Home Loan Interest Rebate In Income Tax India If you take out a home loan jointly each borrower can claim a deduction for home loan interest up to Rs 2 lakh under Section 24 b and a tax deduction for principal repayment up to Rs 1 5 lakh

How to Claim Income Tax Benefits on a Home Loan You can claim income tax rebates on your ongoing Home Loan by following these steps Calculate the tax deduction that you are eligible for You can avail deduction on the interest paid on your home loan under section 24 b of the Income Tax Act For a self occupied house the maximum tax deduction of Rs 2 lakh can be claimed from your gross income annually

Home Loan Interest Rebate In Income Tax India

Home Loan Interest Rebate In Income Tax India

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEipxWF8H_Aq7SeppBfytkFg6LPVk_hhk5a5cXFvwS_UNDLECUyitau3mUyhjEaLNaQS5iRo3s-qhqVVpeVWOSeJz7iGqHLjeakyCZ7pfee6AcHTqZsjBJMzUpw_C-m9XLAw9PiNnOaGwKvL0ZoftkxTfy_U1ATlZ_XpOLkfzb7rj7Ak2tnmKwIcSrh8Sg/s16000/home loan in india.jpg

Home Loan Lowest Interest Rate

https://marathikayda.com/wp-content/uploads/2022/12/home-loan-low-interest-rate-compressed.jpg

Maximizing Home Loan Tax Benefits In India 2023

https://www.kanakkupillai.com/learn/wp-content/uploads/2023/08/Home-Loan-Tax-Benefits-.jpg

Every home loan borrower should be aware of the following income tax rebates on home loans The EMI you pay is made up of two parts principal repayment and interest paid The major component of the EMI can Section 24 of the Income Tax Act provides a valuable opportunity for homeowners to reduce their taxable income by claiming deductions on home loan interest By

Joint home loan borrowers can claim individual home loan rebates in income tax up to Rs 2 lakh on interest paid and Rs 1 5 lakh on the principal amount Raising the tax rebate on home loan interest rates from Rs 2 lakh to a minimum of Rs 5 lakh under Section 24 of the Income Tax Act is imperative This adjustment has the potential to invigorate the housing market especially

Download Home Loan Interest Rebate In Income Tax India

More picture related to Home Loan Interest Rebate In Income Tax India

Joint Home Loan Declaration Form For Income Tax Savings And Non

https://lh3.googleusercontent.com/-m3Y3HavWnbc/YgqSD7tknxI/AAAAAAAAYdw/PRErS72JdeIE0B2a37gG1CvGAfWFlQvHwCNcBGAsYHQ/w1200-h630-p-k-no-nu/1644859917358770-0.png

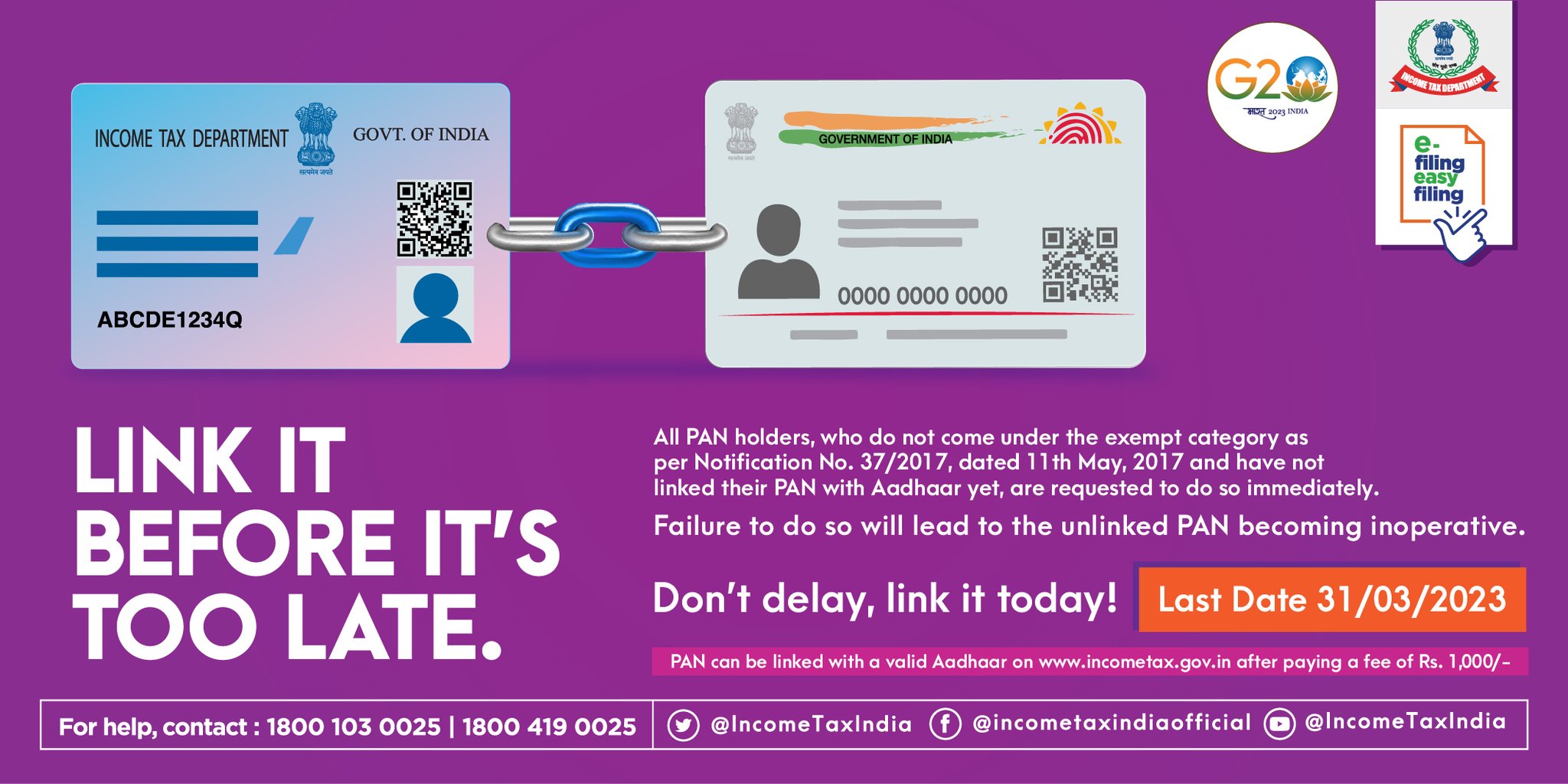

Income Tax India On Twitter Last Date To Link Your PAN Aadhaar Is

https://pbs.twimg.com/media/Freb47YWIAIoWMT.jpg:large

Income Tax India On Twitter RT DDIndialive Union Minister For

https://pbs.twimg.com/media/FoG5GjaXgAIRoQv.jpg

Following are the benefits available on loan taken on House Property which can be claimed as deductions in the Income Tax Return 1 Deduction on Principal Repayment u s 80C The amount paid as Repayment If your annual income is up to INR 18 lakh you are now eligible for interest subsidy on home loans under the Pradhan Mantri Awas Yojana PMAY The interest subsidy is allowed under the new Credit Linked Subsidy Scheme

This includes a maximum of INR 2 00 000 per year for home loan interest paid under Section 24 of the Income Tax Act and INR 1 50 000 per year for home loan principal Under Sections 80C and 24 both the borrowers are eligible for up to Rs 2 lakh tax rebate on interest payment each and up to Rs 1 5 lakh benefit on the principal repayment each

Income Tax India On Twitter RT PBNS India Union Finance Minsiter

https://pbs.twimg.com/media/FpFIupbWYAAxlp_.jpg

Best Bank For Home Loan In India 2024

https://emicalculator.io/wp-content/uploads/2024/02/Best-Bank-for-Home-Loan-in-India.jpg

https://cleartax.in

If you take out a home loan jointly each borrower can claim a deduction for home loan interest up to Rs 2 lakh under Section 24 b and a tax deduction for principal repayment up to Rs 1 5 lakh

https://www.bajajhousingfinance.in › home …

How to Claim Income Tax Benefits on a Home Loan You can claim income tax rebates on your ongoing Home Loan by following these steps Calculate the tax deduction that you are eligible for

Best Home Loan Rates

Income Tax India On Twitter RT PBNS India Union Finance Minsiter

Income Tax India On Twitter As Per Income tax Act 1961 It Is

Income Tax Rebate Astonishingceiyrs

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

What Is Income Tax

What Is Income Tax

How To Calulate Rebate FY 2019 20 AY 2020 21 Chapter 4 Income Tax

Income Tax India On Twitter RT pibchennai

Income Tax Rebate On Home Loan 2022

Home Loan Interest Rebate In Income Tax India - From assessment year 2026 27 onwards the rebate under section 87A will be available to individuals resident in India whose income is chargeable to tax under subsection