Clean Energy Investment Tax Credit Canada Clean economy investment tax credits ITCs As a business you may be eligible for tax credits for investments in Canada that support the transition to net zero

These investment tax credits ITCs include the Clean Technology ITC and the Carbon Capture Utilization and Storage CCUS ITC which cover a portion of The Clean Electricity ITC would provide a 15 refundable tax credit for eligible investments in non emitting electricity generation systems wind concentrated solar solar photo voltaic hydro wave tidal

Clean Energy Investment Tax Credit Canada

Clean Energy Investment Tax Credit Canada

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2022-10/Summary-ITC-and-PTC-Values-Table.png?itok=_72eWNBC

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

https://www.eesi.org/images/content/Summary_of_Clean_Energy_Credits.png

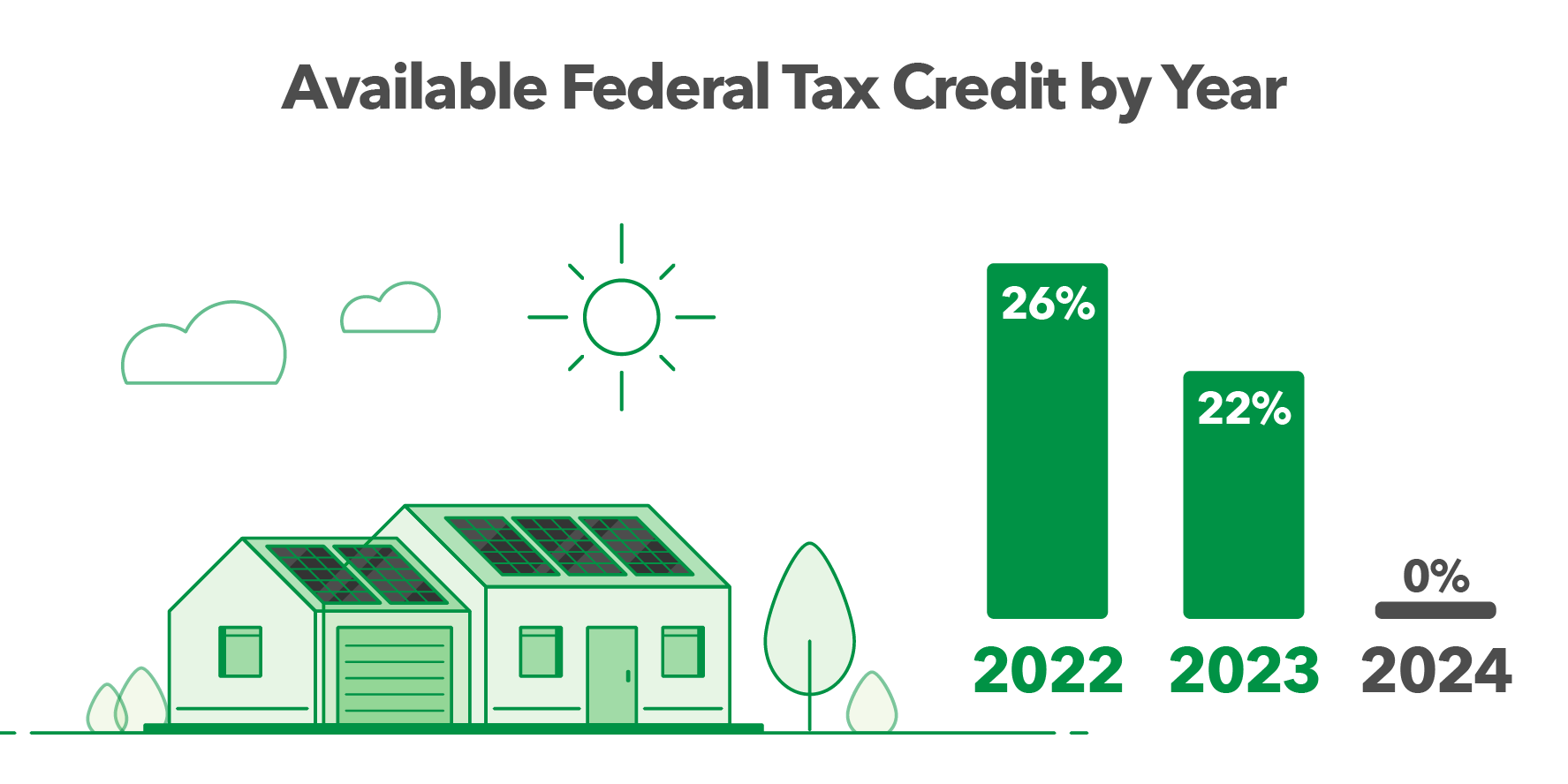

Federal Solar Tax Credit What It Is How To Claim It For 2024

https://www.ecowatch.com/wp-content/uploads/2022/10/Solar-Investment-Tax-Credit-5-1-2.png

This Tax Insights provides an overview of the draft legislation for the CE ITC and the various amendments to the other clean economy ITCs including adding certain The Canadian government has proposed five new refundable investment tax credits ITCs designed to grow Canada s clean economy and allow Canada to remain competitive in attracting investment in clean

Budget 2024 announces further details on and in certain cases expands previously announced investment tax credits ITCs to support the adoption of clean Clean Technology Investment Tax Credit The 30 refundable Clean Tech ITC was first announced in the 2022 Fall Economic Statement The credit is available for

Download Clean Energy Investment Tax Credit Canada

More picture related to Clean Energy Investment Tax Credit Canada

With The Participation Of Canada The Canadian Film Of Video Production

https://i.pinimg.com/originals/aa/60/32/aa60329d06ee2c2b47c1f795c44d3048.png

Tax Mitigation Solar International Legacy Solutions

https://internationallegacysolutions.com/wp-content/uploads/2023/03/iStock-1350734924-mono-scaled.jpg

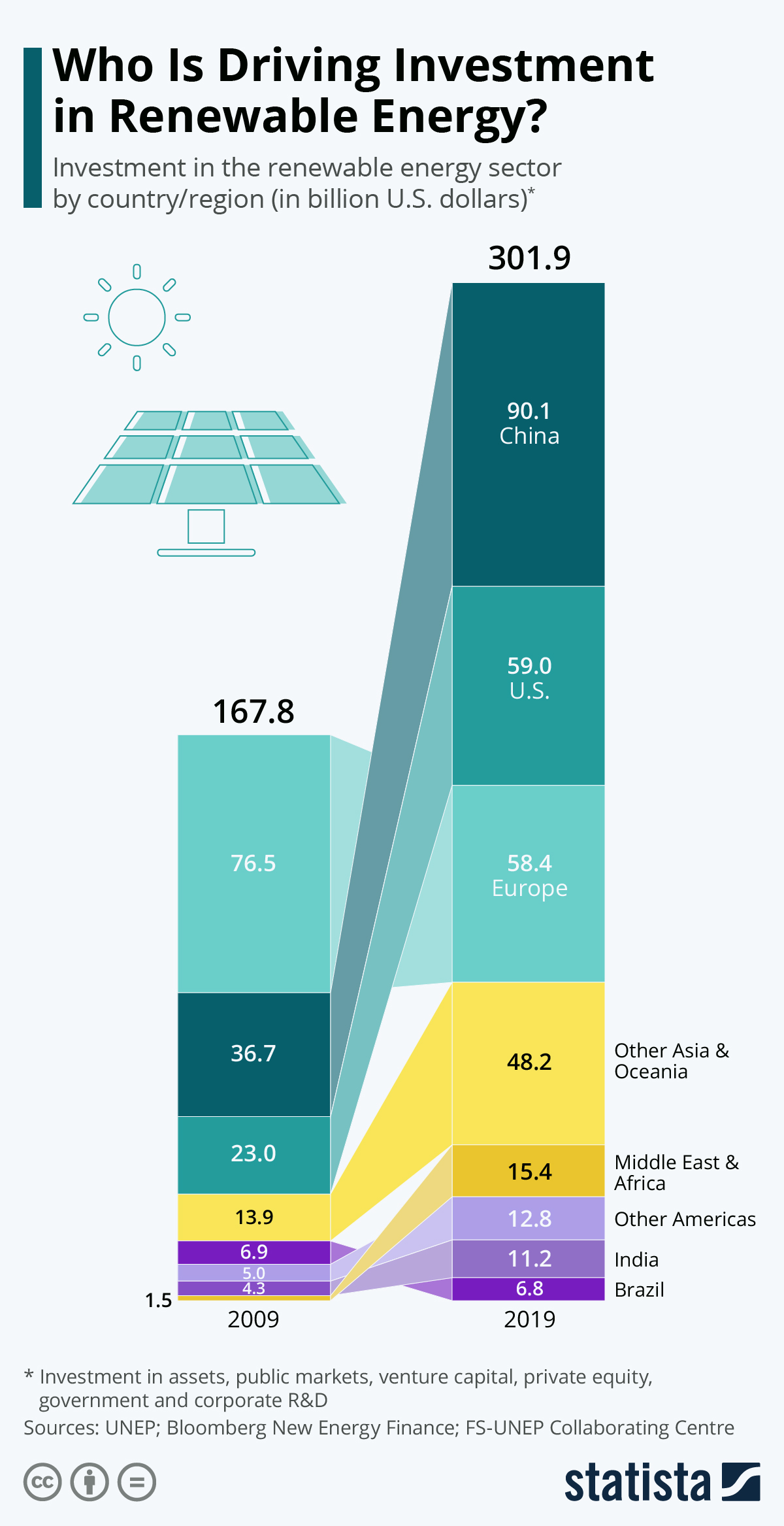

Chart Who Is Driving Investment In Renewable Energy Statista

http://cdn.statcdn.com/Infographic/images/normal/22877.jpeg

Budget 2024 announces a new ITC to support the electric vehicle supply chain in Canada This new investment tax credit referred to as the EV Supply Chain ITC is proposed On November 21 2023 the federal government presented its Fall Economic Statement which included delivery timelines for the five clean economy refundable investment

New refundable investment tax credits aim to incentivize the development and adoption of clean technologies and energy helping Canada meet its greenhouse gas emissions Introducing a 15 percent refundable Clean Electricity Investment Tax Credit for eligible investments in technologies that are required for the generation and storage

International Energy Agency On Twitter While Global Clean Energy

https://pbs.twimg.com/media/F0rqO-qXsAIGH4v.jpg:large

Overview New Renewable Energy Tax Credit Under Section 48

https://www.pbmares.com/wp-content/uploads/2023/07/PBMares-Feature-Image-Construction-real-Estate-blog-post-Energy-Tax-Creditss.png

https://www.canada.ca/.../clean-economy-itc.html

Clean economy investment tax credits ITCs As a business you may be eligible for tax credits for investments in Canada that support the transition to net zero

https://www.bdo.ca/insights/clean-technology-and...

These investment tax credits ITCs include the Clean Technology ITC and the Carbon Capture Utilization and Storage CCUS ITC which cover a portion of

2023 Residential Clean Energy Credit Guide ReVision Energy

International Energy Agency On Twitter While Global Clean Energy

Federal Investment Tax Credit ITC For Solar Panels

Investment Tax Credit Canada Budget To Have Tax Credit For Equipment

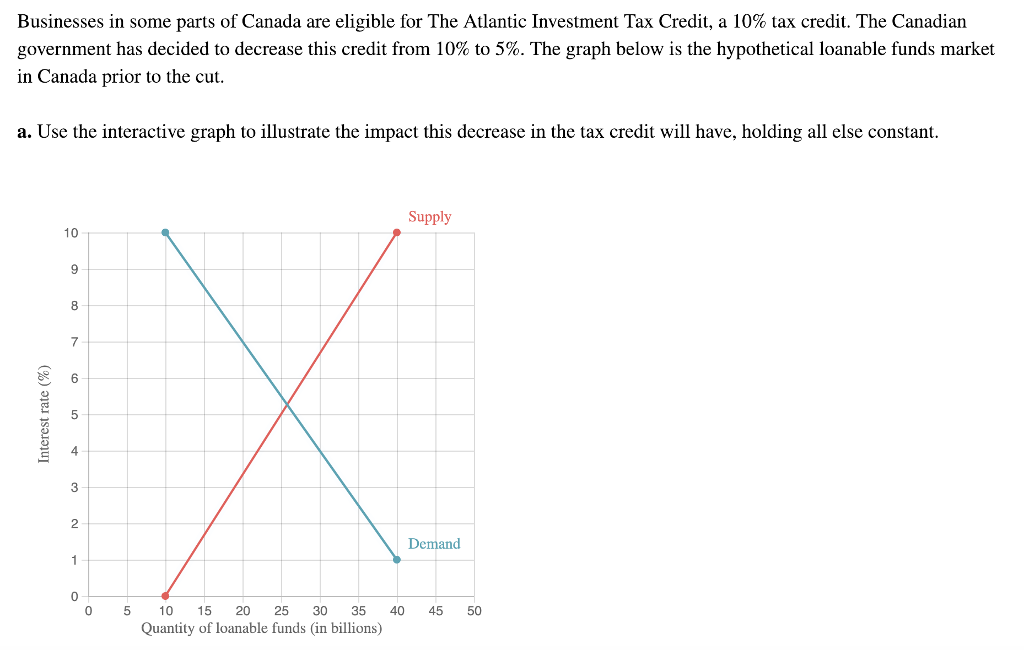

Solved Businesses In Some Parts Of Canada Are Eligible For Chegg

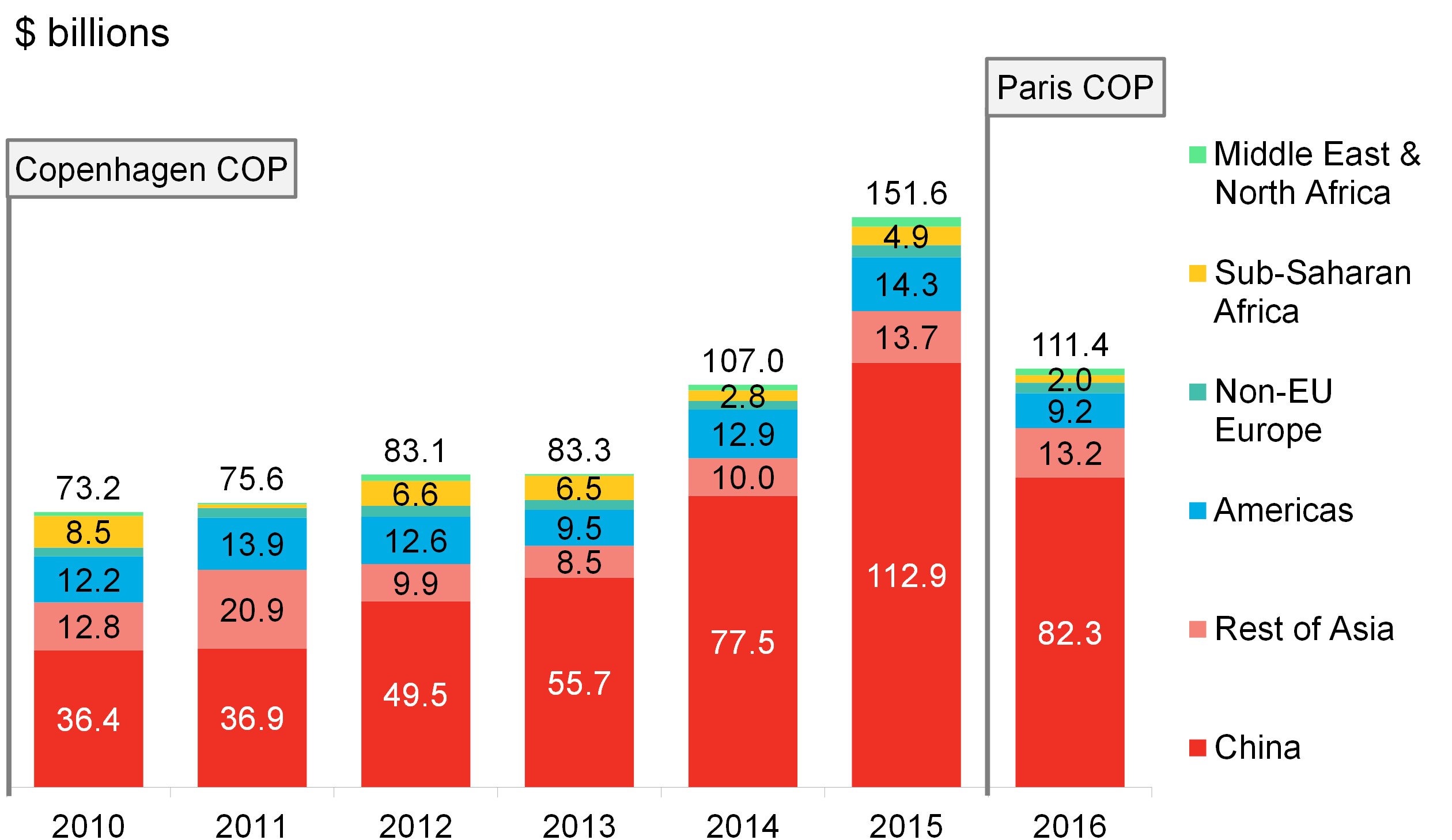

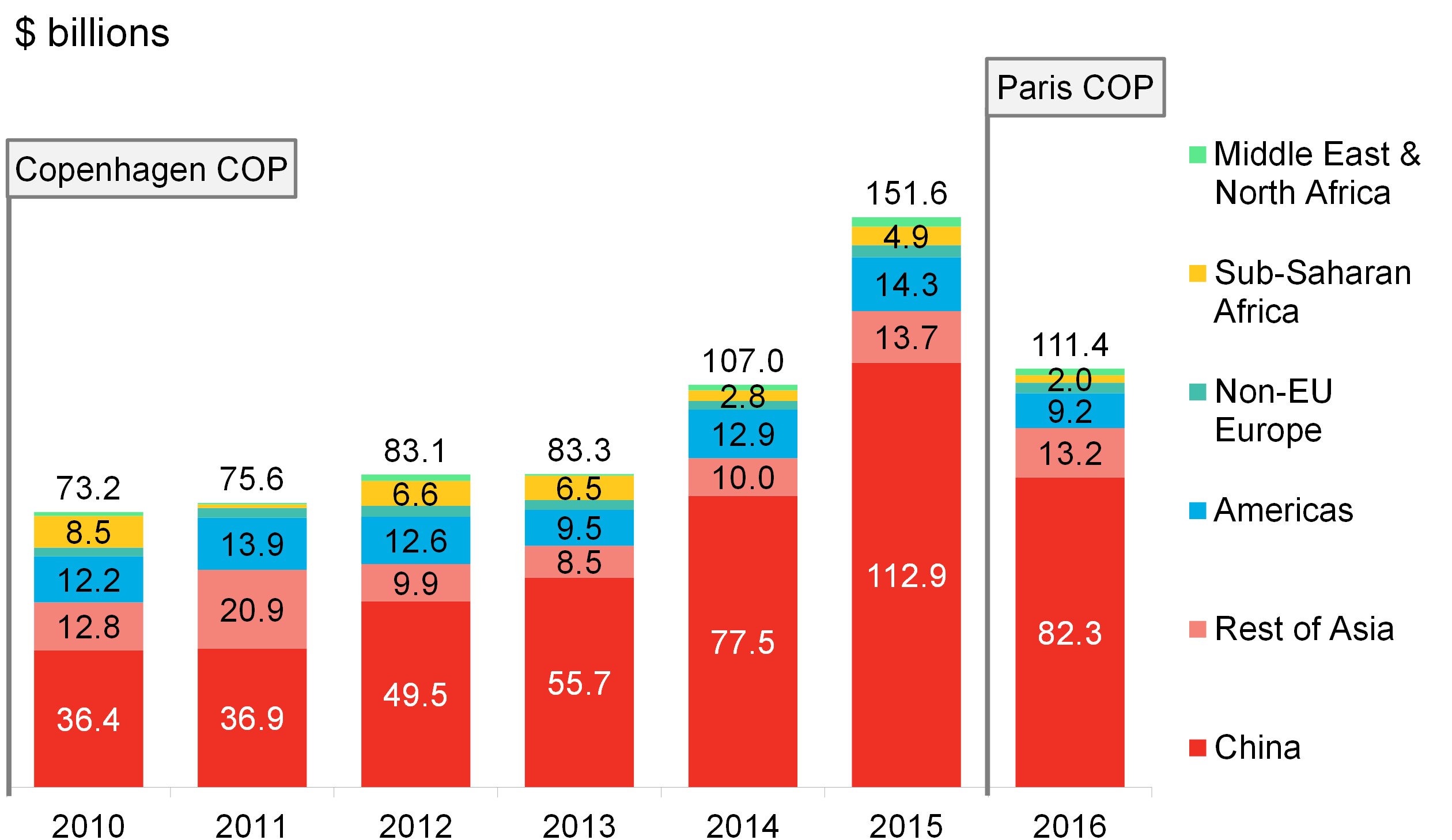

Emerging Markets Clean Energy Investment Climatescope 2017

Emerging Markets Clean Energy Investment Climatescope 2017

What Is The Solar Tax Credit

Federal Tax Credit ITC For Solar Energy Gets Extended

The Federal Solar Tax Credit Can Save You Thousands Green Ridge Solar

Clean Energy Investment Tax Credit Canada - This Tax Insights provides an overview of the draft legislation for the CE ITC and the various amendments to the other clean economy ITCs including adding certain