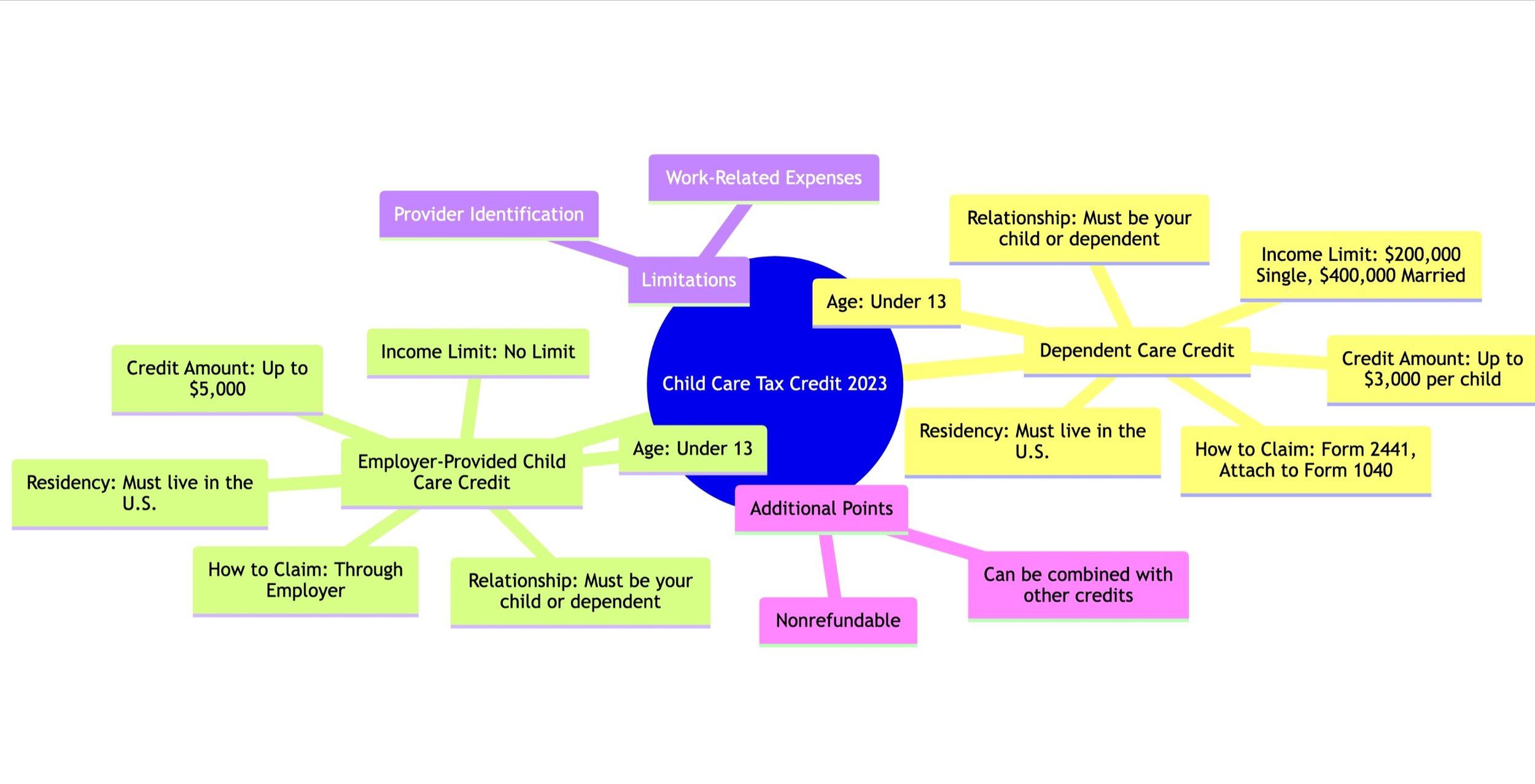

Health Care Tax Credits 2023 Verkko A1 The premium tax credit is a refundable tax credit designed to help eligible individuals and families with low or moderate income afford health insurance purchased through

Verkko 4 elok 2022 nbsp 0183 32 The IRS has announced 2023 indexing adjustments for important percentages under the Affordable Care Act ACA The required contribution Verkko 4 marrask 2022 nbsp 0183 32 Within this provision a refundable premium tax credit PTC is available on a sliding scale basis for individuals and families who are enrolled in a qualified health plan purchased on the state or

Health Care Tax Credits 2023

Health Care Tax Credits 2023

https://images.squarespace-cdn.com/content/v1/5d940768938dd828fc033675/77a228a5-aaee-47f8-a4be-e62a1c4783b2/Web+capture_25-10-2023_224527_showme.redstarplugin.com.jpeg

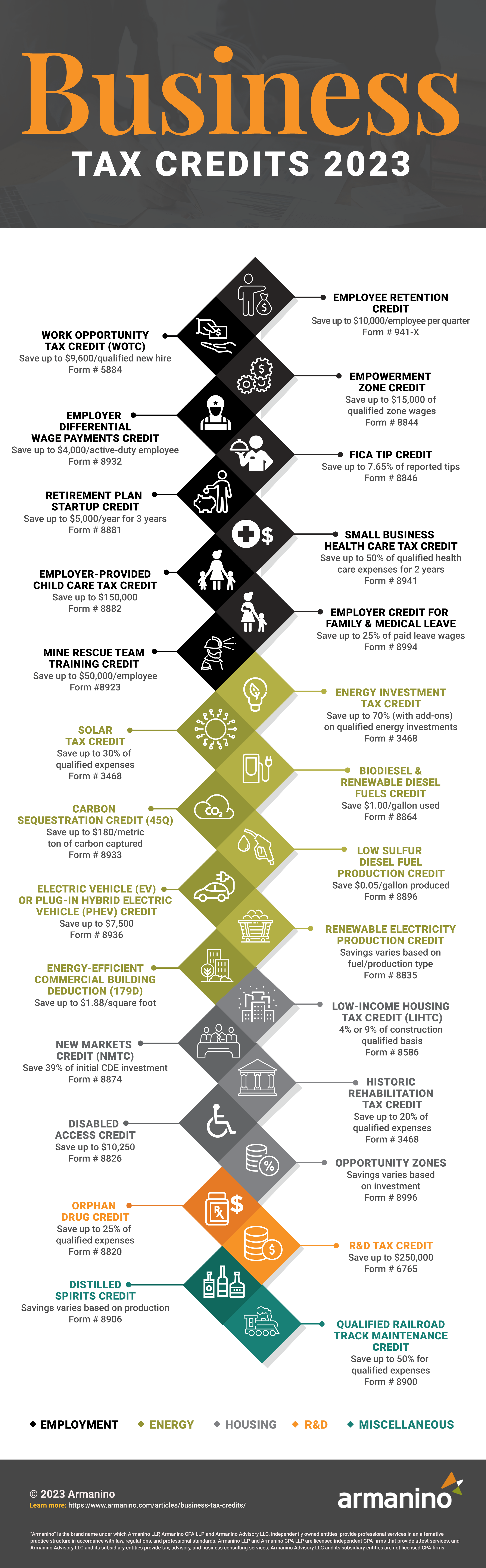

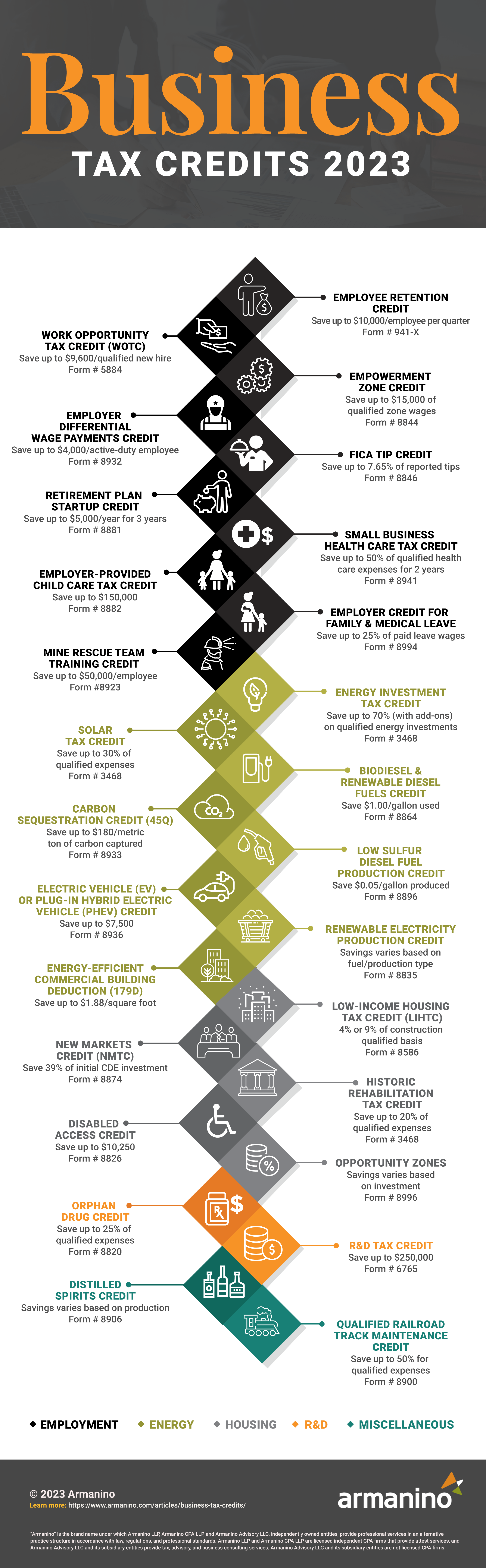

Business Tax Credits 2023 Armanino

https://www.armanino.com/-/media/images/articles/business-tax-credits-2023-infographic.png

IRS Offers Relief To Employers Claiming Small Business Health Care Tax

http://tehcpa.net/wp-content/uploads/2018/04/Small-Business-Health-Care-Tax-Credit-for-2017.jpg

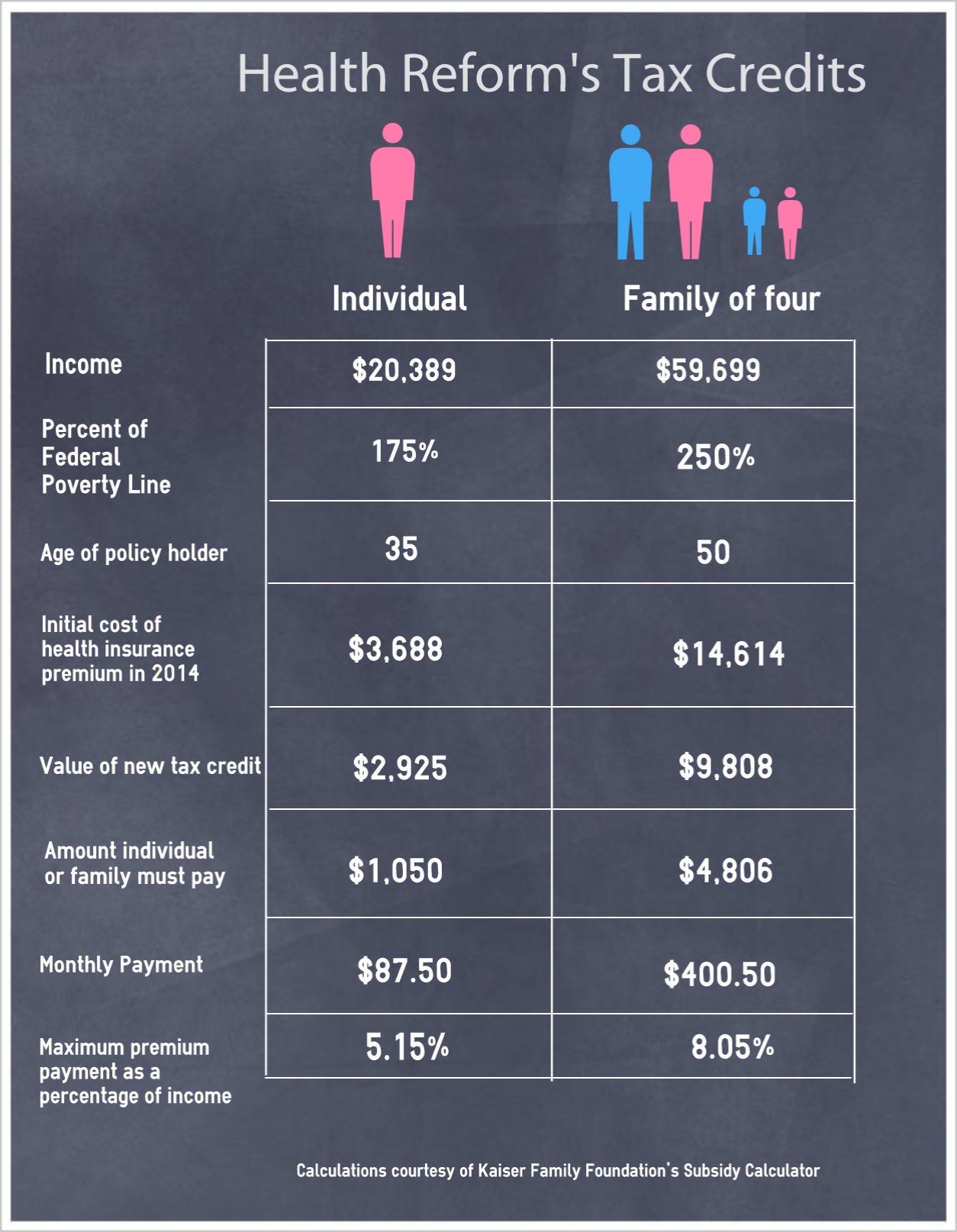

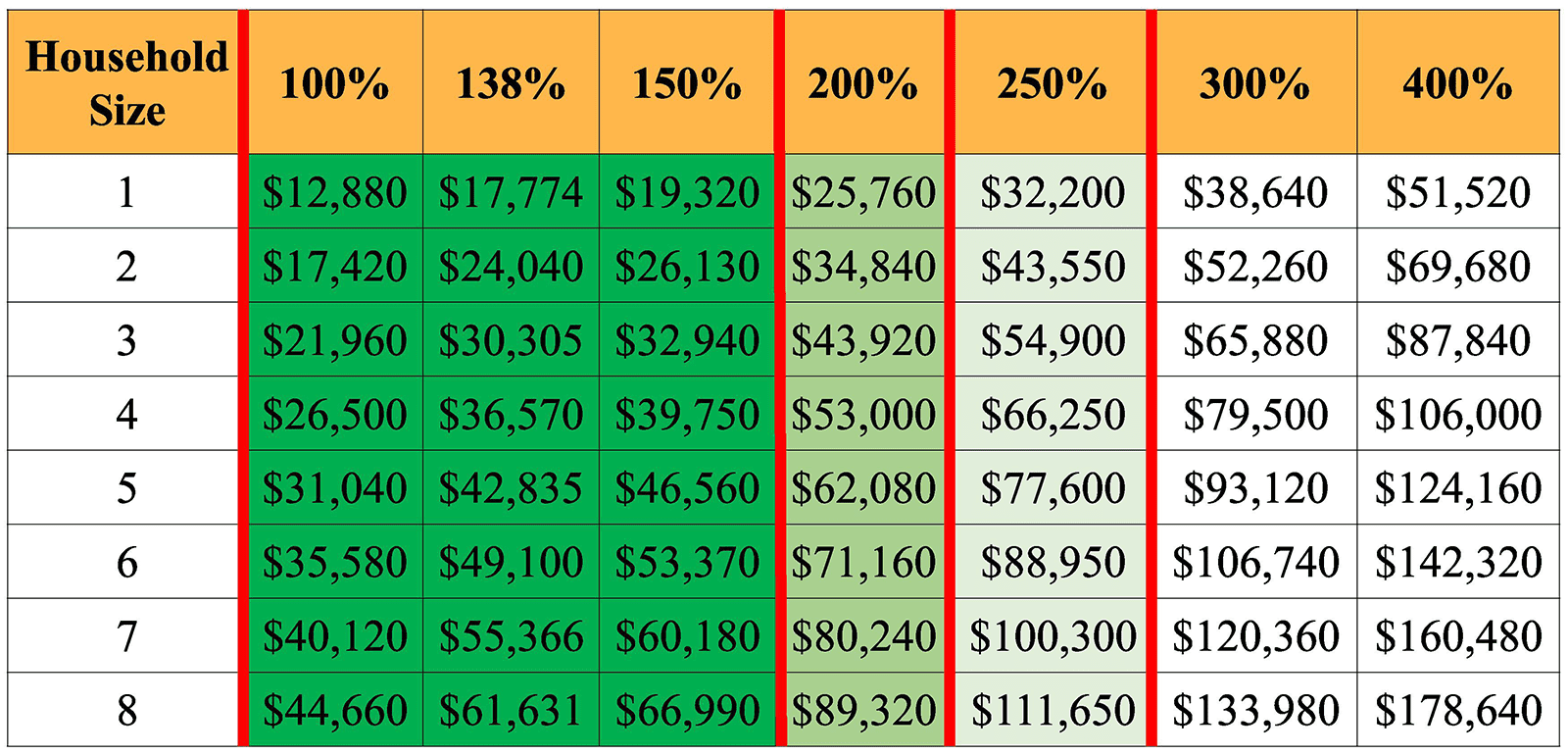

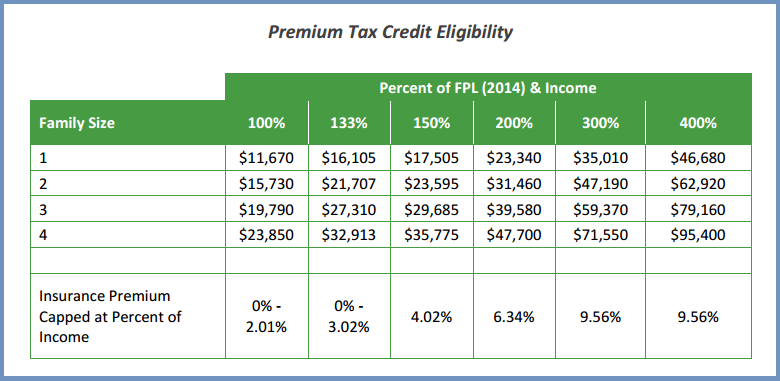

Verkko The Premium Tax Credit helps eligible individuals and families afford health insurance purchased through the Health Insurance Marketplace The IRS will soon mail letters Verkko 5 jouluk 2023 nbsp 0183 32 To be eligible for the premium tax credit your household income must be at least 100 percent and for years other than 2021 and 2022 no more than 400

Verkko The Small Business Health Care Tax Credit Estimator can help you determine if you might be eligible for the Small Business Health Care Tax Credit and how much credit Verkko 17 tammik 2023 nbsp 0183 32 Health Insurance Premium Tax Credit and Cost Sharing Reductions Updated January 17 2023 Congressional Research Service

Download Health Care Tax Credits 2023

More picture related to Health Care Tax Credits 2023

Health Care Tax Credits Eligibility And Economic Impact Medill News

https://dc.medill.northwestern.edu/wp-content/uploads/2013/05/Health_Care_Credits_Infographics.jpg

Minnesota Tax Credits For Workers And Families

https://i0.wp.com/www.taxcreditsforworkersandfamilies.org/wp-content/uploads/2022/02/TCWF_knockout_horizontal.png?w=4439&ssl=1

ACA Tax Credits To Help Pay Premiums White Insurance Agency

https://www.whiteinsuranceokc.com/wp-content/uploads/sites/4713/2021/11/2022-FPL-CHART_0001.png

Verkko Published January 21 2022 Last Updated October 24 2023 Health Care Premium Tax Credit The Premium Tax Credit PTC makes health insurance more affordable by Verkko 18 lokak 2022 nbsp 0183 32 Sign In Employees in 2023 can contribute up to 3 050 to their health care flexible spending accounts FSAs pretax through payroll deduction a 200

Verkko 14 huhtik 2023 nbsp 0183 32 Tax credits for health care in 2023 Premium tax credit The premium tax credit is related to the Affordable Care Act and designed to help individuals and families pay the costs of health Verkko Medicaid Unwinding Premium tax credits are available to people who buy Marketplace coverage and whose income is at least as high as the federal poverty level For an

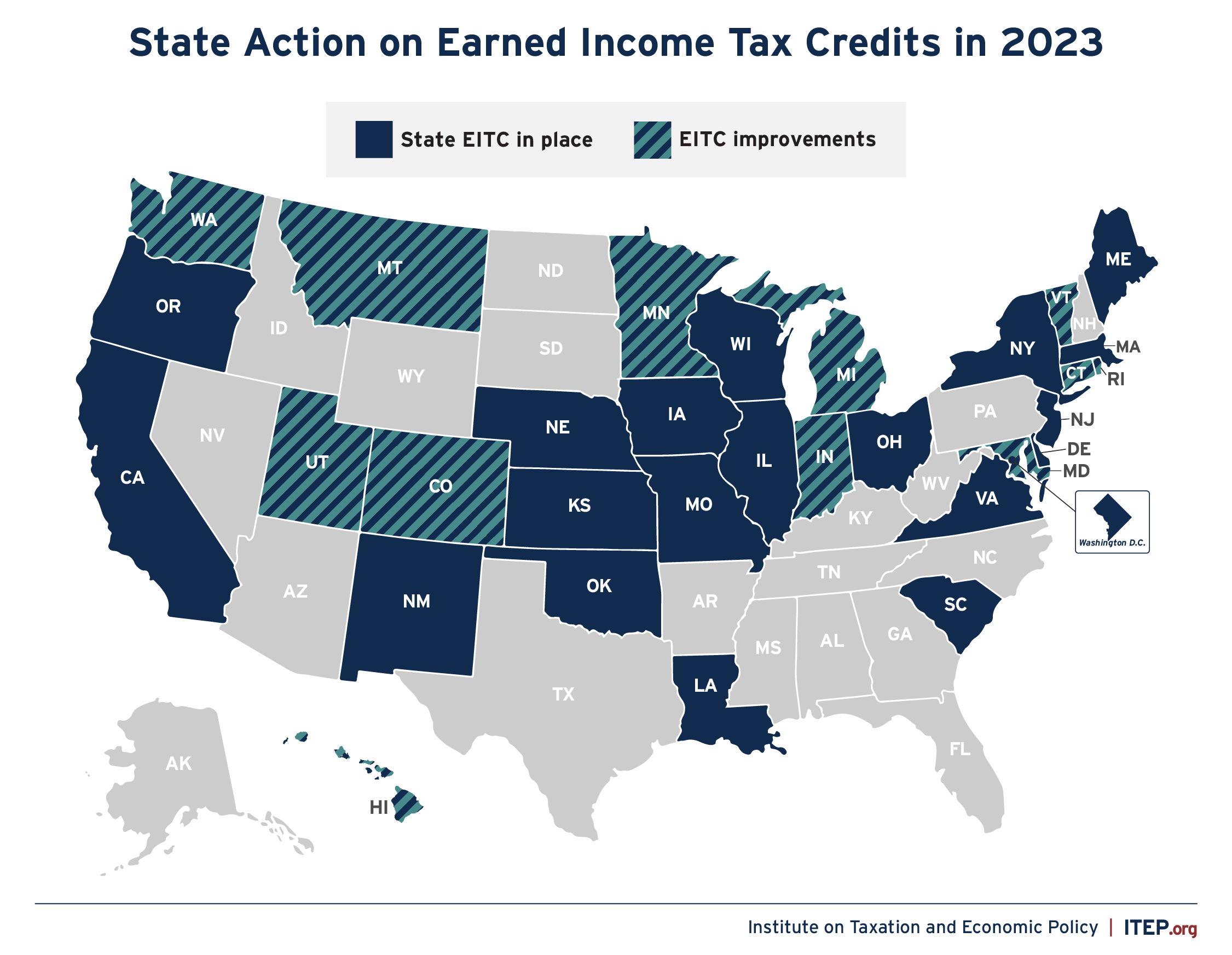

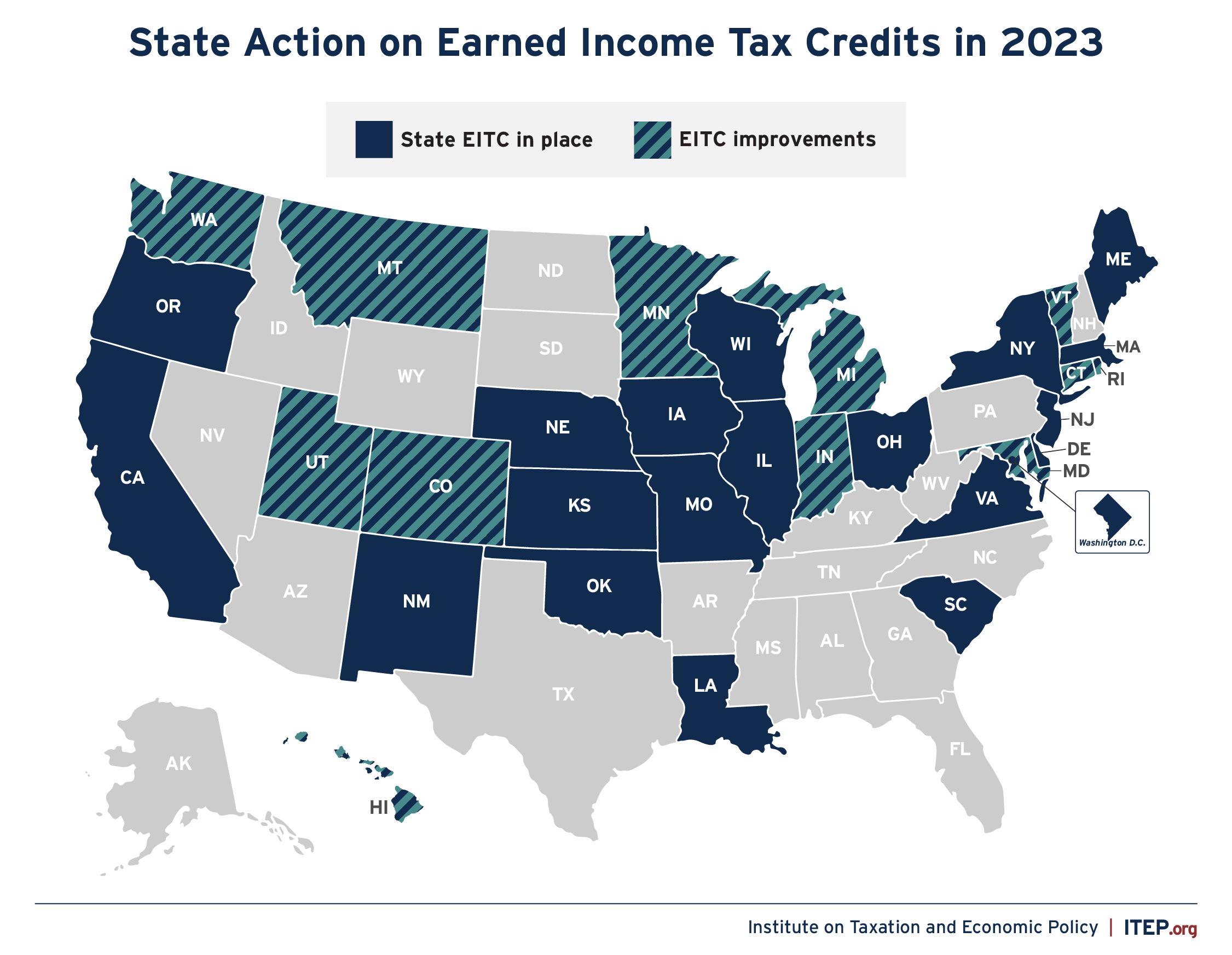

Refundable Credits A Winning Policy Choice Again In 2023 ITEP

https://sfo2.digitaloceanspaces.com/itep/EITC-2023.png

AGH Health Care Tax Credit Is Your Business Eligible

http://aghlc.com/images/health-care-tax-credit.jpg

https://www.irs.gov/.../questions-and-answers-on-the-premium-tax-credit

Verkko A1 The premium tax credit is a refundable tax credit designed to help eligible individuals and families with low or moderate income afford health insurance purchased through

https://tax.thomsonreuters.com/blog/irs-announces-indexing-adjustments...

Verkko 4 elok 2022 nbsp 0183 32 The IRS has announced 2023 indexing adjustments for important percentages under the Affordable Care Act ACA The required contribution

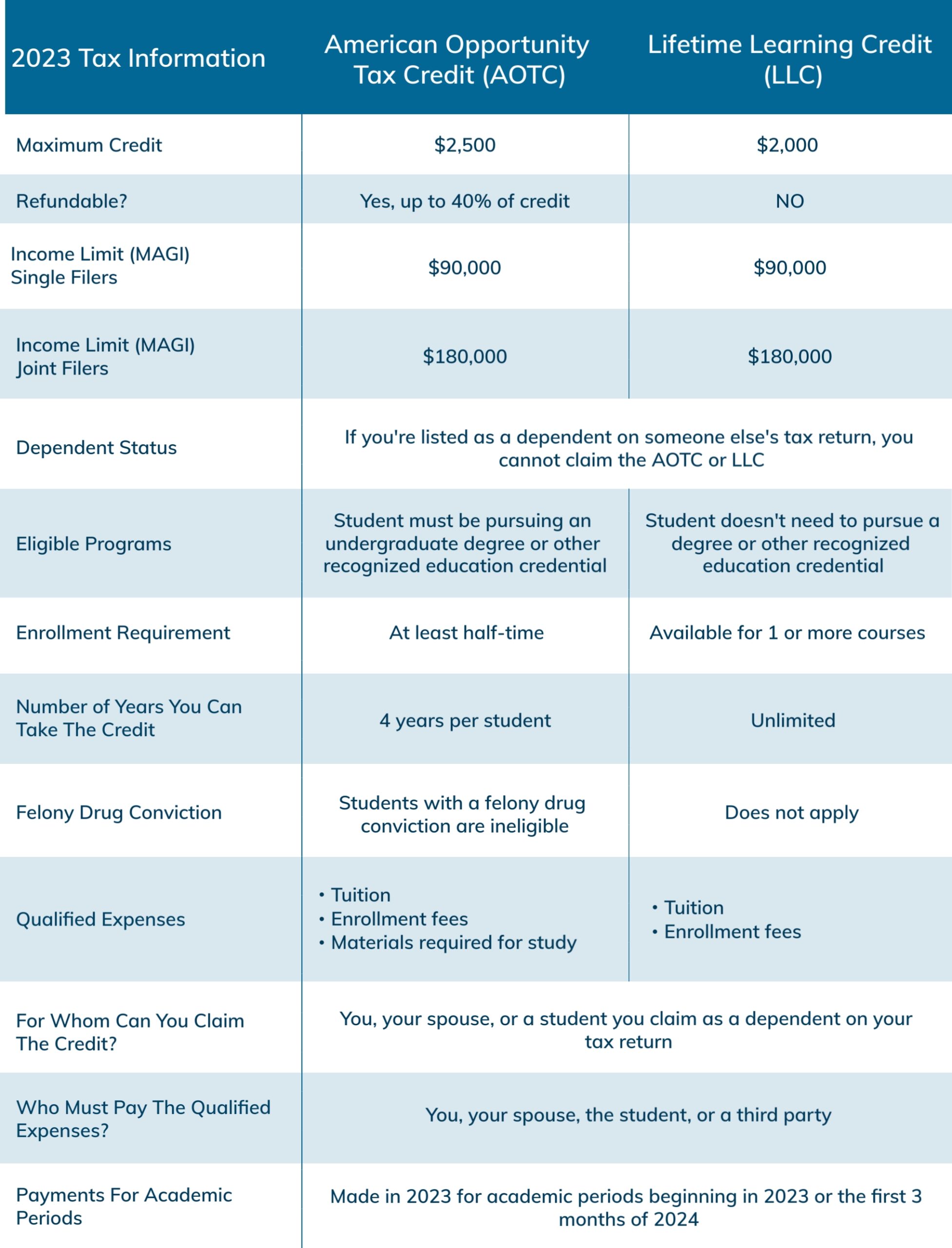

2023 Education Tax Credits Are You Eligible

Refundable Credits A Winning Policy Choice Again In 2023 ITEP

Georgia Tax Credits For Workers And Families

T22 0188 Repeal Child Tax Credit CTC Earned Income Threshold By

New 2023 IRS Income Tax Brackets And Phaseouts

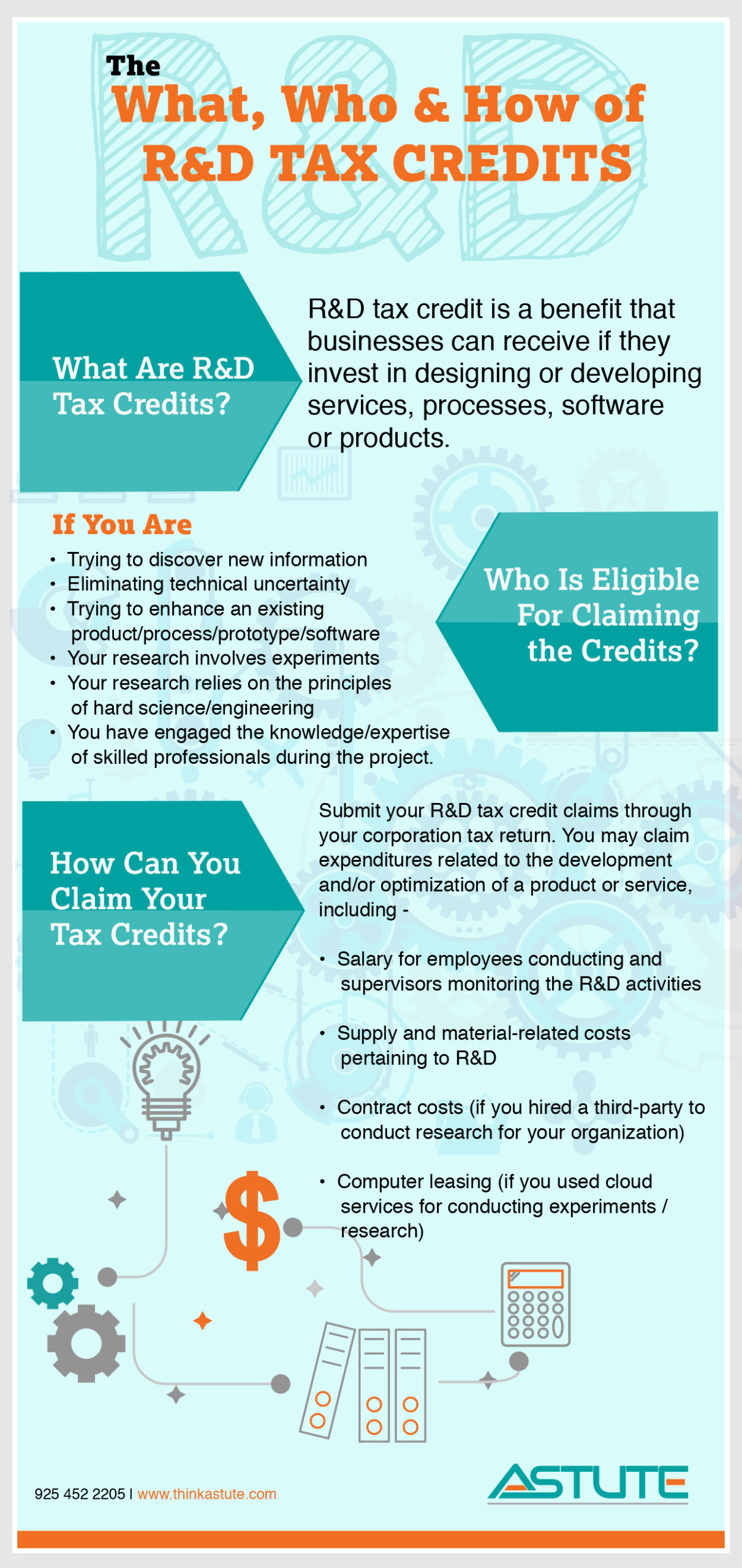

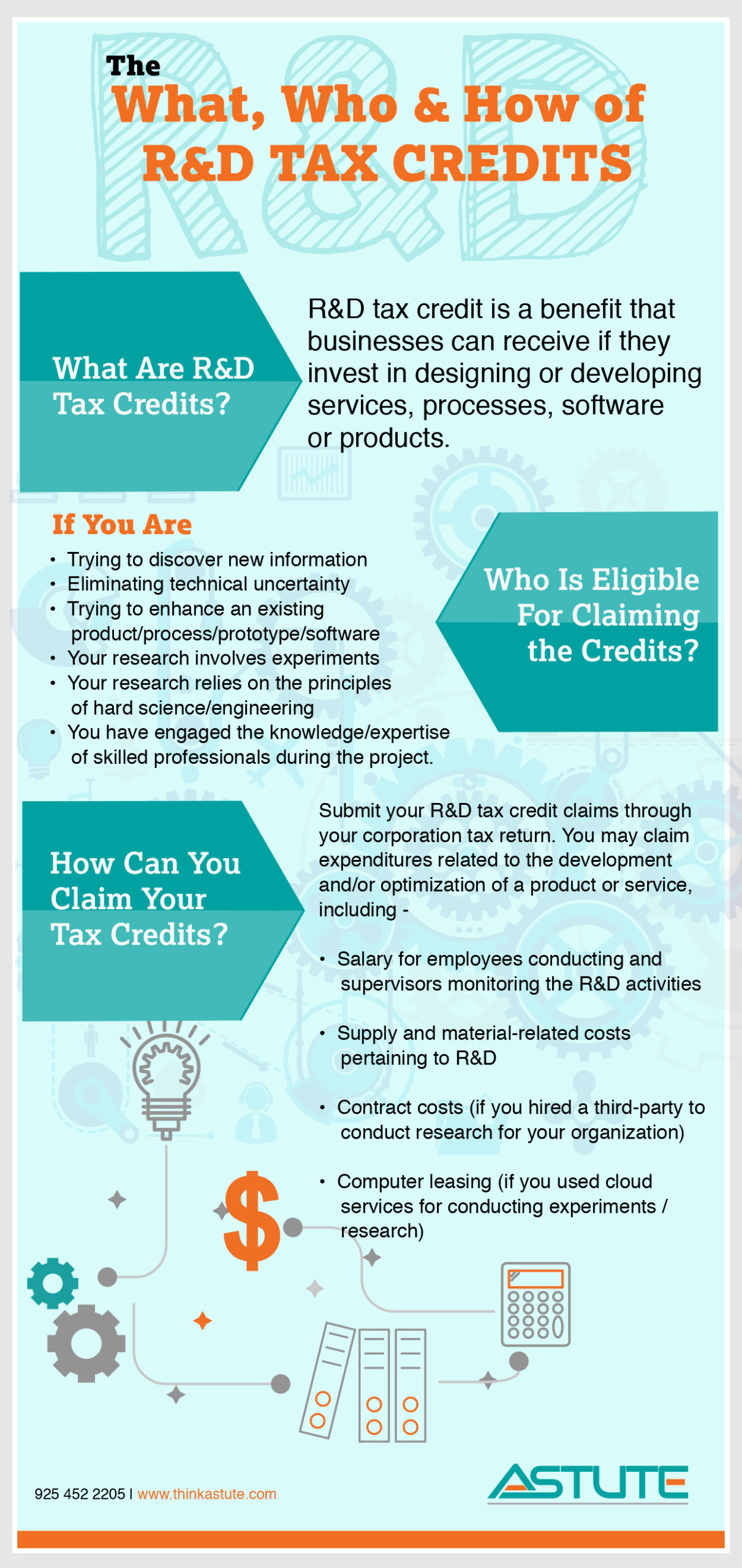

Are You Eligible For R D Tax Credit Find Out Using This Infographic

Are You Eligible For R D Tax Credit Find Out Using This Infographic

FAQs Health Insurance Premium Tax Credits

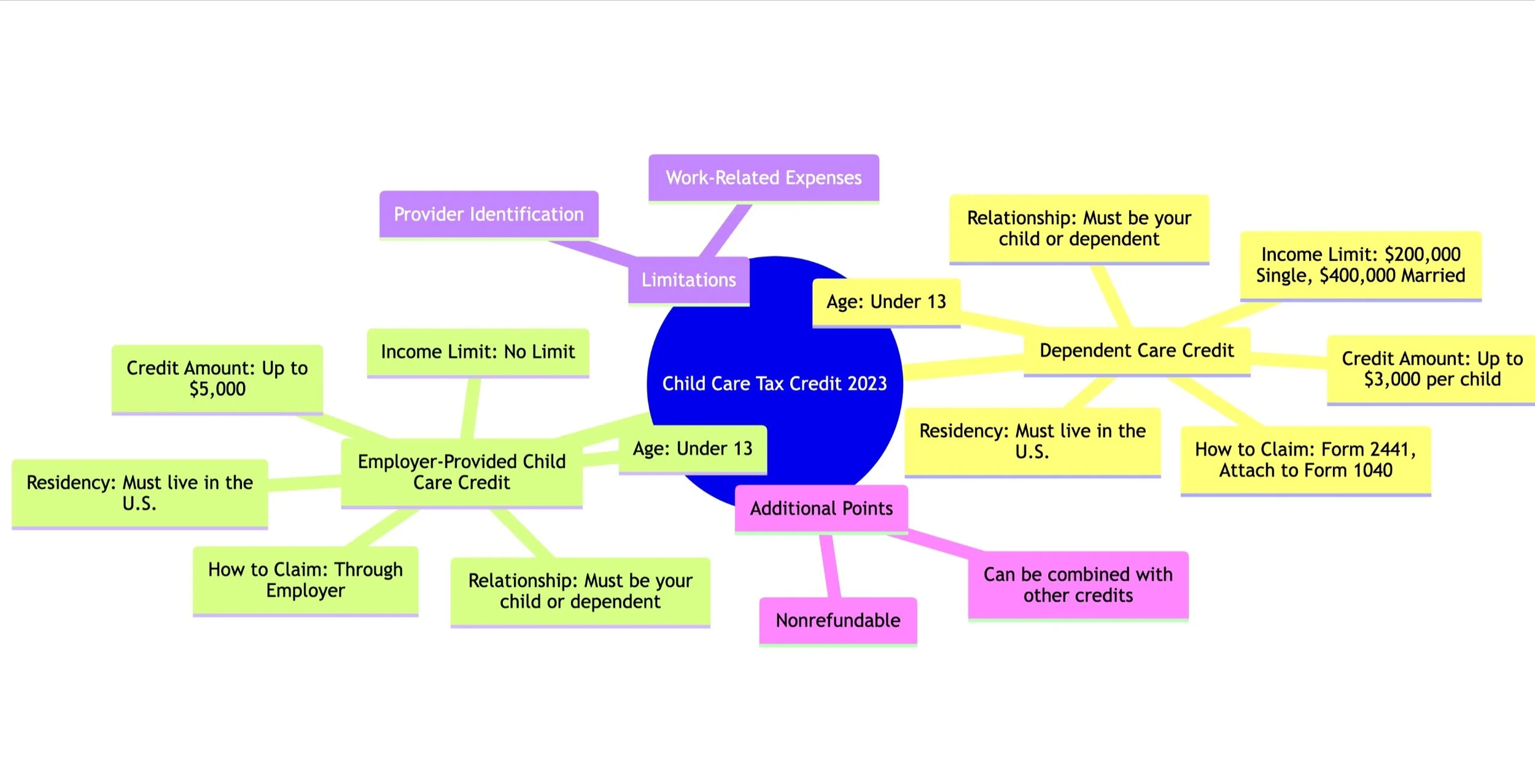

Big Changes To The Child And Dependent Care Tax Credits FSAs In 2021

Frequently Asked Questions 2023 Clean Energy And Electric Vehicle Tax

Health Care Tax Credits 2023 - Verkko 15 lokak 2023 nbsp 0183 32 Let s say the benchmark health plan on Tom s health insurance exchange costs 3 900 per year or 325 per month Use this equation to figure out the