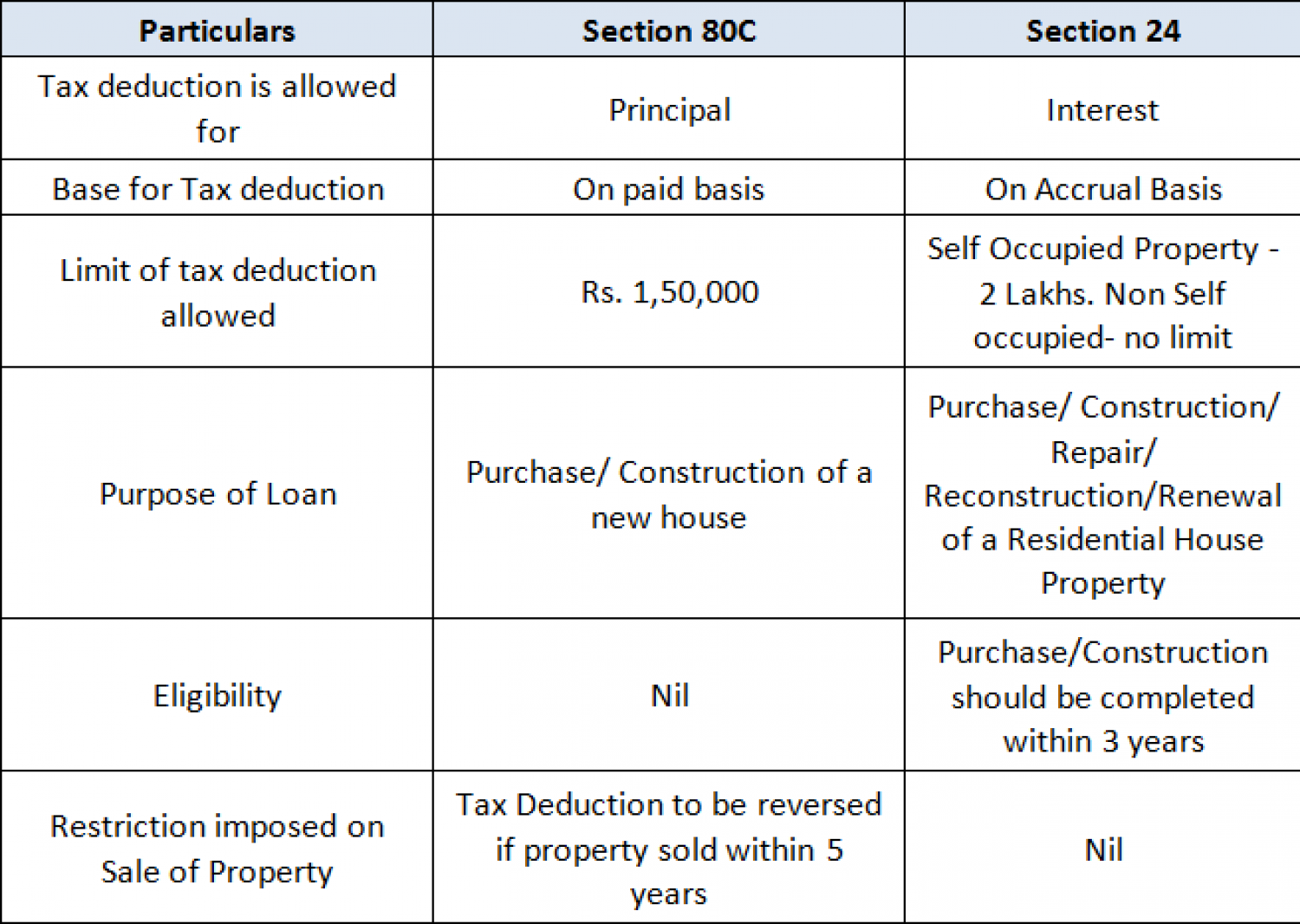

Housing Loan Interest Deduction Under Section 80c Web 18 Dez 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From the assessment year 2018 19 onwards the maximum deduction for interest paid on self occupied house property is Rs 2 lakh

Web 10 Aug 2022 nbsp 0183 32 Deduction For Specified Investments Under Section 80C Section 80C of the IT Act is one of the most popular deductions availed by individual taxpayers as it offers a bucket of Web This is Section 80EEA which provides taxpayers with an extra deduction for paying interest on a house loan Whereas Section 24 exempted interest on home loans up to Rs 2 lakh this section exempts home buyers who take out a home loan and pay interest on the loan an additional Rs 1 5 lakhs Read in detail here

Housing Loan Interest Deduction Under Section 80c

Housing Loan Interest Deduction Under Section 80c

https://life.futuregenerali.in/media/5utfvrlk/chapter-via-section.jpg

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/11/Tax-Saving-Benefits-of-having-property-through-Home-Loan-1.png

Section 80C Everything To Know Deduction Under 80C Tax Saving

https://i.ytimg.com/vi/L1AUhzT9w0Y/maxresdefault.jpg

Web 26 Juli 2018 nbsp 0183 32 953 comments Home loan entitles Individuals to Deduction Under Section 80C of up to Rs 1 50 Lakh and Interest Deduction under section 24 of up to Rs 2 Lakh Articles deals with Faqs on Benefit U s 24 and 80C on Jointly Owned Property Under Construction Property multiple properties and Simultaneous benefit of Interest Web 13 Jan 2023 nbsp 0183 32 The principal amount invested up to INR 1 50 000 is eligible for deduction u s 80C Interest earned on SCSS is taxable as per the tax slab applicable to the individual In case the interest

Web 11 Jan 2022 nbsp 0183 32 Deduction under this section is allowed for any interest payable on loan taken by an individual subject to maximum amount of INR 1 50 000 provided below conditions are fulfilled 1 the loan has been sanctioned by the financial institution during the period beginning on the 1st day of April 2019 and ending on the 31st day of Web 20 Okt 2023 nbsp 0183 32 Updated 20 10 2023 09 45 45 AM The Government of India offers home loan tax benefits of up to Rs 5 lakh to individuals deduction of up to Rs 1 5 lakh on principal repayment under Section 80C and up to Rs 2 lakh on interest payment under Section 24 b To boost affordable housing

Download Housing Loan Interest Deduction Under Section 80c

More picture related to Housing Loan Interest Deduction Under Section 80c

Section 80C Deductions Save Up To 1 5 Lakhs On Taxes

https://life.futuregenerali.in/media/2zjhyg5j/section-80c-deductions.jpg

Section 80C Of Income Tax Act Tax Deduction AY 2023 24

https://cdn-scripbox-wordpress.scripbox.com/wp-content/uploads/2020/01/section-80c.jpg

Deductions Under Section 80C Benefits Works Myfinopedia

https://www.myfinopedia.com/wp-content/uploads/2023/01/Deductions-Under-Section-80C.jpg

Web Vor 2 Tagen nbsp 0183 32 It is to be noted that deductions under Chapter VI A deduction Section 80C 80D 80E and so on are not available for taxpayers who opt for the New Tax regime However salaried individuals can Web Vor einem Tag nbsp 0183 32 Section 80C is one of the most popular sections amongst taxpayers as it allows deductions up to 1 5 lakh by making tax saving investments Section 80 CCD It offers an additional deduction of

Web 9 Feb 2018 nbsp 0183 32 For an individual or Hindu Undivided Family HUF the amount that goes towards the repayment of the principal on a Home Loan is eligible for a deduction under Section 80C of the Income Tax Act You can claim a maximum of Rs 1 50 000 under this section Earlier this was Rs 1 00 000 Web 25 M 228 rz 2016 nbsp 0183 32 Section 80EE proposes an additional deduction of Rs 50000 in respect of interest on housing loans to first time house owners who own a house of Rs 50 lakh or less and have taken a home loan amount of less than or equal to Rs 35 lakh The loan should be sanctioned between April 1 2016 and March 31 2017 to claim a deduction

Deduction From Gross Total Income Section 80C To 80U Graphical Table

https://incometaxmanagement.com/Images/Graphical-ITAX/Deduction-from-GTI/Section-80C.jpg

Section 80C Deduction Under Section 80C In India Paisabazaar

https://www.paisabazaar.com/wp-content/uploads/2017/04/Section80C-infographic-Content.jpg

https://cleartax.in/s/home-loan-tax-benefits

Web 18 Dez 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From the assessment year 2018 19 onwards the maximum deduction for interest paid on self occupied house property is Rs 2 lakh

https://www.forbes.com/advisor/in/tax/tax-income-tax-deduction-80c

Web 10 Aug 2022 nbsp 0183 32 Deduction For Specified Investments Under Section 80C Section 80C of the IT Act is one of the most popular deductions availed by individual taxpayers as it offers a bucket of

Can HRA Home Loan Benefits Be Claimed When ITR Is Filing

Deduction From Gross Total Income Section 80C To 80U Graphical Table

Discover Your Favorite Brand Free Shipping Stainless Steel Flat Collar

Section 24 Of Income Tax Act Deduction For Home Loan Interest

Deductions Under Section 80C Its Allied Sections

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

Tax Savings Deductions Under Chapter VI A Learn By Quicko

Income Tax Deduction Under Section 80C To 80U FY 2022 23

Housing Loan Interest Deduction Under Section 80c - Web 20 Okt 2023 nbsp 0183 32 Updated 20 10 2023 09 45 45 AM The Government of India offers home loan tax benefits of up to Rs 5 lakh to individuals deduction of up to Rs 1 5 lakh on principal repayment under Section 80C and up to Rs 2 lakh on interest payment under Section 24 b To boost affordable housing