Healthcare Worker Tax Deduction Verkko 8 syysk 2023 nbsp 0183 32 4 Common Tax Deductions for Nurses Mid wives and other Healthcare Professional 1 Clothing Uniforms Your work outfit has to be specific to the work you do as a Healthcare Professional Pharmacist or Nurse For example scrubs lab coats or medical shoes are items you can write off when doing your taxes

Verkko 28 huhtik 2023 nbsp 0183 32 According to 167 96 subsection 1 of the Act on income tax taxpayers can deduct statutory employee s pension contributions unemployment insurance contributions and a health insurance contribution p 228 iv 228 rahamaksu from their net taxable earned income Verkko 2 jouluk 2020 nbsp 0183 32 The healthcare contribution withheld from insured employees in 2021 is 0 68 of the earned income taxable in municipal taxation and of other payment criteria referred to in the Health Insurance Act Gov Decree 167 1 subsection 1 The daily allowance contribution withheld from wage earners in 2021 is 1 36 of the wage income

Healthcare Worker Tax Deduction

Healthcare Worker Tax Deduction

https://i.pinimg.com/originals/dc/53/0c/dc530c9cbab3fabe544326a424333f57.jpg

Tax Accounting Services Lee s Tax Service

https://leestaxservicellc.com/files/IMG_1348.png

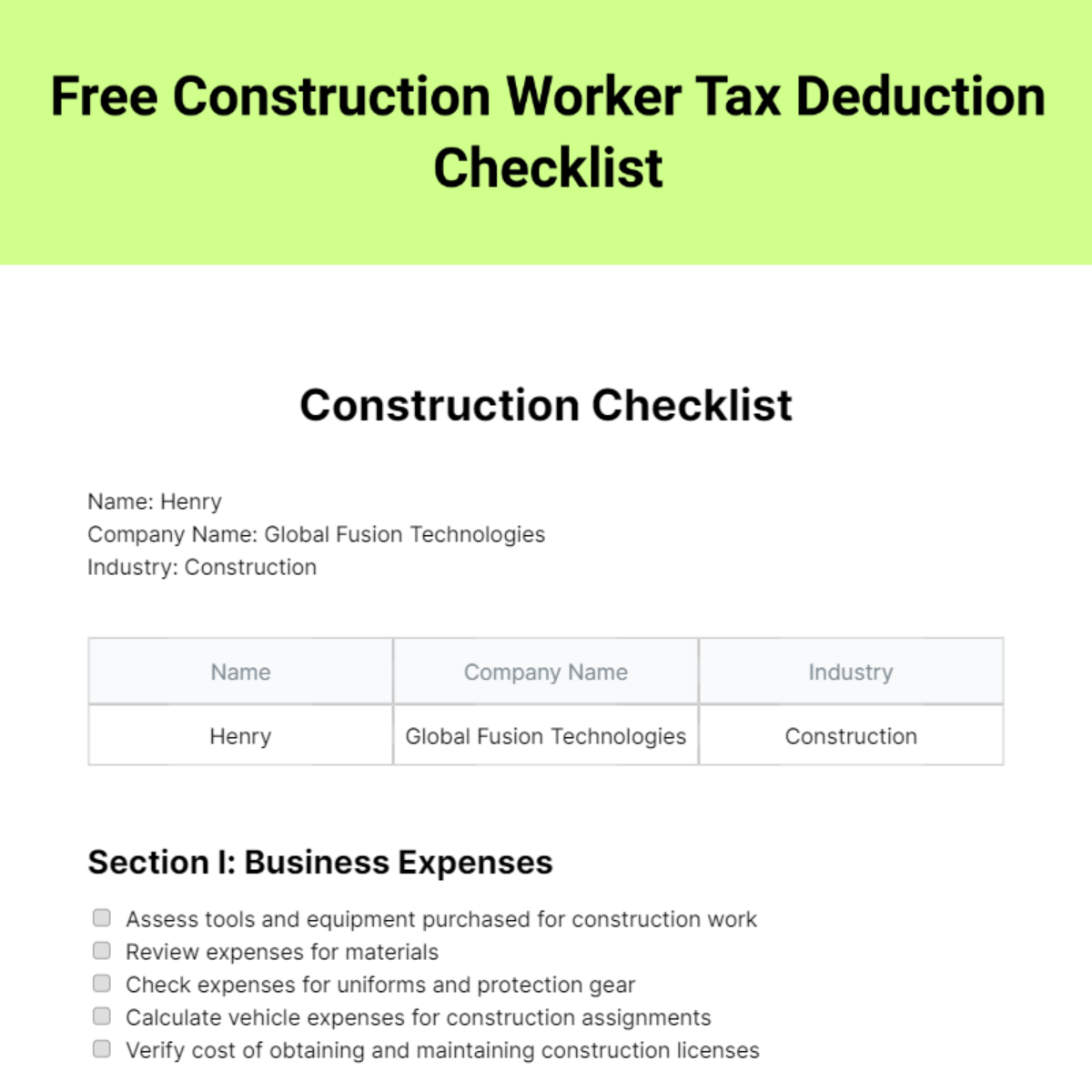

FREE Construction Checklist Edit Online Download Template

https://images.template.net/280926/Construction-Worker-Tax-Deduction-Checklist-edit-online.jpg

Verkko 31 hein 228 k 2022 nbsp 0183 32 The daily allowance contribution of health insurance is 1 18 and it is only collected from employees who earn at least 15 128 a year in wages or trade income In 2023 the medical contribution is 0 60 of the employee s income taxable in municipal taxation Verkko 20 huhtik 2020 nbsp 0183 32 Download this article What are the most common tax deductions for nurses and healthcare workers Capital expenses Often healthcare workers purchase capital equipment in order to do their jobs Items such as stethoscopes nurse s fob watches medical equipment computers mobile phones and daily organisers can be

Verkko While work clothes are not a common tax deduction it is a great tax deduction for nurses and healthcare professionals Why Well most employees do not have a required uniform Nurses and healthcare professionals can write off the costs of their scrubs as a 100 work related uniform Verkko There are some tax deductions for home health care workers you may qualify for as long as the expenses are more than 2 percent of your adjusted gross income and your employer doesn t reimburse you for them

Download Healthcare Worker Tax Deduction

More picture related to Healthcare Worker Tax Deduction

Abolition Of State Tax Deduction Keeps NJ Tax In Check

https://d.newsweek.com/en/full/718411/gettyimages-109917953.jpg

What Will My Tax Deduction Savings Look Like The Motley Fool

https://g.foolcdn.com/editorial/images/436120/tax-deduction_gettyimages-515708887.jpg

1099 MISC Tax Deductions For Gig Workers Tax Deductions Deduction

https://i.pinimg.com/736x/8d/d2/49/8dd24913500c7445023d7d7233a46c78.jpg

Verkko 16 marrask 2023 nbsp 0183 32 If you itemize your deductions for a taxable year on Schedule A Form 1040 Itemized Deductions you may be able to deduct the medical and dental expenses you paid for yourself your spouse and your dependents during the taxable year to the extent these expenses exceed 7 5 of your adjusted gross income for the Verkko 20 lokak 2023 nbsp 0183 32 In addition you can only deduct unreimbursed medical expenses that exceed 7 5 of your adjusted gross income AGI found on line 11 of your 2023 Form 1040 For example if your AGI is 50 000 the first 3 750 of qualified expenses 7 5 of 50 000 don t count

Verkko 12 tammik 2023 nbsp 0183 32 To be tax deductible a medical expense generally must be legal and meet IRS conditions which include Any medical services from physicians surgeons dentists and other medical professionals related to the diagnosis cure mitigation treatment or prevention of disease Any costs for medications prescribed by a medical Verkko 7 hein 228 k 2021 nbsp 0183 32 Healthcare professionals in most countries can deduct work related expenses from their tax bills In your field you could potentially deduct the costs of your uniforms and the cleaning costs thereof from your personal tax return

Petition National Legislation For Ratios In Healthcare Worker

https://assets.change.org/photos/1/di/nx/EpDInxIDwytYhha-1600x900-noPad.jpg?1648860894

Healthcare Worker Tax Rebate Free Stuff UK

https://freestuff.co.uk/wp-content/uploads/2016/10/HealthCareWorkers.jpg

https://www.handytaxguy.com/overlooked-tax-deductions-for-nurses

Verkko 8 syysk 2023 nbsp 0183 32 4 Common Tax Deductions for Nurses Mid wives and other Healthcare Professional 1 Clothing Uniforms Your work outfit has to be specific to the work you do as a Healthcare Professional Pharmacist or Nurse For example scrubs lab coats or medical shoes are items you can write off when doing your taxes

https://www.vero.fi/en/detailed-guidance/guidance/71691/deduction-of...

Verkko 28 huhtik 2023 nbsp 0183 32 According to 167 96 subsection 1 of the Act on income tax taxpayers can deduct statutory employee s pension contributions unemployment insurance contributions and a health insurance contribution p 228 iv 228 rahamaksu from their net taxable earned income

Overlooked Tax Deductions For Healthcare Workers Tax Deductions

Petition National Legislation For Ratios In Healthcare Worker

Maximising Tax Benefits Your Guide To Claiming A Rental Property

CA Guidance For COVID positive Health Workers Amid Shortages Abc10

New Tax Laws Business Deduction Changes You Need To Know About

Overlooked Tax Deductions For Healthcare Workers Tax Deductions

Overlooked Tax Deductions For Healthcare Workers Tax Deductions

Overlooked Tax Deductions For Healthcare Workers Tax Deductions Diy

Tax Reduction Company Inc

Tax Deduction Stock Photo Photo By LendingMemo Under CC 2 Flickr

Healthcare Worker Tax Deduction - Verkko While work clothes are not a common tax deduction it is a great tax deduction for nurses and healthcare professionals Why Well most employees do not have a required uniform Nurses and healthcare professionals can write off the costs of their scrubs as a 100 work related uniform