Home Loan Interest Tax Deduction Calculator India From the assessment year 2018 19 onwards the maximum deduction for interest paid on self occupied house property is Rs 2 lakh For let out property there is

Maximise your home loan tax benefits with our easy to use calculator Estimate potential savings and deductions to make informed financial decisions Explore your eligibility and Home Loan Tax Saving Calculator allows you to get an estimate of the amount of tax that can be saved by claiming deductions available under the Home Loan as per the

Home Loan Interest Tax Deduction Calculator India

Home Loan Interest Tax Deduction Calculator India

https://s-i.huffpost.com/gen/1665605/images/o-DEDUCTIONS-facebook.jpg

Understanding The Mortgage Interest Deduction With TaxSlayer

https://www.taxslayer.com/blog/wp-content/uploads/2023/02/Tax-Breaks-for-Homeowners-and-Renters-min-8.jpg

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2022/07/Tax-benefits-on-Home-Loan-819x1024.jpeg

The home loan income tax benefit calculator simplifies estimating the money saved through income tax deductions on equated monthly instalments EMIs for your home Section 80EE of the Income Tax Act allows a deduction of up to Rs 50 000 per financial year on the interest portion of a residential house property loan The

Housing Finance Income Tax Benefit Calculator helps you to calculate tax benefit eligible on your loan details on tax payable before after loan Avail Income Tax Benefits on Home Loan under section 24 b 80C for up to Rs 2 00 000 Know home loan tax benefits for FY 2022 23 for second home loan joint home loan

Download Home Loan Interest Tax Deduction Calculator India

More picture related to Home Loan Interest Tax Deduction Calculator India

Mortgage Interest Tax Relief Calculator DermotHilary

https://www.annuity.org/wp-content/uploads/mortgage-interest-deduction-formula-640x0-c-default.jpg

Tax Benefits Of Paying Home Loan EMI HDFC Sales Blog

https://www.hdfcsales.com/blog/wp-content/uploads/2021/10/benefits-of-paying-home-loan-emi.png

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/11/Tax-Saving-Benefits-of-having-property-through-Home-Loan-1.png

The Sammaan Capital Home Loan Tax Benefit Calculator is a convenient online tool designed to help you accurately calculate the amount you ll owe on your home loan If you have taken a home loan for the property you can deduct the interest paid on the loan The maximum deduction allowed is currently Rs 2 lakh for self occupied property

Understand tax savings on a home loan under sections 24 80EE and 80C Home loan customers should be aware of the EMI or interest rate tax benefits as they could reduce It is advised that for filing of returns the exact calculation may be made as per the provisions contained in the relevant Acts Rules etc Quick Access Finance Bill 2024

Is Home Loan Interest Tax Deductible RateCity

https://production-content-assets.ratecity.com.au/20210121/can-i-get-a-tax-deduction-for-interest-on-a-home-loan-0hWt_-VCO.jpg

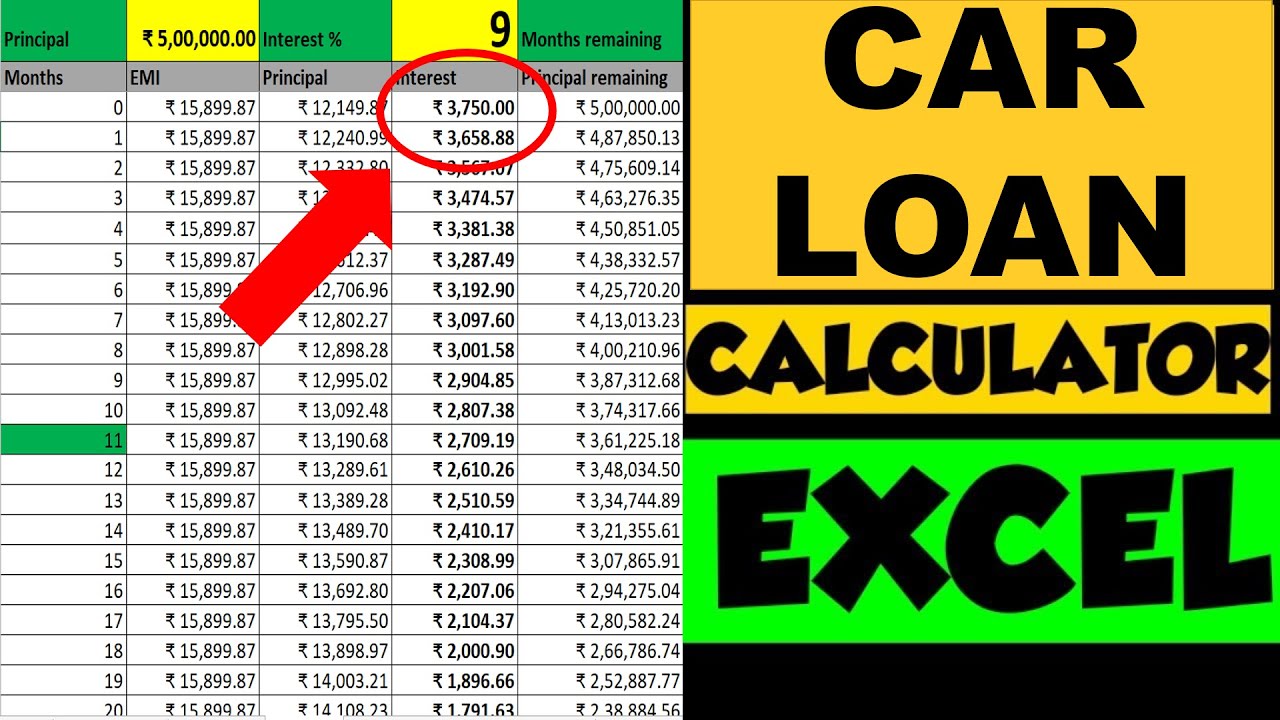

Car Loan EMI Calculator Excel With Principal Interest Examples Car

https://i.ytimg.com/vi/7yvUY3SGtXE/maxresdefault.jpg

https://cleartax.in/s/home-loan-tax-benefit

From the assessment year 2018 19 onwards the maximum deduction for interest paid on self occupied house property is Rs 2 lakh For let out property there is

https://www.bajajfinserv.in/home-loan-tax-benefit-calculator

Maximise your home loan tax benefits with our easy to use calculator Estimate potential savings and deductions to make informed financial decisions Explore your eligibility and

Claiming The Student Loan Interest Deduction

Is Home Loan Interest Tax Deductible RateCity

Home Loan Interest Deduction Under Section 24 Of Income Tax PDF

How To Calculate Home Loan EMI FREE CALCULATOR FinCalC Blog

Student Loan Interest Deduction 2013 PriorTax Blog

HOME LOAN INTEREST TAX DEDUCTION Digihunter YouTube

HOME LOAN INTEREST TAX DEDUCTION Digihunter YouTube

Is Student Loan Interest Tax Deductible RapidTax

Best Home Loan Rates

Tax Savings Deductions Under Chapter VI A Learn By Quicko

Home Loan Interest Tax Deduction Calculator India - Section 80EE of the Income Tax Act allows a deduction of up to Rs 50 000 per financial year on the interest portion of a residential house property loan The