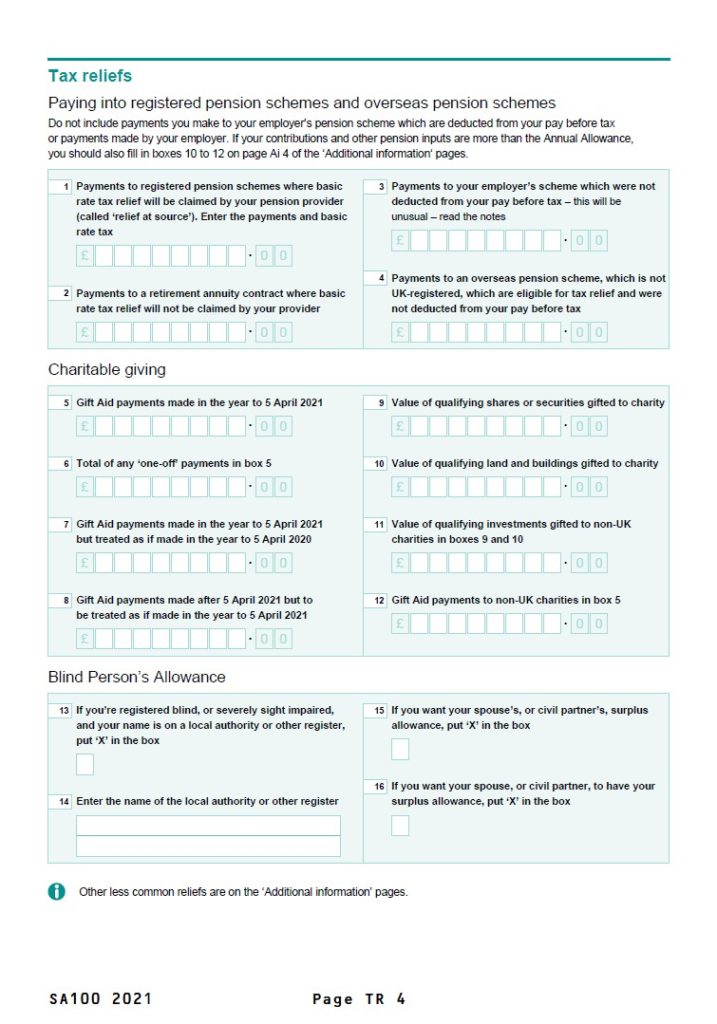

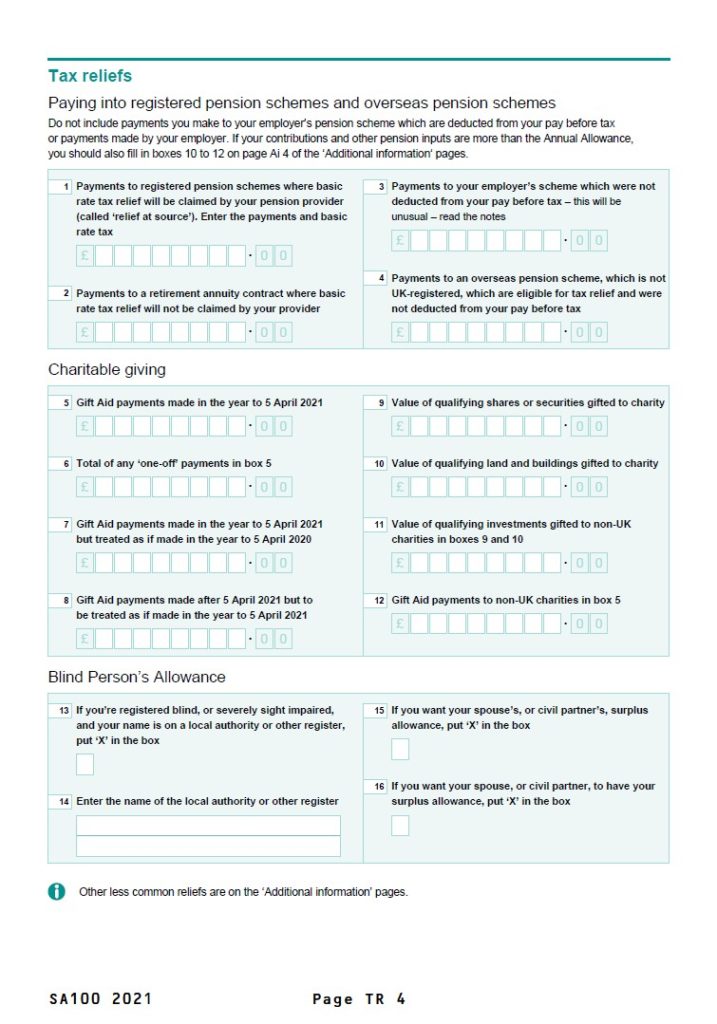

Federal Tax Rebate Work From Home Web 31 janv 2023 nbsp 0183 32 If you worked from home in 2022 you may be wondering if you qualify for the home office deduction which offers a tax break for part of your home expenses

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your Web 18 janv 2022 nbsp 0183 32 Tax deductions for expenses needed to work from home are only available to taxpayers who itemize their deductions Also work from home expenses can only

Federal Tax Rebate Work From Home

Federal Tax Rebate Work From Home

https://printablerebateform.net/wp-content/uploads/2021/07/Work-from-Home-Tax-Rebate-Form-2021-717x1024.jpg

Federal Tax Rebate 2023 Maximize Your Savings And Boost Your Finances

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/05/Federal-Tax-Rebate-2023.jpg?ssl=1

Federal Tax Rebates LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/federal-recovery-rebates-california-budget-and-policy-center-768x591.png

Web The fastest way to get your tax refund is to file electronically and have it direct deposited contactless and free into your financial account You can have your refund direct Web 5 mars 2021 nbsp 0183 32 Daniel Acker Bloomberg News The home office deduction could ve been this tax season s most popular way to reduce taxes a breakout tax break After all the

Web 20 d 233 c 2022 nbsp 0183 32 Individuals should review the information below to determine their eligibility to claim a Recovery Rebate Credit for tax year 2020 or 2021 Find the Amount of Your Web 1 d 233 c 2022 nbsp 0183 32 Key Takeaways Employees who work from home can no longer claim tax deductions for their unreimbursed employee expenses or home office costs on their federal tax return Prior to the 2018 tax

Download Federal Tax Rebate Work From Home

More picture related to Federal Tax Rebate Work From Home

My Work From Home Tax Rebate Disappeared After I Used A Website That

https://i2-prod.mirror.co.uk/incoming/article26473735.ece/ALTERNATES/s1200d/1_HMRC-rebate-claims-firm-exclusive.jpg

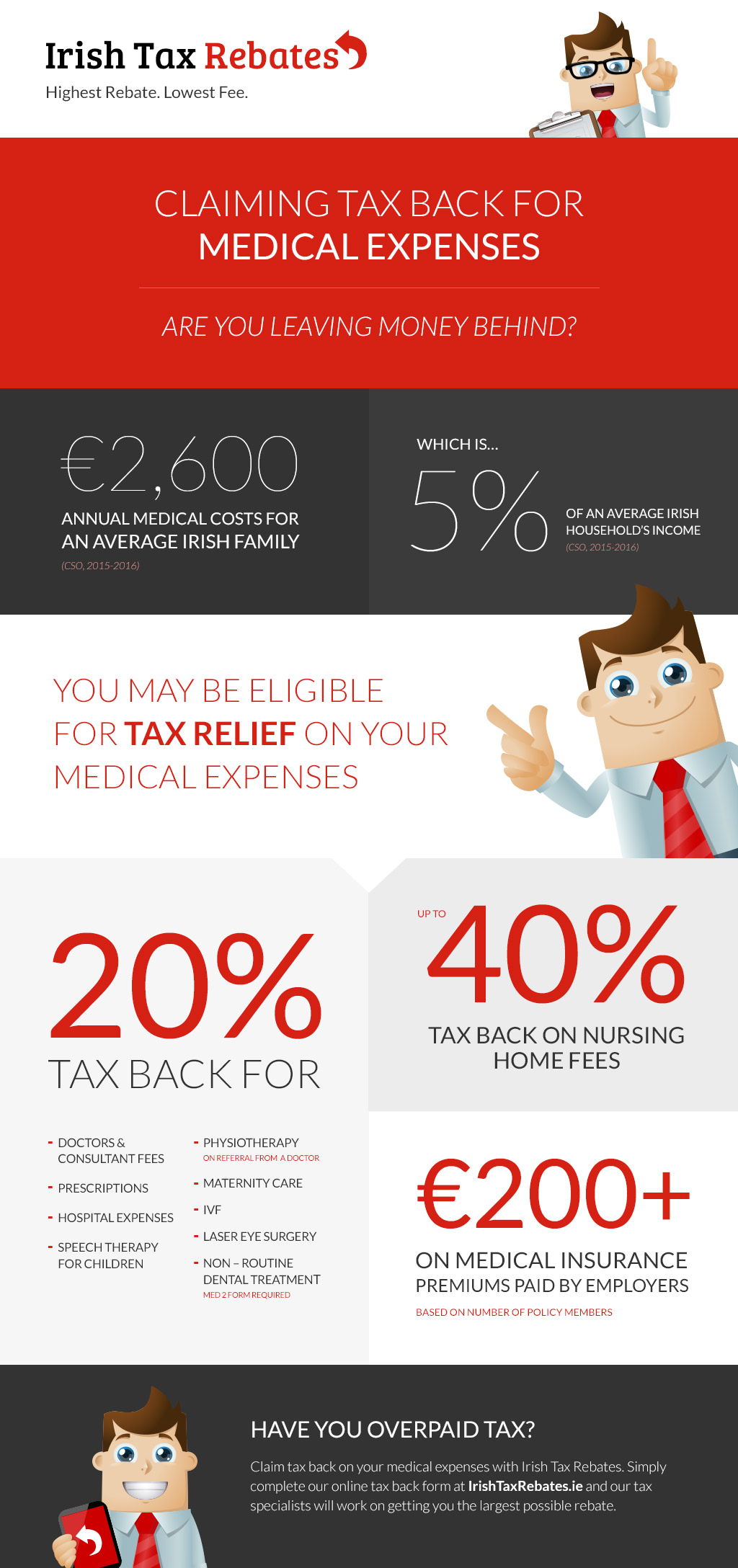

Tax Back On Medical Expenses Infographic Irish Rebates

http://blog.irishtaxrebates.ie/wp-content/uploads/2018/04/itr-infographic-1.jpg

Federal Tax Rebates Electric Vehicles ElectricRebate

https://i0.wp.com/www.electricrebate.net/wp-content/uploads/2022/09/rebates-and-tax-credits-for-electric-vehicle-charging-stations-2.jpg?w=431&h=648&ssl=1

Web 14 avr 2022 nbsp 0183 32 What deductions can you take Can I take that home office deduction Am I working at the dining room table What s going on Lisa Greene Lewis CPA TurboTax expert is here with us right now Web Work from home WFH tax deductions are business expenses that you can subtracted from revenue to lower your tax bill But these deductions almost exclusively apply to those

Web 1 d 233 c 2020 nbsp 0183 32 quot The CRA will allow employees working from home in 2020 due to COVID 19 with modest expenses to claim up to 400 based on the amount of time working from Web 22 f 233 vr 2023 nbsp 0183 32 Although you can t take federal tax deductions for work from home expenses if you are an employee some states have enacted their own laws requiring

Top Mass Save Rebate Form Templates Free To Download In PDF Format

https://i0.wp.com/www.masssaverebate.net/wp-content/uploads/2022/10/top-mass-save-rebate-form-templates-free-to-download-in-pdf-format-101.png?fit=530%2C749&ssl=1

How To Claim Missing Stimulus Money On Your 2020 Tax Return In 2021

https://i.pinimg.com/originals/c5/01/7b/c5017b88440e5203d6056b3107d8882f.png

https://www.cnbc.com/2023/01/31/how-to-know-if-you-can-claim-the-home...

Web 31 janv 2023 nbsp 0183 32 If you worked from home in 2022 you may be wondering if you qualify for the home office deduction which offers a tax break for part of your home expenses

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-e...

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your

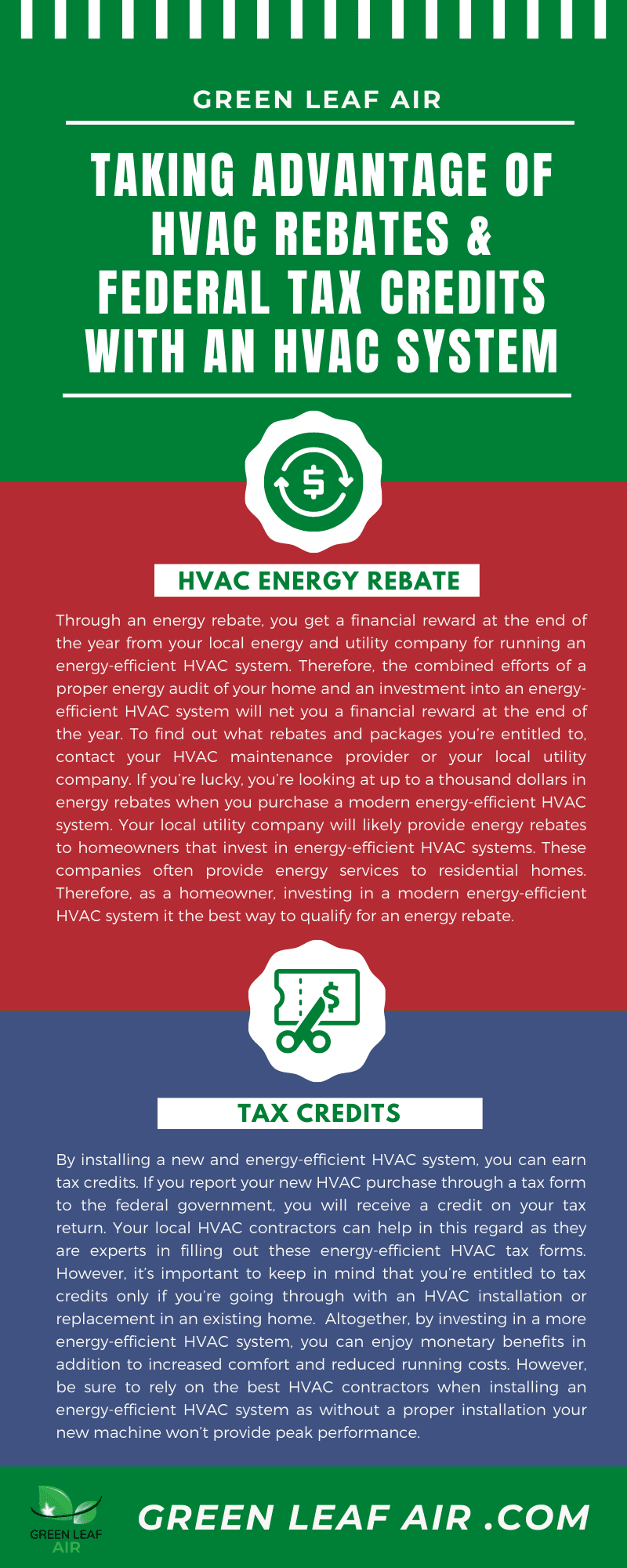

Taking Advantage Of HVAC Rebates Federal Tax Credits With An

Top Mass Save Rebate Form Templates Free To Download In PDF Format

Working From Home Tax Rebate

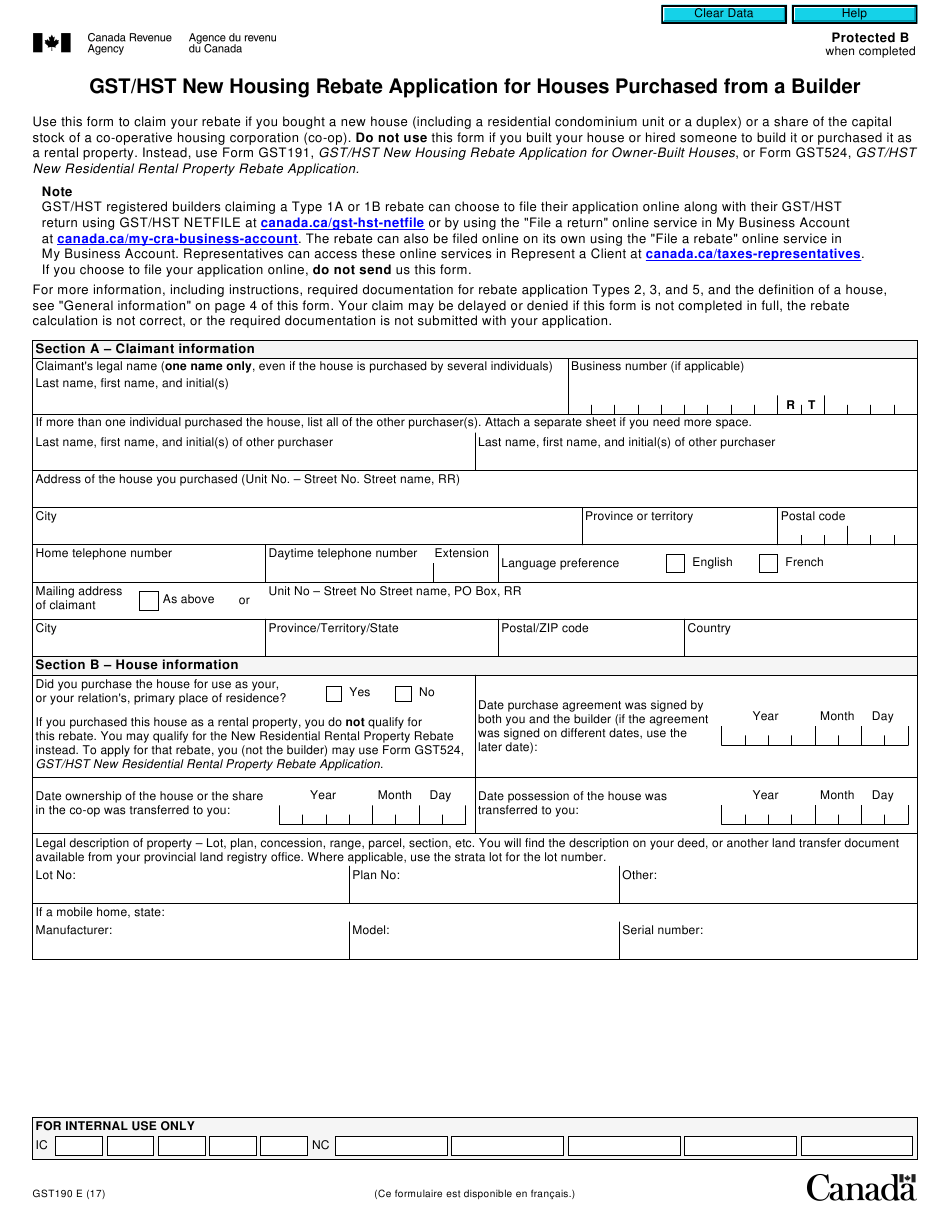

Form GST524 Download Fillable PDF Or Fill Online Gst Hst New

Heat Pump Water Heater Archives Robins Plumbing Inc

Claiming Tax Back When Working From Home Tax Rebates

Claiming Tax Back When Working From Home Tax Rebates

Pin On Canada Home Tax Rebate

2016 Federal Tax Rebates HB McClure

Florida Energy Rebates For Air Conditioners Fcs3266 Fy1032 Energy

Federal Tax Rebate Work From Home - Web 8 f 233 vr 2022 nbsp 0183 32 Working from home or any location away from the office can come with some benefits A simplified tax situation may not be one of them If you worked remotely