Home Loan Interest Exemption Under Section Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution As per this section

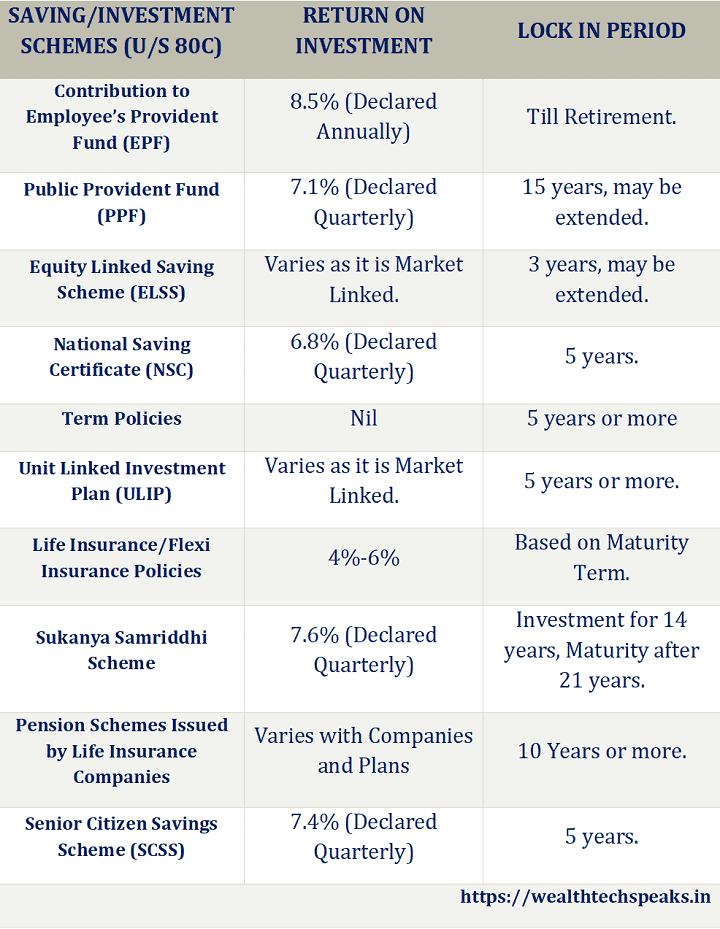

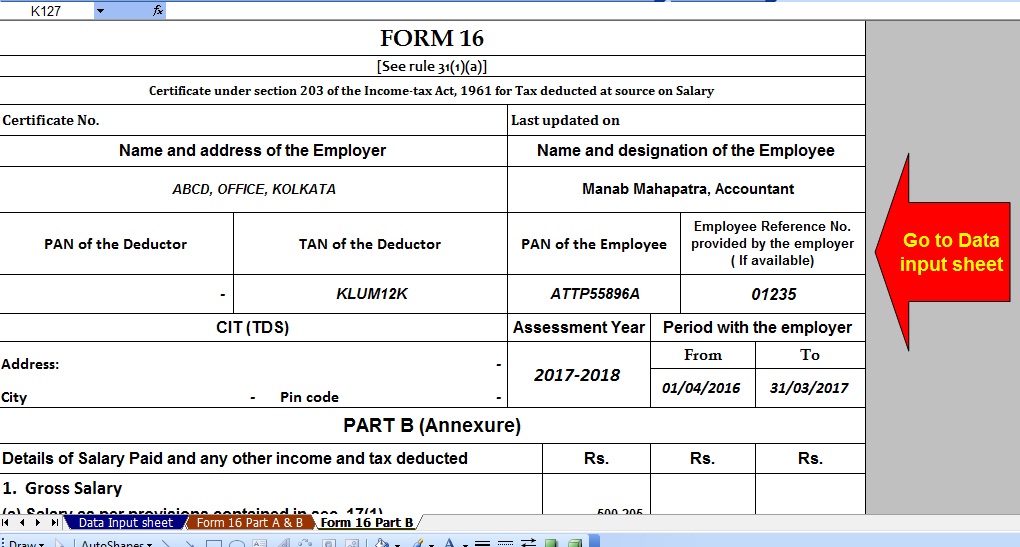

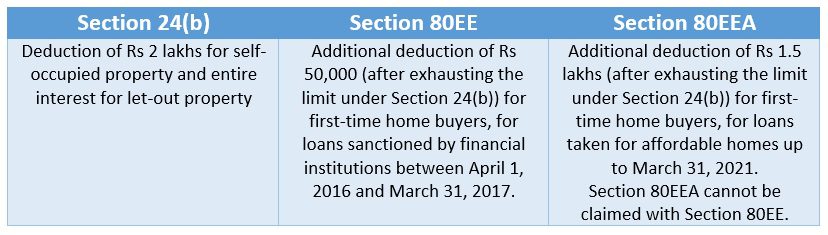

Section 80EE provides deduction for the interest paid on housing loan taken during the period of 01 April 2016 to 31 March 2017 under which you may claim upto Learn how to claim tax deductions on your Home Loan under three sections of the Income Tax Act Section 80C for principal repayment Section 24 for interest payment and

Home Loan Interest Exemption Under Section

Home Loan Interest Exemption Under Section

https://onlinevisas.com/wp-content/uploads/2020/08/national-interest-exemption-trump-travel-ban.jpg

What Is A Portfolio Interest Exemption EPGD Business Law

https://www.epgdlaw.com/wp-content/uploads/2022/07/120893163_s.jpg

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/11/Tax-Saving-Benefits-of-having-property-through-Home-Loan-1.png

Yes you claim deductions on two home loans within the specific limit under Section 24 Rs 2 lakhs per annum if the properties are self occupied Only for your first home you can claim benefits under either Learn how to save taxes on home loan interest and principal repayment under Section 24 b and 80C of the Income Tax Act Find out the eligibility conditions and limits for

Learn how to claim tax benefits on the interest portion of a home loan under Section 80EE of the Income Tax Act Find out the eligibility criteria features conditions and steps to file your tax return and claim deduction By using Section 80EEA an individual is permitted to claim a deduction under Section 24B for the interest paid on home loans This section undertakes the general provisions

Download Home Loan Interest Exemption Under Section

More picture related to Home Loan Interest Exemption Under Section

Income Tax Exemption Calculator For Interest Paid On Housing Loan With

https://tdstax.files.wordpress.com/2016/12/8bb32-non2bgovt2bemployees2b2.jpg

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2022/07/Tax-benefits-on-Home-Loan-819x1024.jpeg

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

https://www.hdfcsales.com/blog/wp-content/uploads/2022/10/Is-plot-loan-eligible-for-tax-exemption-V1-724x1024.png

Learn how to get income tax benefits on your home loan under different sections of the Income Tax Act Find out the eligibility conditions limits and examples of tax deductions on principal repayment interest Learn how to claim a deduction of up to Rs 50 000 on home loan interest under Section 80EE of the Income Tax Act Find out the eligibility criteria documents required and the

Discover Section 80EEA of the Income Tax Act which provides deductions for interest paid on a home loan Explore the eligibility criteria maximum deduction limits and conditions for claiming this tax benefit Interest on Home Loan A taxpayer can claim a deduction on the interest paid on a Home Loan taken to purchase construct repair or renovate a self occupied property The

Income Tax Slab For FY 2022 23 What You Need To Know

https://vakilsearch.com/blog/wp-content/uploads/2022/09/types-of-income-exempted-from-income-tax-in-india-1.png

The New Section 163 j Interest Limits And The Portfolio Interest Exemption

https://www.castroandco.com/images/loan_agreement.jpg

https://cleartax.in/s/section-80ee-income-tax...

Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution As per this section

https://cleartax.in/s/section-80eea-deduction-affordable-housing

Section 80EE provides deduction for the interest paid on housing loan taken during the period of 01 April 2016 to 31 March 2017 under which you may claim upto

Home Loan Interest Exemption Limit Home Sweet Home Modern Livingroom

Income Tax Slab For FY 2022 23 What You Need To Know

Exemption Eligibility Available Under Section 54F For The House

Discover Your Favorite Brand Free Shipping Stainless Steel Flat Collar

National Interest Exemption Vs National Interest Waiver

Section 24 Of Income Tax Act Deduction For Home Loan Interest

Section 24 Of Income Tax Act Deduction For Home Loan Interest

How To Claim Both HRA Home Loans Tax Deductions With Section 24 And

Stamp Duty Exemption 2019 Warren Churchill

Tax Deduction On Home Loan Interest Under Section 80EE Wishfin

Home Loan Interest Exemption Under Section - Learn how to save taxes on home loan interest and principal repayment under Section 24 b and 80C of the Income Tax Act Find out the eligibility conditions and limits for