Home Loan Interest Exemption Under Income Tax Section 80EE provides deduction for the interest paid on housing loan taken during the period of 01 April 2016 to 31 March 2017 under which you may claim upto

Explore the exemptions and deductions allowed under the new tax regime for FY 2023 24 AY 2024 25 Learn about the options available to taxpayers and make You can avail deduction on the interest paid on your home loan under section 24 b of the Income Tax Act For a self occupied house the maximum tax deduction of Rs 2 lakh can be claimed from your gross

Home Loan Interest Exemption Under Income Tax

Home Loan Interest Exemption Under Income Tax

https://www.jagranimages.com/images/newimg/08112022/08_11_2022-bb_23190635.jpg

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2022/07/Tax-benefits-on-Home-Loan-819x1024.jpeg

A Guide To Group Insurance Scheme Exemption Under Income Tax

https://www.plancover.com/insurance/wp-content/uploads/2021/12/A-guide-to-Group-Insurance-Scheme-Exemption-under-Income-Tax.png

Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C You can get home loan tax benefit under different sections like Section 80 EEA which provides income tax benefits of up to Rs 1 5 lakh on the home loan interests paid

Presently under Section 24 a home loan borrower who pays interest on the loan may deduct that interest from his or her gross annual income up to a Tax Benefit on Home Loan Interest Rate You can also benefit from a tax deduction on the interest paid for your home loan According to section 24 of the Income Tax Act if your

Download Home Loan Interest Exemption Under Income Tax

More picture related to Home Loan Interest Exemption Under Income Tax

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/11/Tax-Saving-Benefits-of-having-property-through-Home-Loan-1.png

Home Loan Lowest Interest Rate

https://marathikayda.com/wp-content/uploads/2022/12/home-loan-low-interest-rate-compressed.jpg

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

https://www.hdfcsales.com/blog/wp-content/uploads/2022/10/Is-plot-loan-eligible-for-tax-exemption-V1-724x1024.png

Yes you can claim income tax exemption if you are a co applicant in a housing loan as long as you are also the owner or co owner of the property in question No housing loan interest is not entirely tax exempt in India However the Indian tax code offers deductions for a portion of the interest you pay on your home

Get income tax benefits on Home Loan under Section 24 80EE and 80C Know how much income tax exemption on a housing loan you can claim in 2024 This deduction is over and above the Rs 2 lakhs for interest payments available under Section 24 b of the Income Tax Act Therefore taxpayers can claim a total deduction

Home Loan Deductions And Tax Benefits AY 2022 23 Home Loan Tax

https://i.ytimg.com/vi/DmRsyjsDM7c/maxresdefault.jpg

Income Tax Exemption On Interest Of Education Loan YouTube

https://i.ytimg.com/vi/6NRHslwXCcM/maxresdefault.jpg

https://cleartax.in/s/section-80eea-deduction-affordable-housing

Section 80EE provides deduction for the interest paid on housing loan taken during the period of 01 April 2016 to 31 March 2017 under which you may claim upto

https://taxguru.in/income-tax/exemptions-deduction...

Explore the exemptions and deductions allowed under the new tax regime for FY 2023 24 AY 2024 25 Learn about the options available to taxpayers and make

Amendments In Valuation Norms Under Income Tax Law To Include Non

Home Loan Deductions And Tax Benefits AY 2022 23 Home Loan Tax

Home Loan Interest Exemption In Income Tax Home Sweet Home

Law Of Taxation Concept Of Salary Under Income Tax Act 1961 PDF

How Your Down Payment Impacts Your Home Loan Interest Rate

Tonight On 7NEWS The Home Loan Interest You Shouldn t Be Paying

Tonight On 7NEWS The Home Loan Interest You Shouldn t Be Paying

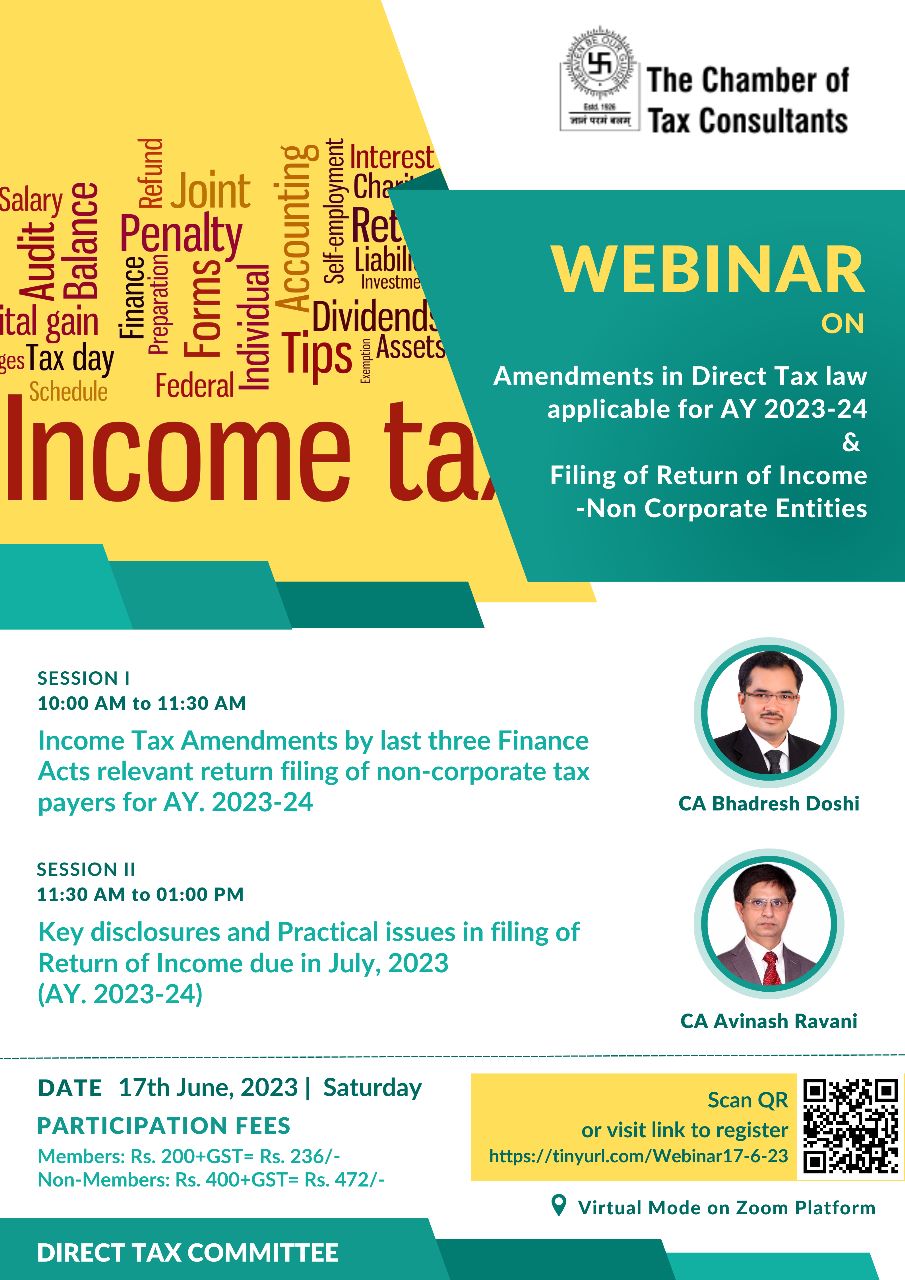

Webinar On Amendments In Direct Tax Law Applicable For AY 2023 24

Home Loan Interest Deduction Under Section 24 Of Income Tax PDF

Home Loan Tax Benefits You Can Get 1 5 2 Lacs Benefits On Home Loan

Home Loan Interest Exemption Under Income Tax - Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C