Green Energy Tax Incentives Canada There are many different kinds of green incentives available in Canada including both tax benefits and cash grants at both the federal and provincial level in addition to general innovation programs You can combine many of these

Find out about the sustainability related tax incentives loans rebates and other programs that boost climate action in Canada Fixed Rate plans give you a single guaranteed rate for your electricity or natural gas that won t change Regardless of whether your organization plans to or has already started investing in clean energy or simply plans to see if it may be eligible it s critical to understand the tax credits that may be available the project

Green Energy Tax Incentives Canada

Green Energy Tax Incentives Canada

https://www.designnews.com/sites/designnews.com/files/cleanenergy.jpg

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

https://www.eesi.org/images/content/Summary_of_Clean_Energy_Credits.png

Redirecting

https://heinonline.org/HOL/ViewImageLocal?handle=hein.journals/nre25&div=52&collection=&method=preview&ext=.png&size=3

As a business you may be eligible for tax credits for investments in Canada that support the transition to net zero emissions Carbon Capture Utilization and Storage CCUS Tax credits can lower the amount of taxes you owe while rebates can make it more affordable to buy or install energy efficient products The Federal Government of Canada offers several tax incentives to encourage

New editions of the technical guides for business income tax incentives for clean energy generation and energy conservation were published on December 12 2014 These guides This Tax Insights provides an overview of the draft legislation for the CE ITC and the various amendments to the other clean economy ITCs including adding certain waste biomass equipment to the clean technology

Download Green Energy Tax Incentives Canada

More picture related to Green Energy Tax Incentives Canada

When And How To Claim Green Energy Tax Credits CLA CliftonLarsonAllen

https://blogs.claconnect.com/nonprofitinnovation/wp-content/uploads/2023/01/Mixed-group-of-business-people-sitting-around-a-table-and-talking.jpg

The House Build Back Better Act Damages The Oil And Gas Industry

https://www.instituteforenergyresearch.org/wp-content/uploads/2021/12/Green-Energy-Tax-Incentives.png

Green Energy Tax Credits For Home Improvement Energy Efficiency

https://i.pinimg.com/736x/32/8c/f2/328cf23005ae5340da3e0af56d40c6e6.jpg

The Oil to Heat Pump Affordability Program is a grant designed for low income Canadians who are looking to switch from oil to the newer more energy efficient heat pumps The Canadian government has proposed five new refundable investment tax credits ITCs designed to grow Canada s clean economy and allow Canada to remain competitive in attracting investment in clean energy

Over the past few years the Department of Finance Canada Finance has proposed a cluster of green energy tax incentives aimed at encouraging both the development Budget 2024 announces further details on and in certain cases expands previously announced investment tax credits ITCs to support the adoption of clean energy

Green Energy Tax Incentives

https://lirp.cdn-website.com/a7c50309/dms3rep/multi/opt/Green+Energy+Tax+Incentives-1920w.jpg

NobleProfit Moment With Rod Richardson Green Energy Tax Cuts Can They

https://i.ytimg.com/vi/7B3pfmgdb5Y/maxresdefault.jpg

https://www.pwc.com › ca › en › today-s-is…

There are many different kinds of green incentives available in Canada including both tax benefits and cash grants at both the federal and provincial level in addition to general innovation programs You can combine many of these

https://energyrates.ca › sustainability-incen…

Find out about the sustainability related tax incentives loans rebates and other programs that boost climate action in Canada Fixed Rate plans give you a single guaranteed rate for your electricity or natural gas that won t change

Commercial Property Condition Assessments PCA Property Inspection Blog

Green Energy Tax Incentives

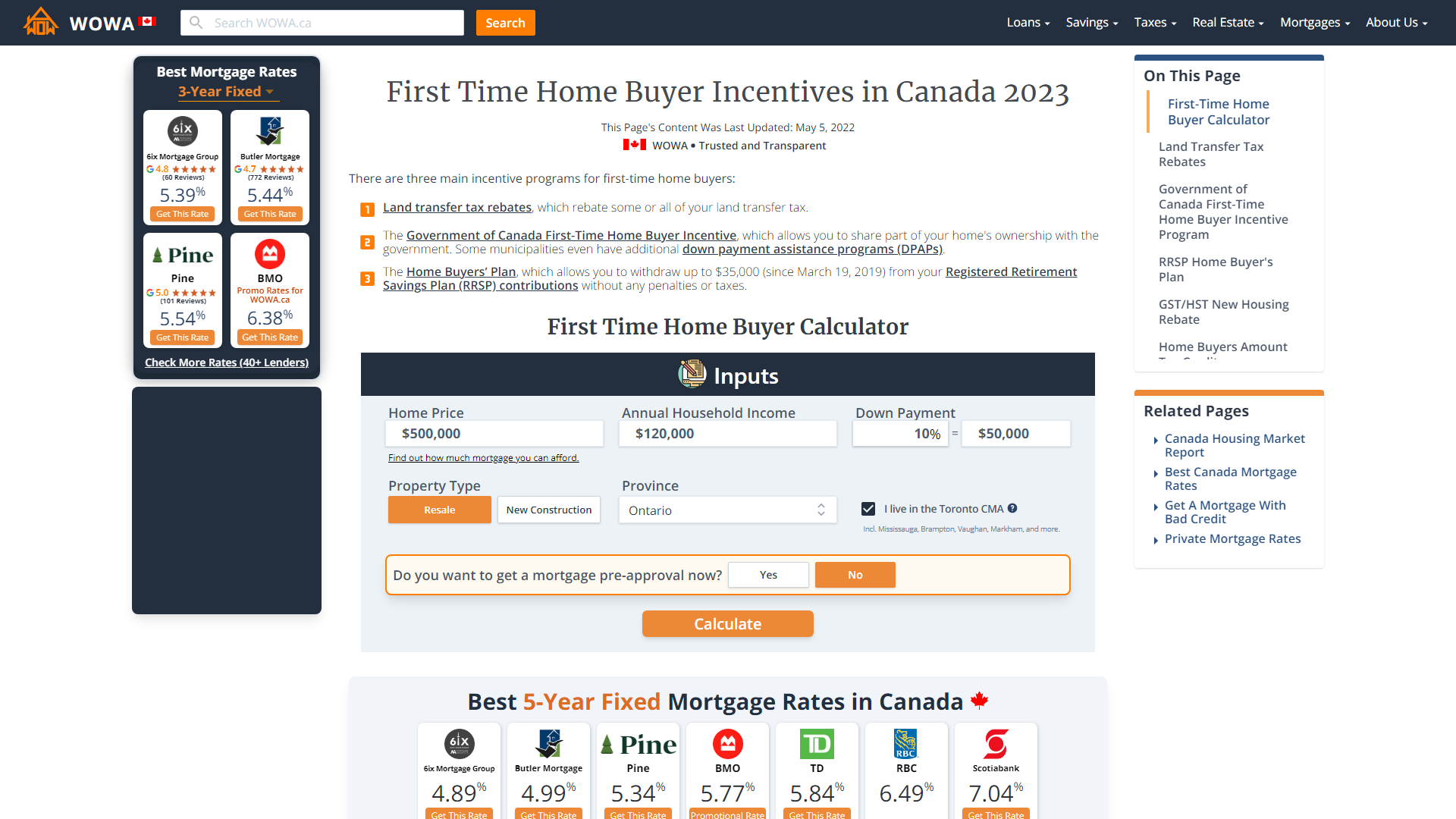

First Time Home Buyers Incentives Canada 2023 WOWA ca

Understanding The Expanded Benefits Of Energy Tax Incentives Under 179D

First Time Home Buyer Incentives Rebates In Ontario Canada 2022

Inflation Reduction Act Green Credits And Rebates Green Mountain Energy

Inflation Reduction Act Green Credits And Rebates Green Mountain Energy

How Recyclers Can Take Advantage Of Tax Incentives

SRED Canada SR ED Canada Tax Incentives In Canada

Oh Canada Virtual Incentives Expands Operations Throughout The Great

Green Energy Tax Incentives Canada - Tax credits can lower the amount of taxes you owe while rebates can make it more affordable to buy or install energy efficient products The Federal Government of Canada offers several tax incentives to encourage