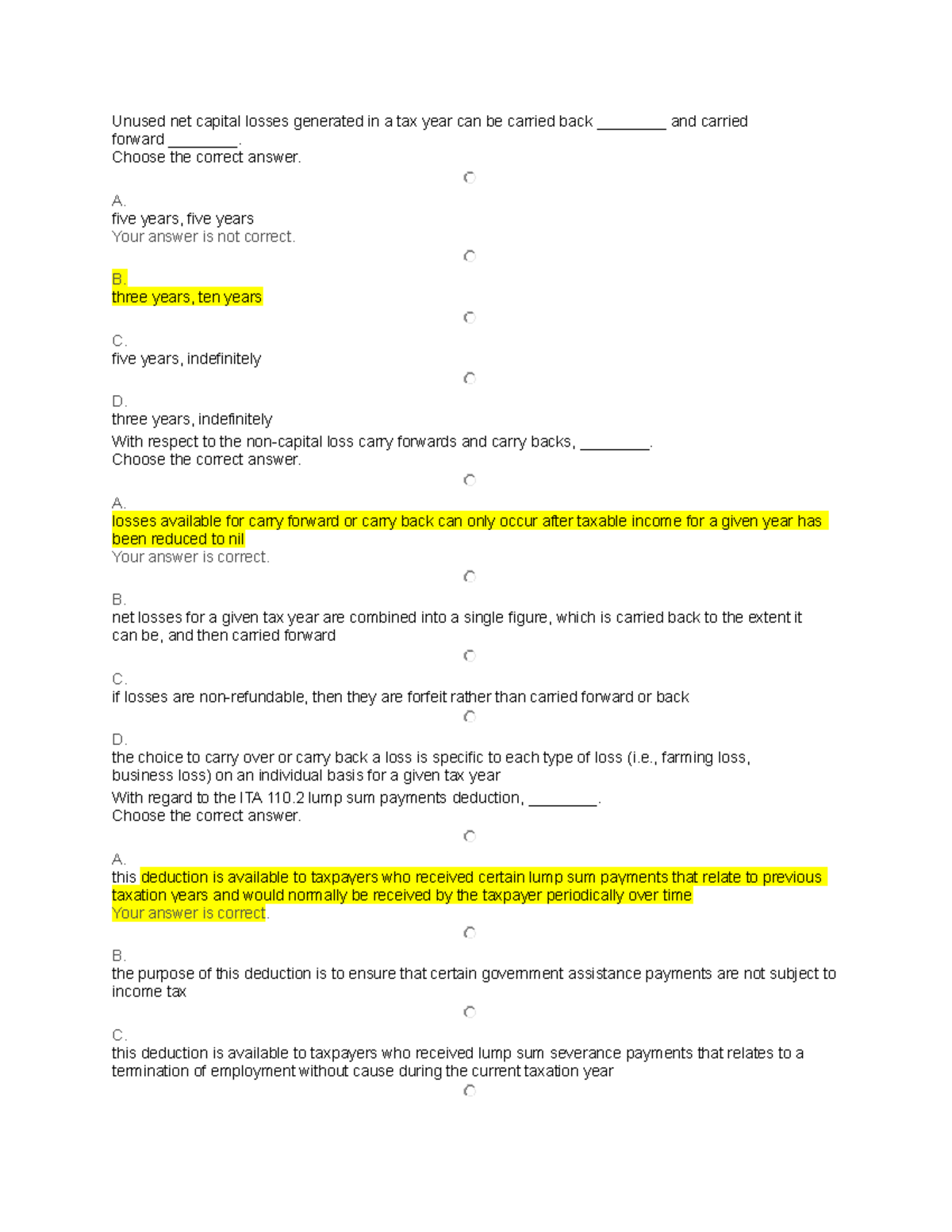

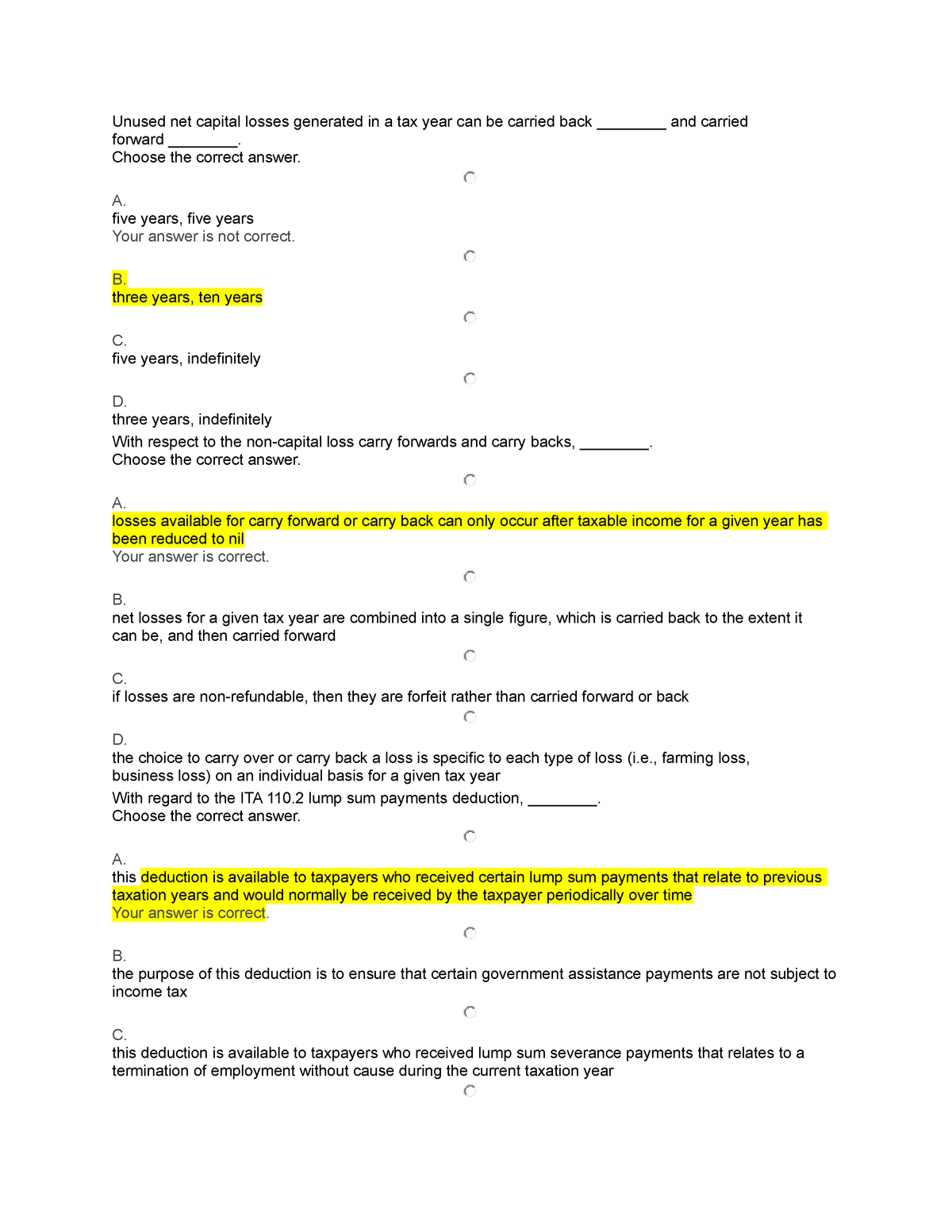

House Rent Received Deduction In Income Tax Rental income How to pay How to declare Deductions Maintenance charges and capital charges Renovation expenses Buyer s expenses building and

What is HRA House Rent Allowance House Rent Allowance HRA is an allowance part of CTC given by your Individuals owning a residential property that generates rental income or is self occupied are eligible to claim deductions under Section 24 Types of deductions Standard

House Rent Received Deduction In Income Tax

House Rent Received Deduction In Income Tax

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/74ba378144ce6f5321b7ff0772ffaa3a/thumb_1200_1553.png

Solved Please Note That This Is Based On Philippine Tax System Please

https://www.coursehero.com/qa/attachment/19096880/

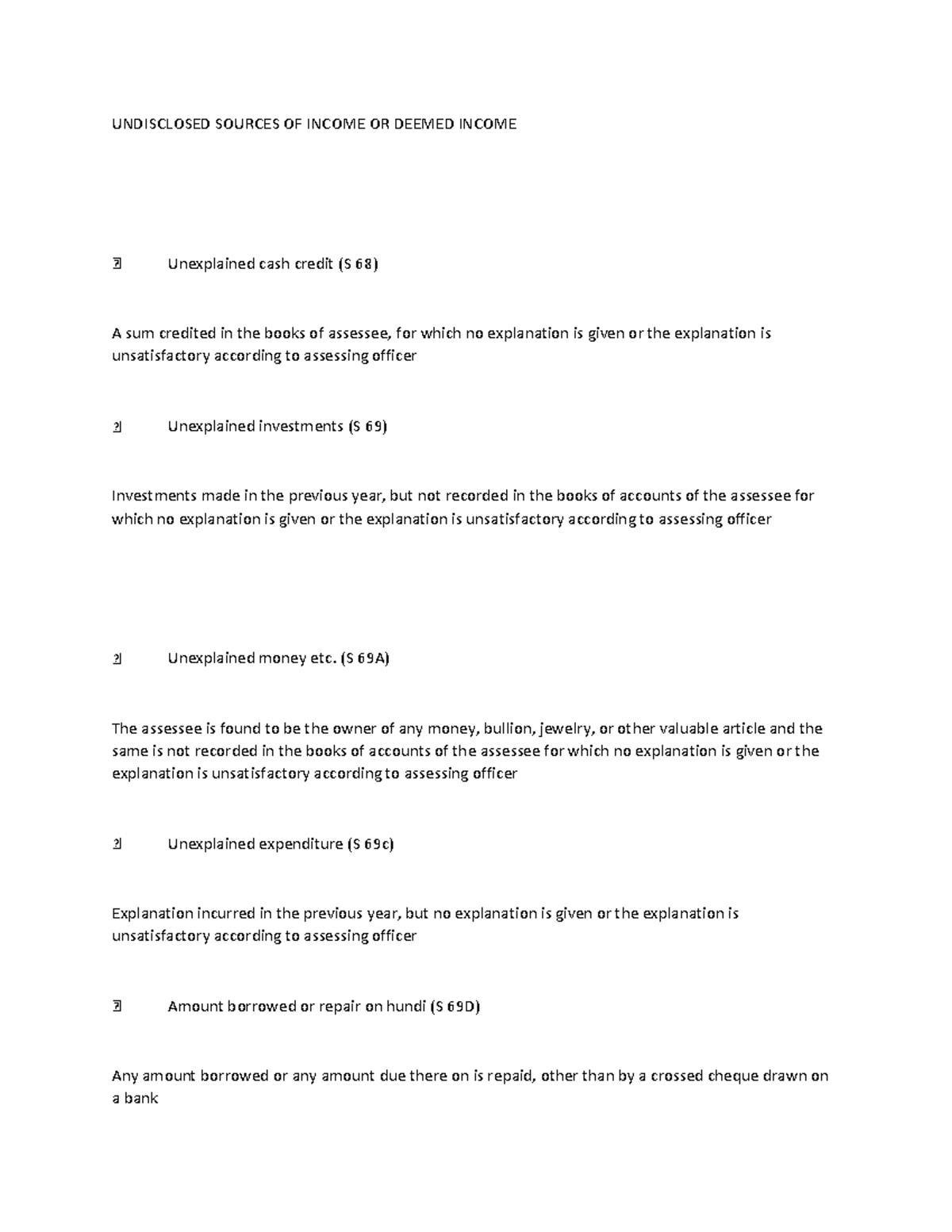

Document In This Notes About Undisclosed Source Of Income In Income

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/df429db1b5f472adb16157417bc4c332/thumb_1200_1553.png

If you receive rental income from the rental of a dwelling unit there are certain rental expenses you may deduct on your tax return These expenses may House rent allowance HRA is received by the salaried class A deduction is permissible under Section 10 13A of the Income Tax Act in accordance with Rule

Check out Housing s tool to generate rent receipt for income tax How much rental income is taxable It is not that the gross rent received becomes taxable From the rent received receivable for In general you can deduct expenses of renting property from your rental income Real estate rentals You can generally use Schedule E Form 1040

Download House Rent Received Deduction In Income Tax

More picture related to House Rent Received Deduction In Income Tax

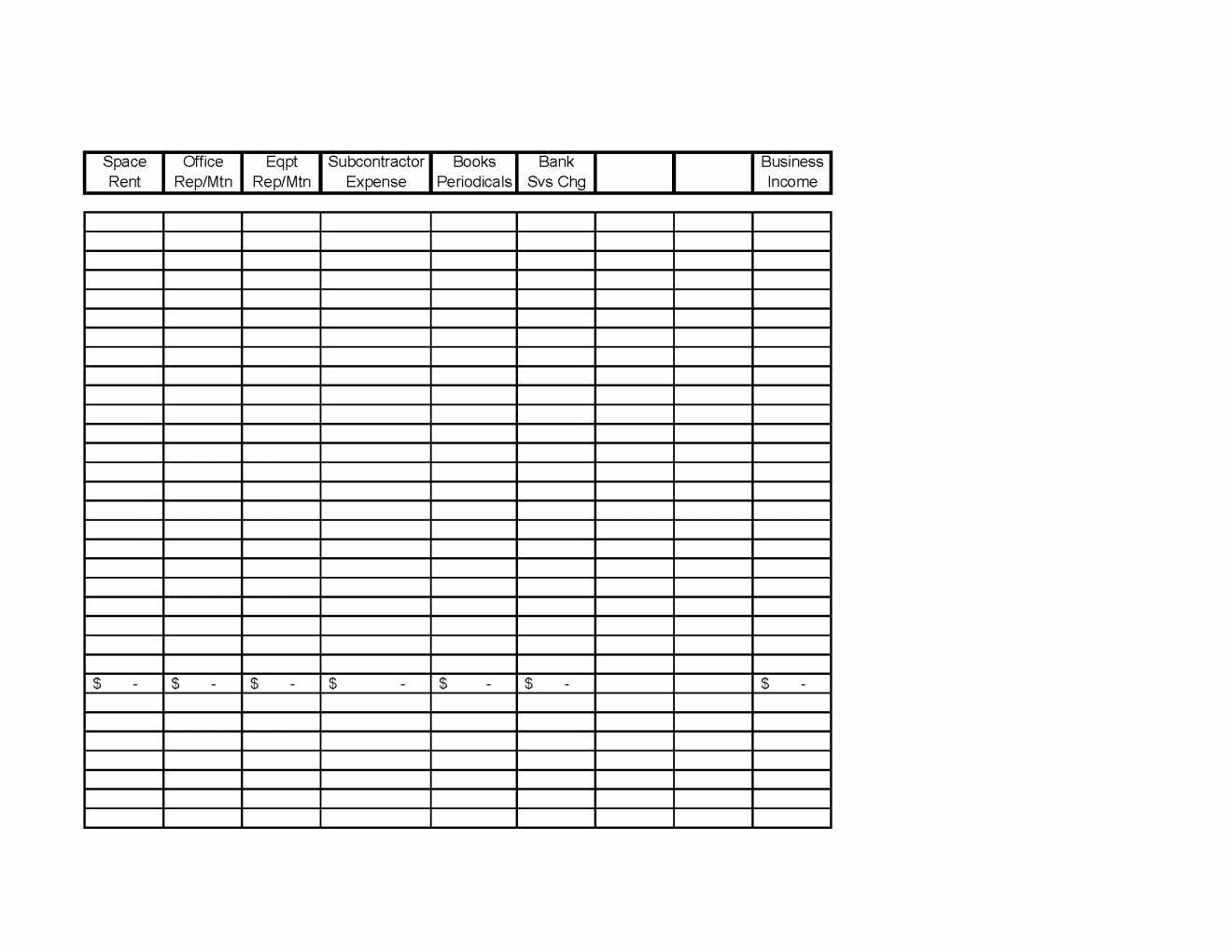

10 2014 Itemized Deductions Worksheet Worksheeto

https://www.worksheeto.com/postpic/2009/12/tax-deduction-worksheet_449398.png

Section 80GG Of Income Tax Act Tax Deduction On Rent Paid

https://images.ctfassets.net/uwf0n1j71a7j/jKbTxFBFWiOrDSzUtJ7Mw/c3e763bef36d86d10157bfc9c81b6142/house-rent-allowance.jpg?w=3840&q=75

Standard Deduction U s 16 ia For Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-3-768x432.jpg

You generally deduct your rental expenses in the year you pay them Publication 527 includes information on the expenses you can deduct if you rent a 19 October 2015 Last updated 18 October 2023 See all updates Get emails about this page Contents Rental income Types of property ownership Record keeping Cash

Amount of HRA tax exemption is deductible from the total salary income before arriving at a gross taxable income This helps an employee to save tax But do 1 Actual House Rent Allowance HRA received from your employer 2 Actual house rent paid by you minus 10 of your basic salary 3 50 of your basic

Standard Deduction 2020 Self Employed Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/standard-deduction-budget-announcements-budget-2018-gives.jpg

Income Tax Deduction For Rent Paid Section 80GG IndiaFilings

https://www.indiafilings.com/learn/wp-content/uploads/2017/10/Section-80GG-Income-Tax-Deduction-for-Rent.jpg

https://www.vero.fi/en/individuals/property/rental...

Rental income How to pay How to declare Deductions Maintenance charges and capital charges Renovation expenses Buyer s expenses building and

https://cleartax.in/s/hra-house-rent-allowance

What is HRA House Rent Allowance House Rent Allowance HRA is an allowance part of CTC given by your

Income Tax Deduction

Standard Deduction 2020 Self Employed Standard Deduction 2021

Strategic Approaches Unleashing The Potential For Tax Savings In

Section 80GG Deduction On Rent Paid Yadnya Investment Academy

Income Tax Problem For Income Taxpayers Federal Order Union Govt

Difference Between Income Tax Deductions Exemptions And Rebate Plan

Difference Between Income Tax Deductions Exemptions And Rebate Plan

Income Tax Spreadsheet Tax Organizer Worksheet Download New In Income

Revisiting General Anti Avoidance Rules In Income Tax Law SCC Blog

Income Tax Returns E filing Made Simple Insurance Funda

House Rent Received Deduction In Income Tax - In general you can deduct expenses of renting property from your rental income Real estate rentals You can generally use Schedule E Form 1040