Home Loan Interest Deduction In Income Tax India Deduction of Interest on Home Loan for the property House Property owners can claim a deduction of up to Rs 2 lakh on their home loan interest if the owner or his family reside in the house property The same treatment applies when the house is vacant

Section 80EE of the Income Tax Act allows a deduction of up to Rs 50 000 per financial year on the interest portion of a residential house property loan The deduction is only available to individuals who meet specific criteria and have taken a home loan between 1 April 2016 to 31 March 2017 First time buyers of affordable property can claim Rs 3 50 lakhs as interest deduction by combining the benefits under Section 24 and Section 80EEA Better still if the property is jointly owned the co borrowers can individually claim Rs 3 50 lakhs per annum as

Home Loan Interest Deduction In Income Tax India

Home Loan Interest Deduction In Income Tax India

https://i.ytimg.com/vi/svu1PzUEfRo/maxresdefault.jpg

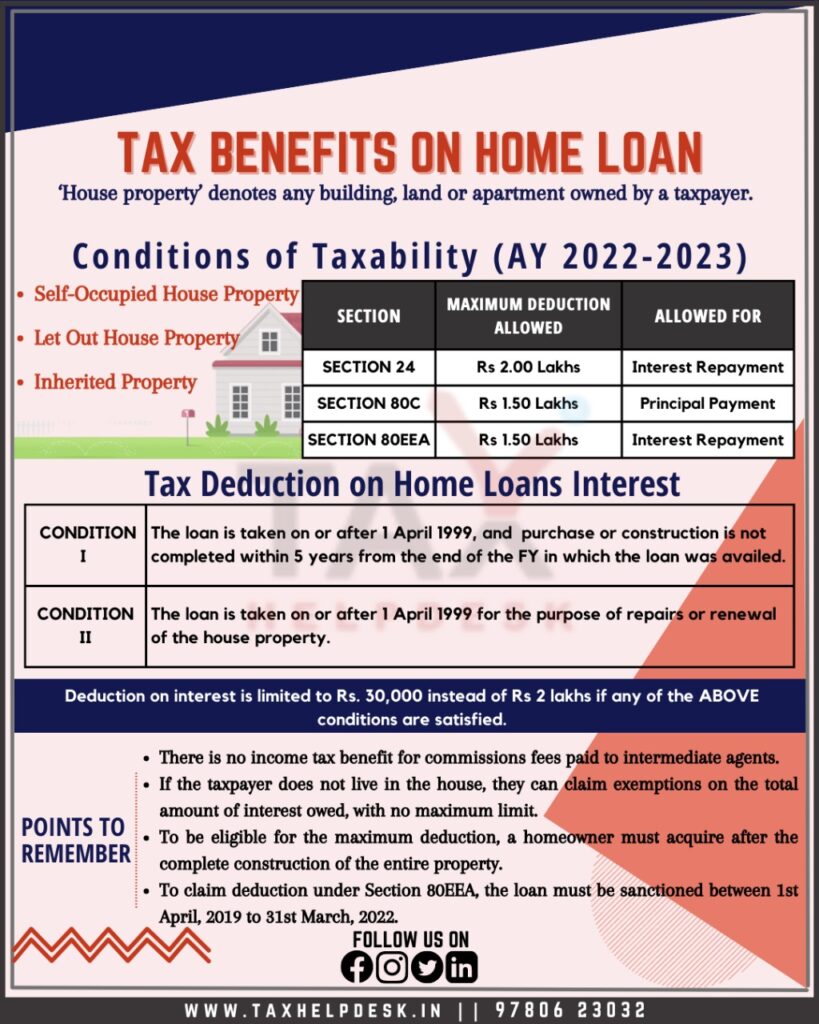

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2022/07/Tax-benefits-on-Home-Loan-819x1024.jpeg

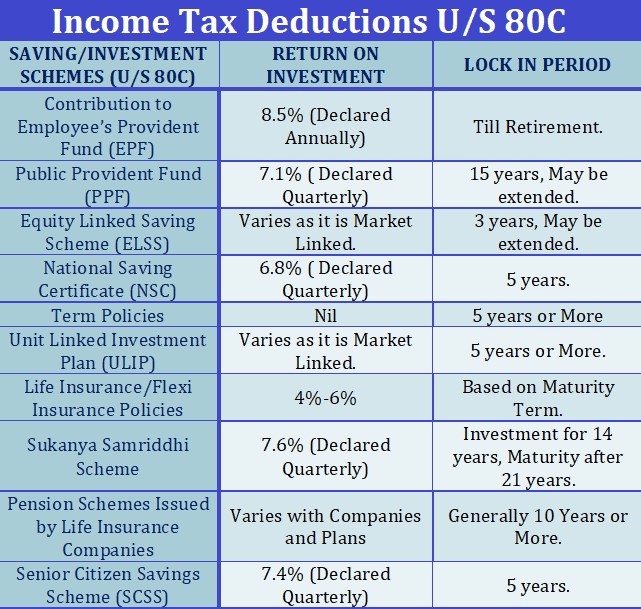

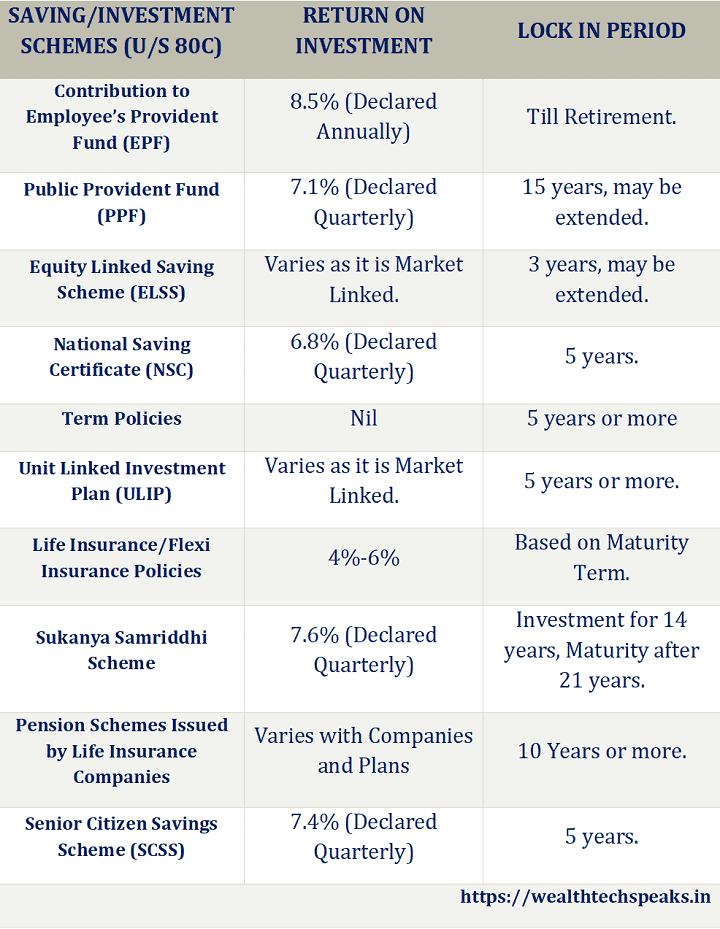

Income Tax Deductions While Filling ITR In India RJA

https://carajput.com/blog/wp-content/uploads/2017/03/Income-Tax-Deductions-Financial-Year-2020-21..jpg

Section 80EE offers tax relief to taxpayers who have taken out a home loan It allows home buyers to take income tax benefits on the interest they need to pay on a home loan As per this section a deduction of up to Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C and up to Rs 2 lakh on interest payment under Section 24 b

A home loan can help you claim an 80C deduction of up to 1 5 lakh a 80EE deduction of 50 000 and a 24 b deduction of 2 lakh making a total taxable value deduction of up to 4 lakh Under Section 24 the interest paid on the home loan Equated Monthly Instalments EMIs during the year can be deducted from your total income with a maximum cap of Rs2 lakh

Download Home Loan Interest Deduction In Income Tax India

More picture related to Home Loan Interest Deduction In Income Tax India

Maximizing Home Loan Tax Benefits In India 2023

https://www.kanakkupillai.com/learn/wp-content/uploads/2023/08/Home-Loan-Tax-Benefits-.jpg

Interest On Home Loan Deduction In Income Tax Home Loan Deduction In

https://i.ytimg.com/vi/rqiJa1_2JO0/maxresdefault.jpg

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/11/Tax-Saving-Benefits-of-having-property-through-Home-Loan-1.png

Section 24 b of the Income Tax Act allows for a deduction of up to Rs 2 lakh on the interest paid towards your home loan in a financial year To avail of this deduction you need to make Both the interest paid on a home loan and the principal paid back on the loan are deductible by an individual filing taxes Section 24 permits a deduction of interest paid on a home loan for self occupied property up to a total of Rs 2 lakh every fiscal year

Currently homebuyers can claim an income tax deduction on the interest paid on their home loan under Section 24 b of the Income tax Act 1961 The maximum amount of deduction that can be claimed is Rs 2 lakh per financial year for a self occupied property A tax payer can deduct both the interest paid on a house loan as well as the principal amount that was repaid on the loan In the case of self occupied property section 24 allows a deduction on the interest paid on a house loan up to a maximum of Rs 2 lakh in a given fiscal year

Home Loan Interest Deduction Under Section 24 Of Income Tax PDF

https://imgv2-2-f.scribdassets.com/img/document/606025745/original/c1a27a7f1f/1707251371?v=1

Home Loan Interest Double Tax Deduction Benefit Removed In Budget 2023

https://freefincal.com/wp-content/uploads/2023/02/Home-Loan-interest-double-tax-deduction-benefit-removed-in-budget-2023.jpg

https://cleartax.in/s/deductions-under-section24...

Deduction of Interest on Home Loan for the property House Property owners can claim a deduction of up to Rs 2 lakh on their home loan interest if the owner or his family reside in the house property The same treatment applies when the house is vacant

https://cleartax.in/s/section-80ee-income-tax...

Section 80EE of the Income Tax Act allows a deduction of up to Rs 50 000 per financial year on the interest portion of a residential house property loan The deduction is only available to individuals who meet specific criteria and have taken a home loan between 1 April 2016 to 31 March 2017

Best Home Loan In India 2023

Home Loan Interest Deduction Under Section 24 Of Income Tax PDF

Home Loan Tax Exemption Check Tax Benefits On Home Loan

Discover Your Favorite Brand Free Shipping Stainless Steel Flat Collar

Is Student Loan Interest Tax Deductible RapidTax

Maximize Your Tax Savings HRA Exemption Home Loan Interest Deduction

Maximize Your Tax Savings HRA Exemption Home Loan Interest Deduction

Personal Loan Tax Benefits Personal Loan Deduction In Income Tax

Home Loan Deduction In Income Tax itrfiling YouTube

NPS Deduction In Income Tax 2023 Guide InstaFiling

Home Loan Interest Deduction In Income Tax India - Section 80EE offers tax relief to taxpayers who have taken out a home loan It allows home buyers to take income tax benefits on the interest they need to pay on a home loan As per this section a deduction of up to