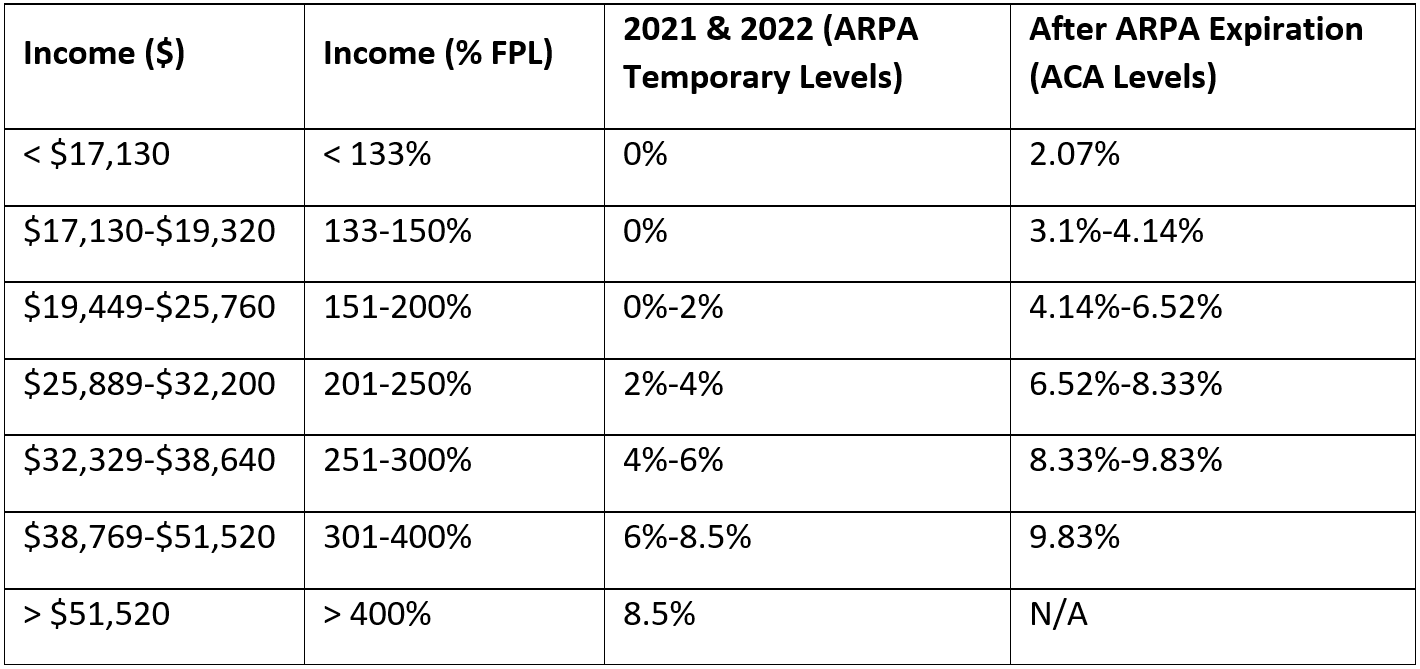

After The American Rescue Plan s Enhanced Premium Tax Credits End AAF

Tax Return 2022 With Eic Latest News Update

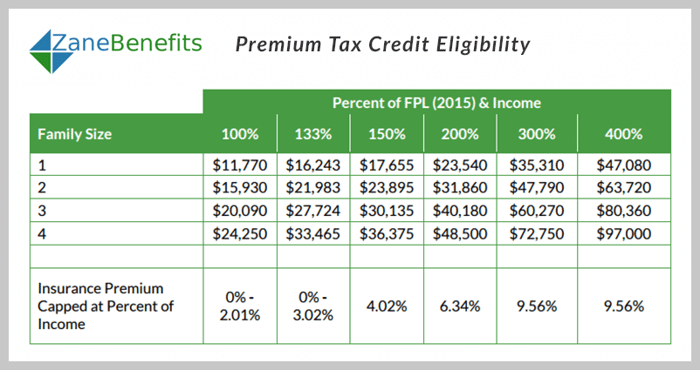

FAQ WA Tax Credit

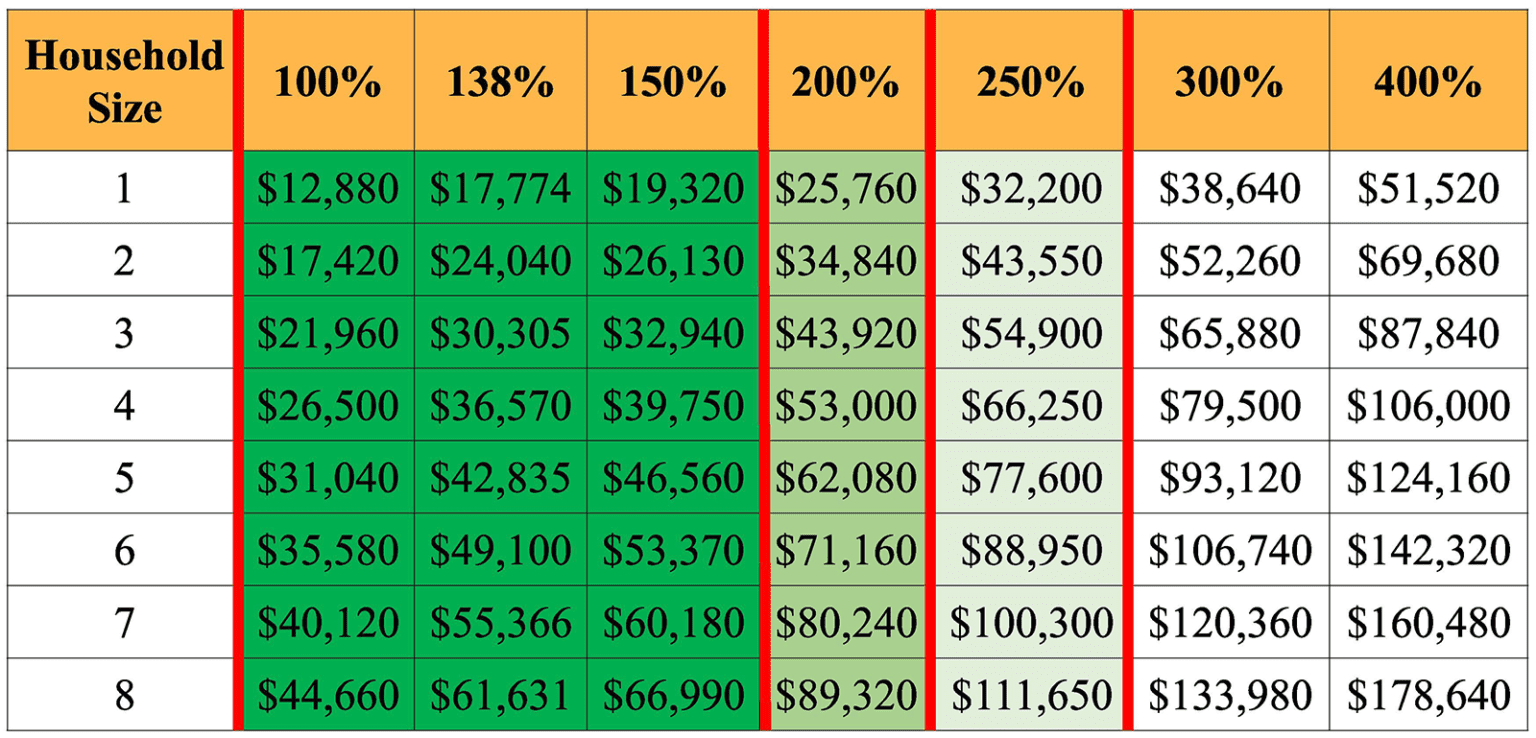

ACA Tax Credits To Help Pay Premiums White Insurance Agency

Affordable Care Act Tax Credit Income Limits Tax Walls

2023 Tax Brackets The Best Income To Live A Great Life

2023 Tax Brackets The Best Income To Live A Great Life

Aca Percentage Of Income 2022 INCOMUNTA

Maximize Your Paycheck Understanding FICA Tax In 2023

Eic Credit Table

Federal Tax Credit Income Limits - The EV tax credit is a federal tax incentive for taxpayers looking to go green on the road Here are the rules income limit qualifications and how to claim the credit in 2024