Federal Tax Incentives For Commercial Solar 179D Provides a tax credit for construction of new energy eficient homes Credit Amount 2 500 for new homes meeting Energy Star standards 5 000 for certified zeroenergy

Total Impact on Tax Liability Assuming the business has a federal tax rate of 21 the net impact of depreciation deductions is calculated as 0 21 712 000 35 600 The best solar incentive is the federal investment tax credit ITC This is true for both home and business owners By crediting your taxes equal to 30 percent of the

Federal Tax Incentives For Commercial Solar

Federal Tax Incentives For Commercial Solar

https://www.evpulsecms.com/wp-content/uploads/2021/02/ev-coin.jpg

Tax Incentives Free Of Charge Creative Commons Financial 3 Image

https://pix4free.org/assets/library/2021-04-28/originals/tax_incentives.jpg

What Are Commercial Solar Tax Incentives Renu Energy

https://renuenergysolutions.com/wp-content/uploads/2020/11/Fort-bragg-commercialNewsky-1080x675.jpg

This resource from the U S Department of Energy DOE Solar Energy Technologies Office SETO provides an overview of the federal investment and production tax credits for Commercial solar tax credits refer to government incentives that reduce the cost of installing solar panels for businesses The Investment Tax Credit ITC is the

The ITC is a tax credit that allows businesses and individuals to claim a credit on their federal income tax return for the cost of installing solar energy systems Previously the ITC provided a credit equal to 26 of Since the signing of the December 2020 COVID 19 Relief package and U S federal government omnibus spending bill as well as the IRS June 2021 extension for

Download Federal Tax Incentives For Commercial Solar

More picture related to Federal Tax Incentives For Commercial Solar

Tax Incentives A Guide To Saving Money For U S Small Businesses

https://www.freshbooks.com/wp-content/uploads/2022/04/tax-incentives-examples.jpg

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

https://www.ecohousesolar.com/wp-content/uploads/2022/09/Ecohouse-Tax-Credit-Featured-09.png

Senate Democrats Would Take Some Small Steps To Clean Up Energy Tax

https://www.taxpolicycenter.org/sites/default/files/styles/manual_crop_1500w/public/blog/ap_932456086173.jpg?itok=MSbntoZX

The most popular federal incentive for commercial solar power is the Investment Tax Credit ITC which provides a tax credit of up to 30 of the cost of February 16 2023 Introduction Businesses that power their facilities with solar energy can take advantage of federal tax credits to offset their installation costs In this article we ll

The ITC is an upfront incentive that reduces federal income tax liability by 30 of a solar system s total installation cost leading to enormous savings for project There are several incentives and programs available that can assist with offsetting electricity and operation costs so it s clear to see why switching to solar energy can be

Commercial Solar Tax Incentives

https://www.beachcitiessolarconsulting.com/wp-content/uploads/2021/09/Skechers-arrays.jpeg

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

https://www.eesi.org/images/content/Summary_of_Clean_Energy_Credits.png

https://www.irs.gov/pub/irs-pdf/p5886.pdf

179D Provides a tax credit for construction of new energy eficient homes Credit Amount 2 500 for new homes meeting Energy Star standards 5 000 for certified zeroenergy

https://www.energy.gov/sites/prod/files/2020/01/f70...

Total Impact on Tax Liability Assuming the business has a federal tax rate of 21 the net impact of depreciation deductions is calculated as 0 21 712 000 35 600

Tax Incentives For Foreign Direct Investment By A J Easson

Commercial Solar Tax Incentives

Federal Solar Tax Credit What It Is How To Claim It For 2024

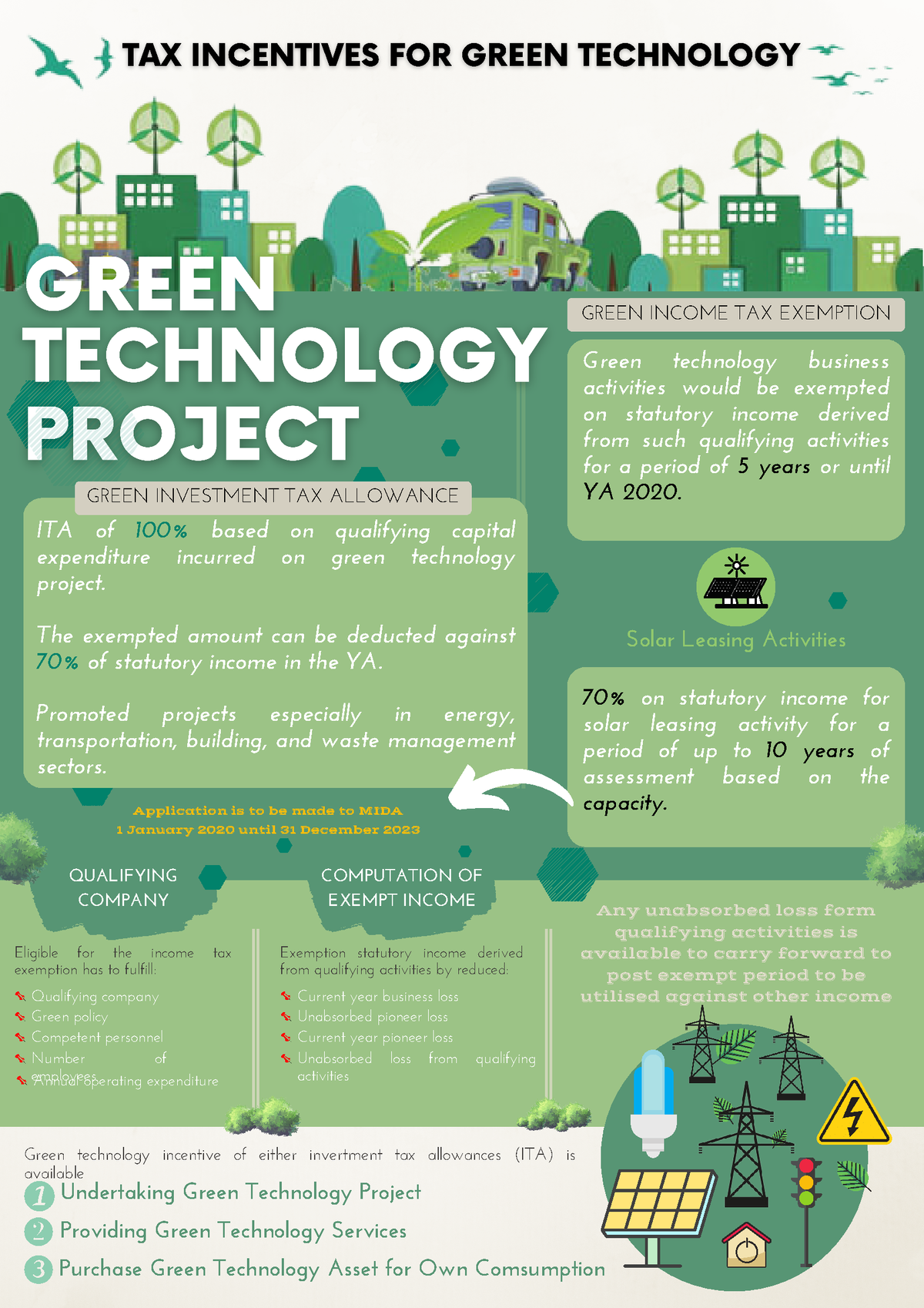

TAX Incentives FOR Green Technology Wan Sharmirizal GREEN INCOME

Federal Solar Tax Credits For Businesses Department Of Energy

Solar Tax Credit Calculator NikiZsombor

Solar Tax Credit Calculator NikiZsombor

Tax Incentives For Digitalisation Automation Green Investment

HVAC Tax Incentives Enhanced In Sweeping Bill ACHR News

Tax Credits Save You More Than Deductions Here Are The Best Ones

Federal Tax Incentives For Commercial Solar - The U S government offers a solar tax credit that can reach up to 30 of the cost of installing a system that uses the sun to power your home Need to jump