Home Office Tax Deduction Canada If you meet the eligibility criteria you can claim a portion of certain expenses related to the use of a work space in your home Commission employees who sell goods or negotiate contracts typically have an income amount in box 42 on their T4 slip can claim some expenses that salaried employees cannot

This page describes the recent changes to claiming work space in the home expenses Eligible employees who worked from home in 2023 will be required to use the detailed method to claim home office expenses The temporary flat rate method does not apply to the 2023 tax year For the 2023 tax year the CRA has stated you will be qualified to write off your home office expenses if your home workspace is where you principally meaning more than 50 per cent of the time performed your duties of employment for a period of at least four consecutive weeks during 2023

Home Office Tax Deduction Canada

Home Office Tax Deduction Canada

https://bedrockonline.com/wp-content/uploads/2020/12/Home-Office-Tax-deductions-768x364.jpg

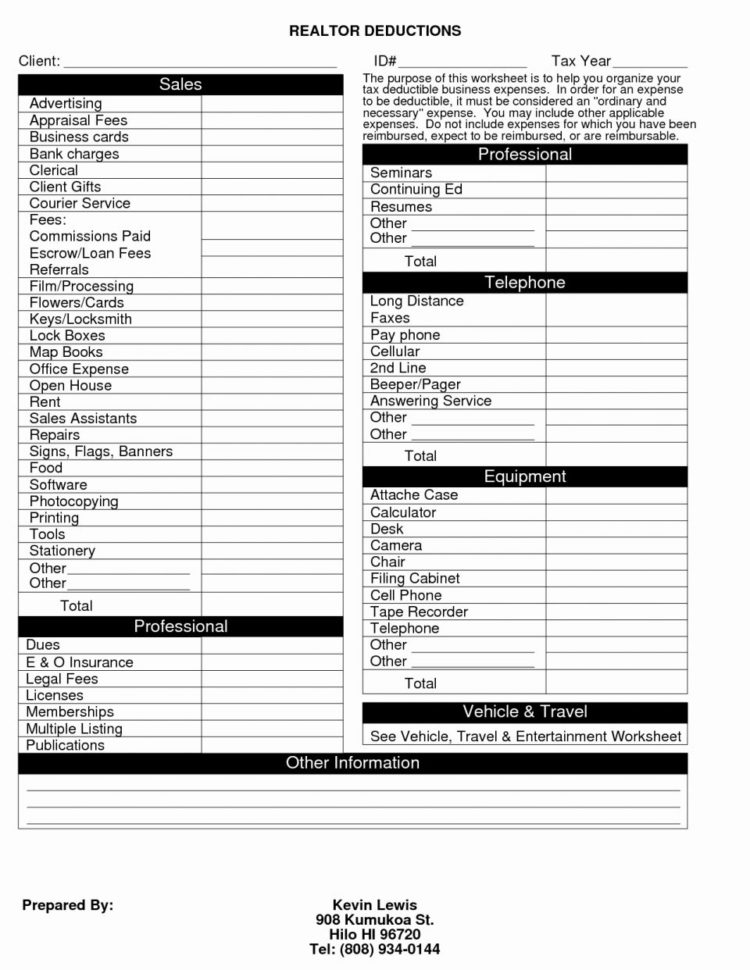

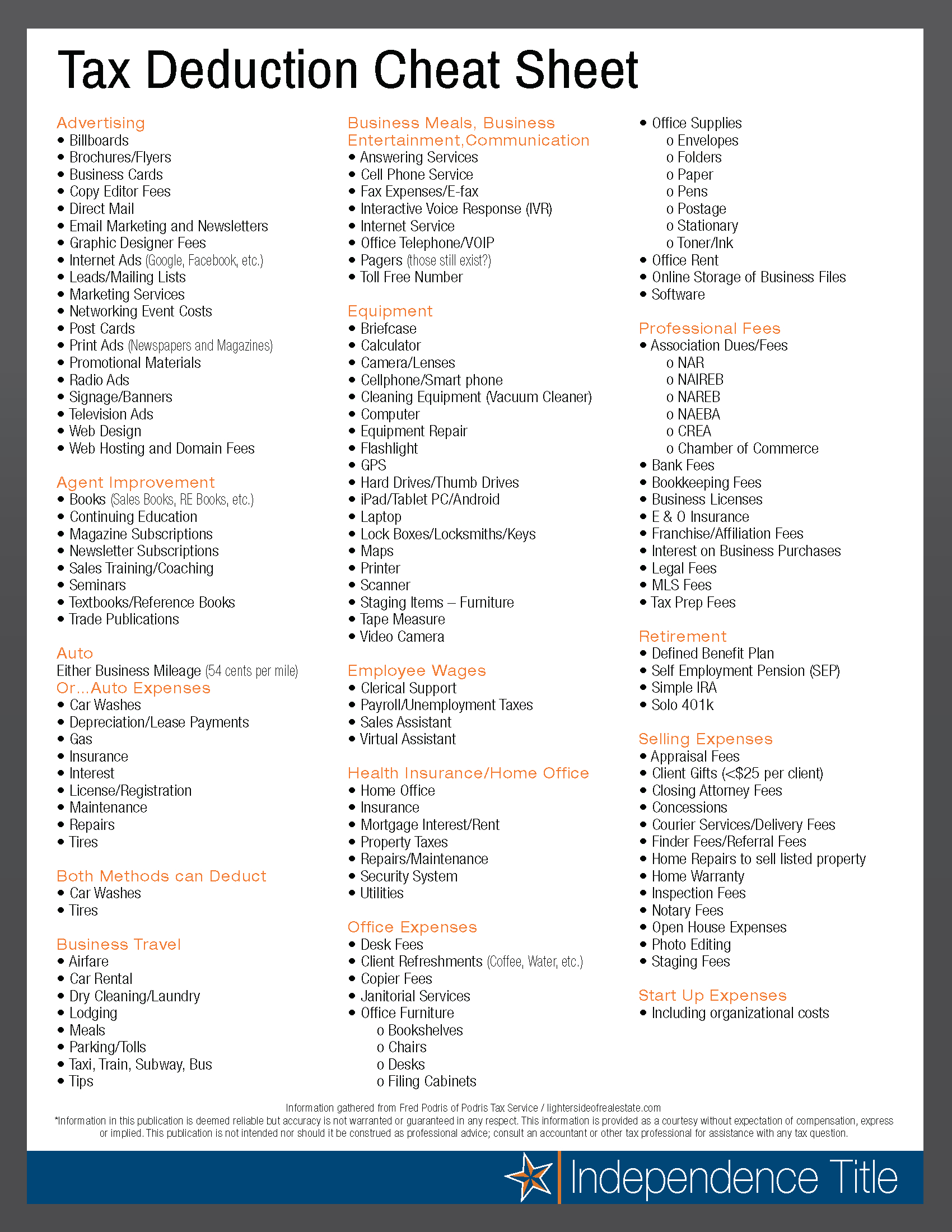

Real Estate Agent Tax Deductions Worksheet 2022 Fill Online

https://www.pdffiller.com/preview/354/967/354967762/large.png

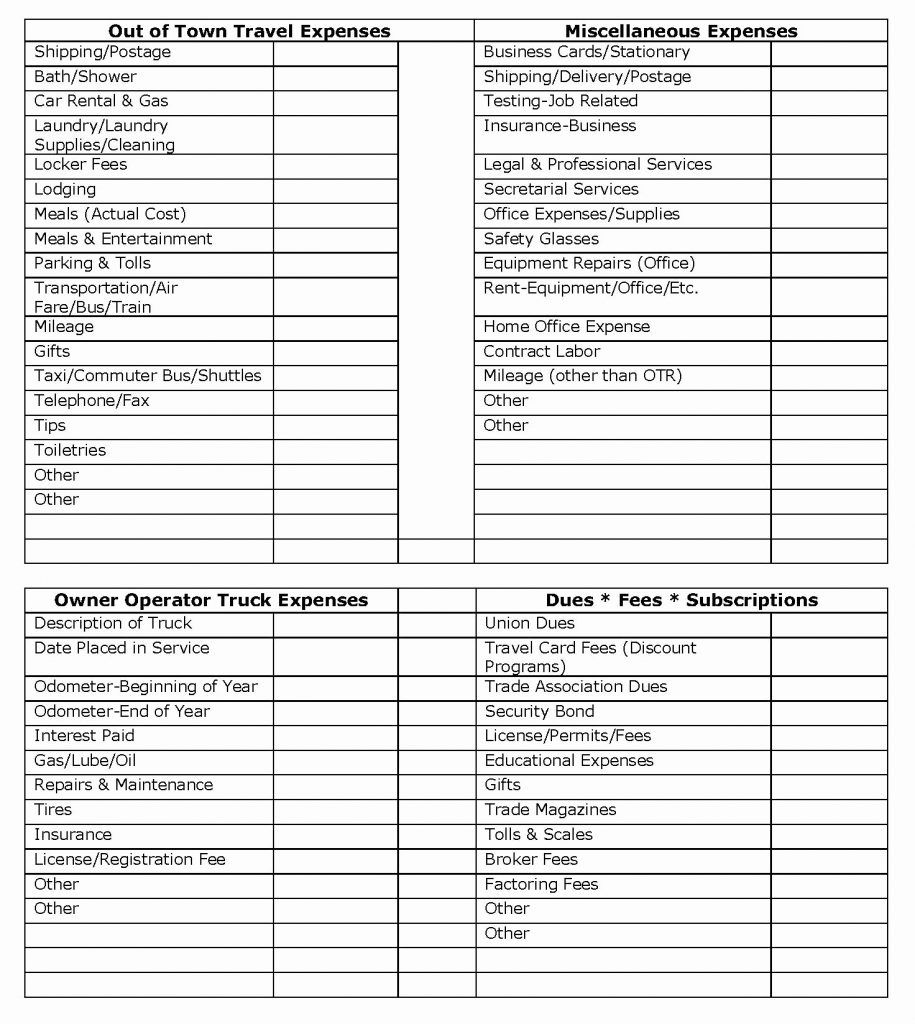

Tax Preparation Excel Spreadsheet In Small Business Tax Preparation

https://db-excel.com/wp-content/uploads/2019/01/tax-preparation-excel-spreadsheet-in-small-business-tax-preparation-worksheet-2017-deductions-2018-750x970.jpg

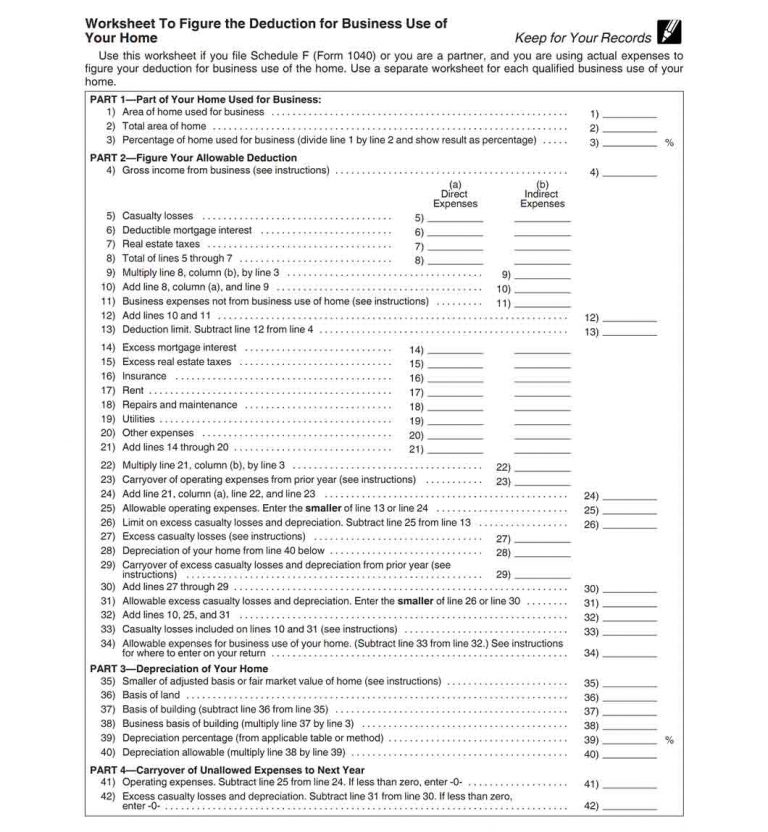

If your home office qualifies for the tax deduction you can claim a portion of your household expenses For example if your home office takes up 10 percent of the square footage of your home you can claim 10 percent of utilities insurance property tax and mortgage interest How to calculate your home office tax deduction Under the temporary flat rate method the home office expense deduction is calculated at 2 per day for each day the eligible employee worked from home in 2021 due to COVID 19 up to

Overview of tax rules for home office expenses Under normal circumstances employees who want to deduct their home office expenses must meet two main conditions First an employee must be required by their contract of employment to maintain a workspace in their home and pay for the related expenses Today more Canadians are working from home than ever before and spending money on home offices that they could potentially deduct on their tax returns There are different regulations around deducting home office expenses for business owners and salaried or

Download Home Office Tax Deduction Canada

More picture related to Home Office Tax Deduction Canada

Home Office Tax Deduction What To Know Fast Capital 360

https://www.fastcapital360.com/wp-content/uploads/2021/02/homeDeduction-768x832.jpg

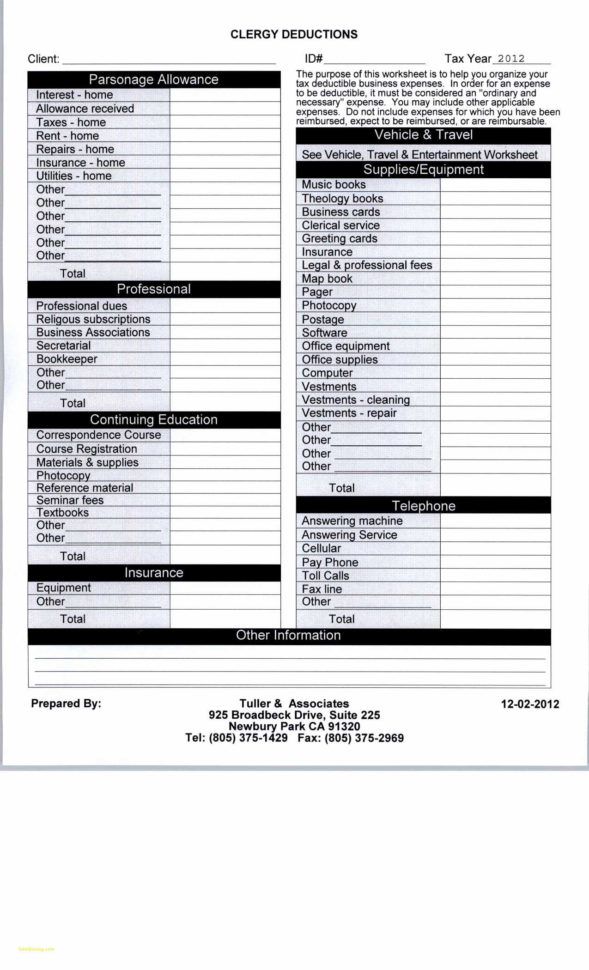

Self Employed Tax Deduction Worksheet

https://i.pinimg.com/originals/74/a4/dd/74a4dd8b0181fa2746d635bd76a42e98.jpg

Spreadsheet Template Page 217 Pid Loop Tuning Spreadsheet Moving

http://db-excel.com/wp-content/uploads/2019/01/self-employed-expense-spreadsheet-with-self-employed-expense-sheet-tax-return-balance-expenses-spreadsheet.jpg

The federal government first introduced a temporary flat rate home office expense tax deduction for the 2020 tax year after the pandemic forced many people to use their kitchens bedrooms and living rooms as makeshift workspaces As an employee you may be able to claim certain home office expenses work space in the home expenses office supplies and certain phone expenses This deduction is claimed on your personal income tax return

[desc-10] [desc-11]

The Home Office Tax Deduction For Canada

https://assets-global.website-files.com/61017e6b22c7fa6cb9edc36a/6111cb3dbe7bdd78911dc9d7_60d8c6a0ace32c1de22200ed_home-office-tax-deduction-2.jpeg

Home Office Deduction Worksheet Excel Osakiroegner 99

https://i.pinimg.com/originals/5b/f1/1c/5bf11ce4adb7b2d7f007c6ab2ba2a967.png

https://www.canada.ca/en/revenue-agency/services/tax/individuals/...

If you meet the eligibility criteria you can claim a portion of certain expenses related to the use of a work space in your home Commission employees who sell goods or negotiate contracts typically have an income amount in box 42 on their T4 slip can claim some expenses that salaried employees cannot

https://www.canada.ca/en/revenue-agency/services/tax/individuals/...

This page describes the recent changes to claiming work space in the home expenses Eligible employees who worked from home in 2023 will be required to use the detailed method to claim home office expenses The temporary flat rate method does not apply to the 2023 tax year

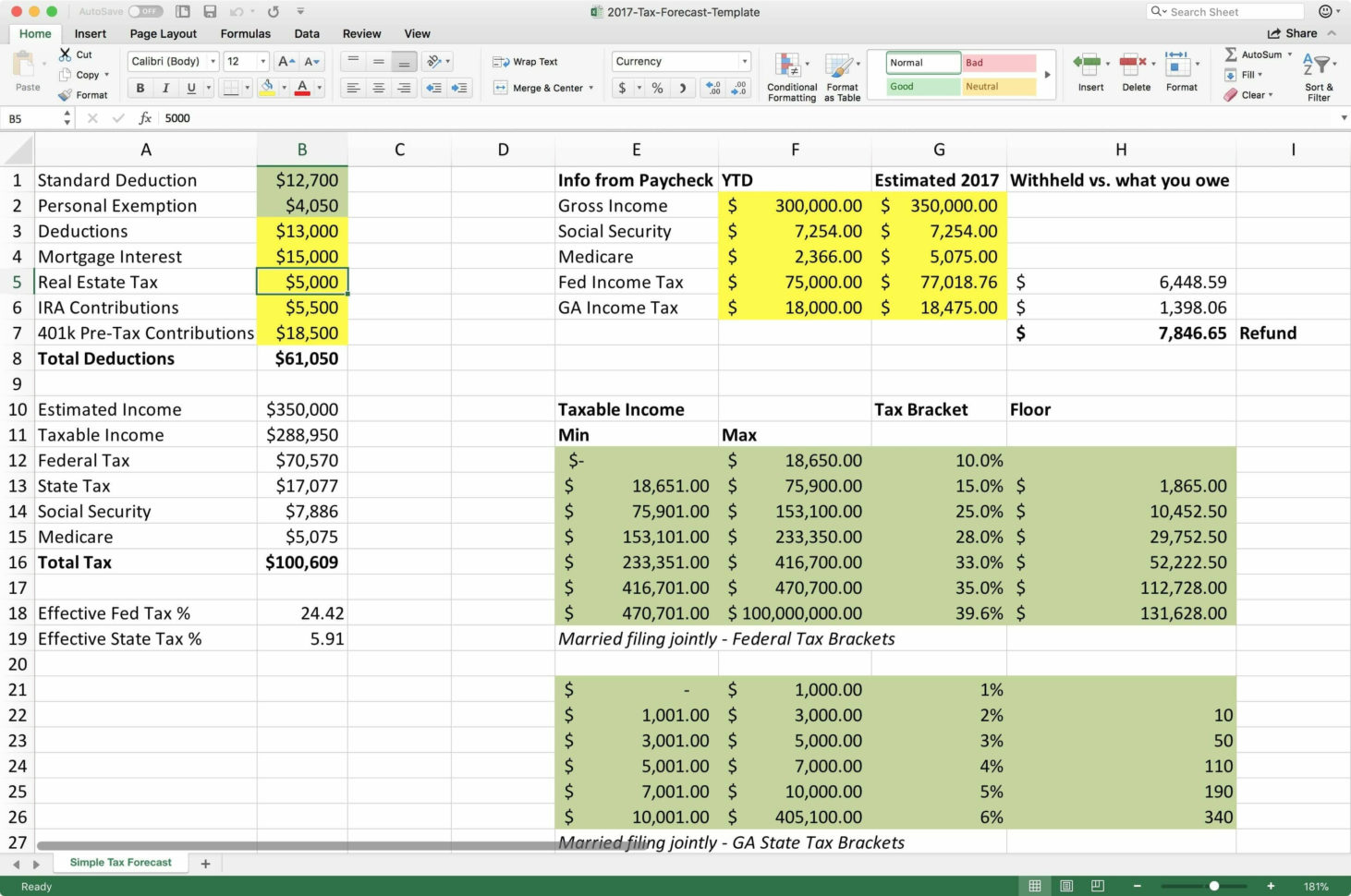

Tax Return Spreadsheet Template Spreadsheets Bank2home

The Home Office Tax Deduction For Canada

Home Internetl Home Office Internet Tax Deduction

Home Office Deduction Worksheet Excel Printable Word Searches

Tax Deduction Cheat Sheet For Real Estate Agents Db excel

Tax Deduction Tracker Spreadsheet Spreadsheet Downloa Tax Deduction

Tax Deduction Tracker Spreadsheet Spreadsheet Downloa Tax Deduction

Tax Deduction Spreadsheet Spreadsheet Downloa Tax Deduction Sheet Tax

13 Car Expenses Worksheet Worksheeto

Should You Claim A Deduction For Your Home Office

Home Office Tax Deduction Canada - How to calculate your home office tax deduction Under the temporary flat rate method the home office expense deduction is calculated at 2 per day for each day the eligible employee worked from home in 2021 due to COVID 19 up to