Irs Tax Deduction For Working From Home Verkko 1 helmik 2023 nbsp 0183 32 There are two ways to claim the deduction The first is the so called simplified way which enables you to deduct 5 per square foot of your home office with a 300 square foot cap for a

Verkko 31 tammik 2023 nbsp 0183 32 Share Key Points Most employees aren t eligible for the home office deduction but you may qualify as a contractor or with a side business To claim the tax break your workspace must be the Verkko 12 jouluk 2023 nbsp 0183 32 For example if you have a 300 square foot home office the maximum size allowed for this method and you work from home for three months 25 of the year your deduction is 375 300 x

Irs Tax Deduction For Working From Home

Irs Tax Deduction For Working From Home

https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/5fff0445fc482eb821062bc3_man-working-from-home.jpg

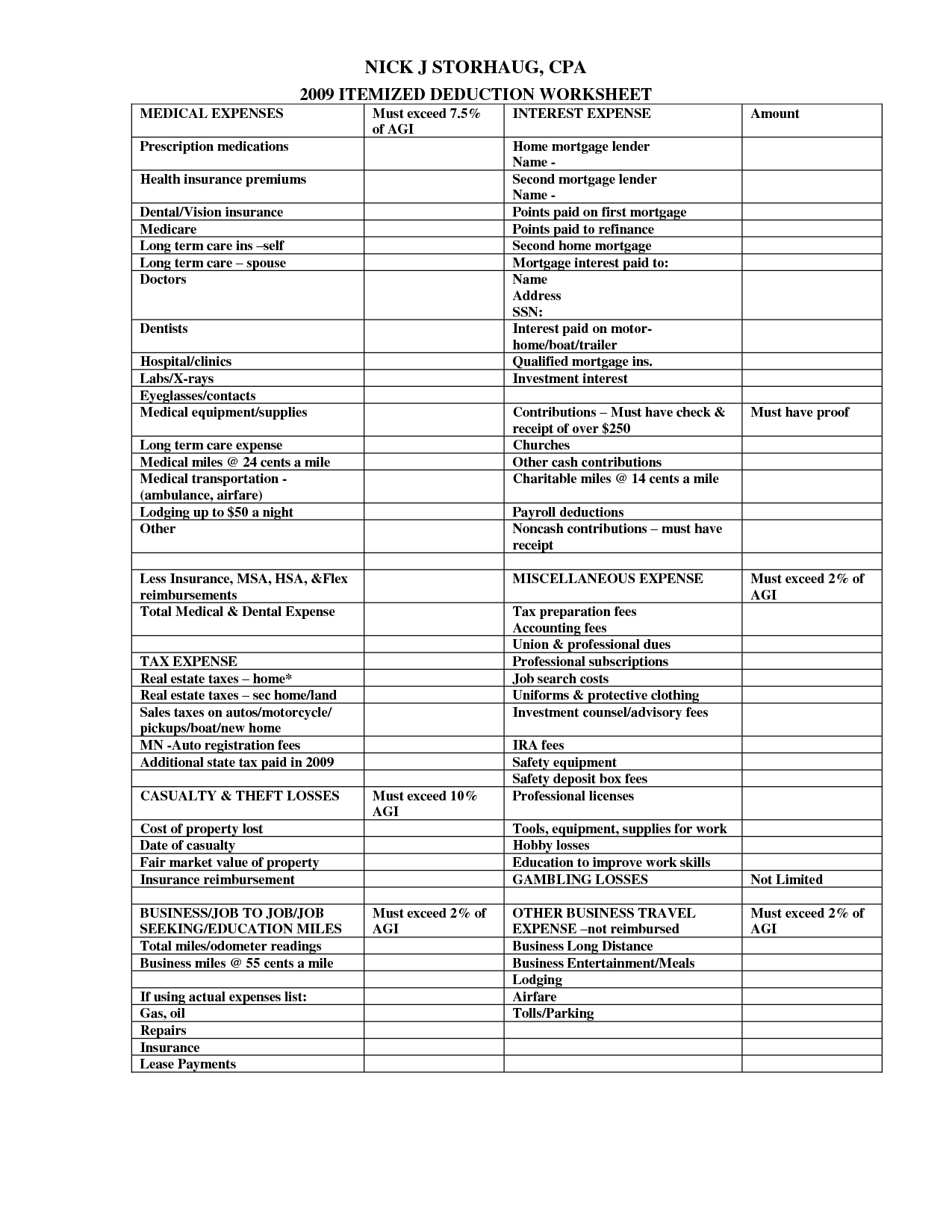

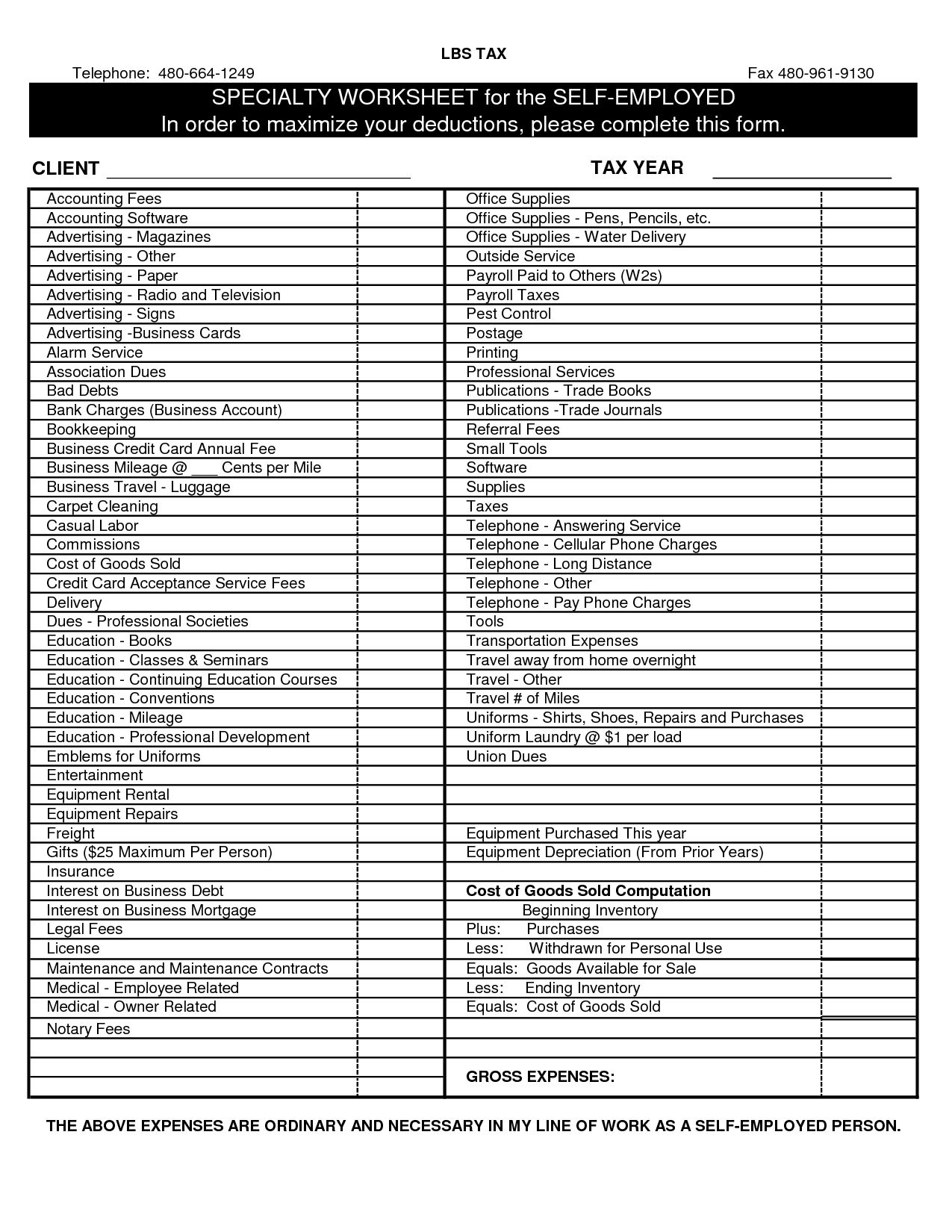

10 Business Tax Deductions Worksheet Worksheeto

https://www.worksheeto.com/postpic/2011/08/tax-itemized-deduction-worksheet_472223.png

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

https://www.investopedia.com/thmb/JjB8KxvTErLB2ZgozO3H_wkKoNA=/2338x2338/smart/filters:no_upscale()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg

Verkko 18 jouluk 2023 nbsp 0183 32 Tax deductions for expenses needed to work from home are only available to taxpayers who itemize their deductions Also work from home expenses can only be written off if they exceed 2 of adjustable gross income Verkko 19 lokak 2023 nbsp 0183 32 Can you claim work from home tax deductions Who can claim 2023 tax deductions when working from home Tax Tip 1 Deduct home office expenses if you only worked for yourself or worked for yourself in addition to a W 2 job Tax Tip 2 Keep thorough records and save receipts

Verkko 21 jouluk 2023 nbsp 0183 32 In other words if you work full time as a freelancer or have a side hustle that requires an office you qualify to deduct a portion of your home s expenses The IRS used to allow W 2 employees to deduct expenses related to working from home but Congress changed that with its 2017 tax reform bill A few very specific Verkko Work from home WFH tax deductions are business expenses that you can subtracted from revenue to lower your tax bill But these deductions almost exclusively apply to those who own their

Download Irs Tax Deduction For Working From Home

More picture related to Irs Tax Deduction For Working From Home

2023 IRS Standard Deduction

https://betterhomeowners.com/images/cached/deed5a26-242c-4893-95cb-399057c10352.jpg

Top Home Business Tax Deductions 3 Things The Irs Requires For Tax

https://i.ytimg.com/vi/OM3h3DKdH4U/maxresdefault.jpg

Can You Take A Tax Deduction For Working From Home Wallpaper

https://www.tomorrowmakers.com/images/article/large/tax-deductions-you-must-have-if-you-work-from-home.jpg

Verkko 6 helmik 2023 nbsp 0183 32 In this scenario you can deduct 10 of your actual eligible expenses because that s the size of your business space in relation to your home s size Let s assume you have the following Verkko 28 marrask 2023 nbsp 0183 32 If you re an employee working remotely rather than a business owner you unfortunately don t qualify for the home office tax deduction however some states do allow this tax deduction for employees Prior to the Tax Cuts and Job Act TCJA passed in 2017 employees could deduct unreimbursed employee business

Verkko 8 helmik 2023 nbsp 0183 32 7 Essential Rules for Claiming a Work From Home Tax Deduction Thinking about claiming a home office deduction on your tax return Follow these tips to avoid raising any eyebrows at the IRS when you file your 2022 tax return which is due on April 18 2023 1 You can t claim it if you re a regular employee even if your company Verkko You can deduct travel expenses paid or incurred in connection with a temporary work assignment away from home However you can t deduct travel expenses paid in connection with an indefinite work assignment Any work assignment in excess of one year is considered indefinite

IRS Schedule C Tax Deductions Expenses For Small Business Owners

https://www.moneycrashers.com/wp-content/uploads/2018/02/home-office-tax-deduction-1200x802.jpg

IRS 2017 Tax Deduction Schedule For LTC Insurance LTC News

https://www.ltcnews.com/site_data/articles/104/Article-Image.jpg

https://finance.yahoo.com/news/taxes-2023-qualify-home-office...

Verkko 1 helmik 2023 nbsp 0183 32 There are two ways to claim the deduction The first is the so called simplified way which enables you to deduct 5 per square foot of your home office with a 300 square foot cap for a

https://www.cnbc.com/2023/01/31/how-to-know-if-you-can-claim-the-home...

Verkko 31 tammik 2023 nbsp 0183 32 Share Key Points Most employees aren t eligible for the home office deduction but you may qualify as a contractor or with a side business To claim the tax break your workspace must be the

California Individual Tax Rate Table 2021 20 Brokeasshome

IRS Schedule C Tax Deductions Expenses For Small Business Owners

The IRS Tax Deduction Calculator Updated Guide Shoeboxed

2016 Self Employment Tax And Deduction Worksheet Db excel

Can You Get A Tax Deduction For Working From Home YouTube

Home Sweet Home Team Blog Blog Archive Home Related Tax Deduction

Home Sweet Home Team Blog Blog Archive Home Related Tax Deduction

Printable Itemized Deductions Worksheet

New IRS Efforts To Destroy Tax Deductions For PPP Paid Expenses

When Is Working From Home A Tax Deduction TL DR Accounting

Irs Tax Deduction For Working From Home - Verkko 20 tammik 2023 nbsp 0183 32 For those filing in 2023 the standardized deduction is 12 950 for single filers 19 400 for head of household filers and 25 900 for married people filing jointly Most people working at home would have expenses well below those figures Self employed workers who are considered business owners by the IRS can still